An worker can begin receiving the pension beneath EPS solely after rendering a minimal service of 10 years and attaining the age of 58 or 50 years. In case of loss of life / disablement, the above restrictions doesn’t apply. One has to submit Type 10D by final employer to assert Pension. This text provides overview of EPS Contribution,Pension from EPS, how a lot EPS pension would one get,explains the right way to fill EPS Pension Type 10D to Declare your Pension from EPS.

Overview of Pension from EPS

Staff’ Pension Scheme (EPS) affords pension on disablement, widow pension, and pension for nominees. In 1995 EPS changed the Household Pension Scheme (FPS) of 1971. When an worker joins an institution coated beneath the Staff Provident Funds & Miscellaneous Provision Act, 1952 (s)he turns into a member of Staff Provident Fund Scheme (EPF) and Staff’ Pension Scheme (EPS) . Our article Fundamentals of Worker Provident Fund: EPF, EPS, EDLIS explains EPS,EPS intimately.

EPS Contribution, Switch of EPF and Withdrawal from EPF/EPS

EPS Contribution

- EPS is relevant to all members who joined EPF after 15.11.1995

- 8.33% of employer’s month-to-month contribution from the EPF goes to EPS.

- Month-to-month contribution to EPS is restricted to eight.33% of Rs. 15000 or Rs 1250 p.m.

- In contrast to the EPF contribution, EPS half does NOT get any curiosity.

- On attaining 58 Years of age, a EPF member ceases to be a member of EPS robotically.

- From 25 Apr 2016 one can defer pension upto 60 years with/with out contribution

What Occurs when you resign earlier than finishing 10 years of service?

For EPS, if the service interval is lower than 10 years, you’ve choice to both withdraw your corpus or get it transferred by acquiring a ‘Scheme Certificates’. As soon as, the service interval crosses 10 years, the withdrawal choice ceases.

- In the event you resign earlier than finishing 9 years and 6 months of service, you get the withdrawal profit which will depend on your month-to-month wage and the quantity of years of service. EPS all the time rounds up the variety of years. So, when you labored for 4 years and seven months, it will likely be thought of as 5 years.

- A member who has accomplished 58 years of / claimant on behalf of a deceased member who died after the age of 58 years with out finishing the eligible service of 10 years ought to apply for Withdrawal Profit by Type 10C.

What occurs to pension once you switch a job?

Technically, EPS and EPF are usually not linked . You possibly can withdraw the EPF as soon as you permit the group after filling Type 19. However once you switch the EPF utilizing EPF Type 13, then EPS can also be transferred. It’s quantity is just not mirrored within the passbook. However interval of switch is recorded.

Pension from EPS

- An worker can begin receiving the pension beneath EPS solely after rendering a minimal service of 10 years and attaining the age of 58 or 50 years. That is Referred to as superannuation

- If an worker is a member of Staff’ Pension Scheme. He/She has left employment at 48 yrs. of age and eight yrs. of service. He is not going to obtain any pension.

- If worker is a member of Staff’ Household Pension Scheme and has left employment at 48 years of age with 12 years of service to his/her credit score. He/She is going to obtain pension on reaching age of 58 years.An worker can obtain the pension beneath EPS solely after rendering a minimal service of 10 years.

- From 25 Apr 2016 one can defer pension upto 60 years with/with out contribution

- No pension is payable earlier than the age of fifty years.

- Early pension after 50 years however earlier than the age of 58 years is topic to discounting issue for yearly falling in need of 58 years. That is known as as Earlier than superannuation and one shouldn’t be in service.

- In case of loss of life / disablement, the above restrictions doesn’t apply.

- Loss of life will be whereas in service or whereas not in service.

- Everlasting incapacity means completely unfit for the employment which the member was doing on the time of such disablement

- If member is alive, pension to member

- If member is just not alive, Pension to to partner and two kids beneath 25 years of age

- For pension, withdrawal profit, scheme certificates and so on. utility ought to be by ex-employer.

- For pension, Type 10D is for use. For withdrawal profit & scheme certificates, fill Type 10 C.

- Declare Type 10D ought to be submitted in two copies and in three copies(triplicates) if pension is to be drawn in different Area/Sub Area.

How lengthy the pension is out there?

