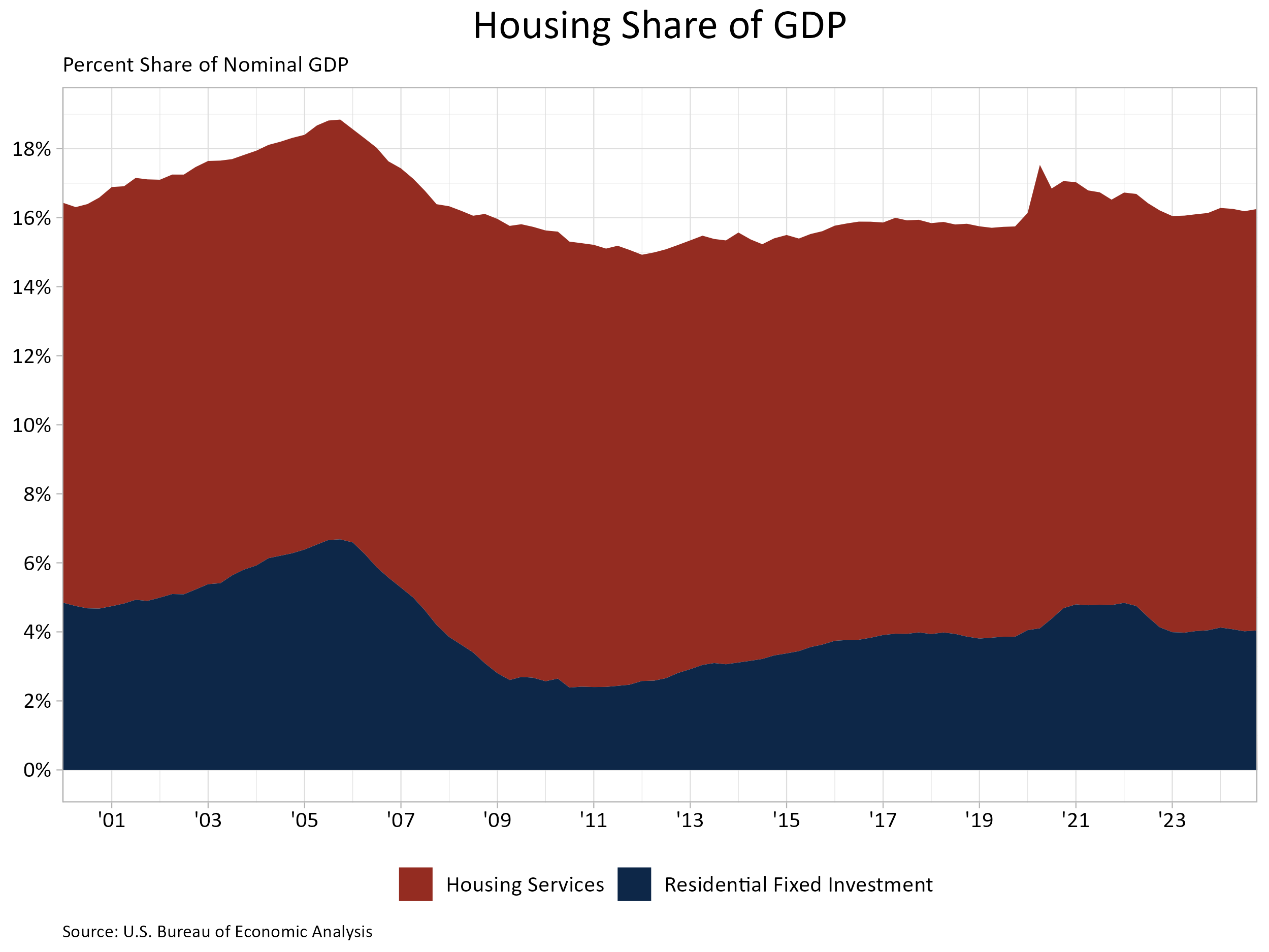

Housing’s share of the economic system remained unchanged at 16.2% within the fourth quarter of 2024, in line with the advance estimate of GDP produced by the Bureau of Financial Evaluation. For the 12 months, housing’s share of the economic system was 16.2%, up from 16.0% in 2023 and down from 16.5% in 2022.

