The freefincal robo-advisor software will now characteristic fairness glide paths for retirement buckets, offering enhanced danger administration. We even have an up to date video person information. The up to date model has already been despatched to all present customers. Those that didn’t obtain the notification can contact us.

These unfamiliar with the software’s options can seek advice from the total listing of options beneath. The software would assist anybody aged 18 to 80 plan for his or her retirement, in addition to six different non-recurring monetary objectives and 4 recurring monetary objectives, with an in depth money circulation abstract. Greater than 3000 buyers and monetary advisors are utilizing the software. The software was featured within the Financial Instances: Meet Pattabiraman, the person who helps many plan a greater retirement by way of his calculators.

To grasp how glide paths work, we should first perceive the retirement bucket construction used within the robo-advisor software. Allow us to do that with an instance. Because of reader Asish Prabhakar for uplifting this replace together with his attention-grabbing questions.

New video person information

Pattern monetary plan calculation utilizing the freefincal robo advisor

A 35-year-old reader hopes to retire by the age of fifty. He’s married to a homemaker aged 30. We will plan for retirement revenue from when he reaches 50 to when his spouse (or, usually, the youthful partner) reaches 90. Due to this fact, he has 15 years to speculate and must plan for inflation-protected retirement revenue for 45 years.

We are going to contemplate a 6% inflation fee earlier than and after retirement. It’s higher to find out how a lot your bills are rising yearly and use that fee. You need to use our Private Inflation Calculator.

Inputs and assumptions

- Month-to-month bills of Rs. 50,000

- One other Rs. 50,000 annual bills.

- Current property: Rs. 65 lakhs in shares, mutual funds, and 50 lakhs in EPF

- The anticipated return from fairness is roughly 10% (post-tax), and the return from EPF is 7% (that is after 15 years, so it’s higher to err on the facet of warning).

Output:

- The common month-to-month bills on the time of retirement can be roughly Rs. 1.3 lakhs.

- The overall corpus required (excluding present investments) is about Rs. 4.9 Crores!

- Factoring in present investments, the online goal corpus to be achieved is simply Rs. 81 Lakhs. That’s the energy of beginning early and accumulating a sizeable corpus by age 35.

- The month-to-month funding (together with necessary EPF or NPS deductions) is Rs. 22,000! If he can enhance the investments by 10% a yr, the preliminary funding decreases to Rs. 12,000!

