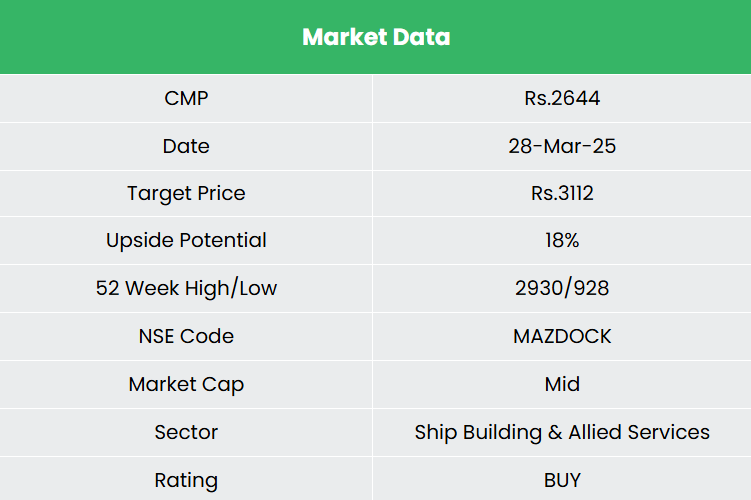

Mazagon Dock Shipbuilders Ltd – Ship & Submarine Builders to the Nation

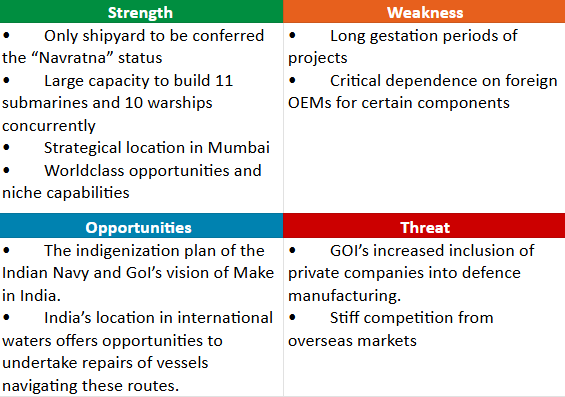

A Navratna firm working underneath the aegis of the Ministry of Defence, Mazagon Dock Shipbuilders Ltd (MDL) is among the main shipbuilding yards in India. Integrated in 1934 and headquartered in Mumbai, the corporate has established itself as a premier war-shipbuilding yard in India, producing warships for the Navy and offshore constructions for Bombay Excessive. The corporate specialises in developing, repairing, and refurbishing warships and submarines at its amenities in Mumbai and Nhava. Since inception it has constructed a complete 805 vessels, together with 30 warships, starting from superior destroyers to missiles boats in addition to 8 submarines. At present, its current yard accommodates 11 submarines and 10 warships concurrently.

Merchandise and Companies

The corporate’s product portfolio includes of warships, cargo ships, passenger ships, provide vessels, multipurpose assist vessels, water tankers, tugs, dredgers, fishing trawlers, barges, and border outposts, jackets, wellhead platform most important decks, course of platforms, jack up rigs and so on.

Subsidiaries: As of FY24, the corporate has 1 affiliate firm and no subsidiaries/joint ventures.

Funding Rationale

- Strategic enterprise initiatives – The corporate has acquired 15 acres of land subsequent to its present shipyard, the place it plans to construct a brand new facility. It will embrace a a lot bigger dry dock, permitting for the development of larger warships and enhancing its ship restore and upkeep companies. On the similar time, the corporate is developing the nation’s largest floating dry dock at Nhava Island close to Mumbai to accommodate massive ship orders. Moreover, the corporate has established a devoted “Make in India” division, resulting in the profitable indigenization of 57 key gadgets and methods for ships and submarines. MDL has additionally contributed 1,017 gadgets to the Ministry of Defence’s Constructive Indigenization Checklist (PIL). Collaborations with BEL and different companions are ongoing to additional indigenize extra elements. Furthermore, the corporate has begun increasing its product portfolio into the aviation sector and has secured an MRO contract for helicopter repairs.

