I like Will Rogers’ quote, “Don’t gamble; take all of your financial savings and purchase some good inventory and maintain it until it goes up, then promote it. If it don’t go up, don’t purchase it.” good friend of mine as soon as mentioned {that a} balanced portfolio will often have funds which are shedding cash. Then there are the bizarre years like 2022 when few classes apart from cash market funds, short-term bonds, and commodities had constructive returns. This text appears to be like at how Vanguard International Wellesley Earnings Fund (VGWIX) might match into the portfolio of a timid investor, or how WisdomTree Dynamic Forex Hedged Worldwide Fairness Fund (DDWM) would possibly match into the portfolio of a considerably much less timid investor.

With all of this market turmoil and uncertainty, we are able to scale back anxiousness by getting out and doing the issues we get pleasure from. Scent the roses. This child Gold Finch was having fun with the sunshine in our yard and the fowl seed that we set out. Flip off the information and go for a stroll.

With all of this market turmoil and uncertainty, we are able to scale back anxiousness by getting out and doing the issues we get pleasure from. Scent the roses. This child Gold Finch was having fun with the sunshine in our yard and the fowl seed that we set out. Flip off the information and go for a stroll.

On the investing aspect, we are able to develop long-term plans and persist with them. A well-balanced portfolio inside our danger tolerance will help scale back anxiousness.

I’m looking for sustainable simplicity.

As I overview investments of household and mates, I’m requested why do I (we) personal this fund if it’s shedding? Up to now, somebody informed me that they bought all equities earlier than the Nice Monetary Disaster, however they by no means acquired again in, and I confirmed how rather more they might have had if they’d simply stayed in. Buyers ought to improve their monetary literacy and perceive their danger tolerance.

The psychology of investing is that the concern of shedding is usually larger than the satisfaction of gaining. Inflation is a stealthy thief. Folks see their ultra-conservative investments gaining, however don’t see the lack of buying energy. I take this under consideration when helping household and mates with investments. They often need to earn more money, however promote the dips and miss the upswings. I like to recommend utilizing monetary advisors to develop a long-term plan and keep it up.

Worldwide equities are outperforming home shares currently, partly as a result of valuations are very excessive within the US. Some analysts cite tariffs as disproportionately impacting the US. Once I clarify this to timid traders, they ask if they need to purchase worldwide shares. My reply isn’t any, as a result of they don’t wish to see the worth of their accounts or funds go down.

For the much less timid investor who can deal with that some holdings will go down whereas others are up, I just like the WisdomTree Dynamic Forex Hedged Worldwide Fairness Fund (DDWM). It’s categorised by MFO as a Nice Owl Fund for persistently being within the high quintile of Worldwide Multi-Cap Worth funds for risk-adjusted returns. I chosen it from all worldwide fairness funds for its excessive risk-adjusted efficiency.

For the ultra-conservative, timid investor who doesn’t wish to see massive losses amongst their funds, I counsel combined asset funds with world publicity. I’ve assisted a few of them up to now to personal the Vanguard Wellesley Earnings Fund (VWINX/VWIAX), and it’s typically considered one of their favorites. VWINX has 13% publicity to worldwide investments.

My recommendation for some timid traders to get extra publicity to worldwide equities is to contemplate switching to the Vanguard International Wellesley Earnings Fund (VGWIX), which has a 52% publicity to worldwide investments. The International Wellesley fund has outperformed its counterpart for the previous 5 years with barely much less danger. Each have about 37% allotted to shares. I additionally like VGWIX, partly, as a result of its valuation is far decrease than VWINX. Each of those funds are categorised as Blended-Asset Goal Allocation Conservative.