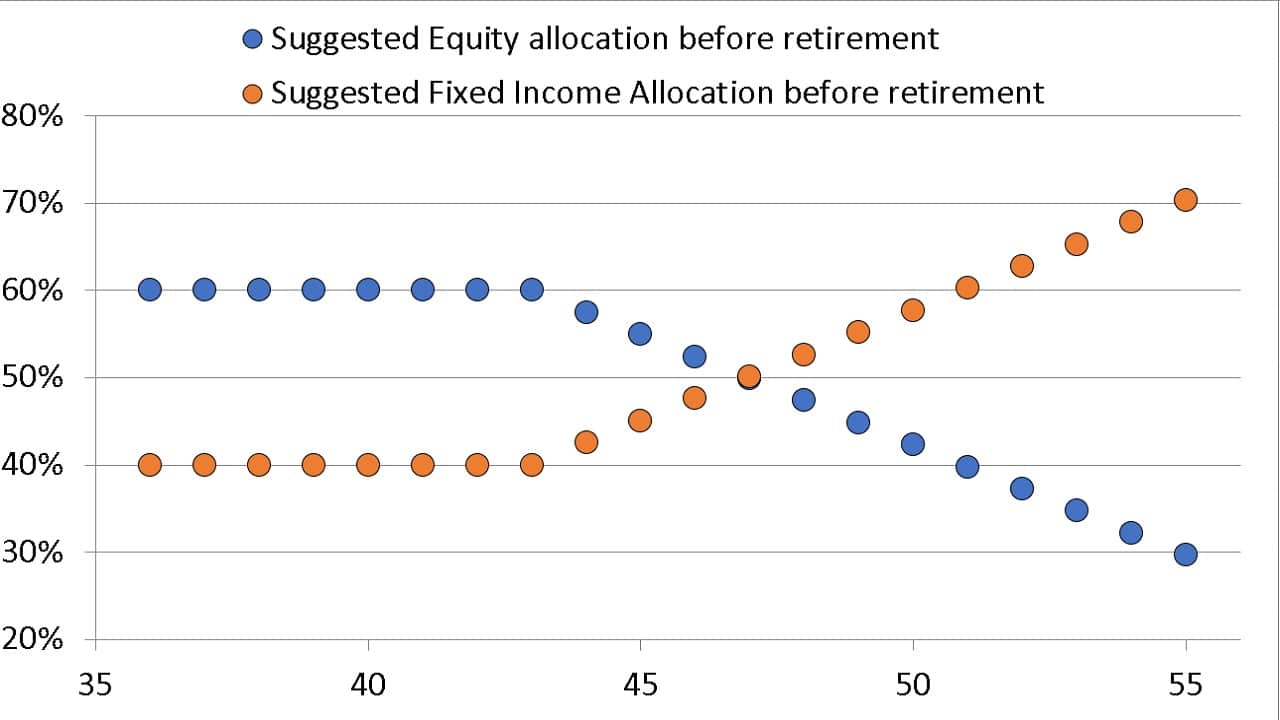

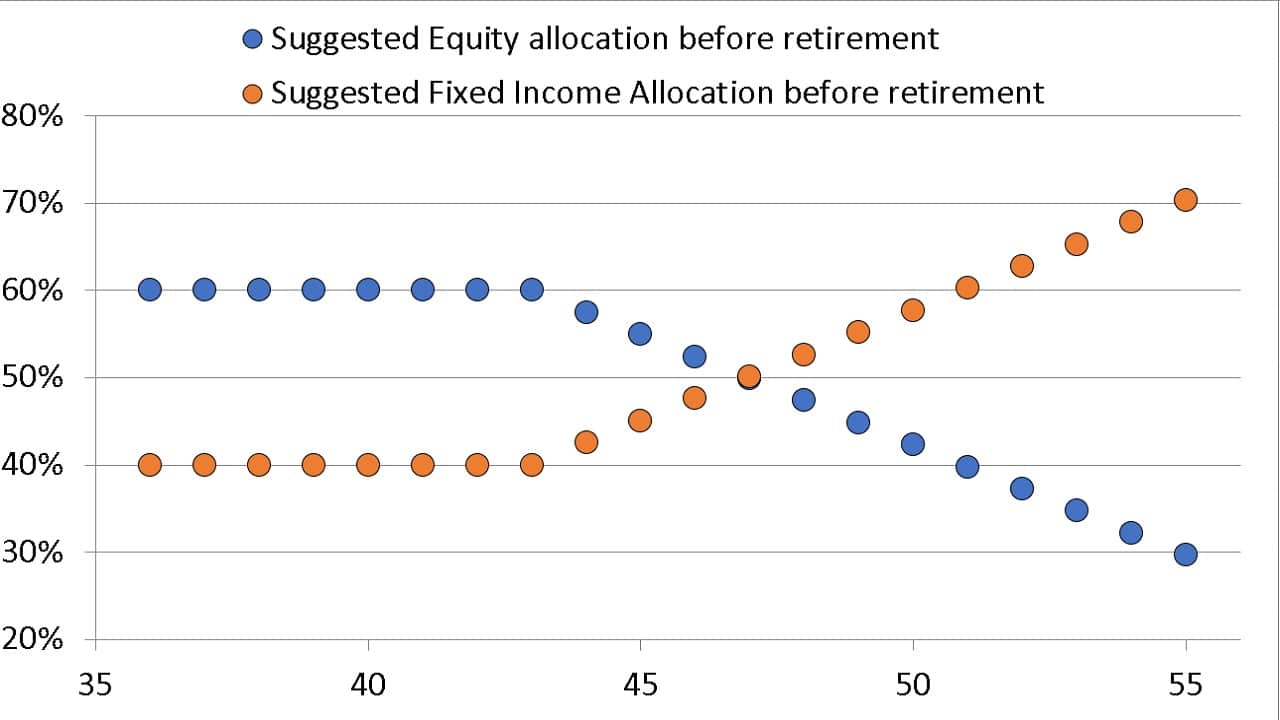

To make sure the portfolio is sufficiently de-risked and the precise retirement corpus is near the anticipated corpus at any time, the robo software recommends a variable asset allocation, as proven beneath. This is named an asset allocation glide path or an fairness glide path. This automated characteristic is designed for investments made earlier than retirement. We’ve now up to date the robo software to incorporate this characteristic post-retirement as properly.

