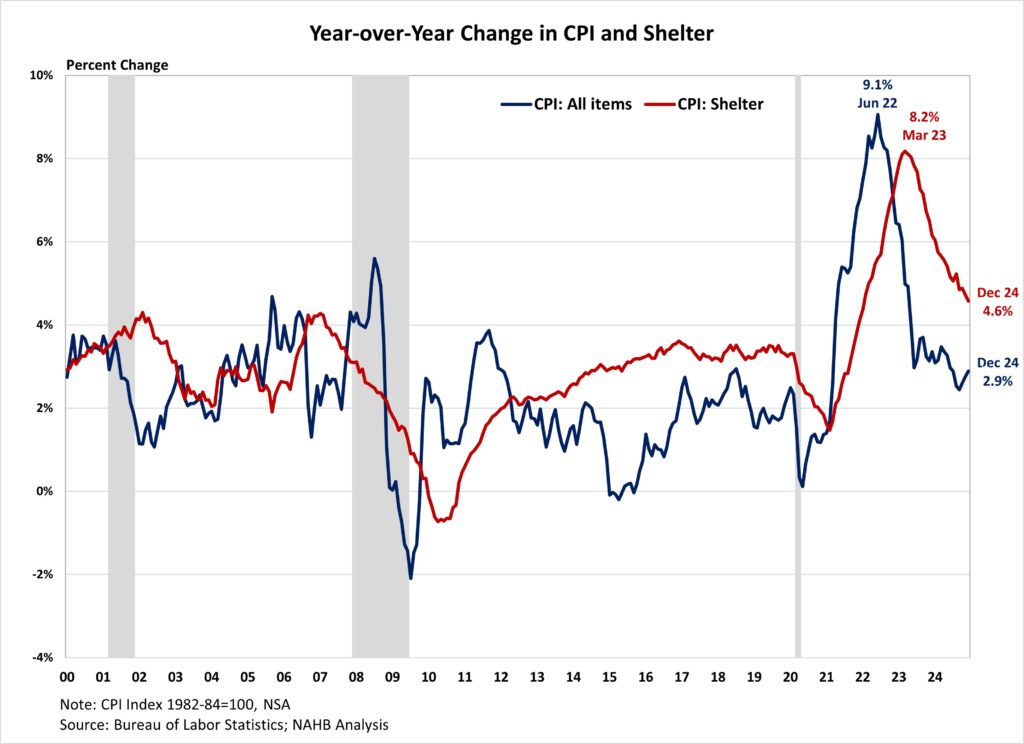

Inflation edged as much as a five-month excessive in December as vitality costs surged, accounting for greater than 40% of the month-to-month headline enhance. Inflation ended 2024 at a 2.9% price, down from 3.4% a 12 months in the past, though the final mile to the Fed’s 2% goal continues to be difficult. Whereas core inflation remained cussed as a consequence of elevated shelter and different service prices, housing prices confirmed indicators of cooling – the year-over-year change within the shelter index remained under 5% for a fourth straight month and posted its lowest annual acquire since January 2022, suggesting a continued moderation in housing inflation.

Whereas the Fed’s rate of interest cuts might assist ease some stress on the housing market, its capacity to deal with rising housing prices is restricted, as these will increase are pushed by a scarcity of reasonably priced provide and rising growth prices. The truth is, tight financial coverage hurts housing provide as a result of it will increase the price of AD&C financing. This may be seen on the graph under, as shelter prices proceed to rise at an elevated tempo regardless of Fed coverage tightening. Extra housing provide is the first answer to tame housing inflation.

Moreover, the election outcome has put inflation again within the highlight and added further dangers to the financial outlook. Proposed tax cuts and tariffs might enhance inflationary pressures, suggesting a extra gradual easing cycle with a barely larger terminal federal funds price. Nevertheless, financial progress is also larger with decrease regulatory burdens. Given the housing market’s sensitivity to rates of interest, a better inflation path might lengthen the affordability disaster and constrain housing provide as builders proceed to grapple with lingering provide chain challenges. In the course of the previous twelve months, on a non-seasonally adjusted foundation, the Client Worth Index rose by 2.9% in December, in keeping with the Bureau of Labor Statistics’ report. This adopted a 2.7% year-over-year enhance in November. Excluding the unstable meals and vitality parts, the “core” CPI elevated by 3.2% over the previous twelve months, after holding regular at 3.3% for 3 months. The part index of meals rose by 2.5%, whereas the vitality part index fell by 0.5%.

