THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Managing your cash can really feel overwhelming when your accounts, budgets, and targets all reside elsewhere.

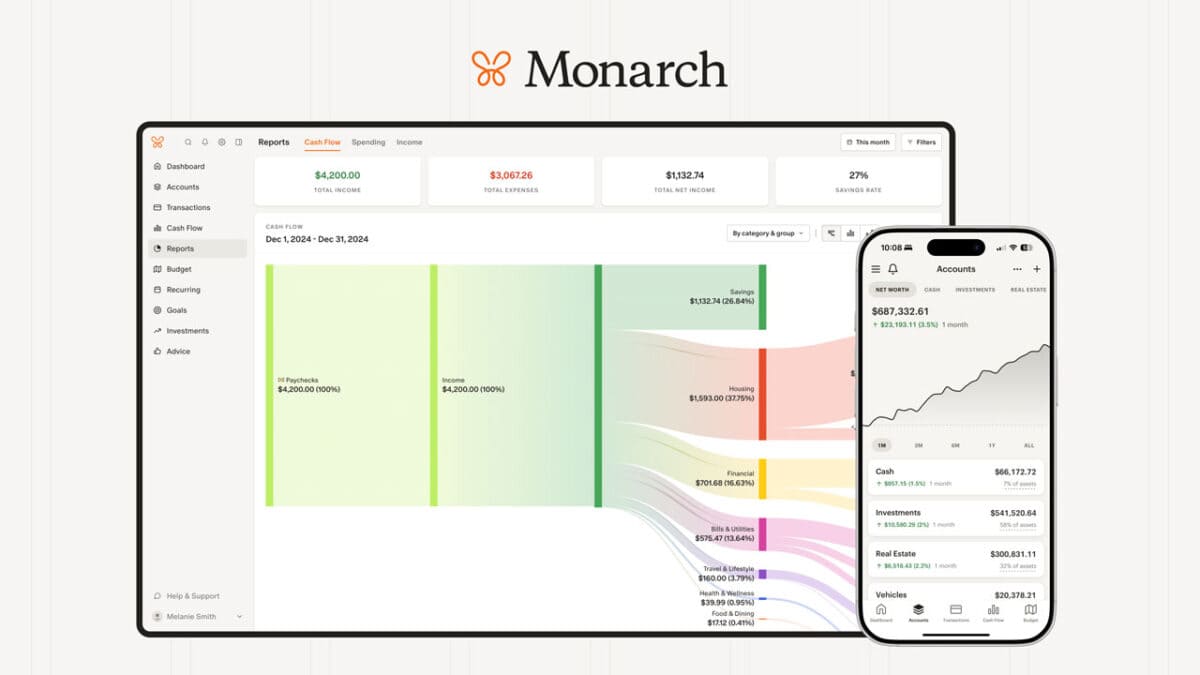

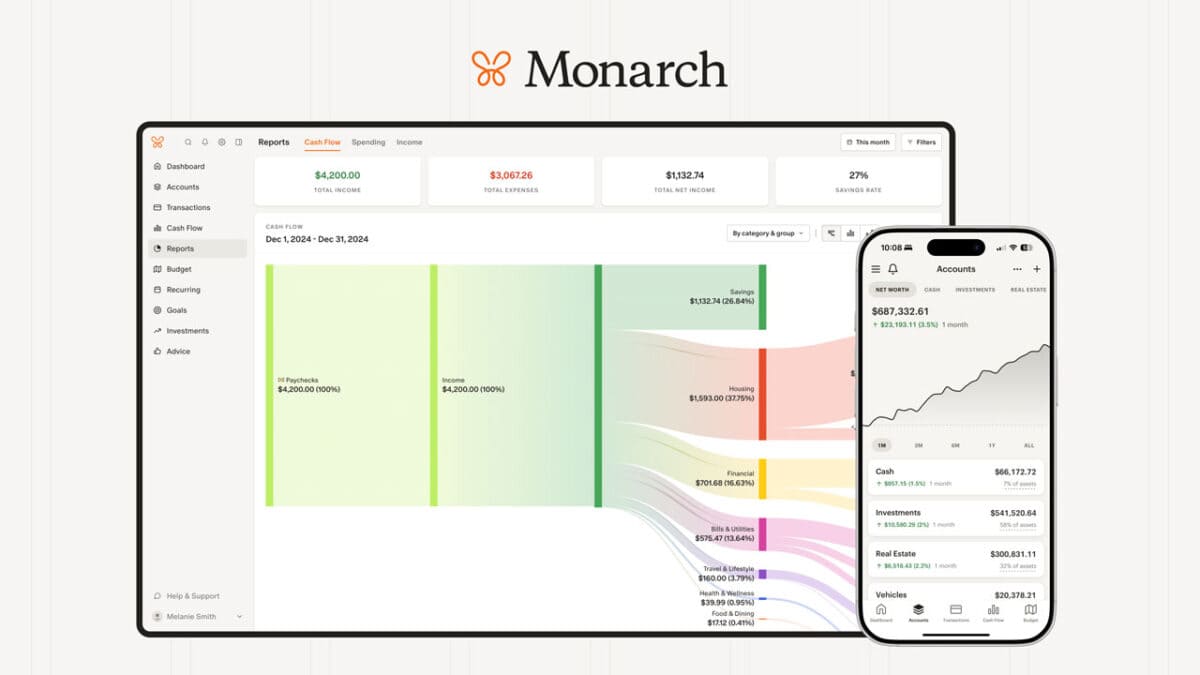

Monarch Cash goals to repair that by bringing every little thing collectively in a single clear, highly effective dashboard.