Because the portfolio’s fairness publicity decreases, so too does the anticipated web return from the portfolio. That is factored in from day one within the above calculation.

This is just one a part of the retirement calculation. What about after retirement? The second half determines how the corpus can be divided into buckets. A retirement bucket technique refers to how a retiree invests their corpus in numerous investments and makes an attempt to generate inflation-protected revenue.

The robo software divides the retirement corpus into 5 buckets. That’s, the retirement corpus can be divided into 5 components. This is just one of some ways to assemble a bucket technique. This assumes 45 years in retirement.

- An emergency bucket to deal with sudden bills. Instance: 5%

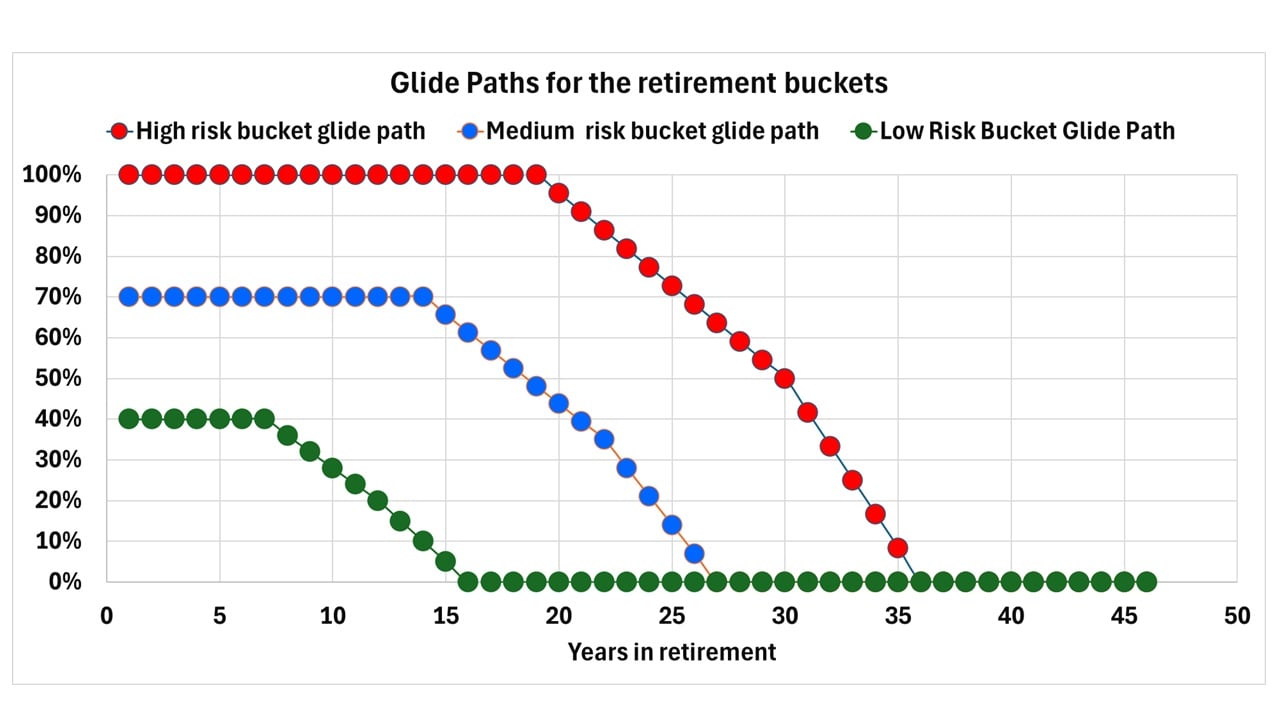

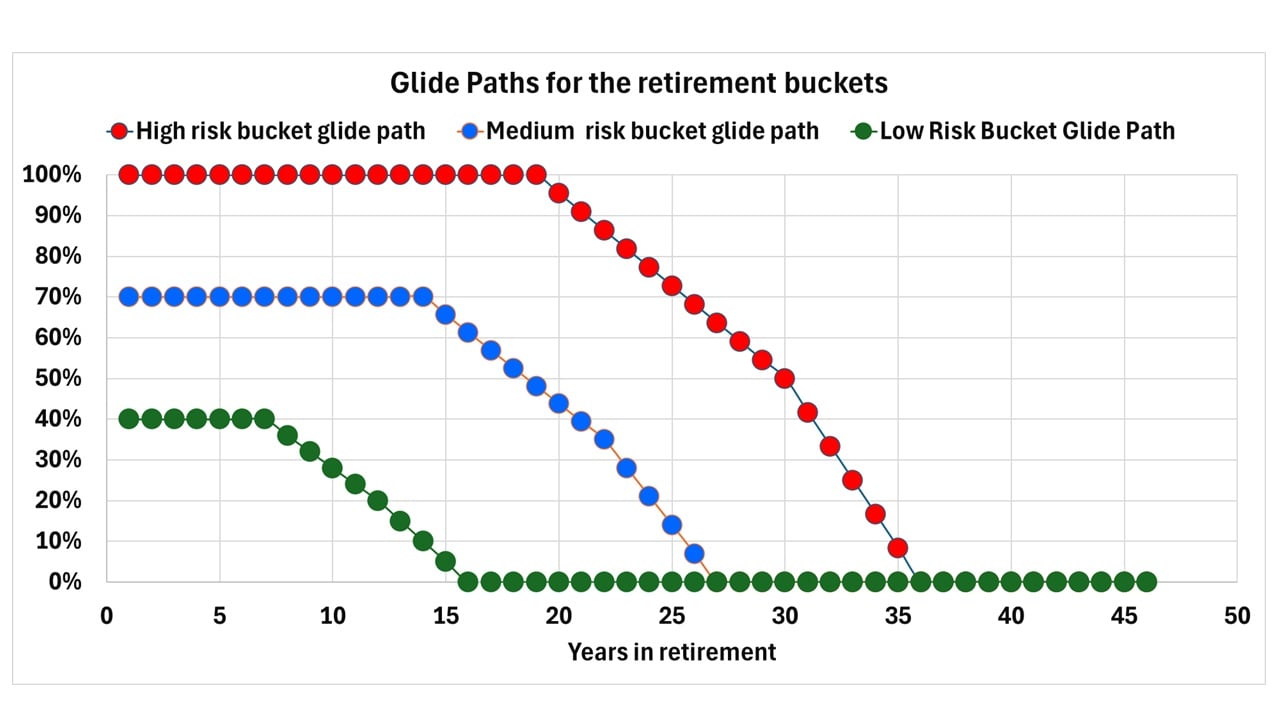

- An revenue bucket that gives assured revenue for the primary 15 years of retirement. Throughout this era, investments are allotted throughout the next three classes.

- Corpus from a low-risk bucket that gives retirement revenue from yr 16 to yr 26. To supply this revenue, the low-risk bucket may have an asset allocation of fifty% in equities and 50% in debt in the course of the funding interval (years 1 to fifteen of retirement). This corpus weighs about 25%.

- Corpus from a medium-risk bucket will present retirement revenue from years 27 to 35. To generate this revenue, the bucket shall have an asset allocation of 70% fairness and 30% debt in the course of the funding interval (years 1 to 27). This corpus weighs about 15%.

- Corpus from a high-risk bucket will present retirement revenue from years 36 to 45. To supply this revenue, the bucket shall have an asset allocation of 100% fairness in the course of the funding interval (years 1 to 36). This corpus accounts for about 9-10%.

What about retirement bucket administration? The current replace!

There are two methods to handle the retirement buckets.

Choice 1 – Actively: The retiree ensures that the revenue bucket at all times has sufficient cash to offer inflation-indexed revenue for the following 10-15 years always. This reduces sequence danger considerably.

Choice 2 – Passively: Right here, the retiree makes use of one bucket after exhausting the opposite. For instance, after 15 years, the low-risk bucket may be become 100% debt and supply revenue for about 11 years. After that, the opposite buckets will also be progressively used.

How does one make the change? The opposite buckets will maintain a good portion in fairness; ought to they not be progressively lowered to decrease danger? How can the 50% fairness held within the low-risk bucket be regularly decreased? If we don’t lower it regularly, the general fairness allocation of the corpus might enhance with time.

To handle these points, we have now up to date the freefincal robo advisor software with fairness glide paths for the low-risk, medium-risk and high-risk buckets.