The extra cyclical house constructing and reworking part – residential fastened funding (RFI) – was 4.0% of GDP, stage with the earlier quarter. The second part – housing companies – was 12.2% of GDP, additionally stage with the earlier quarter. The graph under stacks the nominal shares for housing companies and RFI, leading to housing’s whole share of the economic system.

Housing service progress is way much less unstable when in comparison with RFI because of the cyclical nature of RFI. Traditionally, RFI has averaged roughly 5% of GDP whereas housing companies have averaged between 12% and 13%, for a mixed 17% to 18% of GDP. These shares are likely to range over the enterprise cycle. Nevertheless, the housing share of GDP lagged through the post-Nice Recession interval because of underbuilding, significantly for the single-family sector.

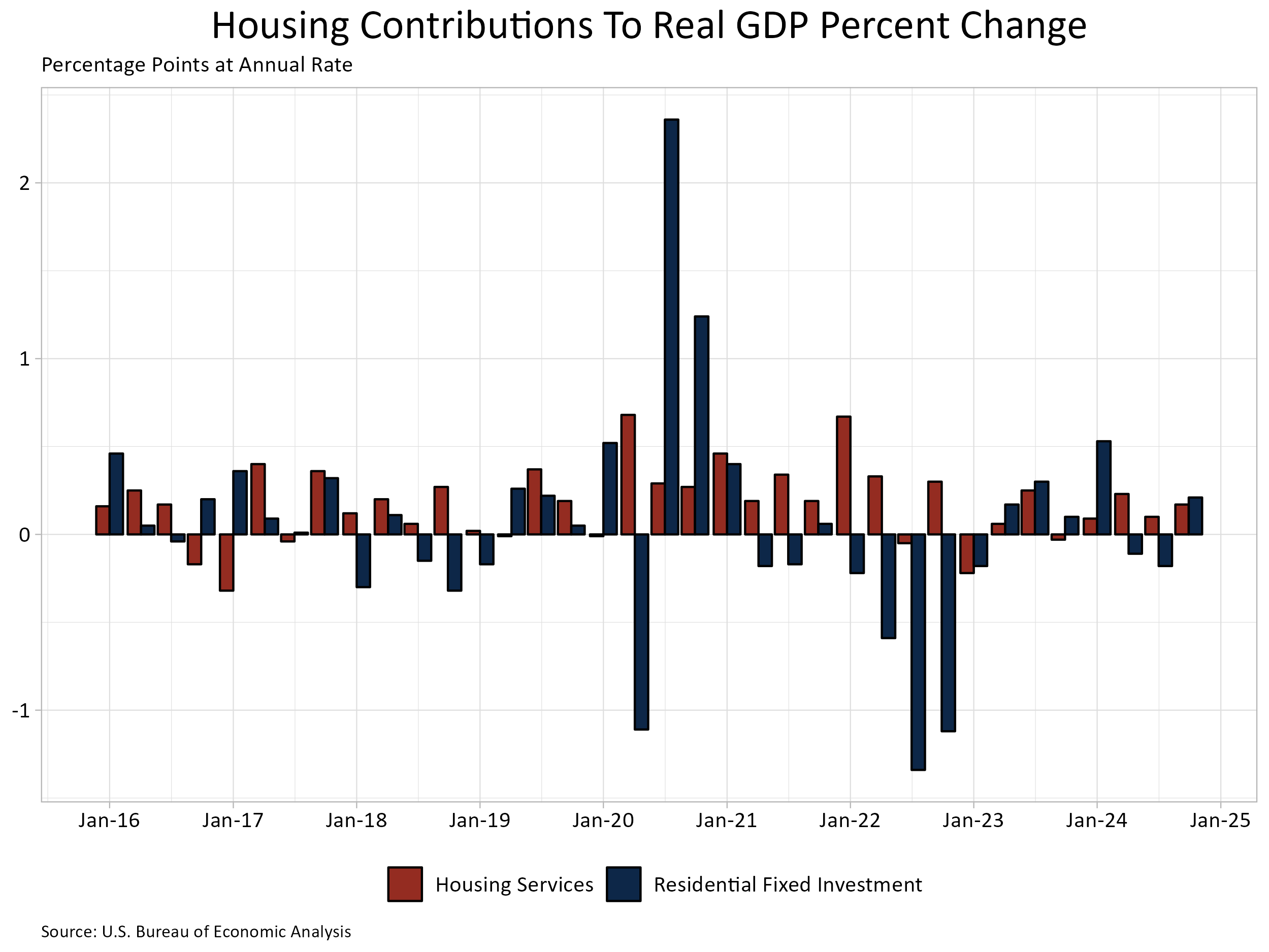

Within the fourth quarter, RFI added 21 foundation factors from the headline GDP progress price within the fourth quarter of 2024, a welcomed consequence as RFI beforehand had two consecutive quarters of unfavorable contributions to GDP. The Federal Reserve, whereas holding unchanged this month, lowered the federal funds price by 100 foundation factors in September and December of 2024. This seemingly improved financing situations for a lot of builders, resulting in RFI’s progress within the fourth quarter. A notable commentary from the fourth quarter launch was nonresidential fastened funding (much like RFI, however for nonresidential buildings) negatively contributed 31 foundation factors to GDP progress, the primary unfavorable impact on the economic system for nonresidential fastened funding in over three years.