On this Monarch Cash evaluate, I’ll stroll you thru how the app helps you observe spending, handle budgets, and keep on prime of your targets.

It does this all whereas providing you with a transparent, real-time image of your monetary life.

I exploit Monarch Cash myself and like it, however I’ll additionally share the place it falls quick and the way it compares to rivals like YNAB, Copilot, Simplifi, and Quicken Traditional.

I’ve tried most budgeting apps through the years, so I’ve a good suggestion of the benefits and downsides of them.

By the tip, you’ll know whether or not Monarch Cash actually matches your monetary type, or if one other software could be a greater match.

Monarch Cash Assessment

- Ease of Use

- Account Syncing Reliability

- Budgeting & Aim-Setting Instruments

- Worth for Cash

Abstract

Monarch Cash makes it simple to take management of your funds. You may join all of your accounts, observe your spending, and plan for the longer term—multi functional easy, ad-free app. Click on right here to begin your free trial and save 50% off your first 12 months with code MONARCHVIP.

Monarch Cash Assessment

What’s Monarch Cash?

Monarch Cash is an all-in-one cash administration app that makes managing you funds easy.

You may join your monetary accounts, see the place your cash’s going, and set targets that truly encourage you.

It’s constructed for actual life: versatile sufficient for solo customers, but excellent for {couples} and households managing shared funds.

It helps two foremost budgeting kinds:

- Class budgeting – assign spending limits by class

- Flex budgeting – arrange prices into fastened, versatile, and non-monthly teams