Suppose the retiree desires to undertake a passive bucket technique. In that case, the software now mechanically calculates an asset allocation schedule for the low, medium and high-risk buckets as proven beneath for the above instance.

This data is offered in a brand new sheet referred to as “bucket backend”.

If the retiree follows this asset allocation schedule, then they don’t have to fret about shifting funds from one bucket to a different every year in retirement. Naturally, the worth to pay for it is a gradual decreasing of the fairness allocation. Nonetheless, contemplating that it will considerably cut back the chance of a poor sequence of returns, it’s worthwhile.

This may successfully decrease the return expectation from every bucket and marginally enhance the corpus required for the funding. Nonetheless, it’s properly price it in our opinion for the related peace of thoughts.

Not all customers might want these glide paths for the buckets in order that they are often turned on or off within the “Low Stress Buckets” sheet cells B28, B29, and B30. Customers can allow or disable the glide path possibility individually for every bucket for better flexibility.

If the glide paths are used, the corpus required will increase from Rs. 4.90 Crores to Rs. 5.31 Crores. The preliminary funding quantity (rising by 10% per yr) is Rs. 18,215. Contemplating the additional layer of security and safety, this enhance is sort of cheap in our opinion.

One can argue that the bucket glide path can also be an “energetic” bucket technique, the place, as an alternative of transferring cash from one bucket to a different, we alter the asset allocation inside every bucket. That is true, however it’s helpful for individuals who want the most secure possibility. Virtually, some transactions amongst buckets are inevitable, if not indispensable.

Even when you don’t just like the glide path possibility, we propose conserving it ‘on’ as it should allow conservative planning.

