Whenever you rent a brand new worker, you should gather a accomplished Kind W-4, Worker’s Withholding Certificates. That is how you establish federal revenue tax withholding. In some unspecified time in the future within the onboarding course of, an worker could ask you the best way to fill out Kind W-4.

Have you learnt the reply?

Learn on to discover ways to fill out a W-4 so that you is usually a useful resource to your workers.

What’s Kind W-4?

Kind W-4 is a new worker kind workers should fill out to find out federal revenue tax withholding.

Staff should fill out info like their Social Safety quantity, submitting standing, and dependents.

After you obtain a accomplished W-4 kind, you’ll be able to decide how a lot to withhold from the worker’s wages for federal revenue taxes.

When do workers fill out Kind W-4?

Staff should fill out the W-4 once they begin working someplace.

If workers don’t submit a Kind W-4, you should withhold revenue tax from their wages as in the event that they have been single with zero allowances.

Can your workers change W-4 kinds at any time? Usually sure, workers could replace their W-4 kinds throughout the yr. For instance, workers could need to change their federal revenue tax withholding in the event that they get married. Or, they could merely need to alter their tax withholdings.

Nonetheless, workers can not change their W-4 kinds in case you have acquired a lock-in letter from the IRS.

What duty does the employer have for the W-4?

You don’t submit Kind W-4 to the IRS. Nonetheless, employers have a number of Kind W-4 tasks.

Employers should:

- Distribute W-4 kinds to new hires

- Replace your payroll tax withholding based mostly on the worker’s W-4 kind

- Hold all W-4 kinds in your information

- Submit Kind W-4 to the IRS in the event that they ask you to in a written discover

- Forestall workers from altering W-4 kinds if the IRS despatched you a lock-in letter

Make life a bit easier. Give workers the power to replace their W-4 kinds in a web based worker portal. Use payroll software program with a free worker portal to get began.

How one can fill out Kind W-4

Are your workers at a loss over the best way to fill out the brand new W-4 kind? Right here’s a step-by-step information on the best way to fill out Kind W-4 so you’ll be able to assist your group.

Steps 1-5 are on your worker. The “Employers Solely” part is your duty. Worksheets are optionally available and relevant to workers in sure conditions.

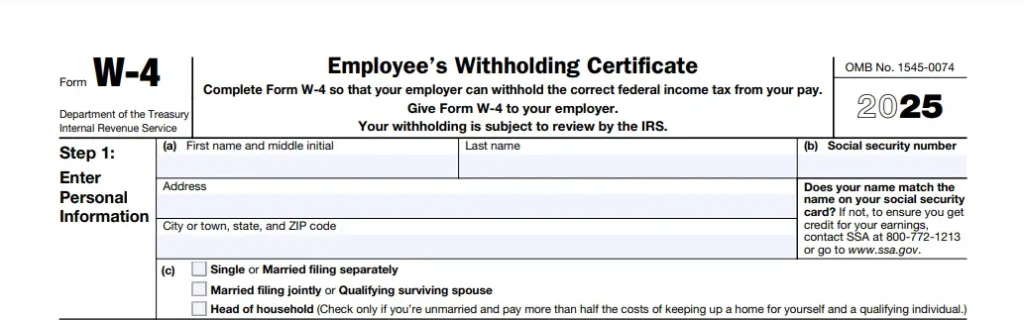

Step 1: Enter Private Data

The primary part of the W-4, “Step 1: Enter Private Data,” is necessary. All workers should full Step 1.

Your worker should enter their private info and point out their submitting standing in Step 1 of Kind W-4.

Staff should enter the next in Step 1:

- First identify and center preliminary

- Final identify

- Social Safety quantity

- Handle

- Submitting standing

- Single or Married submitting individually

- Married submitting collectively or Qualifying surviving partner

- Head of family

You’ll want this private info out of your worker to precisely fill out Kind W-2, Wage and Tax Assertion.

