Pricey associates,

Welcome to the “Midsommar in Scandinavia” challenge of the Mutual Fund Observer. Chip and I are having fun with a long-planned vacation in Sweden and Norway. We’re equally delighted that you simply’re right here … and we’re there!

On this month’s Observer…

Amongst different issues (how would I do know for positive? I’m in Gamla Stan), Lynn Bolin addresses the rising menace of tariff-induced inflation with “Defending In opposition to Tariff Induced Inflation,” analyzing how widespread tariffs will possible be handed via to shoppers and drive inflation to an estimated 3.4% peak subsequent quarter. Drawing on 5 years of post-pandemic bond efficiency knowledge, he demonstrates that shorter-duration and inflation-protected securities have considerably outperformed conventional intermediate-term bonds, main him to rotate into funds like Vanguard Brief-Time period Inflation-Protected Securities Index (VTAPX), Constancy Inflation-Protected Bond Index Fund (FIPDX), and PIMCO Inflation Response Multi-Asset Fund (PZRMX). Bolin has diminished his inventory allocation from 65% to 50% and now maintains roughly 7% of his bond allocation in inflation-protected securities, with one other 40% in shorter-duration bonds, whereas additionally incorporating target-maturity TIPS ETFs like iShares iBonds Oct 2030 Time period Suggestions ETF (IBIG) into his bond ladders.

America’s premier Asian funding boutique, Matthews Asia, has fallen on exhausting instances. Former CEO and portfolio supervisor Mark Headley has returned from retirement, intent on fixing that. Our hour-long interview is summarized in “Good Bones There.”

With none doubt, probably the most profitable small-cap worth fund in existence is Scott Barbee’s Aegis Worth Fund. We final shared a full profile of the fund in 2013, but it surely has appeared in eight data-driven articles since then. We determined it was excessive time to meet up with Mr. Barbee and proper our oversight in a profile of Aegis Worth Fund (AVALX).

Three years in the past, within the midst of a market meltdown (do you even recall the ’22 crash now), we provided recommendation on how to deal with a … ummm “spanked portfolio.” The whimsical accompanying graphic generated a stunning quantity of website visitors. This month, we provide a three-year retrospective on our 2022 recommendation: hold calm and contemplate small-value funds with high-quality portfolios. The efficiency numbers appear promising.

We additionally share a Launch Alert for Stewart Traders Worldwide Leaders Fund, the US launch of a profitable non-US technique specializing in a concentrated portfolio of high-quality, sustainable companies. The launch was seeded by a US basis, so the preliminary share class is establishment with retail within the pipeline!

Effervescent just under the floor

Hedge funds are shifting to Asia. Goldman Sachs reviews that hedge fund buying and selling in Asian markets have a five-year excessive in June. “Hedge funds purchased equities in Japan, Hong Kong, Taiwan and India final week, however have been brief promoting onshore Chinese language shares,” Goldman stated.

Household places of work are shifting to infrastructure and personal debt. A BlackRock survey of 175 household places of work, the funding supervisor for ultra-wealthy households, reviews that one-third have been planning to extend publicity to personal debt this 12 months and 30% have been planning to commit extra sources to infrastructure investments.

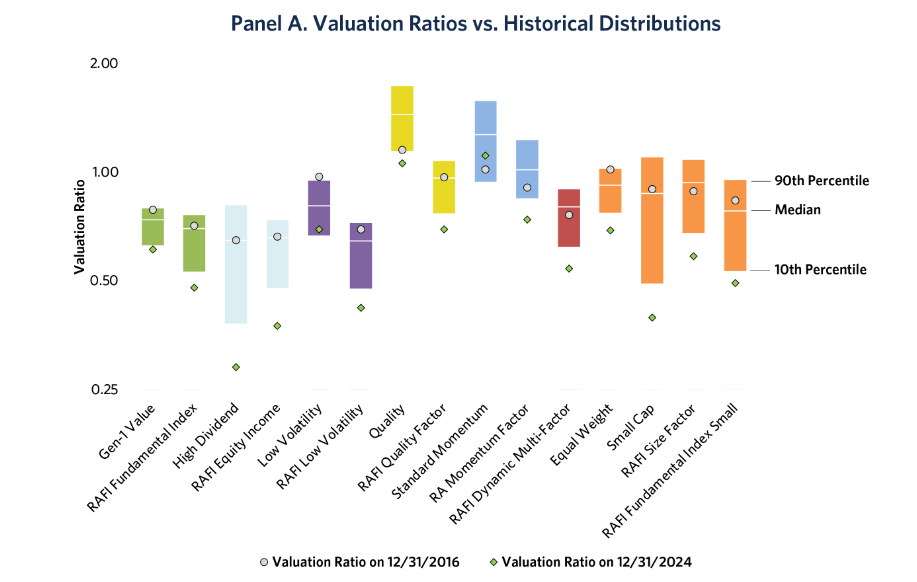

Nearly each sensible beta (e.g., low volatility or elementary valuation) technique has failed to supply, in response to new analysis from Analysis Associates (free registration required). The brief model: RA has been monitoring the efficiency of a collection of factor-based portfolios since 2018, trying to see whether or not any supplied the promised extra return.