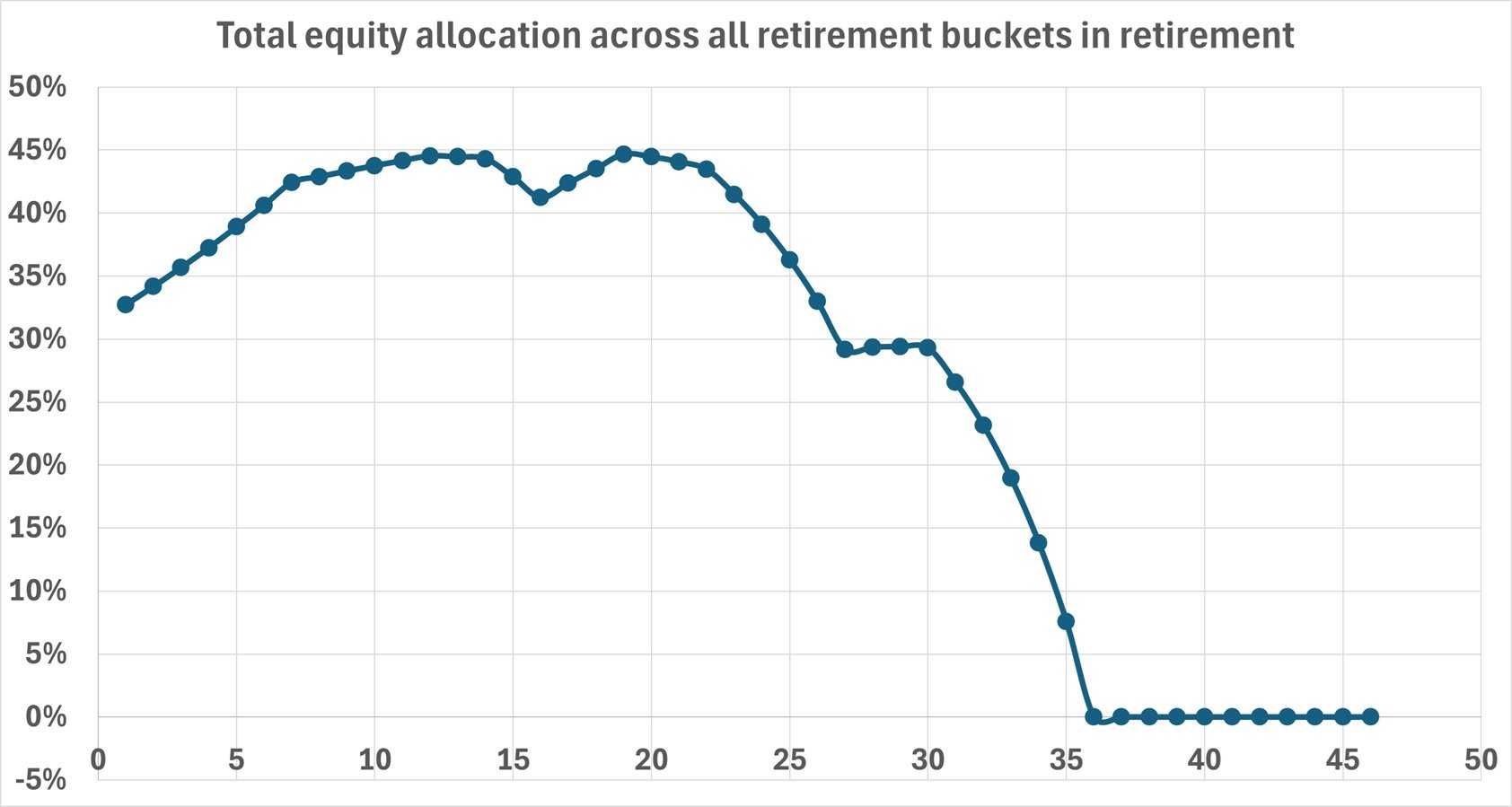

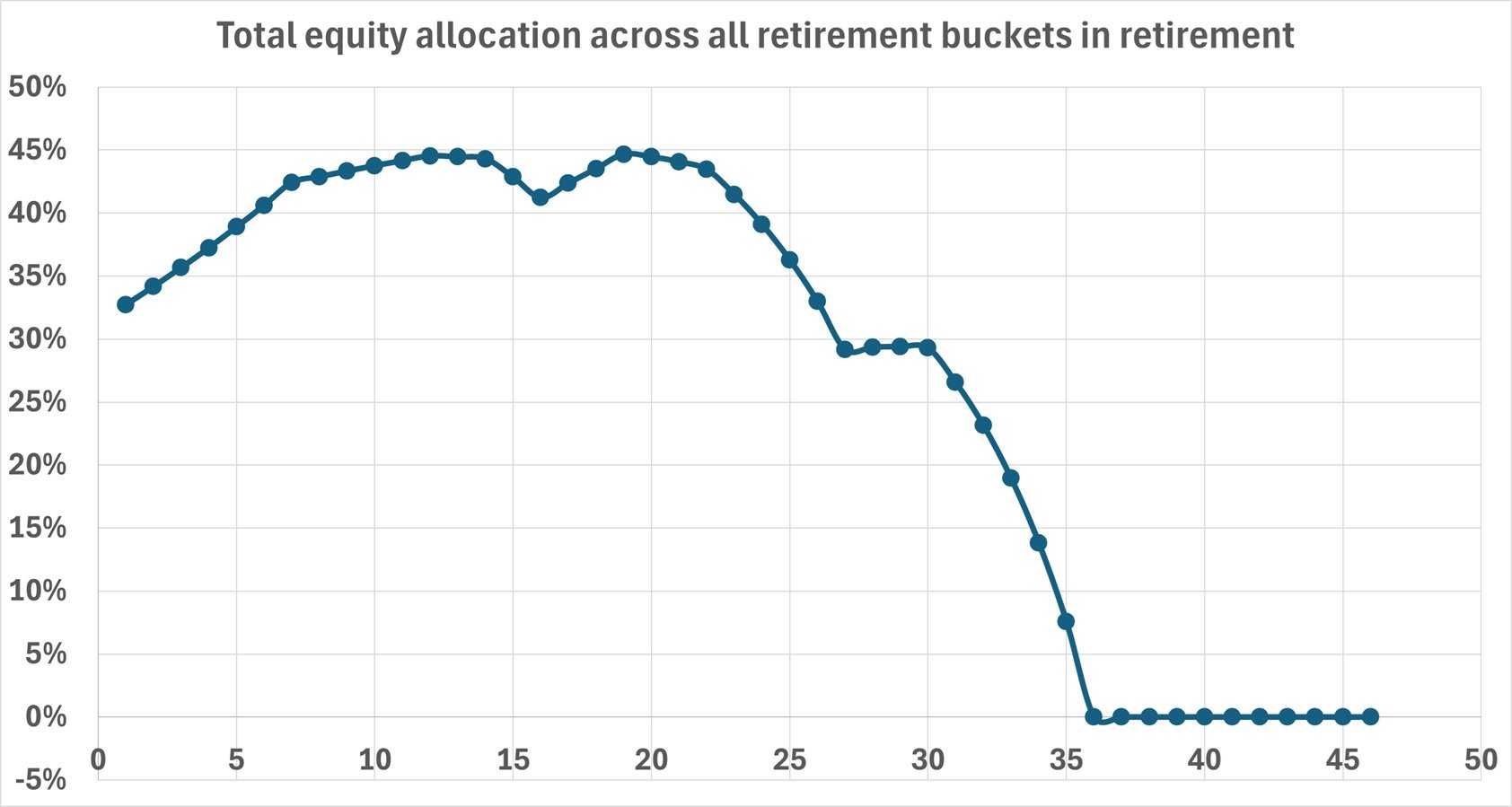

You possibly can visualise the evolution of the full fairness allocation throughout all retirement buckets in retirement and the way in which the full corpus modifications in retirement within the “bucket backend” sheet.

Please word that if the bucket glidepaths are turned off, the fairness allocation within the chart above will enhance over time. Whereas this will likely appear alarming at first, the energetic strategy of ensuing 10-15 years of inflation-indexed bills within the revenue bucket will negate this danger. Such an motion will rely on future return sequences and can’t be projected.