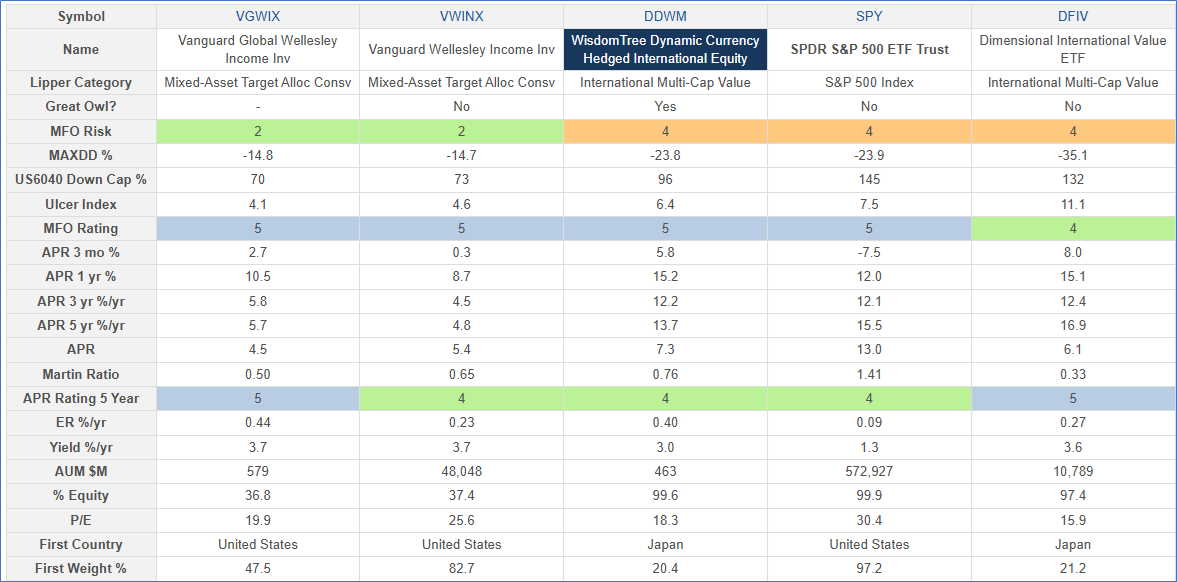

Desk #1: Excessive Performing Worldwide Fairness and International Blended Asset Funds – 7 Years

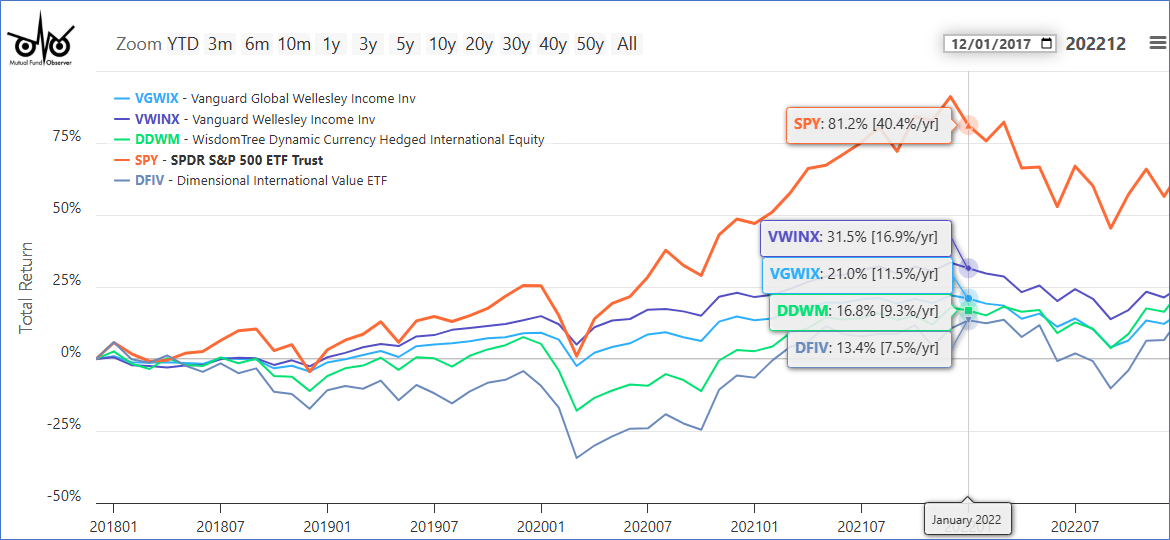

Determine #1 reveals that the efficiency of the Vanguard International Wellesley Earnings Fund (VGWIX) has been very near that of Vanguard Wellesley Earnings Fund (VWINX) for the previous seven years. The return of WisdomTree Dynamic Forex Hedged Worldwide Fairness Fund (DDWM) has been barely larger than Dimensional Worldwide Worth ETF (DFIV), however with much less draw back danger.

Determine #1: Excessive Performing Worldwide Fairness and International Blended Asset Funds – 7 Years