They didn’t. In each case, simply investing in “the market” was a greater wager.

The excellent news: “the market” – outlined by its massive / development / momentum subset, is now so egregiously overpriced that just about all the things outdoors of that area of interest is dramatically underpriced.

The best way to learn that chart is to start out by discovering the little inexperienced diamonds. These are the more-or-less present valuations of every technique relative to its historic valuations. Inexperienced diamonds under the coloured bar, which illustrates the historic vary from 10th percentile to 90th, alerts that the technique is now cheaper than it has been 90% or 95% of the time.

RA concludes that’s excellent news since valuation issues:

… we imagine there could also be hope for all sensible beta methods. If markets obtain a wake-up name and valuations revert, a mess of systematic factor-based fairness methods may all have a subject day. After eight years of going horribly incorrect, sensible beta investing could now go horribly proper.

AI is quite a bit dumber than we thought. A collection of analysis reviews, most just lately from Apple, argue that whereas AI can execute sure duties exceptionally properly, reasoning shouldn’t be amongst them. The researchers discovered that in easy reasoning duties, together with the Towers of Hanoi problem, AIs underperform 7-year-olds. Their central argument is that even probably the most superior LLMs don’t assume in any method that resembles us. Their conclusion is that AI “considering” isn’t just totally different, it’s horrible. (Gary Marcus, “A Knockout Blow for LLMs? LLM ‘reasoning’ is so cooked, they turned my identify right into a verb,” Communications of the ACM, 6/16/2025).

Because the complexity of calls for rises, shifting AI past its consolation zone, so does the frequency of hallucinations. One estimate is that 79% of responses from a few of the newer AI include hallucinated content material (“A.I. Is Getting Extra Highly effective, however Its Hallucinations Are Getting Worse,” New York Instances, 5/6/2025, subscription required).

A coda to that argument: ChatGPT simply misplaced a chess match to an Atari 2600. If you happen to’re, oh, underneath 50, you might be forgiven for the query “WTF is an Atari?” as a result of the 2600 is a house online game console launched in 1977. ChatGPT truly volunteered to play the previous recreation system. Oops. One report of the match contained this abstract:

The truth is, the Atari wiped the ground with ChatGPT when it got here to chess. I don’t imply the near-half-century-old recreation console gained. I imply that ChatGPT made blunders that might embarrass the greenest of inexperienced persons.

On the upside, maybe it thinks it gained? “So I stated ‘right here, maintain ma beer an’ gimme a knight an’ I kicked its little Atari keester all the best way to …’”.

AI is dirtier than we thought. Not “smutty grime” (although that’s good, too) however “energy- and water-gulping soiled.” MIT researchers discovered two troubling developments: AI knowledge facilities use extra energy and extra energy derived from fossil fuels than “regular” knowledge facilities:

… greater than half of the electrical energy going to knowledge facilities will probably be used for AI. At that time, AI alone may eat as a lot electrical energy yearly as 22% of all US households. In the meantime, knowledge facilities are anticipated to proceed trending towards utilizing dirtier, extra carbon-intensive types of vitality (like fuel) to fill rapid wants, leaving clouds of emissions of their wake. (“We did the mathematics on AI’s vitality footprint. Right here’s the story you haven’t heard,” MIT Expertise Overview, 6/2025)

A part of the problem is that AI corporations appear desperately involved with obscuring the magnitude of their vitality and water use, which some suspect feels like a responsible conscience at work.

AI customers are stupider than we thought. Of us have casually and consistently noticed the tendency of individuals to be lazy, turning to AI to do their work and thoughtlessly passing it alongside as their very own. The underlying phenomenon is known as “cognitive offloading.” It’s pushed by two organic imperatives: people have a restricted provide of vitality every day and considering requires lots of vitality. Our survival response is to assume as little as essential to get via the day. The well mannered time period for us is “cognitive misers.” We depend on tips, shortcuts, and habits – none of which require a lot vitality – to muddle via. However we additionally offload duties – we delegate – at any time when doable. As a fast take a look at, what number of phone numbers are you able to recite off the highest of your head? (No, 9-1-1 doesn’t depend.) After I was younger, the reply was in all probability “dozens.” Immediately, it’s in all probability two or three (my very own, Chip’s, and my son’s). I depend on my telephone to maintain monitor of the remaining. That’s cognitive offloading.

