Generally it looks like everybody simply desires threat nowadays. Crypto. Sports activities playing. Choices buying and selling, ETFs that magically yield 10% or extra. Nevertheless, in case you’re within the reverse camp and also you need absolutely the least quantity of threat, you’d need to retire off an funding that has a return that’s fully-guaranteed, pays out a month-to-month earnings like clockwork, is even assured to develop with inflation.

If that pursuits you, take a look at 3 Methods to Construct an Inflation-Adjusted Pension by Allan Roth – which first reminds you that Social Safety is strictly this! – but in addition introduces a brand new collection of LifeX Inflation-Protected Longevity Earnings ETFs.

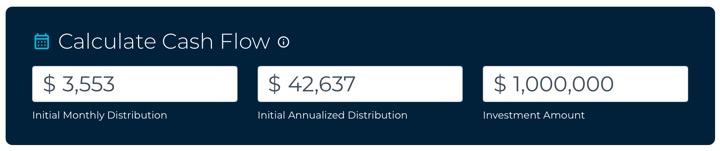

At present charges as of 12/11/25, the LifeX 2055 Inflation-Protected Longevity Earnings ETF (LIAM) comprises a managed portfolio of United States Treasury Inflation Listed Bonds (TIPS) that may give you a 4.26% assured actual withdrawal fee for 30 years. Meaning a $1,000,000 portfolio would distribute roughly $42,600 in annual earnings for 30 years (by way of the yr 2055), however importantly would enhance with CPI inflation annually. At 3% common inflation, your thirtieth yr’s earnings would have grown to over $100,000 a yr.

After these 30 years, you may be left with nothing. Your preliminary principal will likely be gone. Due to this fact, your earnings taken annually is partially a return of principal.

The expense ratio is 0.25%, which isn’t Vanguard-level however not horrible. I like that it does the entire be just right for you in a tidy ETF bundle, as constructing a TIPS ladder your self is usually a bit difficult (and do you need to preserve doing it at age 80, 90?). After all, I additionally fear about what occurs in case you purchased a 30-year ladder at 65 and occur to dwell previous 95. It might occur, and bear in mind, this product is supposed for the risk-averse of us that wish to cowl all of the bases.

Normally, I really feel a TIPS ladder or equal that adjusts with inflation would work effectively together with a standard annuity like an SPIA or a deferred longevity annuity that begins at a later age, which doesn’t modify with inflation however does present an increased preliminary fastened earnings that may final so long as you reside. That is what I’ve arrange for my mother and father – Social Safety that rises with inflation, plus a joint earnings annuity that pays out so long as one resides.