Lifelong pension is out there to the member. Upon his loss of life, family members are entitled for the pension. Household means workers’ partner and kids beneath 25 yrs. of age. I

- In case of loss of life of member having household, pension is payable to (1) the partner and (2) two kids beneath 25 years of age. When a baby reaches 25 years of age, the third little one beneath 25 yrs of age will likely be given pension and so forth.

- If the kid is disabled, he could get pension until his loss of life.

- In any case, solely 2 kids will obtain pension at a time.

- If member doesn’t have household, pension is payable to single nominated individual. One can change one nomination anytime inside the framework of guidelines for such nomination. In different phrases if one has a household, nomination ought to be in favour of a member(s) of the household. If he/she has no household he/she will nominate anybody he/she needs

- If not nominated and having dependent guardian, pension is payable first to Father after which on father’s loss of life to Mom.

What occurs if one applies for pension between 50 and 58 years?

- No pension is payable earlier than the age of fifty years .

- You possibly can go for pension after 50 however should forgo 4% for yearly earlier than you flip 58.

What’s the components for calculating the month-to-month pension?

Below Staff’ Pension Scheme, the month-to-month retiring pension is set on the premise of ‘Pensionable Service’ and ‘Pensionable Wage’ and is labored out as follows:

- One can apply for EPS Pension from a date instantly following the date of completion of 58 years of age however that the individual has retired or

ceased to be within the employment earlier than that date. - Pension will depend on variety of years of your service.

- Most Pension one can get is Rs 7,500 per thirty days.

- The Authorities has since Sep 2014 carried out minimal pension of Rs. 1000 per thirty days to the member/disabled/widow/widower/ guardian/nominee pensioners and Rs. 250 per thirty days for kids pensioners and Rs. 750 per thirty days to orphan pensioners

- The EPFO additionally suspended the improved pension fee to widows, kids and orphans beneath the scheme. Below the modified scheme, the minimal month-to-month pension for widows has been mounted at Rs 1,000 and for kids at Rs 250 per thirty days. Equally, the minimal pension entitlement for orphans has been mounted at Rs 750 per thirty days.

- Most service for the calculation of service is 35 years.

- The fraction of service for six months or extra is handled as one yr and the service lower than six months shall be ignored. So 9 years and 6 months will likely be rounded upto 10 years.

- If no wage is earned for a sure interval, that interval is to be deducted from the service, as there will likely be no contribution to Pension Fund.

- No pensioner can obtain a couple of EPF Pension. So when you’ve got labored in a number of organizations you meed to consolidate all of your EPS after which apply for EPS Pension. You probably have a number of Scheme Certificates it’s essential submit all of these.

- EPS Pension is taxable and has to be thought of beneath the pinnacle Earnings from Salaries.

Making use of For EPS pension

Learn how to apply for the EPS pension?

- For pension, EPS Pension Type 10D ought to be stuffed.

- The appliance ought to be forwarded by the institution by which the member final served/died. The institution ought to furnish the certificates and wage particulars duly attested by the approved officer.

- if the institution is closed, the appliance ought to be forwarded by Justice of the Peace/Gazetted Officer/Financial institution Supervisor/some other approved officer as could also be accepted by the Commissioner.

- With Type 10D, you’ll be required to connect the checking account proof [copy of passbook/canceled cheque] . For this, you need to have an account within the financial institution, which is designated by EPFO for pension facility. For the small print of such financial institution, you’ll be able to go to your close by EPFO.

- Pictures of your loved ones together with you, your partner and kids beneath age of 25 yrs. Beforehand EPFO asks for 3 pictures, however now they’re taking 4 pictures.

- Age proof of the member and household, as within the {photograph}.

- Any scheme certificates, issued earlier by any EPFO.

- All of the above paperwork and type ought to be attested by your employer, or any gazetted officer.

- The shape ought to be submitted in duplicate for house state and triplicate for out of state.

How lengthy does it take to get Pension?

The claims, full in all respects submitted together with the requisite paperwork shall be settled and profit quantity paid to the beneficiaries inside thirty days from the date of its receipt by the Commissioner. If there may be any deficiency within the declare, the identical shall be recorded in writing and communicated to the applicant inside thirty days from the date of receipt of such utility. In case the Commissioner fails with out adequate trigger to settle a declare full in all respects inside thirty days,the Commissioner shall be answerable for the delay past the mentioned interval and penal curiosity on the price of 12 per cent each year could also be charged on the profit quantity and the identical could also be deducted from the wage of the Commissioner.] 40. Ins. by GSR 376 dated the twenty seventh October, 1997 (w.e.f. eighth November 1997)

Learn how to Fill EPS Type 10D to assert Pension from EPS

This explains the right way to fill Type 10D to assert Pension from EPS.