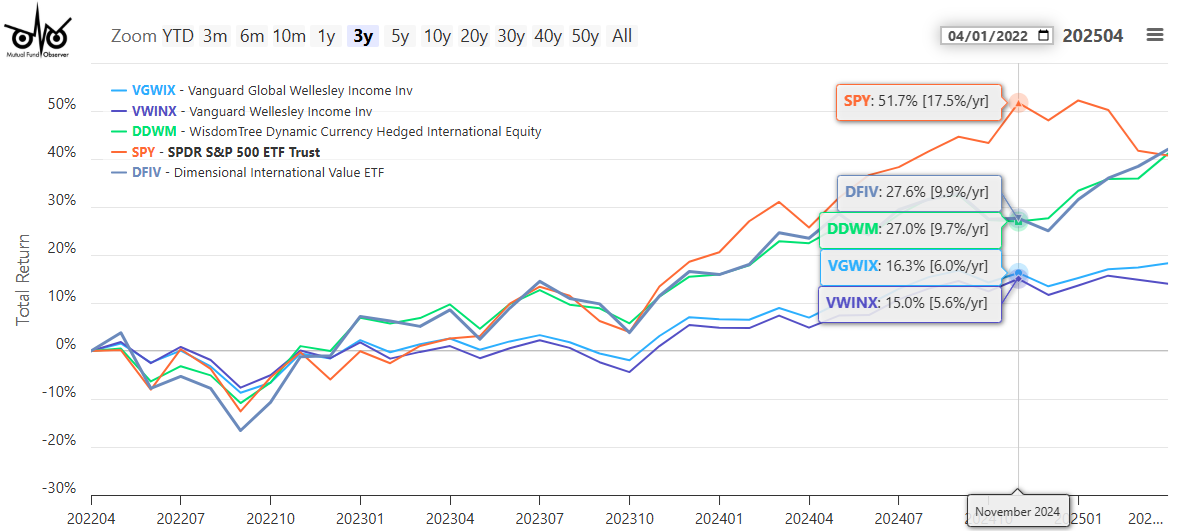

Determine #2 reveals that the efficiency of the Vanguard International Wellesley Earnings and Vanguard Wellesley Earnings has been nearly similar for the previous three years. Likewise, the efficiency of WisdomTree Dynamic Forex Hedged Worldwide Fairness ETF and Dimensional Worldwide Worth ETF can also be comparable.

Determine #2: Excessive Performing Worldwide Fairness and International Blended Asset Funds – 3 Years

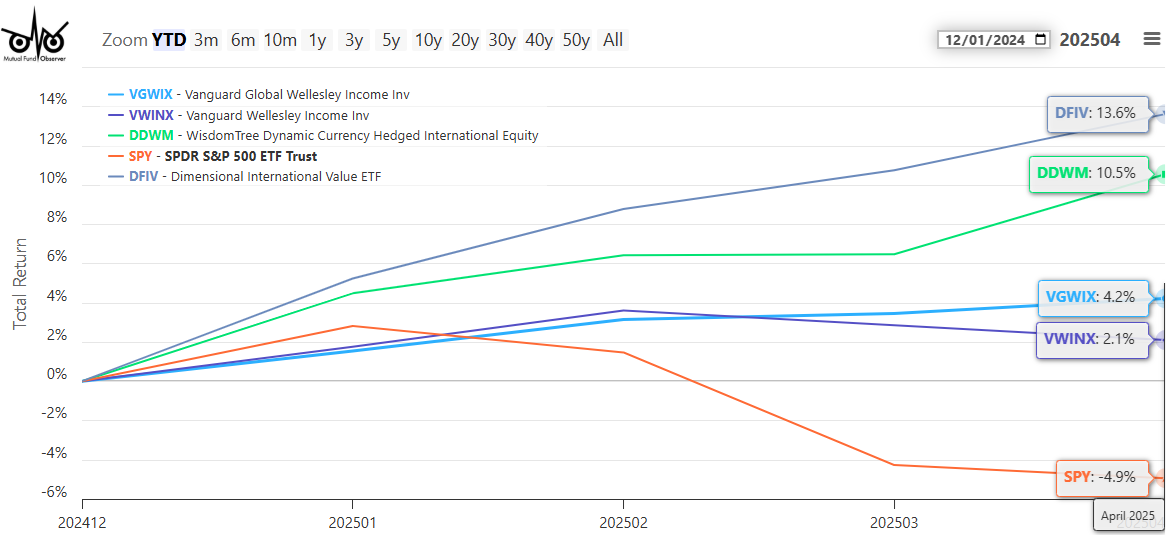

12 months up to now as of April, Dimensional Worldwide Worth ETF (DFIV) is outperforming WisdomTree Dynamic Forex Hedged Worldwide Fairness Fund (DDWM). The Vanguard International Wellesley Earnings is outperforming Vanguard Wellesley Earnings.

Determine #3: Excessive Performing Worldwide Fairness and International Blended Asset Funds – YTD

Closing

I extracted all combined asset funds with 40% or much less allotted to shares, above common risk-adjusted efficiency, and common or higher annual p.c returns. I narrowed the record to these with not less than 20% invested internationally. Vanguard International Wellesley Earnings Fund (VGWIX) is about the one fund to make the record of sixteen funds apart from Blended-Asset Goal Funds with a goal date of 2025 or earlier, and Blended-Asset Goal At this time funds. So, the timid investor who needs to get worldwide publicity ought to have a look at Vanguard International Wellesley Earnings Fund (VGWIX).