A second set of MIT researchers, the Mind on Massive Language Fashions workforce, has been doing pretty rigorous analysis on how our brains reply to the provision of AI/LLMs as an offloading possibility. (Spoiler alert: not properly.) Most just lately, they gave three teams of scholars the identical activity. One group had entry to ChatGPT, one had entry to Google, and the opposite needed to assume for themselves. (Yikes.) The research ran over 4 months and included each mind exercise screens and direct commentary. Their findings:

Mind connectivity systematically scaled down with the quantity of exterior help: the Mind‑solely group exhibited the strongest, widest‑ranging networks, Search Engine group confirmed intermediate engagement, and LLM help elicited the weakest total coupling … The reported possession of LLM group’s essays within the interviews was low. The Search Engine group had sturdy possession, however lesser than the Mind-only group. The LLM group additionally fell behind of their capability to cite from the essays they wrote simply minutes prior. (Your Mind on ChatGPT, 6/2025)

The brief model: the brains of Chat-dependent college students actually powered down and whereas the scholars nominally accomplished the work themselves, that they had little perception in their very own written conclusions and couldn’t fairly keep in mind what they’d simply stated.

Slightly as we will’t fairly keep in mind our sibling’s telephone quantity 5 minutes after we known as them.

Job opening: Finest billionaire pal

The White Home apparently has a gap for a brand new Finest Billionaire Good friend (BBF) after a spectacular fallout between Mr. Trump and the earlier holder of the place, Mr. Musk. Mr. Musk, who invested closely in Mr. Trump’s election marketing campaign, left authorities service, such because it was, denounced Mr. Trump’s signature legislative package deal as “a disgusting abomination” and endorsed a name for Mr. Trump’s impeachment. He nonetheless affirmed his “love for the man.”

Two of Mr. Musk’s associates attribute the fallout to Mr. Trump’s failure to provide Musk and Tesla favorable therapy underneath the invoice. “Elon was butthurt,” in response to one supply. Musk threatened to decommission his fleet of Dragon spacecraft. Trump threatened to “terminate Elon’s Authorities Subsidies and Contracts” and to research his enterprise practices. Musk caved.

We’ve written a good quantity concerning the historical past and enduring psychology of those alliances (“If you happen to’re so wealthy, why aren’t you sensible?” LinkedIn, 4/2025).

Two issues to recollect:

- This isn’t aberrant habits; it’s a wonderfully predictable sequence of occasions pushed by well-documented psychological analysis (it’s exceedingly tough to amass huge wealth with the presence of excessive danger tolerance and indifference to unfavourable externalities) and repeated endlessly over the course of the previous 125 years. The ultra-rich cozy as much as authoritarian guidelines, hoping to commerce help for future wealth. It goes poorly.

- This must be an essential filter for buyers, on a regular basis {and professional} alike. Latest headlines start with “Invoice Ackman says …” or “5 locations billionaires are placing their cash” ought to elevate your shields, not your hopes. With huge respect for Mr. Ackman’s acumen at making himself very, very wealthy, neither his political preferences nor his funding actions must information your considering. They’re manifestations of his world and pursuits, not yours.

Thankfully, the BBF place is more likely to be swiftly stuffed. UBS reviews (6/2025) that there are actually 31 individuals with wealth in extra of $50 billion {dollars}.

Queue varieties to the fitting!

Thanks …

To the entire people serving to to make our Scandinavian sojourn wonderful!

We requested, you answered!

Thanks a lot to all the parents who shared good needs and journey recommendation for our upcoming Scandinavian journey: Stuart, Leah, Marjorie, DGH, and Roger. Thanks, thanks!

Stuart: the Vasa Museum is one among our must-see websites! Gotland and Stumholmen are saved for our subsequent journey.

Leah: thanks for the sweater recommendation – we’re setting apart a price range for Bergen. And Chip could be reserving a desk at Bryggen Tracteursted as I write.

DGH: Pending good climate, the Norse Folkemuseum and time to wander round Bygdøy are on the itinerary. Additionally, can we like cinnamon rolls? “Like” is such an understatement. WB Samson, bought it!

Roger: We’re doing the Norway in a Nutshell with an in a single day in Flåm. Because you and Leah each made word of the climbing/strolling alternatives, we’ll see what we will slot in. We even have Frogner Park on the checklist!

And, many thanks, at all times, to the regular contributors who assist us hold the lights on and our spirits up: the great people at S&F Funding Advisors, Wilson, Greg, William, William, Stephen, Brian, David, Doug, and Altaf. We’ll completely Fika with you ASAP!

We’ll see you in August and share the journey!