- Main orders in pipeline – MDL is a powerful contender for main future initiatives of Indian Navy, Indian Coast Guard and abroad purchasers. Among the recognized main enterprise alternatives the place the corporate is a powerful contender consists of subsequent technology corvettes, 5 subsequent technology destroyers and 6 undertaking P75(I) standard submarines. The corporate can be anticipating the follow-on orders on frigates for Challenge 17 Bravo. Past Navy, the corporate can be accepting orders from Indian Coast Guard and export purchasers. It’s got order value Rs.2,684 crore from Indian Coast Guard for the development of superior patrol vessels. The corporate can be diversifying into the Upkeep, Restore & Overhaul (MRO) of MI-17 helicopters for the Nepalese Military. On the non-defence entrance, the corporate has signed an MoU with State Catastrophe Administration Authority, Goa. The MoU will concentrate on growing and implementing an “AI-based Wi-fi Catastrophe Detection, Rescue & Communication System. It has additionally received a Rs.1,486 crore contract from ONGC for pipeline alternative associated works.

- Q3FY25 – MDL reported a income of Rs.3,144 crore marking a rise of 33% in comparison with the Rs.2,362 crore income of Q3FY24. Working revenue stood at Rs.1,104 crore in opposition to the Rs.808 crore of Q3FY24, a surge by 37% YOY. The online revenue stood at Rs.807 crore which is a progress of 29% as in comparison with the Rs.627 crores of similar interval within the earlier yr. The EBITDA margin was reported to be 35% and internet revenue margin was reported to be 26%.

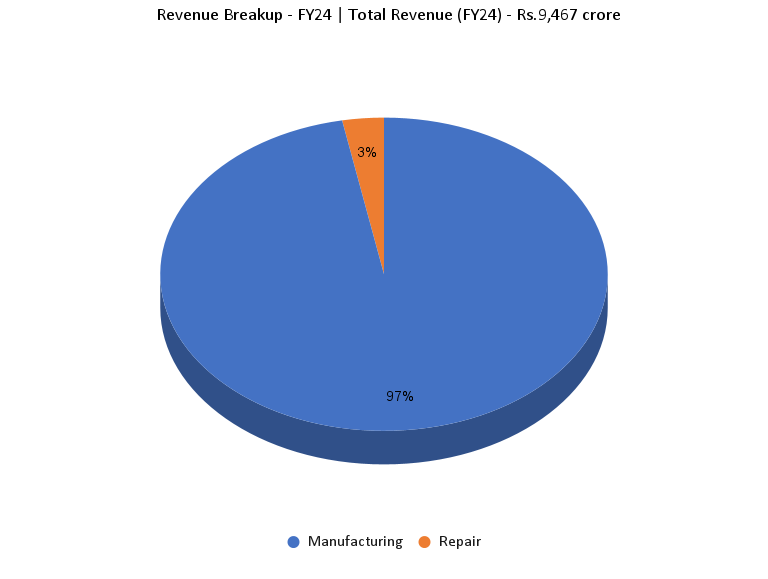

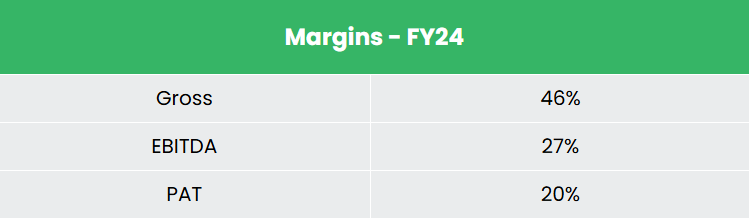

- FY24 – The corporate generated income of Rs.9,467 crore throughout FY24, a rise of 21% in comparison with the FY23 income. EBITDA was at Rs.2,513 crore, up by 69% YoY. The corporate reported internet revenue of Rs.1,937 crore, a rise of 73% YoY.