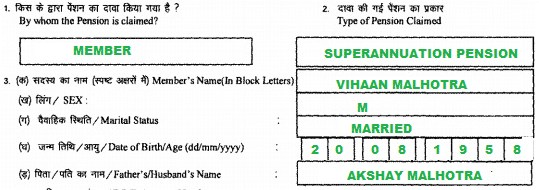

1 By whom is pension claimed?

- MEMBER : one who has been contributing to EPF and EPS.

- WIDOW/WIDOWER : spouse/husband of somebody who was contributing to EPF and EPS.

- MAJOR : Youngster above 18 years of one who has been contributing to EPF and EPS.

- ORPHAN :

- GUARDIAN : if little one of 1 who has been contributing to EPF and EPS is lower than 18 then the Guardian.

- NOMINEE : Nominee talked about by member in EPF Nomination Type

- DEPENDENT PARENT : Father/mom. If member has not nominated and has dependent guardian, pension is payable first to Father after which on father’s loss of life to Mom.

2 Sort of Pension Claimed

- SUPERANNUATION PENSION :By member on attaining 58 years age, whether or not in service or not

- REDUCED PENSION: By member after the age of fifty years however beneath 58 years and having left service

- DISABLEMENT PENSION: By member on leaving service on account of whole and everlasting disablement.

- WIDOW & CHILDREN PENSION: By household (partner and kids) on loss of life of the Member.

- ORPHAN PENSION: By surviving son/daughter (of age as much as 25 years as on date of loss of life of member/partner whichever is later) on the loss of life or remarriage of the deceased member.

- NOMINEE PENSION: By nominee declared by the Member by his/her Type 2(R) in case the member had no household (Partner and kids).

- DEPENDENT PARENT: By the dependent father and mom of the deceased member who died with out a household (partner and kids) and did not nominate an individual for pension.

3 Particulars

- The title should be talked about in BLOCK LETTERS.

- Marital Standing: Whether or not married/single/widow/widower/Divorcee.

- Date of Start: In dd/mm/yyyy format.

- Father’s Identify and in case of a married feminine member, Husband’s title in BLOCK LETTERS.

4. EPF Account Quantity: The account quantity ought to have the Area Code (two alphabets), Workplace Code (three alphabets) code quantity (most 7 digits), extension (sub code, if any, most three characters) and account quantity (most 7 digits). The area codes have modified after creation of the a number of areas in some states, particularly Maharashtra, Tamil Nadu, Karnataka, West Bengal, Punjab, Gujarat, Andhra Pradesh, Uttar Pradesh, Haryana and Delhi. For getting the proper Area and Workplace Codes, please go to Institution Search facility supplied beneath hyperlink for Staff by the web site epfindia.gov.in

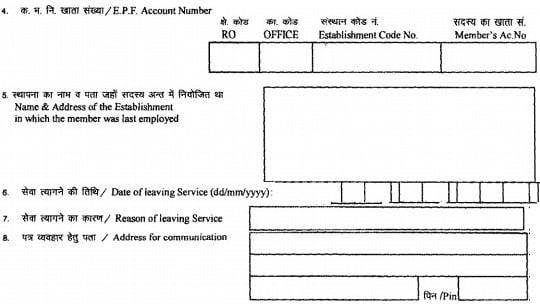

5. Identify and Handle of the Institution the place the member was final employed.

6. Date of Leaving service Point out the precise date of leaving service in date/month/yr type. If one has attained 58 years and continues to be in service. In such case point out,” nonetheless in service”.

7. Cause of Leaving Service: If the explanation for leaving service was on account of whole and everlasting disablement, as indicated by the institution to the P.F. Workplace by Type 10/Type 5 (PS)/ECR (Digital Challan cum Return) then solely the member is entitled for Disablement Pension. In all different instances the precise motive for leaving service could also be given.

8. Handle for communication :Your tackle for communication

8A In case of diminished pension (opted date for graduation of pension.) If the member has left service earlier than 58 years of age, has not accomplished 58 years age as on date of utility and is prepared for drawing diminished pension, he/she ought to point out the date from which /she needs to get pension. The opted date can’t be previous to date of achieving 50 years age and date of leaving service.