Housing companies added 17 foundation factors (bps) to GDP progress. Amongst family expenditures for companies, housing companies contributions have been the fourth-highest contributor to headline GDP progress behind well being care (46 bps), different companies (31 bps) and monetary companies and insurance coverage (18 bps).

General GDP elevated at a 2.3% annual price, down from a 3.1% enhance within the third quarter of 2024, and down from a 3.0% enhance within the second quarter of 2024. Headline GDP progress in 2024 was 2.8%, down barely from 2.9% in 2023 however up from 2.5% in 2022.

Housing-related actions contribute to GDP in two fundamental methods:

The primary is thru residential fastened funding (RFI). RFI is successfully the measure of house constructing, multifamily growth, and reworking contributions to GDP. RFI consists of two particular kinds of funding, the primary is residential buildings. This funding contains development of recent single-family and multifamily buildings, residential reworking, manufacturing of manufactured properties, brokers’ charges and a few kinds of tools which are constructed into the construction. RFI’s second part, residential tools, contains funding corresponding to furnishings or family home equipment which are bought by landlords for rental to tenants.

For the fourth quarter, RFI was 4.0% of the economic system, recording a $1.200 trillion seasonally adjusted annual tempo. RFI grew 5.3% at an annual price within the fourth quarter after falling 4.4% within the third. Among the many two kinds of RFI, actual funding in residential buildings rose 5.3% whereas for residential tools it rose 4.9%. Funding in residential buildings stood at a seasonally adjusted annual tempo of $1.178 trillion, making its share of residential funding far higher than that of residential tools, which was at seasonally adjusted annual tempo of $21.5 billion.