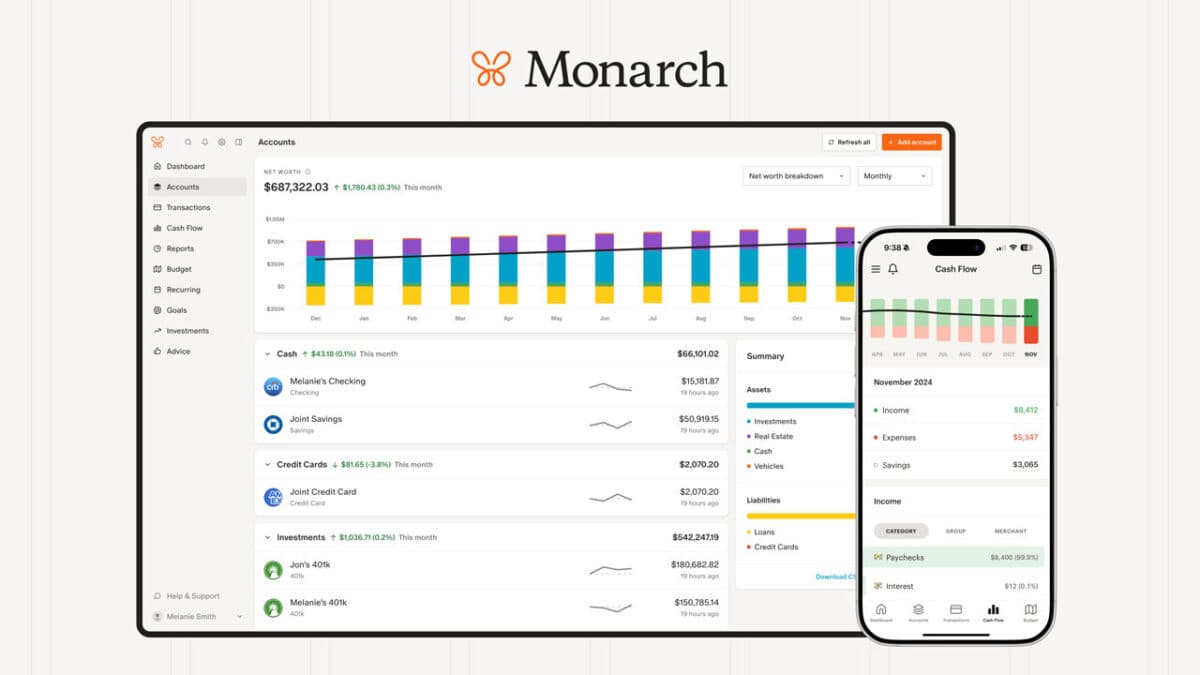

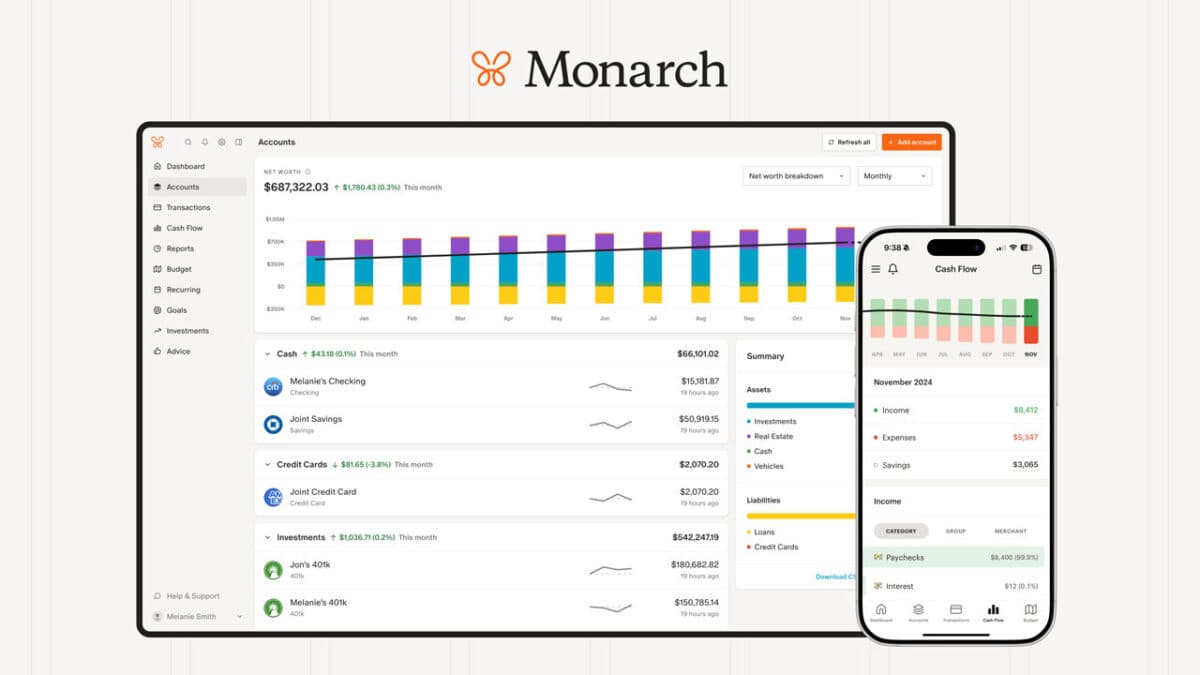

You too can add receipts, break up transactions, preserve tabs in your investments, and observe your internet price over time.

The dashboard is customizable, letting you see your most essential knowledge first.

This budgeting software works on the net, iOS, and Android, syncing throughout units for straightforward entry.

I handle my cash totally on my desktop (and I like to recommend you do too, merely due to how highly effective the web-based platform is), however love having the app on my iPhone so I can see the place issues stand once I’m on the go.

Who Is Monarch Cash For?

You’ll discover Monarch Cash helpful if you wish to handle funds with another person or want a versatile budgeting system.

It’s fashionable amongst {couples}, households, and former Mint customers who desire a shared view of earnings, bills, and targets.

That doesn’t imply you received’t discover it precious if you’re single.

It’s simply that it was designed for {couples} to handle their funds as a crew.

In the event you like detailed monitoring, you may set financial savings targets, monitor investments, and evaluate stories exhibiting spending patterns.

The app’s sharing characteristic lets a number of customers log in beneath one subscription, so everybody sees the identical numbers in actual time.

As a result of Monarch doesn’t promote your knowledge or retailer account passwords, it’s additionally a good selection when you care about privateness and safety.

They even supply a seven day free trial earlier than paying for a month-to-month or yearly plan.

The service operates on a month-to-month subscription mannequin, permitting customers the pliability to decide on between month-to-month and annual billing.

Finest Budgeting Software

Monarch Cash

Monitor your spending, set targets, and develop your internet price—multi functional place. Strive Monarch Cash free for 7 days, and whenever you’re able to improve, use code MONARCHVIP to save 50% off your first 12 months.

We earn a fee when you make a purchase order, at no extra value to you.