Commutation and Return of Capital in EPS Pension Type 10D

Commutation and Return of Capital on superannuation was discontinued from 26-Sep-2008, (Notification Quantity GSR 688 (E) dated 26- 09-2008) in an try and curb the EPS deficit. So fill Sl. No.9, 10 and 11 of the shape solely if the date of begin of member pension is earlier than 26/09/2008 (instances the place the appliance is being filed belatedly however the member is due for pension from such date)

Below the commutation of pension scheme, a retiring worker had an choice to obtain almost 30% of his pension corpus in a single go and draw month-to-month pension from his remaining corpus. Commutation is the choice to obtain a capital sum at present as an alternative of receiving a month-to-month pension for remainder of your life. Price of commutation is upto 1/third of the Authentic Pension. Suppose the unique pension is Rs.600, the commutation worth is Rs.20,000. On commutation, the pension payable will likely be Rs. 400,

Return of capital on superannuation was the choice to money out all the pension corpus i.e , workers had the choice to get one-time money by foregoing their month-to-month pension.

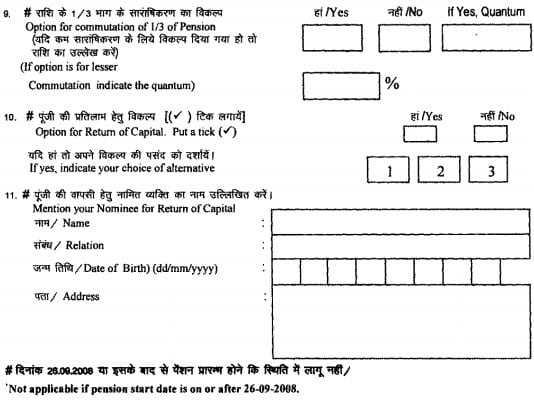

Household Particulars in EPS Pension Type 10D

As talked about earlier Lifelong pension is out there to the member. Upon his loss of life, family members are entitled for the pension. This part is about particulars of the household. Whereas the member pension is accepted, the pension quantity payable to the household (partner/kids) are additionally determined and in case of the loss of life of the member as pensioner, the partner/kids/orphan will begin getting the pension on submission of the loss of life certificates and there is not going to be any requirement of processing of the widow/kids/orphan pension once more. In case of a deceased member, it must be stuffed by the partner/kids.

The record of surviving relations of the Member, overlaying his partner, all kids ought to be furnished. The particulars of Guardian ought to be given in respect of every minor little one, as of the date of utility. In help of the age of kids, age proof certificates obtained from the college or Registrar of Start-death or E.S.I. Report, or Municipal authorities ought to be enclosed. Within the case of Guardian apart from pure guardian, a Guardianship Certificates ought to be enclosed.

13 Date of Loss of life of member(if relevant). Relevant solely in case the member is just not alive. In help of the date of loss of life, loss of life Certificates ought to be enclosed.

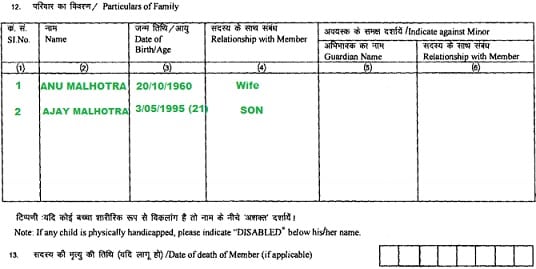

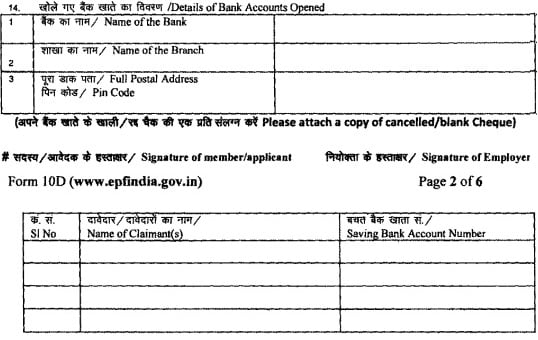

Financial institution Particulars for EPS Pension in EPS Pension Type 10D

Pension is payable by any department of sure Banks relying on place the place the pensioner needs to obtain pension. Therefore Saving Financial institution Accounts ought to be opened solely within the mentioned Financial institution(s). The member, the partner and kids (minor or main) must also open S.B. A/cs in the identical department of the Financial institution. In case the declare is most popular by partner, he/ she ought to give his/her S.B.A/c No. and in addition separate S.B.A/c No.s in respect of every little one. S.B. A/c No.s of kids who’re beneath the age of 25 years (as on date of loss of life of the member) ought to be given. On behalf of minor little one, S.B. A/c opened within the title of minor and operated by the guardian of the minor and A/c No. ought to be given.