On a month-to-month foundation, the CPI rose by 0.4% in December on a seasonally adjusted foundation, after a 0.3% enhance in November. The “core” CPI elevated by 0.2% in December, after rising 0.3% for 3 consecutive months.

The value index for a broad set of vitality sources rose by 2.6% in December, with will increase throughout all classes together with gasoline (+4.4%), gas oil (+4.4%), pure fuel (+2.4%) and electrical energy (+0.3%). In the meantime, the meals index rose 0.3%, after a 0.4% enhance in November. Each indexes for meals away from residence and meals at residence elevated by 0.3%.

The index for shelter (+0.3%) was the most important contributor to the month-to-month enhance in all gadgets index, accounting for practically 37% of the entire enhance. Different high contributors that rose in December embody indexes for airline fares (+3.9%), used vehicles and vans, (+1.2%) and new automobiles (+0.5%). In the meantime, the index for private care (-0.2%) was among the many few main indexes that decreased over the month. The index for shelter makes up greater than 40% of the “core” CPI, rose by 0.3% in December, the identical enhance final month. Each indexes for house owners’ equal lease (OER) and lease of main residence (RPR) elevated by 0.3% over the month. Regardless of the moderation, shelter prices remained the most important contributors to headline inflation.

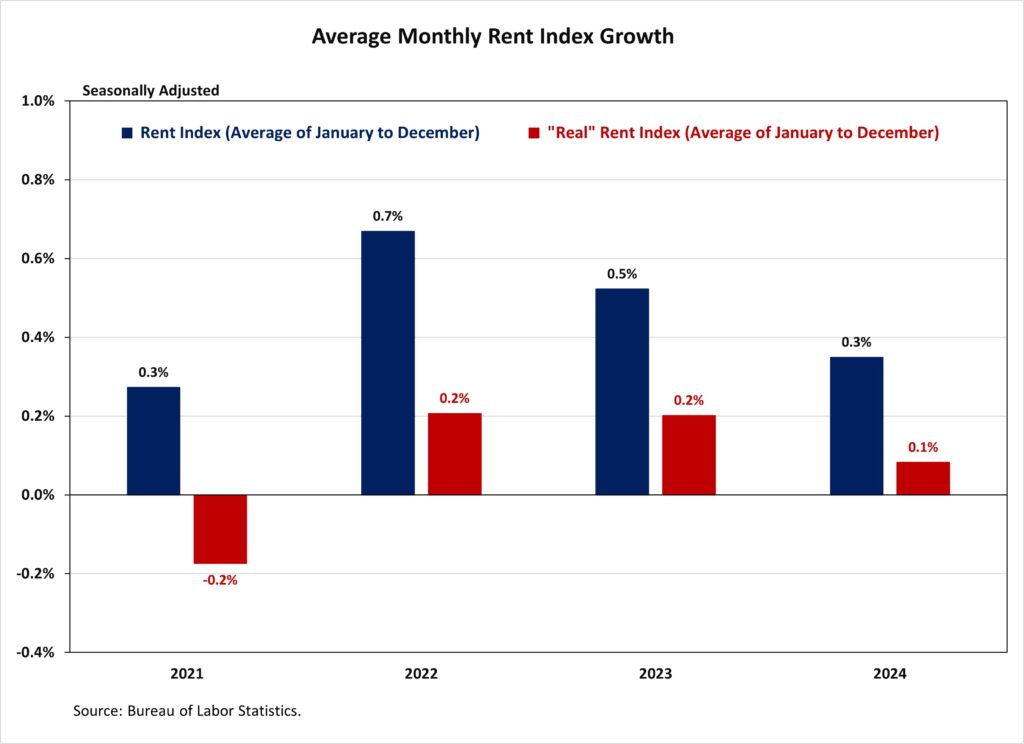

NAHB constructs a “actual” lease index to point whether or not inflation in rents is quicker or slower than general inflation. It offers perception into the provision and demand situations for rental housing. When inflation in rents is rising sooner than general inflation, the true lease index rises and vice versa. The actual lease index is calculated by dividing the value index for lease by the core CPI (to exclude the unstable meals and vitality parts). In December, the Actual Lease Index rose by 0.1%. Over the twelve months of 2024, the month-to-month progress price of the Actual Lease Index averaged 0.1%, slower than the typical of 0.2% in 2023.

Uncover extra from Eye On Housing

Subscribe to get the newest posts despatched to your e-mail.