Key Options and Instruments

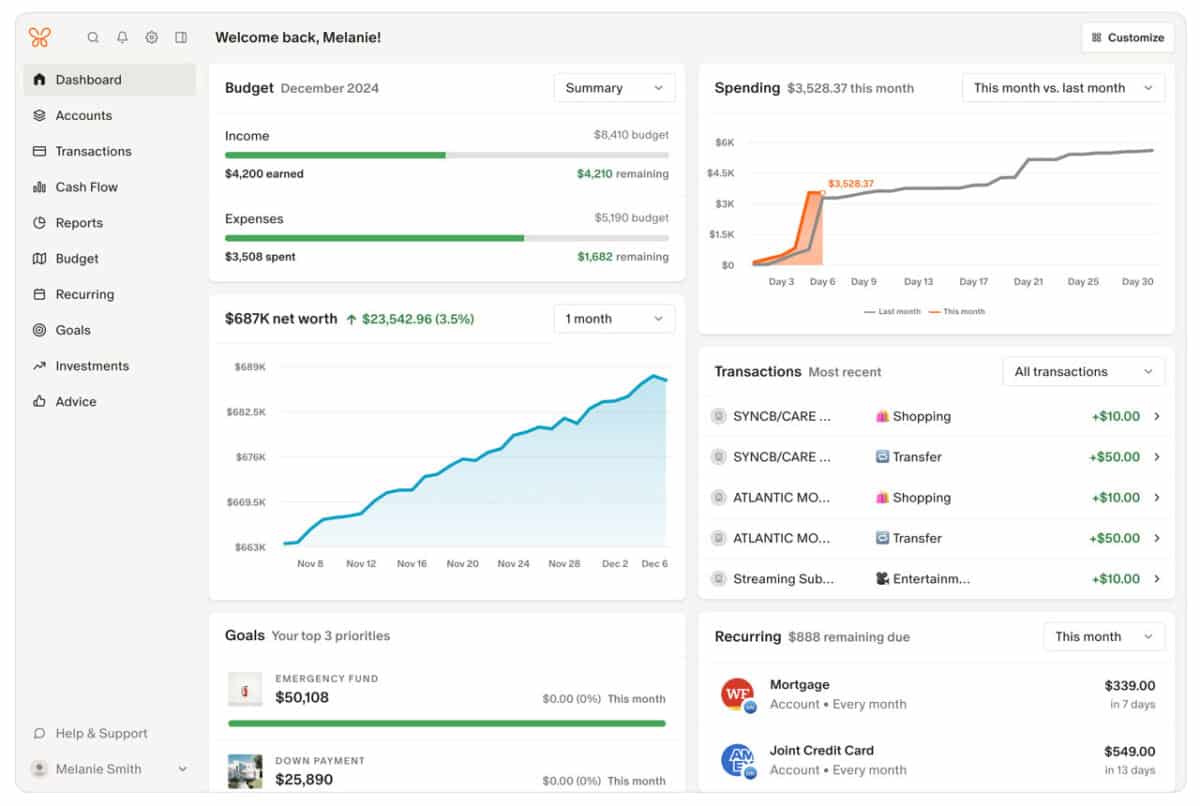

Complete Monetary Dashboard

You may see all of your monetary particulars in a single place by means of Monarch Cash’s dashboard.

It reveals your balances, budgets, and spending developments in easy charts and tables, offering a visible breakdown of your funds.

This helps you perceive the place your cash goes and what you may modify.

The dashboard updates mechanically, so that you all the time have present data.

You may view your internet price, money circulation, and class breakdowns as properly, with out switching screens.

What I really like is which you could additionally customise the structure to spotlight what issues most.

If you wish to give attention to family spending, financial savings targets, or funding efficiency, you may arrange the dashboard to solely present this data.

This makes it simpler to remain targeted in your priorities.

With different budgeting apps, the flexibility to customise the dashboard is proscribed or in some circumstances, non-existent.

Account Integration and Information Aggregators

Monarch connects to your financial institution accounts, bank cards, and funding platforms by means of safe knowledge aggregators.

These connections allow you to see all of your monetary exercise in a single app with out guide entry.

As soon as linked, the app mechanically imports transactions and updates balances.

You may tag bills, create customized classes, and observe recurring funds.

In case you have accounts at a number of monetary establishments, Monarch’s integration saves you time.

It consolidates transactions from completely different financial institution web sites, so that you now not have to log into every financial institution web site individually to trace your funds.

You may hyperlink fashionable banks like Chase, Capital One, and USAA, in addition to smaller regional banks and credit score unions.

The app makes use of encryption and read-only entry to maintain your data protected.

Collaboration Options for {Couples} and Households

Monarch Cash consists of collaboration instruments that make it simpler to handle shared accounts and budgets with others.

You may invite a associate or member of the family to view and edit your monetary roadmap.

Every individual can observe bills, set targets, and handle shared bills in actual time.

This helps you keep on the identical web page about payments, financial savings, and monetary priorities.

You may assign roles and permissions, so everybody has the suitable stage of entry.

For instance, perhaps you need your accountant or monetary advisors to see your finances, however you don’t need them to have the flexibility to make modifications.

On this case, you can provide them a decrease entry stage to see the knowledge they want and nothing extra.

These collaboration options make it easy to plan collectively with out sharing passwords or switching units.

Budgeting Strategies and Flexibility

Monarch offers you management over how you propose and observe your spending.

It additionally emphasizes purpose setting, permitting customers to create and handle monetary targets alongside their budgets.

You may assign transactions to detailed classes, modify versatile spending limits, and handle each month-to-month and irregular bills in a single place.

In truth, this platform gives you two completely different strategy to finances – class and versatile budgeting.

Class Budgeting Defined

Class budgeting helps you see precisely the place your cash goes every month.

It’s similar to zero primarily based budgeting techniques.

You divide your bills into classes comparable to groceries, transportation, eating, and leisure.

Every class has a set finances, which helps you keep conscious of your habits.

Monarch mechanically types exercise into these classes.

You may edit or rename them to match your way of life.

For instance, you may have a “Meals” class to trace all issues meals associated.

Or if you wish to get extra detailed, you may create extra classes like “Eating Out” and “Espresso” to see precisely what you bought on what class.

You may view your account knowledge in charts or tables, making it simple to match precise bills to your projected quantities.

Over time, this methodology helps you establish areas to chop again or reallocate funds.

Flex Budgeting System

Flex budgeting offers you extra freedom than fastened month-to-month limits.

As a substitute of assigning each greenback to a selected class, you group bills into fastened, versatile, and non-monthly varieties.

It’s a modern-day twist on the favored 50/30/20 rule of budgeting.

Fastened prices embody lease or mortgage funds.

Versatile prices cowl issues like eating or procuring, the place spending can fluctuate.

Non-monthly prices embody annual charges or vacation presents.

This method works properly in case your earnings or bills change from month to month.

You may shift cash between versatile classes with out breaking your general finances.

Monarch then tracks these modifications mechanically, so you may see how changes have an effect on your complete bills.

Flex budgeting helps you keep real looking whereas nonetheless sustaining construction.

You determine the place to tighten or loosen primarily based in your targets.

Dealing with Non-Month-to-month and Recurring Bills

Monarch helps you handle non-monthly and recurring payments and bills so that they don’t shock you later.

You may mark payments or subscriptions as recurring, and the app provides them to a month-to-month calendar view.

This characteristic reveals upcoming fees and helps you put together forward of time.

For instance, in case your annual insurance coverage cost is due in June, you may unfold financial savings throughout earlier months.

You too can observe subscriptions like streaming providers or fitness center memberships.