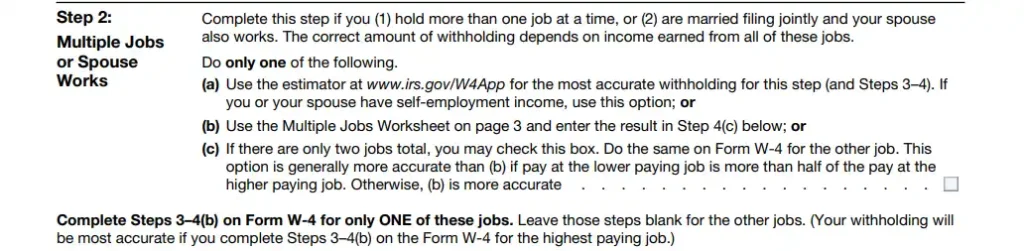

Step 2: A number of Jobs or Partner Works

Staff should full “Step 2: A number of Jobs or Partner Works” provided that it applies to them.

Your worker ought to fill it out if they’ve multiple job at a time or are married submitting collectively with a partner who additionally works.

Does your worker work multiple job at a time? Or, is your worker married submitting collectively with a partner who additionally works?

If that’s the case, Step 2 applies to your worker, and the worker should do one of many following:

- Use the IRS estimator for correct withholding,

- Use the A number of Jobs Worksheet (Step 2(b)) and enter the lead to Step 4(c) of Kind W-4, OR

- Verify this field if there are solely two jobs whole (and do the identical on the Kind W-4 for the opposite job)

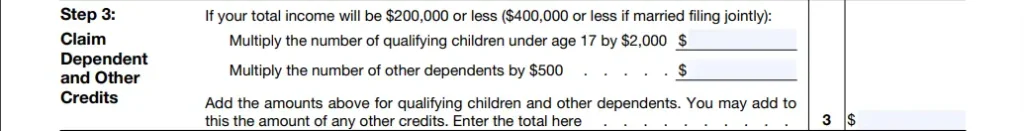

Step 3: Declare Dependent and Different Credit

Staff should full “Step 3: Declare Dependent and Different Credit” provided that it applies to them.

Your worker ought to fill out Step 3 if they’ve qualifying kids (kids below age 17) or different dependents or need to declare further credit. Solely workers whose whole revenue is $200,000 or much less ($400,000 or much less is married submitting collectively) can declare the kid tax credit score and different dependent credit.

Will the worker’s whole revenue be $200,000 or much less ($400,000 or much less if married submitting collectively)? Does your worker have a qualifying youngster below age 17 or different dependents?

If the reply to each questions is sure, the worker might want to:

- Multiply the variety of qualifying kids below the age of 17 by $2,000 and enter the quantity

- Multiply the variety of different dependents by $500 and enter the quantity

Lastly, the worker will add the above quantities collectively for qualifying kids, different dependents, and the quantity of some other credit. The worker then enters the quantity in Step 3.

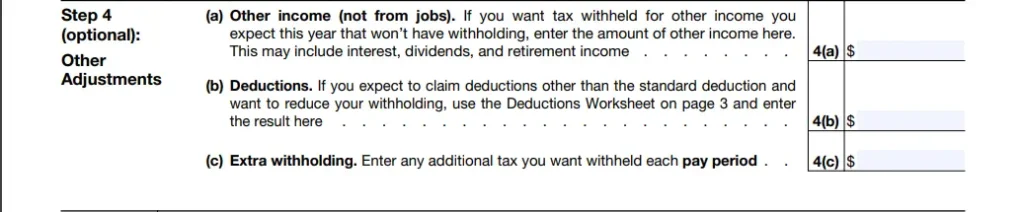

Step 4 (optionally available): Different Changes

Staff can full “Step 4 (optionally available): Different Changes” voluntarily.

Your worker ought to fill out this part if they need further taxes withheld or in the event that they need to scale back their withholding.

The worker can alter their tax withholding with the next choices:

- Different revenue (not from jobs): Staff can enter an quantity if they need tax withheld for different revenue they count on to obtain throughout the yr.

- Deductions: Staff who count on to say deductions apart from the usual deduction can use the Deductions Worksheet to cut back their tax withholding.

