Nationwide Aluminium Firm Ltd – Asia’s largest bauxite-alumina-aluminium advanced

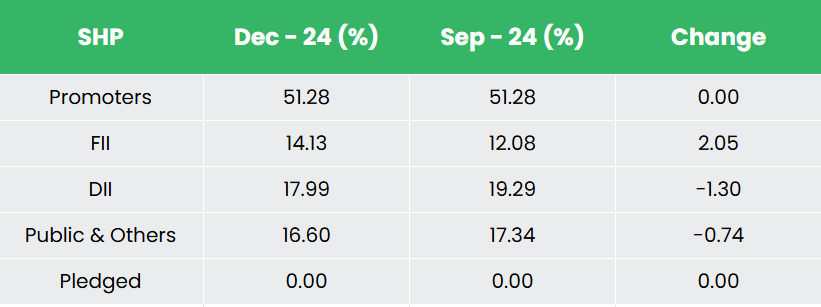

Based in 1981 and headquartered in Bhubaneswar, Nationwide Aluminium Firm Ltd. (NALCO) is a “Navratna” firm with a 51.28% possession by the Indian Authorities. It is likely one of the nation’s largest built-in bauxite, alumina, aluminium, energy and coal advanced. The corporate has captive bauxite mines (capability of 6.8 MTPA) in Panchpatmali and alumina refinery (capability of two.1 MTPA) at Damanjodi, within the District of Koraput in Odisha and aluminium smelter (0.46 MTPA) & captive energy plant (1,200 MW) at Angul. Moreover, NALCO has coal reserves and wind energy vegetation, with respective era capacities of 4 MTPA and 198 MW to assist its energy wants.

Merchandise and Providers

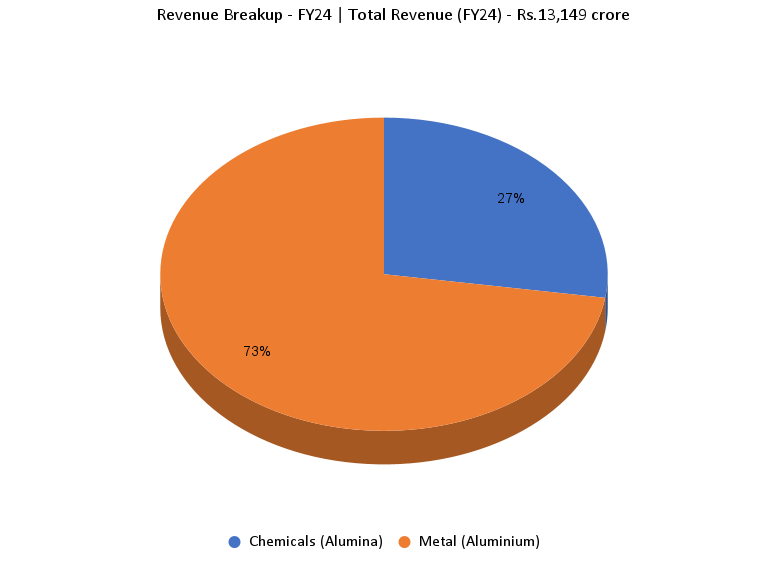

The corporate produces and sells alumina and aluminium merchandise (ingots, billets, wire rods and roll merchandise) in each home and worldwide markets.

Subsidiaries: As of FY24, the corporate has 4 joint ventures and no subsidiaries/affiliate firms.

Funding Rationale

- Main growth tasks – The corporate has outlined growth plans throughout all its operational segments. It goals to fee new Pottangi bauxite mines with a capability of three.5 MTPA in FY26. Moreover, a brand new conveyor belt is being put in from the prevailing Panchpatmali bauxite mines to the refinery. To accommodate the upper mining throughput, the corporate is organising new 5th stream alumina refinery (to be commissioned in FY26) with a capability of 1 MTPA. Over the following 3-5 years, the corporate is increasing its aluminium smelter capability by 0.5 MTPA and its captive energy capability (for which it has signed an MoU with NTPC). The mixed capex for these two tasks is Rs.30,000 crore. To additional optimise its operations, the corporate has determined to nominate a Mine Developer and Operator (MDO). Concurrently, the corporate can be creating a 25.5 MW wind energy plant in Tamil Nadu and creating the Utkal-D & E coal blocks with a mixed peak manufacturing capability of 4 MTPA.

- The KABIL JV – The corporate, holding a 40% stake, has shaped a three way partnership known as KABIL with Hindustan Copper Ltd (30% stake) and Mineral Exploration and Consultancy Ltd. The three way partnership goals to determine, purchase, develop, course of, and commercially make the most of strategic minerals in worldwide areas for provide to India, thereby supporting the Authorities of India’s “Make in India” initiative. KABIL’s principal focus is sourcing key battery minerals resembling Lithium and Cobalt. In FY24, the corporate signed an exploration and growth settlement with CAMYEN, Argentina, for 5 lithium mines. Moreover, KABIL, in partnership with the Crucial Minerals Workplace (CMO) of Australia, has engaged a Industrial Advisor to help with the shortlisting and due diligence of Lithium and Cobalt mineral belongings in Australia.

