Picture supply: Getty Photos

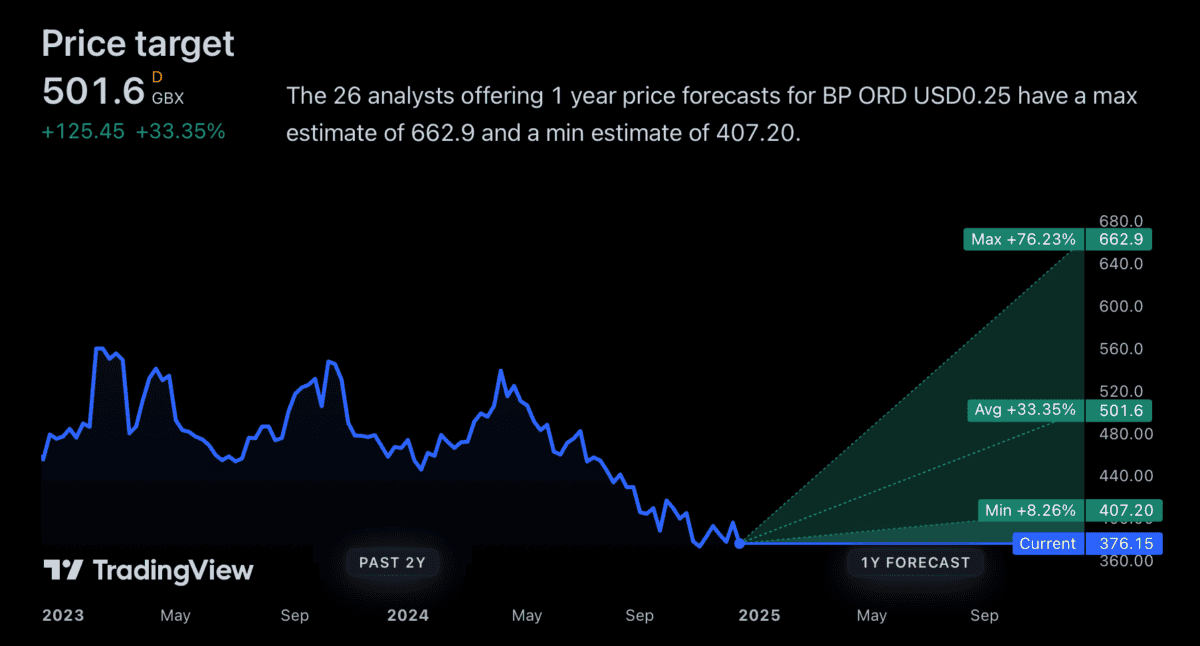

Analyst value targets for BP (LSE:BP) shares are fairly optimistic heading into 2025. The best estimate I can discover is £6.62.

That’s round 75% larger than the inventory’s present degree. So whereas 2024 hasn’t been a very good 12 months for the BP share value, might 2025 deliver a dramatic turnaround?

Oil outlook

Crucial factor for BP – as with all oil main – is the worth of oil. However whereas I’ve a constructive view on this over the long run, I’m not vastly optimistic for 2025.

A few issues make me cautious – each on the availability aspect of the equation. The primary is the opportunity of elevated manufacturing coming from the US as decrease taxes deliver down prices throughout the Atlantic.

Moreover, oil output in Saudi Arabia is at the moment close to 2020 (i.e., pandemic) ranges. With decrease prices than the competitors, I believe it’s a matter of when – quite than if – manufacturing will increase there.

Saudi Arabia oil manufacturing 2015-2024

Supply: Buying and selling Economics

For the oil value to remain at its present degree, I believe demand might want to improve. And outdoors of China – which is admittedly an enormous issue – I’m not assured this may occur within the subsequent 12 months.

Valuation

For the time being, BP shares commerce at a major low cost to different oil majors. However by itself, this isn’t a powerful motive for considering the share value goes to rise subsequent 12 months.

One of many classes I’ve discovered in 2024 is that low costs can persist for a very long time. And if it takes too lengthy for the underlying worth of the shares to be realised, this may make for a disappointing funding.

Importantly, although, administration is benefiting from the discounted valuation. It’s within the course of of shopping for again shares, which shall be simpler the longer the share value stays down.

Moreover, there’s a dividend with a 6.31% yield on supply for the time being. This could go a way in the direction of offsetting the chance price of ready for traders searching for a possible restoration.

Worth targets

A 75% bounce may appear to be loads – and it’s. However it may not be implausible given the valuations – and dividend yields – on supply elsewhere within the sector.

If the BP share value reached £6.62, the dividend yield would fall to three.63%. That’s in the direction of the decrease finish of the vary the opposite oil majors are buying and selling in, however it wouldn’t make it an enormous outlier.

| Inventory | Dividend yield |

|---|---|

| BP | 6.32% |

| Chevron | 4.62% |

| ConocoPhillips | 3.28% |

| ExxonMobil | 3.75% |

| Shell | 4.49% |

| TotalEnergies | 6.19% |

That goes a good distance in the direction of justifying a £6.62 value goal for BP shares. Even at that degree, the inventory would nonetheless have an identical dividend yield to ExxonMobil.

Buyers ought to take into account that US corporations are set to profit from tax cuts, whereas UK oil corporations are going through windfall taxes. However even contemplating this danger, the valuation low cost could be very broad for the time being.

Alternative?

So far as I can see, the most effective motive for considering the BP share value may be about to climb 75% is that this may shut the valuation hole to the opposite oil majors. And that isn’t a nasty concept, by any means.

Buyers want to contemplate how shortly this may occur. However with a considerable dividend along with ongoing share buybacks, there’s an opportunity the wait may be price it.