Every time pension is opted from a spot past the jurisdiction of the area by which the member was final employed, he ought to verify the title of the designated financial institution relevant in that Area and open a S.B. A/C therein. On sanction of Pension, intimation will likely be despatched to the pensioner to contact the financial institution. The record of Banks by which provision has been made for the retired workers drawing pension beneath Staff’ Provident Fund Organisation (EPFO) as per Press Info Bureau Aug 2015 is given beneath

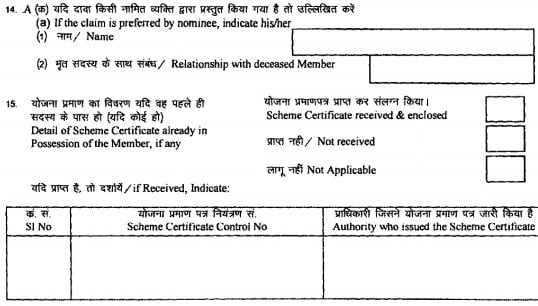

Nomination Particulars and Scheme Certificates in EPS Pension Type 10D

In case of loss of life of the member earlier than attaining 58 years with out leaving any eligible relations to obtain the pension, the nominee as appointed by the member by the From 2 (Revised) already despatched to the P.F. Workplace could apply, giving his particulars in opposition to this column. In case the member had no household and had died earlier than appoint a nominee for pension, his/her dependent guardian (father & mom) could apply for pension, pension will likely be paid to father and on his loss of life to mom

As talked about earlier For EPS, if the service interval is lower than 10 years, you’ve choice to both withdraw your corpus or get it transferred by acquiring a ‘Scheme Certificates’. when you’ve got obtained Scheme Certificates then it’s important to enter the small print on this part.

16. If pension is being drawn beneath E.P.S, 1995 If the applicant is already receiving pension beneath Staff’ Pension Scheme, 1995 declare pension, the small print ought to be furnished in opposition to this column.

Record of paperwork to be submitted with EPS Pension Type 10D

17. Record of paperwork to be enclosed together with EPS Pension Type 10D

- Descriptive position of pensioner and his/her specimen signature/Thumb impression (in duplicate); (Type is enclosed with the Declare Type)

- Pictures: The images ought to be attested by the employer or his approved official, indicating the individual, whom the {photograph} pertains to and in addition the P.F. Account No. of the member, written on the verse and positioned in a separate envelope.

- 3 pass-port measurement pictures If claimed by the member Joint picture with partner, there is no such thing as a have to ship {photograph} of the kids.

- If claimed by widow/widower the {photograph} ought to be despatched for widow/widower and his/her two kids (beneath 25 years) individually.

- Within the case of a member, who’s completely and completely disabled through the employment, he/she ought to bear a Medical Examination earlier than the Medical Board suggested by the E.P.F. Workplace. Nevertheless, the disablement ought to happen whereas in employment.

- Cancelled cheque of the Financial institution the place one needs to get Pension.

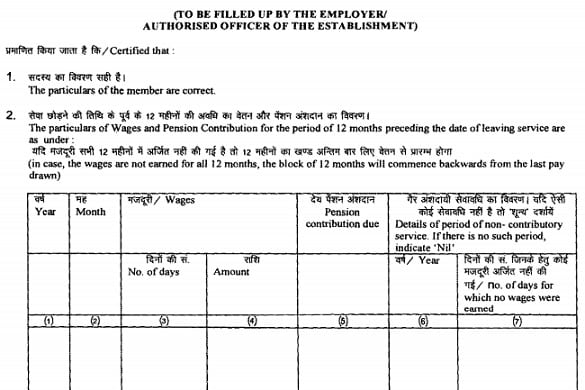

Employer Approval in EPS Pension Type 10D

The appliance ought to be forwarded by the institution by which the member final served/died. The institution ought to furnish the certificates and wage particulars duly attested by the approved officer.