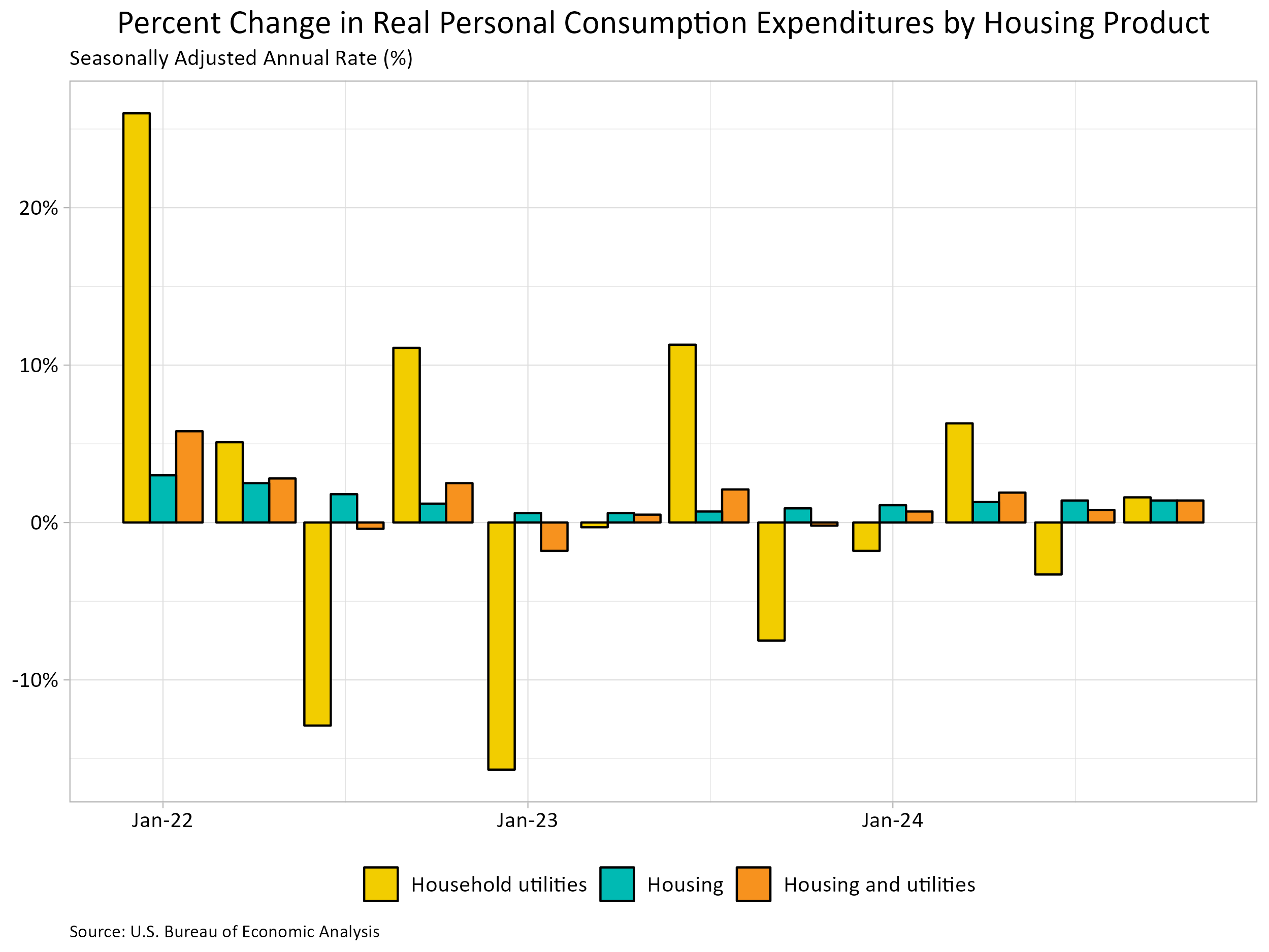

The second influence of housing on GDP is the measure of housing companies. Much like the RFI, housing companies consumption will be damaged out into two parts. The primary part, housing, contains gross rents paid by renters, house owners’ imputed lease (an estimate of how a lot it will price to lease owner-occupied items), rental worth of farm dwellings, and group housing. The inclusion of householders’ imputed lease is important from a nationwide revenue accounting method, as a result of with out this measure, will increase in homeownership would end in declines in GDP. The second part, family utilities, consists of consumption expenditures on water provide, sanitation, electrical energy, and gasoline.

For the fourth quarter, housing companies represented 12.2% of the economic system or $3.625 trillion on a seasonally adjusted annual foundation. Housing companies grew 1.4% at an annual price within the fourth quarter. Actual individual consumption expenditures for housing additionally grew 1.4%, whereas family utilities expenditures grew 1.6%. On the seasonally adjusted annual tempo, housing expenditures was $3.166 trillion and family utility expenditures stood at $458.9 billion in seasonally adjusted annual charges.

Uncover extra from Eye On Housing

Subscribe to get the most recent posts despatched to your e mail.