It lists these in a single place, making it easy to cancel unused ones.

By planning for irregular prices, you keep away from gaps and preserve your bills constant all year long.

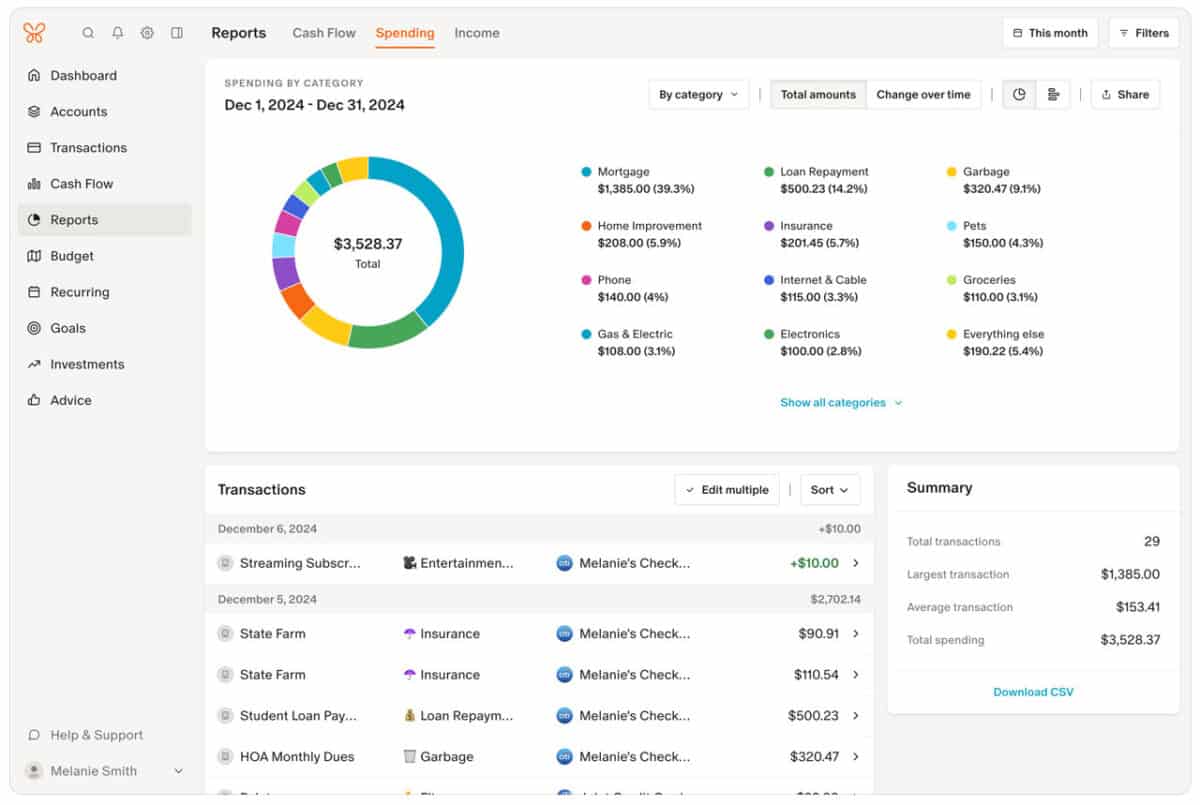

Monitoring Spending and Monetary Progress

Customizable Spending Classes

Monarch Cash allows you to create and modify expense classes that suit your way of life.

You can begin with default teams like groceries, transportation, or leisure, then rename, add, or delete them as wanted.

You may even assign emojis for every class, for individuals who like visuals.

The software program additionally means that you can arrange particular person financial savings targets for particular functions, making it simple to trace progress towards every purpose individually.

Sensible Transaction Administration

The app mechanically imports your transactions when you hyperlink your monetary accounts.

Then it makes use of your transaction historical past that will help you establish patterns and enhance your cash choices.

You may then evaluate, edit, or break up them into a number of classes if a purchase order covers a couple of sort of expense.

You may add notes, add receipts, or conceal particular transactions to maintain your information clear.

Monarch additionally learns out of your edits, enhancing the way it categorizes future bills.

This characteristic has come in useful for me.

We belong to Plant Health and Monarch put this expense into the charges class because the identify of the transaction is “iclub charges”.

As soon as I up to date the class to “Gymnasium”, all future Planet Health fees go beneath this class.

One other instance is with our cellphone.

This one the software program has not discovered the right way to correctly categorize, however I’m OK with that.

Whereas we do have a cellphone invoice, the invoice itself will not be 100% cellphone.

We subscribe to some streaming providers by means of our cellphone plan to save cash.

Every month I’ve to enter this cost and break up it between cellphone and TV.

Whereas I might love for the software program to categorize this accurately, it could actually’t know or do every little thing, so I simply realize it’s a small replace I have to make.

Lastly, I really like the flexibility so as to add notes to transactions so sooner or later, I can click on to remind myself of the expense.

For instance, we had some tree work accomplished. I put this within the “House Upkeep” class after which made a observe, “tree work”.

I didn’t need to create a class for one thing that occurs as soon as each few years and the observe helps me to seek out the expense sooner or later.

Money Circulate and Web Price Monitoring

Monarch combines knowledge out of your checking, financial savings, bank cards, loans, and funding accounts to point out your full monetary image.

You may view your money circulation – earnings versus bills – by means of charts that spotlight developments over time.

Your internet price updates mechanically as account balances change.

This consists of belongings like investments and liabilities comparable to loans or bank card debt.