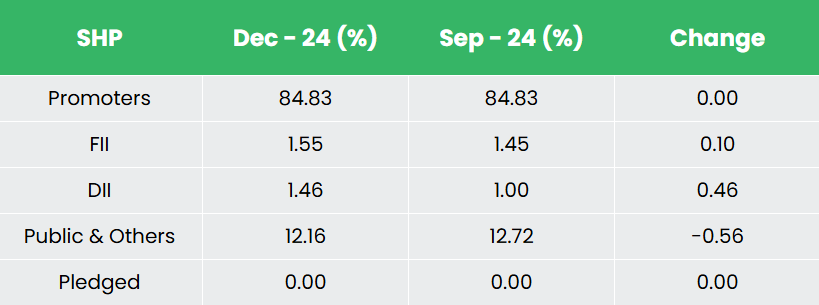

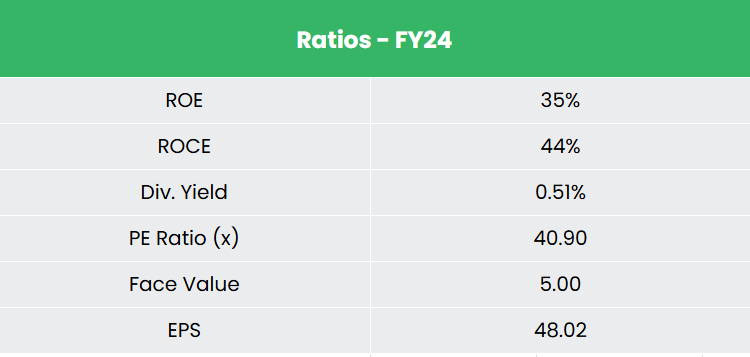

- Monetary Efficiency – The corporate has generated income and internet revenue CAGR of 33% and 47% over the interval of three years (FY21-24). Common 3-year ROE & ROCE is round 27% and 33% for FY21-24 interval. The corporate has sturdy steadiness sheet with zero debt in its capital construction.

Business

India is among the strongest army forces on the planet and the trade holds a spot of strategic significance for the Indian authorities. The nation’s defence manufacturing trade is quickly rising, pushed by substantial authorities investments, rising exports, and insurance policies geared toward fostering self-reliance and technological innovation. As a part of the ‘Aatmanirbhar Bharat’ (Self-Reliant India) initiative, the federal government has prioritized the Defence and Aerospace sectors, specializing in constructing home manufacturing capabilities supported by a powerful analysis and improvement framework. To modernize its army and reduce dependence on international defence imports, the federal government has launched a number of initiatives to advertise ‘Make in India’ efforts by means of coverage backing. Moreover, India has set an bold objective of reaching US$ 6.02 billion (Rs. 50,000 crore) in annual defence exports by 2028-29. With an purpose to supply monetary help to Shipbuilders and grant infrastructure standing for the trade the federal government has formulated the Shipbuilding Monetary Help Coverage whereby it has put aside Rs.40 billion to implement the scheme.

Development Drivers

- In 2025-26 the central authorities has allotted Rs.6,81,210 crore for the Ministry of Defence which is 6% larger than the earlier yr.

- Rising demand for defence manufacturing given the rising issues of nationwide safety.

- Provision for 100% International Direct Funding (FDI) by means of Authorities route and 74% by means of Computerized route into the defence sector.

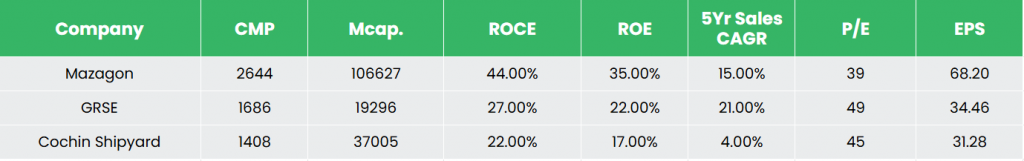

Peer Evaluation

Opponents: Cochin Shipyard Ltd, Backyard Attain Shipbuilders & Engineers Ltd, and so on.

Among the many above opponents, MDL stands out with regular income progress, superior return ratios, and robust earnings potential, reflecting the corporate’s monetary stability and its skill to effectively generate revenue and returns on invested capital.

