Right this moment’s Speak Your E book is dropped at you by J.P. Morgan Asset Administration:

See right here and right here for extra data on J.P. Morgan Asset Administration ETF analysis

-

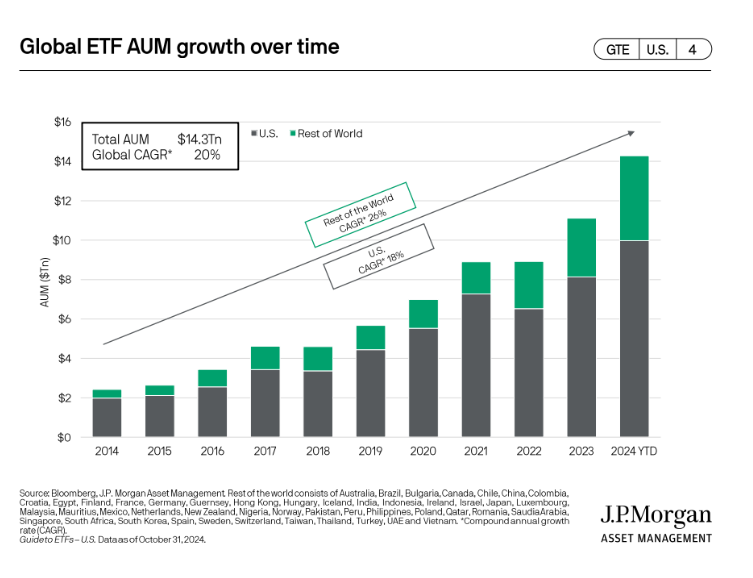

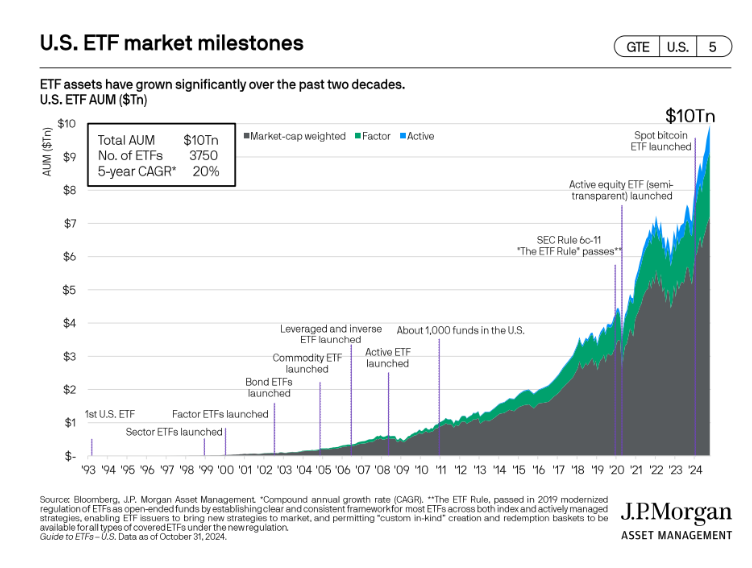

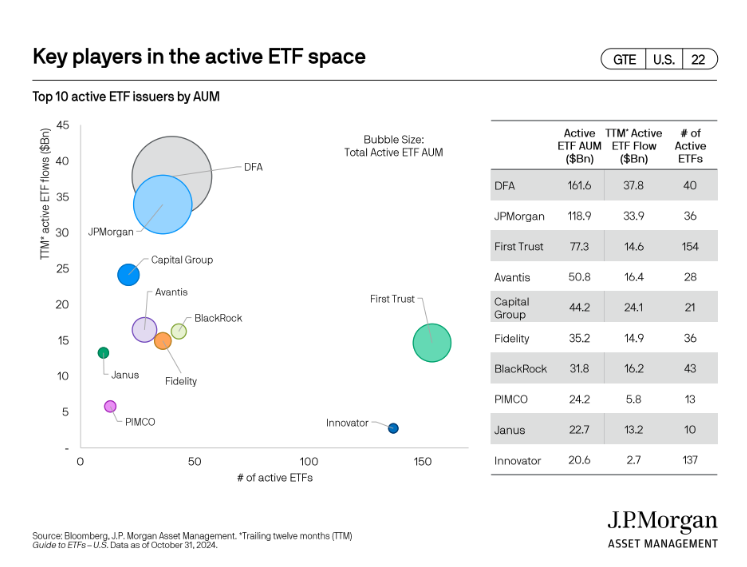

The place the ETF flows are coming from

-

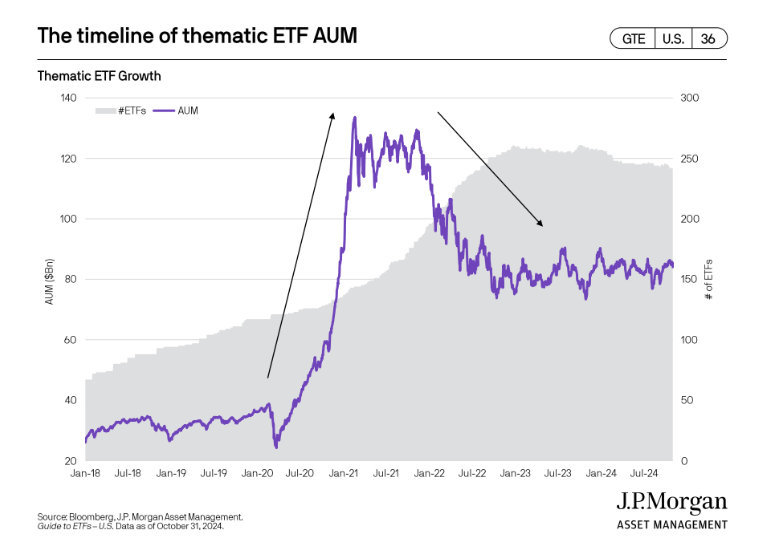

The expansion and decline of thematic ETF flows

-

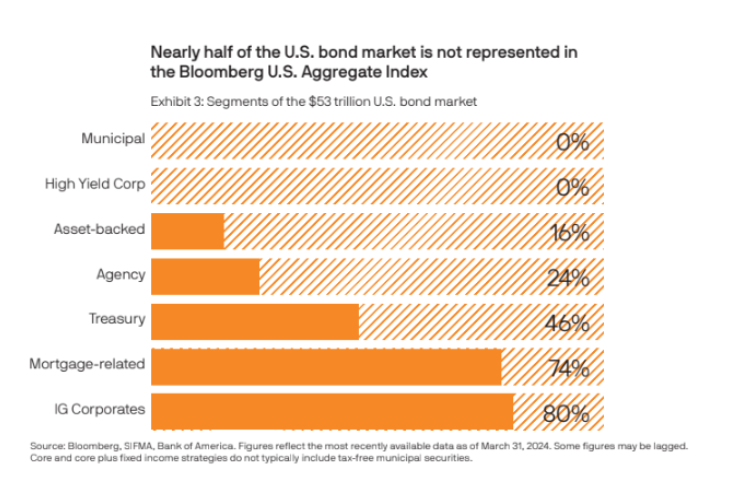

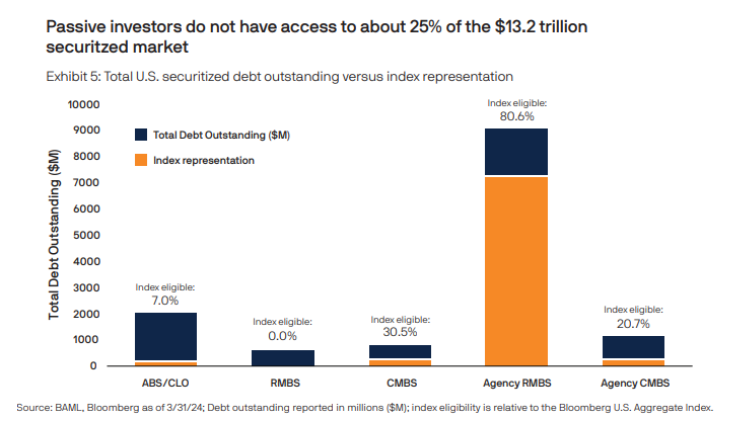

Why the AGG doesn’t embrace a wide range of bonds

-

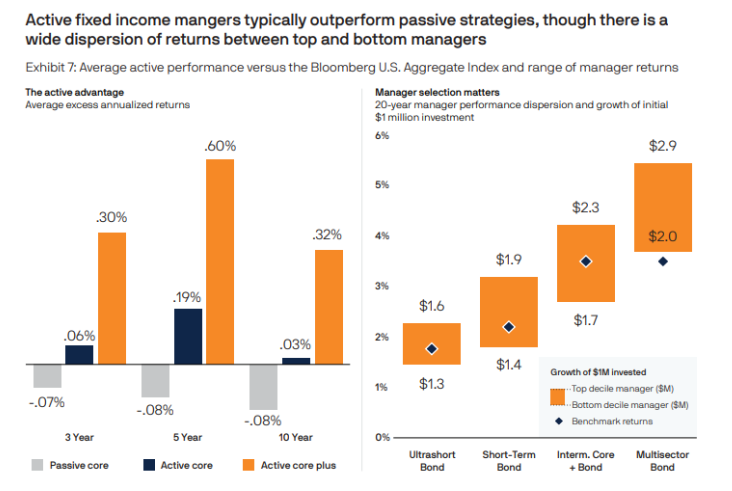

Why mounted earnings indices are simpler to beat than fairness indices

-

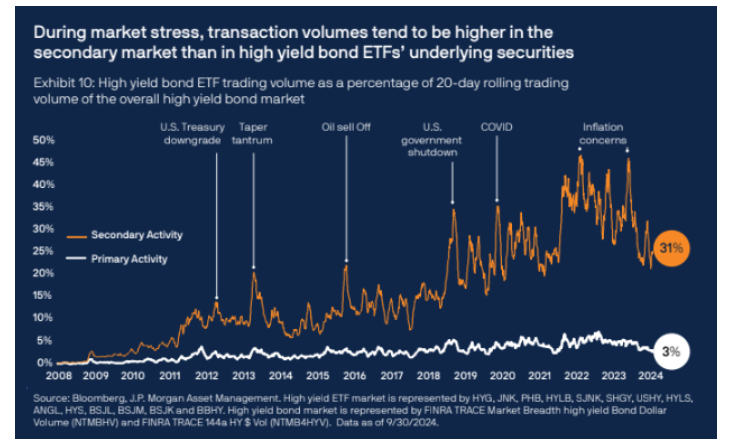

Ideas on personal belongings throughout the ETF wrapper

J.P. Morgan ETFs are distributed by JPMorgan Distribution Providers, Inc. is a member of FINRA. J.P. Morgan Asset Administration is the model identify for the asset administration enterprise of JPMorgan Chase & Co., and its associates worldwide. JPMorgan isn’t affiliated with Ritholtz Wealth Administration LLC and The Irrelevant Investor.

Take a look at our t-shirts, espresso mugs, and different swag right here.

