Navigating by the waters of medical health insurance protection is hard. You is perhaps questioning, Do employers have to supply medical health insurance? Though the Inexpensive Care Act (ACA) requires employers with 50 or extra full-time equal workers to offer medical health insurance, no employer has to supply excepted advantages.

However, many employers do provide excepted advantages.

What does this all imply? Must you leap on board and provide excepted advantages to your crew? To make that sort of choice, it’s essential know what’s an excepted profit and what the brand new Excepted Profit HRA is.

What are excepted advantages?

Excepted advantages below ACA are kinds of protection that aren’t included in a conventional medical health insurance plan.

The Inexpensive Care Act requires {that a} conventional medical health insurance plan covers the next well being advantages:

- Ambulatory affected person companies

- Emergency companies

- Hospitalization

- Being pregnant, maternity, and new child care

- Psychological well being and substance use dysfunction companies

- Prescribed drugs

- Rehabilitative and habilitative companies and units

- Laboratory companies

- Preventive and wellness companies

- Pediatric companies, together with oral and imaginative and prescient care for youngsters

As you possibly can see within the above record, there are a couple of advantages not included (e.g., imaginative and prescient protection for adults).

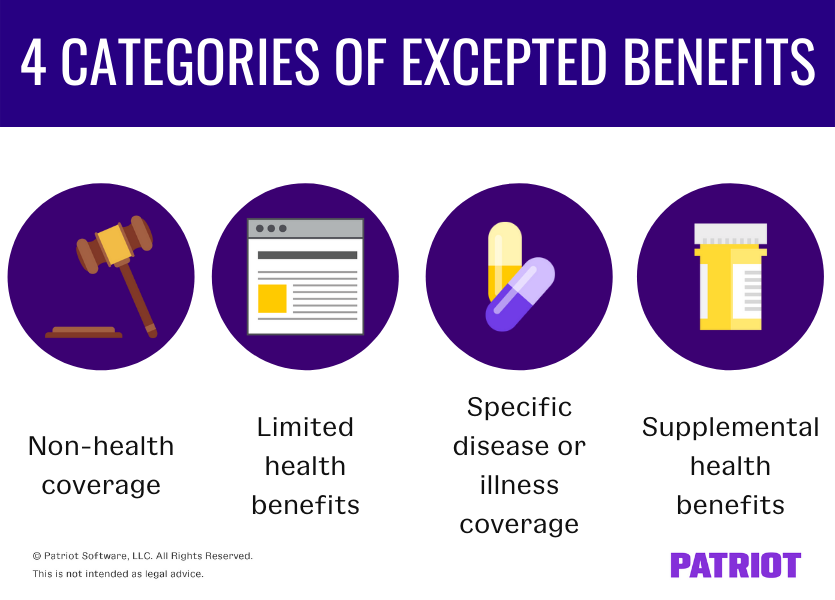

There are 4 classes of excepted advantages, in keeping with the Division of Labor:

- Non-health protection

- Restricted well being advantages

- Particular illness or sickness protection

- Supplemental well being advantages

Non-health protection

The primary class of excepted advantages below ACA embody advantages that aren’t thought of well being care protection.

These advantages are add-ons to common medical health insurance protection. Sometimes, these advantages pay out wage alternative and should by the way cowl medical care protection after an accident or prolonged sickness or damage. Nevertheless, they don’t cowl common well being care prices for workers who get sick.

Examples of protection included below this class of excepted advantages embody:

Restricted well being advantages

Restricted well being advantages are supplied individually from conventional well being care plans. These advantages will not be required below the ACA and embody:

- Dental protection

- Imaginative and prescient protection

- Lengthy-term care advantages (e.g., nursing dwelling)

Particular illness or sickness protection

The third class of excepted advantages covers kinds of advantages which can be particular to a sure sort of sickness or illness. Any such protection has no coordination with advantages below a bunch well being plan.

Examples of this class of excepted advantages embody:

- Protection for a selected illness or sickness (e.g., most cancers insurance coverage)

- Hospital indemnity (insurance coverage that pays the holder if they’re hospitalized)

Supplemental well being advantages

The final sort of excepted advantages class contains separate insurance coverage insurance policies which can be supplemental to Medicare or Armed Forces well being care protection.

In uncommon circumstances, this class may additionally embody separate insurance coverage insurance policies which can be supplemental to a bunch well being plan.

Excepted Profit HRA

Since January 2020, employers can select to supply workers an Excepted Profit HRA. Should you provide it, your workers should enroll throughout open enrollment.

An Excepted Profit HRA is considered one of two kinds of HRAs with the opposite being the Particular person Protection HRA (ICHRA).

Whereas the ICHRA is an alternative choice to conventional group-term medical health insurance, the Excepted Profit HRA is one thing employers can provide together with conventional medical health insurance.

Are you able to provide the Excepted Profit HRA?

If you wish to provide workers the Excepted Profit HRA as a part of your worker advantages package deal, it’s essential to additionally provide them a conventional medical health insurance plan.

Nevertheless, the worker doesn’t should enroll within the conventional medical health insurance plan to enroll within the Excepted Profit HRA—you simply have to supply it.

What do Excepted Profit HRAs cowl?

Excepted profit HRAs cowl issues not included in a conventional medical health insurance plan, together with:

- Dental protection

- Imaginative and prescient protection

- Brief-term, limited-duration insurance coverage (STLDI)

- Copays, deductibles, and different bills not lined by a major medical health insurance plan

2025 Excepted profit contribution restrict

Employers contribute to an Excepted Profit HRA. However, you possibly can solely contribute as much as a specific amount for every worker.

For 2025, the annual contribution restrict for an Excepted Profit HRA is $2,150.

Excepted Profit HRA vs. common HRA

So, what’s the distinction between an Excepted Profit and HRA that reimburses excepted advantages?

In contrast to common HRAs, Excepted Profit HRAs can reimburse workers for medical care bills that aren’t thought of excepted advantages.

In case you have workers, you want a dependable approach to run payroll. Patriot’s on-line payroll makes use of a easy three-step course of. Plus, we provide free setup and assist to get you going and aid you alongside the way in which. Discover our award-winning software program along with your free trial at this time!

This text has been up to date from its authentic publication date of November 11, 2019.

This isn’t supposed as authorized recommendation; for extra info, please click on right here.