Outlook

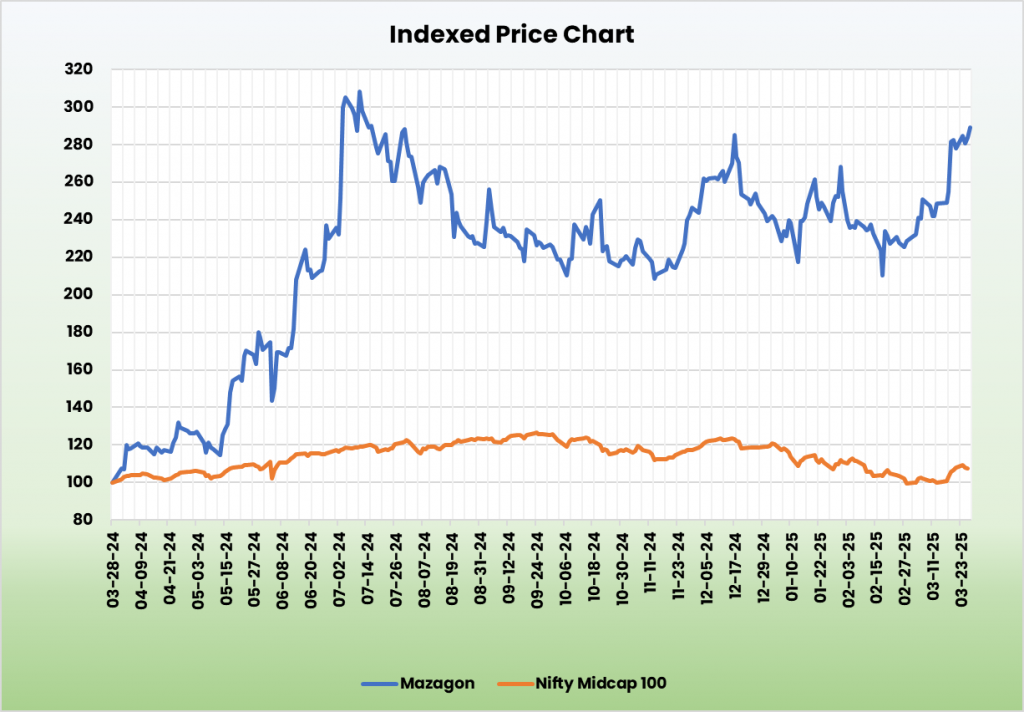

We imagine MDL has sturdy progress potential resulting from its operational ties with the Authorities of India (GoI) and its function as a key defence public sector enterprise that manufactures warships and submarines for the Ministry of Defence (MoD). With rising issues about nationwide safety, the Indian defence manufacturing trade is anticipated to develop. Administration has projected a income progress of 10% to 12% for FY25 and plans a capital expenditure of Rs.5,000 crore over the following few years. These deliberate expansions are set to just about double the corporate’s capability, permitting it to construct bigger vessels and tackle a number of large-scale initiatives concurrently. As of December 31, 2024, MDL’s order e book stands at Rs.34,787 crore. Moreover, the corporate’s concentrate on indigenization has led to lowered development prices, a pattern anticipated to proceed, leading to secure revenue margins and earnings.

Valuation

As a number one shipyard within the development of frontline warships and submarines, we imagine that the corporate will proceed to be a key participant in fulfilling the nation’s defence infrastructure wants. We suggest a BUY ranking within the inventory with the goal worth (TP) of Rs.3,112, 33x FY26E EPS.

SWOT Evaluation

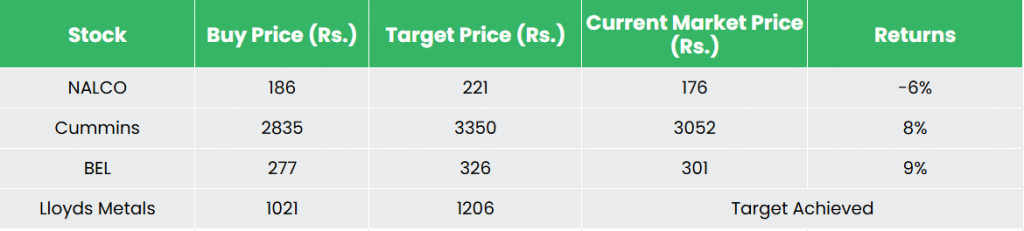

Recap of our earlier suggestions (As on 28 March 2025)

Disclaimer: Investments within the securities market are topic to market dangers, learn all associated paperwork fastidiously earlier than investing. Securities quoted listed below are exemplary, not recommendatory. Please seek the advice of your monetary advisor earlier than investing. Please word that we don’t assure any assured returns for the securities quoted right here.

Analysis disclaimer: Funding within the securities market is topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing. Registration granted by SEBI, and certification from NISM under no circumstances assure the efficiency of the middleman or present any assurance of returns to traders.

For extra particulars, please learn the disclaimer.

Different articles it’s possible you’ll like

Publish Views:

75