Record of Banks the place one can get EPS Pension

The record of Banks by which provision has been made for the retired workers drawing pension beneath Staff’ Provident Fund Organisation (EPFO) as per Press Info Bureau Aug 2015 is given beneath

| S.No. | EPFO Regional Workplace | Pension Disbursing Banks |

| 1 | Delhi (North) | PNB, SBI, IB, UBI, HDFC, ICICI, AXIS |

| 2 | Delhi (South) | PNB, SBI, IB, UBI, HDFC, ICICI, AXIS |

| 3 | Dehradun | PNB, SBI |

| 4 | Gurgaon | PNB, SBI, HDFC, ICICI, AXIS |

| 5 | Faridabad | PNB, SBI, HDFC, ICICI, AXIS |

| 6 | Jaipur | PNB, Thar Gramin Financial institution, HDFC, ICICI, AXIS, SBBJ |

| 7 | Shimla | PNB, SBI, AXIS |

| 8 | Ludhiana | PNB, SBI, HDFC, AXIS |

| 9 | Chandigarh | PNB, SBI, HDFC, AXIS, ICICI |

| 10 | Bihar | PNB, BOI, HDFC |

| 11 | Meerut | PNB, SBI |

| 12 | Kanpur | PNB, SBI, HDFC, ICICI, AXIS |

| 13 | Hyderabad | SBI, UBI, AB, HDFC, AXIS, ICICI |

| 14 | Guntur | SBI, AB, HDFC, AXIS, ICICI |

| 15 | Nizamabad | SBI, SY. BANK, Gramin BANK, UBI, AB, AXIS |

| 16 | Bhuvneshwer | SBI, BOI, UCO Financial institution, HDFC, AXIS, ICICI |

| 17 | Bangalore | SBI, CANARA, SY. BANK, CORP. BANK, VIJAYA BANK, HDFC, AXIS, ICICI |

| 18 | Goa | SBI, BOI, HDFC |

| 19 | Gulbarga | SBI, CANARA, SY. BANK, ICICI,CORP. BANK |

| 20 | Mangalore | SBI, CANARA, SY. BANK, CORP. BANK, VIJAYA BANK, AXIS |

| 21 | Peenya | SBI, CANARA BANK, SY. BANK, CORP. BANK, HDFC, AXIS, ICICI |

| 22 | Coimbatore | SBI, IB, IOB, HDFC, AXIS, ICICI |

| 23 | Kerala | PNB, SBI, IB, IOB, CANARA, SY. BANK, FED.BANK, HDFC, AXIS, ICICI, North Malabar Gramin Financial institution, SBT |

| 24 | Madurai | SBI, IB, IOB, HDFC, AXIS, ICICI |

| 25 | Tambram | SBI, IB, IOB, HDFC, AXIS, ICICI |

| 26 | Chennai | SBI, IB, IOB, HDFC, AXIS, ICICI |

| 27 | Ranchi | PNB, BOI, UBI, HDFC, AXIS, ICICI |

| 28 | Jalpaiguri | SBI, UBI, UCO, CBI, UBKG BANK |

| 29 | Kolkata | PNB, UBI, HDFC, AXIS,ICICI |

| 30 | Guwahati | SBI, HDFC, AXIS, ICICI |

| 31 | Raipur | PNB, SBI, HDFC, AXIS, ICICI, CBI, |

| 32 | Bandra | PNB, SBI, BOI, HDFC, AXIS, ICICI, BOM, IB |

| 33 | Thane | PNB, SBI, BOI, HDFC, AXIS, ICICI |

| 34 | Kandivali | PNB, SBI, BOI, HDFC, AXIS,ICICI |

| 35 | Pune | PNB, SBI, BOI, HDFC, AXIS, ICICI, BOM |

| 36 | Nagpur | PNB, SBI, BOI, HDFC, AXIS, ICICI |

| 37 | Ahemdabad | SBI, DENA, HDFC |

| 38 | Surat | SBI, DENA, HDFC, AXIS, ICICI |

| 39 | Vadodara | SBI, DENA, HDFC |

| 40 | Indore | PNB, SBI, HDFC, AXIS, ICICI |

Obtain Type 10D

Associated Articles