You too can create customized stories to investigate spending or progress towards financial savings targets.

These insights enable you to see when you’re shifting nearer to monetary stability or want to regulate your finances.

Having all this data in a single dashboard makes it simpler to measure your development and make knowledgeable choices about your funds.

Setting and Managing Monetary Objectives

Monarch allows you to create customized monetary targets that suit your wants, comparable to saving for a trip, paying off debt, or constructing an emergency fund.

You may assign every purpose to a number of financial savings accounts and observe progress mechanically as your balances change.

A variety of account varieties are supported for purpose monitoring, making it simple to handle all of your monetary aims in a single place.

You may view your targets in a transparent dashboard that reveals how shut you might be to reaching every goal.

The app updates your progress as new transactions happen, so that you all the time see real-time outcomes.

That can assist you keep on observe, you may set it as much as ship reminders and visible progress bars.

You may modify your targets anytime, whether or not you need to improve your financial savings charge or change deadlines.

This flexibility makes it simpler to adapt your technique as your monetary state of affairs modifications.

Funding Monitoring Capabilities

Monarch connects to hundreds of brokerages and funding accounts, providing you with a full image of your portfolio.

You may see your internet price, observe efficiency over time, and evaluate asset allocation in a single place.

The app mechanically pulls in balances and account exercise out of your linked accounts.

You may categorize by sort, like shares, bonds, or retirement funds, to higher perceive the place your cash goes.

Monarch’s stories enable you to spot developments and examine your development along with your targets.

You too can conceal or filter accounts to give attention to particular belongings.

This characteristic helps you make knowledgeable choices with out switching between a number of platforms.

The largest draw back for me relating to investments is which you could’t see dividend earnings or detailed achieve/loss data.

However, the funding monitoring was not too long ago launched, so it’s nonetheless in beta.

I’m assured with future updates, this part of the platform will see enhancements.

Credit score Card Administration

Monarch Cash makes managing your bank cards as easy and stress-free as potential.

With its sturdy bank card administration system, you may join all of your bank card accounts, regardless of which monetary establishments you utilize.

This implies you get real-time updates on all of your transactions, balances, and funds, multi functional place.

That can assist you keep on prime of your bank card funds, it gives customizable alerts and notifications.

You’ll get reminders when payments are due, and you may arrange alerts for particular actions or classes.

This helps you keep away from late charges, curiosity fees, and the stress of missed funds.

Plus, by monitoring all of your accounts in a single place, you’re much less prone to overlook a cost or let your spending get away from you.

Credit score Rating Monitoring

Whereas Monarch Cash focuses on managing your funds and investments, it additionally helps credit score rating monitoring.

You may view your credit score data alongside your bills and financial savings knowledge, providing you with a extra full monetary overview.

Seeing your credit score rating subsequent to your finances helps you perceive how your borrowing habits have an effect on your general monetary well being.

You may observe modifications in your rating over time and establish areas for enchancment.

Pricing, Plans, and Consumer Expertise

Now let’s speak value.

Monarch Cash fees a subscription payment for full entry however features a quick trial so you may check its options first.

It’s accessible and extremely rated on the Google Play Retailer, highlighting its recognition and consumer satisfaction amongst Android customers.

It’s additionally accessible for obtain on the Apple App Retailer, making it simply accessible to iOS customers.

The app focuses on a clear, ad-free expertise with robust syncing, customizable dashboards, and instruments for each people and {couples} who need to handle all their funds in a single place.

With that stated, I’ve discovered that utilizing the net model is the very best.

Not that there’s something incorrect with the app model, I simply want engaged on my desktop/laptop computer over a pill or cellphone.

And Monarch’s inside analysis reveals individuals who use the desktop model usually tend to be long run customers and see extra outcomes.

Subscription Prices and Free Trial

Monarch Cash gives one premium plan that unlocks each characteristic.

You may pay $99.99 per 12 months (about $8.33 monthly) or select to pay $14.99 month-to-month.

Each choices embody the identical instruments, so the annual choice merely saves you cash.

You get a 7-day free trial, regardless when you select month-to-month or annual, which supplies you full entry to check the software program earlier than paying.

Throughout this trial, you may have full entry to all of the budgeting options, permitting you to hyperlink accounts, observe bills, create financial savings targets, and extra.

Perceive there is no such thing as a everlasting free model, which can be a downside when you want free instruments.

Nonetheless, the pricing displays its give attention to privateness and reliability—there aren’t any advertisements, upsells, or knowledge gross sales.

For a lot of customers, this makes the subscription worthwhile.

In case you have any points along with your subscription or in the course of the free trial, you may contact help for help or to cancel your trial earlier than you might be charged.

Moreover, when you join utilizing my hyperlink and use the code MONARCHVIP, you get free entry for 7 days and save 50% off the annual plan.

Finest Budgeting Software

Monarch Cash

Monitor your spending, set targets, and develop your internet price—multi functional place. Strive Monarch Cash free for 7 days, and whenever you’re able to improve, use code MONARCHVIP to save 50% off your first 12 months.

We earn a fee when you make a purchase order, at no extra value to you.

Professionals and Cons of Monarch Cash

Professionals of Monarch

- Advert-free and personal expertise

- Works for each people and {couples}

- Connects with over 13,000 monetary establishments

- Customizable dashboard and budgeting choices

- Dependable syncing and cross-device entry

Cons of Monarch

- No free plan after the trial

- Barely increased value than some rivals

- Funding tracker lacks detailed data

Why I’m A Fan of Monarch

I’ve been utilizing Monarch for somewhat over a 12 months now.