Nothing on this weblog constitutes funding recommendation, efficiency information or any suggestion that any specific safety, portfolio of securities, transaction or funding technique is appropriate for any particular particular person. Any point out of a specific safety and associated efficiency information isn’t a suggestion to purchase or promote that safety. Any opinions expressed herein don’t represent or indicate endorsement, sponsorship, or suggestion by Ritholtz Wealth Administration or its workers.

The Compound Media, Inc, an affiliate of Ritholtz Wealth Administration, obtained compensation from the sponsor of this commercial. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investing in speculative securities includes the danger of loss. Nothing on this web site ought to be construed as, and might not be utilized in reference to, a suggestion to promote, or a solicitation of a suggestion to purchase or maintain, an curiosity in any safety or funding product.

Buyers ought to fastidiously think about the funding targets and dangers in addition to prices and bills of the JPMorgan ETF earlier than investing. The abstract and full prospectuses comprise this and different details about the ETF. Learn the prospectus fastidiously earlier than investing. Name 1-844-4JPM-ETF or go to www.jpmorganETFs.com to acquire a prospectus. Supply: Morningstar.

JEPI AUM based mostly on 2023 World Actively Managed ETF AUM as of 11/30/24. Fairness Premium Earnings ETF JEPI RISK SUMMARY: The worth of fairness securities could fluctuate quickly or unpredictably as a consequence of components affecting particular person corporations, in addition to adjustments in financial or political situations. These worth actions could end in lack of your funding. Investments in Fairness-Linked Notes (ELNs) are topic to liquidity danger, which can make ELNs troublesome to promote and worth. Lack of liquidity may trigger the worth of the ELN to say no. Since ELNs are in observe kind, they’re topic to sure debt securities dangers, corresponding to credit score or counterparty danger. Ought to the costs of the underlying devices transfer in an surprising method, the Fund could not obtain the anticipated advantages of an funding in an ELN, and will understand losses, which could possibly be important and will embrace the Funds total principal funding. Investing includes dangers, together with lack of principal.

JPMorgan Distribution Providers, Inc. is a member of FINRA.