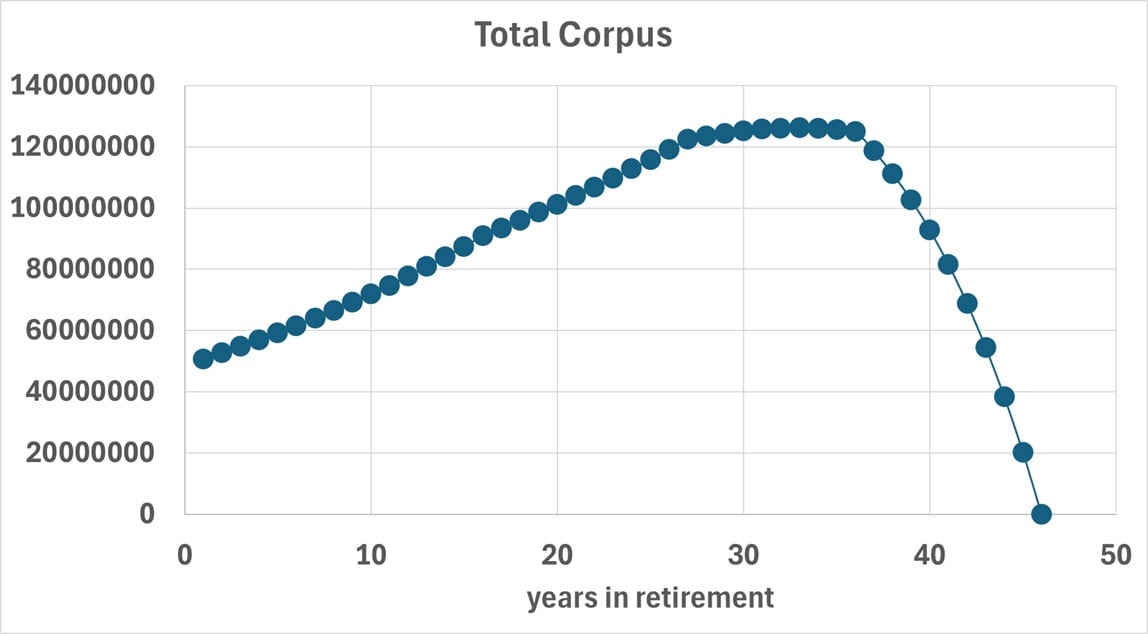

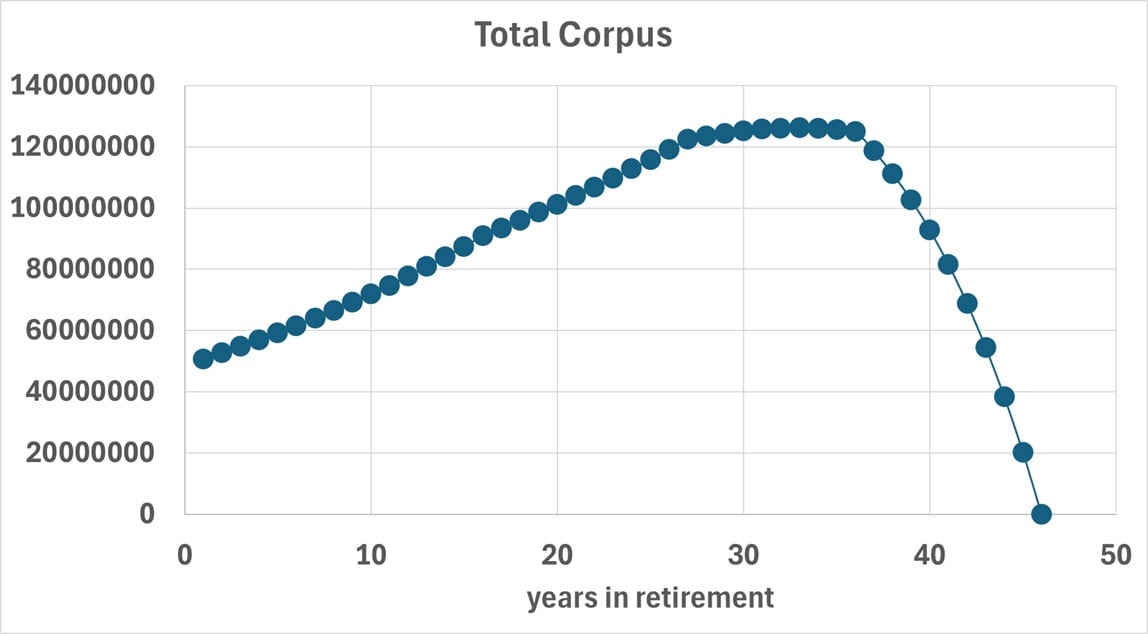

That is how the retirement corpus will evolve.

We hope this replace will assist alleviate the uncertainty related to utilizing retirement buckets. From a sensible perspective, we nonetheless advocate sustaining 10 to fifteen years of inflation-indexed revenue within the revenue bucket a minimum of each few years throughout retirement. These glide paths will assist the person keep a conservative return expectation.

Current customers will obtain this and all future updates.

Options of the Robo advisor software

The software would assist anybody aged 18 to 80 plan for his or her retirement, six different non-recurring monetary objectives, and 4 different recurring monetary objectives with an in depth money circulation abstract.

Retirement planning capabilities (illustrations are linked beneath)

- Can deal with as much as three post-retirement revenue streams

- Automated asset allocation schedule to cut back sequence of returns danger (poor returns that may derail our plans)

- Detailed bucket technique calculation

- Choices to incorporate numerous ranges of pension after retirement (revenue flooring)

- Choice to DIY bucket technique and use an annuity ladder.

- Totally customisable. No hidden formulae.

All the main points are defined right here: Robo Advisory Software program Instrument: Construct an entire monetary plan!

It is a video information.

Greater than 2500 buyers and monetary advisors are utilizing the software. The software was not too long ago featured within the Financial Instances: Meet Pattabiraman, the person who helps many plan a greater retirement by way of his calculators.

- All inputs are totally customisable.

- It may be used for industrial/skilled use as properly. Many advisors use this to create monetary plans for his or her purchasers.

- Customers will get all future updates.

Presentation: The software is offered in two codecs

- As an Excel file with macros. It should work on Mac Excel and Home windows Excel.

- Or on Google Sheets with scripts.

All inputs are totally customisable. It may be used for industrial functions as properly. Greater than 3000 buyers and monetary advisors are utilizing the software. Customers may even obtain all future updates.

One-time buy; lifetime entry. Value consists of future updates to the sheet.

Get the robo software by paying Rs. 5625 (Google Sheets version; Immediate Obtain. No refunds allowed). Use the low cost code: robo25

Use this hyperlink to get the software to get the Robo Advisory Template Excel Sheets Version at a 20% low cost for Rs. 4500 solely (the common value is Rs. 5625). Use the low cost code: robo25 (it will work on Mac and Home windows Excel)

Outdoors India? Then use this Paypal hyperlink to pay USD 80 (Kindly write to freefincal [AT] Gmail [DOT] com after you pay).

Retirement planning Illustrations made with the robo software:

Do share this text with your pals utilizing the buttons beneath.