- Additional withholding: Staff can request to have further tax withheld every pay interval.

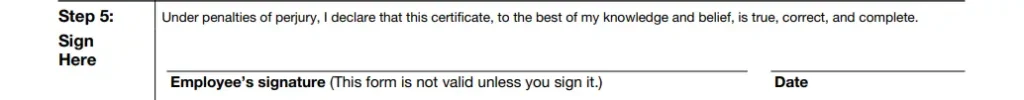

Step 5: Signal Right here

“Step 5: Signal Right here” is necessary. All workers should signal their W-4 kind for it to be legitimate.

This part is reserved for the next two entries:

- Worker’s signature

- Date

Employers Solely

Staff don’t fill on this final part. It’s reserved for employers solely.

Employers should enter the next info on every worker’s W-4 kind:

- Your identify and tackle

- The worker’s first date of employment

- Your Employer Identification Quantity (EIN)

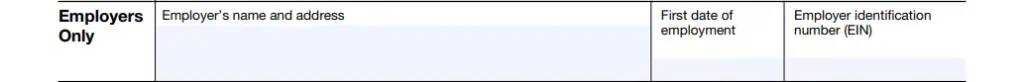

Worksheets

Kind W-4 contains two worksheets:

- Step 2(b): A number of Jobs Worksheet

- Step 4(b): Deductions Worksheet

The worker solely wants to finish one or each of those worksheets relying on their state of affairs.

Staff full the A number of Jobs Worksheet provided that they select the choice in Step 2(b) on Kind W-4.

Staff full the Deductions Worksheet provided that they full Step 4(b) as a result of they count on to say further deductions and need to scale back withholding.

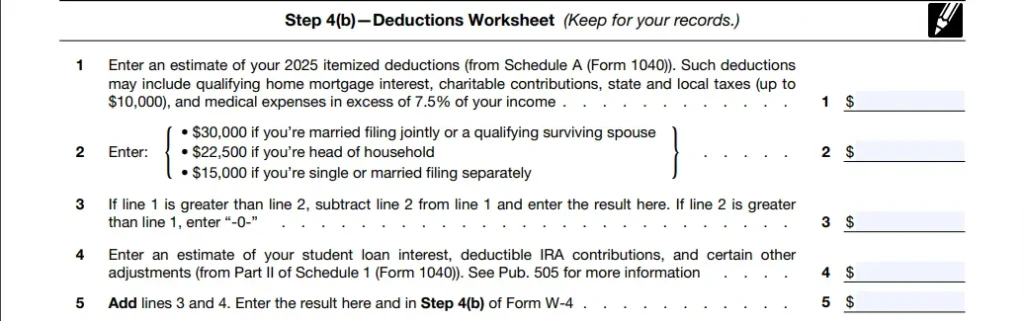

How one can correctly fill out a W-4 [example]

Let’s have a look at an instance. Your new worker, Marsha, is finishing Kind W-4.

She is married and submitting collectively along with her husband, who additionally works. Marsha has two kids below the age of 17.

Marsha wants to finish Step 2 as a result of she is married submitting collectively and her husband works. She additionally wants to finish Step 3 as a result of she has two qualifying kids.

Right here is how Marsha’s Kind W-4 would look:

Sources to assist your group full W-4s

Does your worker desire a huge refund at tax time? Or, would they relatively earn extra all year long?

The IRS has a Tax Withholding Estimator workers can use to estimate federal revenue tax withholding. Staff can use this device to finish their W-4 kinds and optimize their federal revenue tax withholding.

Your workers can use this device to:

- Estimate withholding

- Decide how withholding quantities affect refunds, take-home pay, or taxes due

- Select a withholding quantity that matches their wants

Make tax withholding a snap with Patriot’s on-line payroll. You may let workers fill out W-4 kinds of their on-line portal. After they signal their W-4 kind, the modifications will routinely replace the payroll system. Get your free trial immediately!

This isn’t meant as authorized recommendation; for extra info, please click on right here.