I like it as a result of it makes it simple for my spouse and me to finances.

Earlier than Monarch, I used to be the “proprietor” of managing our family funds and would replace her on the place we stand.

However now, she is an lively participant.

I took the time to set issues up and invited her with a hyperlink contained in the app.

She has her personal login and might see every little thing, even make notes, add classes, and many others.

I additionally love that I don’t need to reauthorize our financial institution accounts on a regular basis.

Not like Mint, the place I must reauthorize our a number of financial institution accounts on a regular basis, I’ve by no means had to do that with Monarch.

There’s nothing extra irritating than desirous to see the place you stand financially and having to log again into your accounts after which anticipate them to sync.

Now, as a lot as I hype this software program, there’s one challenge I’ve and that’s with investments.

I desire a detailed take a look at my investments and Monarch doesn’t do that….but.

The funding tracker is in beta, so I hope that with future updates, this challenge will get resolved.

Nonetheless, it’s ok for an correct internet price quantity.

Monarch Cash vs You Want A Finances

Each Monarch Cash and You Want A Finances (YNAB) enable you to handle your spending, however they take completely different approaches.

You’ll discover Monarch focuses on flexibility, and allows you to hyperlink all of your monetary accounts, bank cards, loans, and even investments.

You may view your whole monetary image in a single place.

YNAB however sticks to a strict zero-based budgeting methodology.

It focuses solely on this and doesn’t embody funding monitoring.

| Characteristic | Monarch | YNAB |

|---|---|---|

| Budgeting Type | Versatile (class or money circulation) | Zero-based budgeting |

| Account Sync | Financial institution, bank cards, loans, investments | Financial institution and credit score accounts |

| Collaboration | Share with associate/household | Single-user focus |

| Free Trial | Sure (7 days) | Sure (34 days) |

| Worth | $14.99/mo or $99/yr | $14/mo or $109/yr |

You may want Monarch if you’d like a broader monetary overview and instruments for purpose monitoring or internet price monitoring.

It additionally means that you can invite companions or members of the family at no further value.

YNAB works greatest when you like construction and need to assign each greenback a job.

It gives robust academic help, together with guides and workshops, that will help you keep on with your plan.

Each apps cost a subscription payment, however every gives a brief trial so you may check which one matches your state of affairs higher free of charge.

Monarch Cash vs Copilot Cash

When evaluating Monarch Cash and Copilot Cash, you’ll discover that each enable you to handle your funds, however they take completely different approaches.

Monarch focuses on detailed budgeting and planning instruments, whereas Copilot Cash emphasizes simplicity and personalised insights.

You may join a number of accounts within the app to see your whole monetary image in a single place.

Copilot Cash additionally hyperlinks your accounts however highlights spending patterns and offers you fast, actionable suggestions.

| Characteristic | Monarch | Copilot Cash |

|---|---|---|

| Budgeting Type | Versatile (class or money circulation) | Easy budgeting with automated insights |

| Interface | Customizable dashboard | Clear, minimal design |

| Collaboration | Share with associate/household | Single-user focus |

| Free Trial | Sure (7 days) | Sure (30 days) |

| Worth | $14.99/mo or $99/yr | $13/mo or $95/yr |

In the event you like hands-on management, Monarch offers you extra methods to plan, observe, and modify your targets.

You may even invite others to collaborate on shared budgets.

In the event you want a guided expertise, Copilot Cash’s AI-driven insights and straightforward navigation make it easier to remain on observe with out a lot setup.

It’s essential to notice that Copilot Cash solely works on Apple units, whereas Monarch works on Home windows and Apple units.

For me, I actually like Copilot Cash, however I work on a PC, so I must do all my budgeting on my iPad, which was a deal breaker for me.

Each apps let you attempt them out free of charge, so you may check which one matches your type of managing cash greatest.

Monarch Cash vs Simplifi

Once you examine Monarch Cash and Quicken Simplifi, you’ll discover that each enable you to handle your funds, however they give attention to various things.

Simplifi goals to make budgeting easy and fast, whereas Monarch offers you a deeper take a look at your full monetary image.

You’ll discover Simplifi simpler if you’d like a clear structure and easy instruments.

It’s constructed for every day expense monitoring and setting short-term targets.

Some customers point out minor syncing bugs, however it’s nonetheless user-friendly and backed by Quicken’s lengthy historical past.

Monarch, however, offers you extra management over customization.

You may observe your internet price, investments, and money circulation in a single place.

It additionally helps shared family budgets, which can assist when you handle funds with a associate.

| Characteristic | Monarch | Quicken Simplifi |

|---|---|---|

| Financial institution Syncing | Dependable | Occasional points reported |

| Interface | Customizable dashboard | Clear and easy |

| Finest For | Superior customers, buyers, households | Newcomers, easy budgets |

| Funding Monitoring | Sure | Restricted |

| Worth | $14.99/mo or $99/yr | $48/yr |

In the event you like detailed insights and long-term planning, chances are you’ll want Monarch.

However if you’d like a lighter, simpler app to begin budgeting quick, Simplifi may swimsuit you higher.

Each supply free trials, so you may check which one matches your type.

Monarch Cash vs Quicken Traditional

Once you examine Monarch Cash and Quicken Traditional, you’ll discover they serve completely different sorts of customers.

Monarch focuses on a contemporary, cloud-based expertise, so you may entry your knowledge anyplace.

Quicken Traditional gives a extra conventional desktop setup with deeper monetary instruments.

It additionally shops knowledge domestically, although it now consists of cloud sync choices for backup and cell entry.

| Characteristic | Monarch | Quicken Traditional |

|---|---|---|

| Platform | Internet & Cellular (Home windows/PC/Android/Apple) | Desktop (Home windows/Mac) |

| Worth | $14.99/mo or $99/yr | $84/yr |

| Budgeting | Sturdy focus | Included however much less visible |

| Funding Monitoring | Primary portfolio view | Superior instruments and stories |

| Collaboration | Shared family budgets | Single-user focus |

| Enterprise Instruments | Not accessible | Contains small enterprise options |

You’ll discover Monarch simpler to arrange and extra visually interesting.

It mechanically imports transactions, categorizes spending, and tracks targets.

Quicken Traditional offers you extra management over particulars like customized stories, tax planning, and rental property administration.

It’s nice when you prefer to dig into monetary knowledge or handle a number of accounts in a single place.

In the event you want a clear, easy dashboard and cell comfort, Monarch matches higher.

However if you’d like detailed evaluation and offline management, Quicken Traditional may really feel extra comfy.

Monarch Cash vs Rocket Cash

When evaluating Monarch Cash and Rocket Cash, the largest distinction comes down to manage versus automation.

Rocket Cash (previously Truebill) focuses on mechanically managing your funds, figuring out subscriptions, negotiating payments, and monitoring bills with minimal effort.

It’s excellent if you’d like fast insights with out diving too deep.

Nonetheless, a few of its greatest options, like subscription cancellation and invoice negotiation, require a premium plan or commission-based charges.

Monarch, however, offers you extra flexibility and depth.

You may construct a customized finances, set monetary targets, and observe your internet price and investments in a single dashboard.

Nonetheless, it doesn’t negotiate payments or cancel subscriptions, however it offers you cleaner knowledge, higher group, and stronger instruments for long-term monetary planning.

| Characteristic | Monarch | Rocket Cash |

|---|---|---|

| Pricing | $14.99/mo or $99/yr | Free, Premium Plan pricing varies |

| Finest For | Customized budgeting and long-term planning | Automating financial savings and subscription monitoring |

| Funding Monitoring | Sure | Restricted |

| Invoice Negotiation | No | Sure (with paid plan) |

| Web Price Monitoring | Sure | Primary |

| Interface | Fashionable and extremely customizable | Easy and automatic |

If you need a hands-off app that finds methods to save cash mechanically, Rocket Cash could be your choose.

However when you want to take an lively function in your funds, like planning, monitoring, and constructing wealth over time, Monarch offers you way more management.

Ceaselessly Requested Questions

What are customers saying about Monarch Cash on Reddit?

You’ll discover that many Reddit customers like Monarch Cash for its clear design and skill to hyperlink a number of accounts.

They usually point out that it’s a very good choice for {couples} or households who need to handle shared budgets.

Some customers additionally say it helps them keep organized after switching from Mint.

Are there any frequent complaints about Monarch Cash?

The commonest complaints contain the dearth of a free plan and occasional syncing delays with sure banks.

A couple of customers additionally point out that setup takes time, particularly when customizing classes.

Nonetheless, most agree that when it’s arrange, the app runs easily.

Is Monarch Cash price it?

If you need an ad-free budgeting software with detailed monitoring and powerful customization, chances are you’ll discover it price the price.

It’s particularly useful when you handle a number of accounts or share funds.

Is Monarch Cash Legit?

Sure, Monarch Cash is a professional monetary app.

It’s been reviewed by main retailers like Forbes Advisor and NerdWallet, each of which verify that it’s an actual firm providing safe, paid monetary administration providers.

Can Monarch Cash be trusted with private monetary data?

You may belief Monarch Cash along with your knowledge as a result of it doesn’t retailer your banking passwords or transfer cash between accounts.

It makes use of third-party knowledge suppliers with robust encryption and safety requirements.

Your data stays personal and guarded.

You may study extra in regards to the safety Monarch takes right here.

How a lot does Monarch Cash value?

Monarch Cash gives two paid choices.

The month-to-month plan prices $14.99 monthly, and the yearly plan prices $99.99 per 12 months (about $8.33 monthly).

You may attempt it free for seven days earlier than subscribing.

Who’re the creators of Monarch Cash, and what’s their background?

Monarch Cash was based by former Mint and Intuit workers who needed to construct a extra versatile, user-focused budgeting app.

Their background in monetary expertise helped them design a software centered on privateness, customization, and collaboration for people and households.

Closing Ideas

On the finish of the day, Monarch Cash simply makes managing my funds simpler.

It’s easy sufficient to make use of each day, but highly effective sufficient to deal with every little thing from monitoring investments to constructing long-term targets.

I’ve tried quite a lot of budgeting apps, and Monarch is the one I really caught with as a result of it helps me see the place my cash’s going and really feel assured in regards to the future.

If you wish to try it out for your self, seize the free trial and use the code MONARCHVIP to save lots of 50% off your first 12 months.

It’d simply grow to be the final budgeting app you ever want.

Finest Budgeting Software

Monarch Cash

Monitor your spending, set targets, and develop your internet price—multi functional place. Strive Monarch Cash free for 7 days, and whenever you’re able to improve, use code MONARCHVIP to save 50% off your first 12 months.

We earn a fee when you make a purchase order, at no extra value to you.