- Q3FY25 – Throughout Q3FY25, the corporate generated income of Rs.4,662 crore, a rise of 39% as in comparison with the Rs.3,348 crore of Q3FY24. EBITDA elevated by 206% from Rs.756 crore of Q3FY24 to Rs.2,311 crore of the present quarter. Web revenue elevated from Rs.471 crore of Q3FY24 to Rs.1,566 crore of Q3FY25, a development of 232% YoY. The improved monetary efficiency is attributed to higher realization and gross sales of alumina, use of captive coal and discount in the price of uncooked supplies.

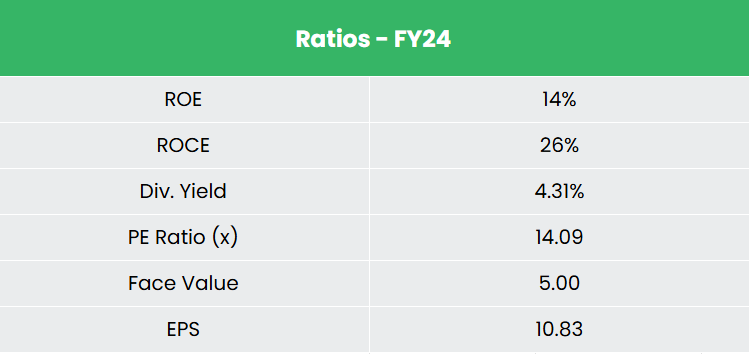

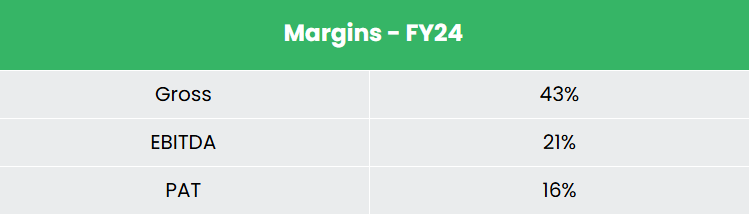

- FY24 – The corporate generated income of Rs.13,149 crore, a decline of 8% in comparison with FY23 income. Working revenue is at Rs.2,801 crore, up by 20% YoY. The corporate posted internet revenue of Rs.1,988 crore, a rise of 39% YoY. EBITDA margin improved from 16% to 21% and internet revenue margin elevated from 11% to fifteen%.

- Monetary Efficiency – The corporate has generated income and internet revenue CAGR of 14% and 9% over the interval of three years (FY21-24). Common 3-year ROE & ROCE is round 16% and 22% every for FY21-24 interval. The corporate has a debt-to-equity ratio of 0.01.

Business

The metals and mining sector is essential to a nation’s growth, supplying important uncooked supplies for key industries. The expansion of a rustic’s industrial sector is intently linked to the growth of its mining trade. This sector has the potential to enormously affect GDP development, overseas change earnings, and supply a aggressive benefit to industries resembling development, infrastructure, automotive, and vitality by securing very important uncooked supplies at inexpensive costs. India’s strategic location, which facilitates exports, together with its cost-effective manufacturing and conversion processes, has helped it grow to be the world’s fourth-largest aluminium producer.

Progress Drivers

- 100% FDI by computerized route within the mining sector.

- The huge sources of quite a few metallic and non-metallic minerals is anticipated to function a basis for the growth and development of the nation’s mining trade.

- Indian authorities’s initiatives and schemes resembling Gati Shakti Grasp Plan, Make in India, Pradhan Mantri Awas Yojna – Housing for all, City Infrastructure growth scheme for small and medium cities is anticipated to foster the expansion of Metals and Mining sector in India within the subsequent few years.

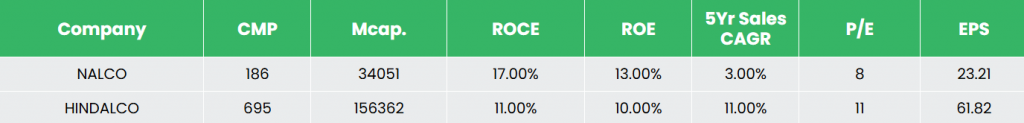

Peer Evaluation

Competitor: Hindalco Industries Ltd.

Environment friendly capital allocation and value optimisation methods has resulted within the firm producing higher returns and revenue margins (TTM working revenue margin of 39% vs 13% of Hindalco) in comparison with its competitor.

Outlook

At present NALCO is likely one of the lowest price bauxite and alumina producers internationally. Being a zero-debt firm supplies the corporate with higher leverage alternatives to lift funds for its future growth plans. We imagine the corporate’s development potential is pushed by three key components: 1) built-in operations and strategic location, 2) uncooked materials securitization, 3) expanded refinery capability and smelter capability addition to offer scope for extrusion and different value-added merchandise. Moreover, the corporate is actively taking part in mining auctions. Wanting forward, NALCO plans to enter the manufacturing of value-added aluminium merchandise, which provide larger margin potential and elevated profitability.

Valuation

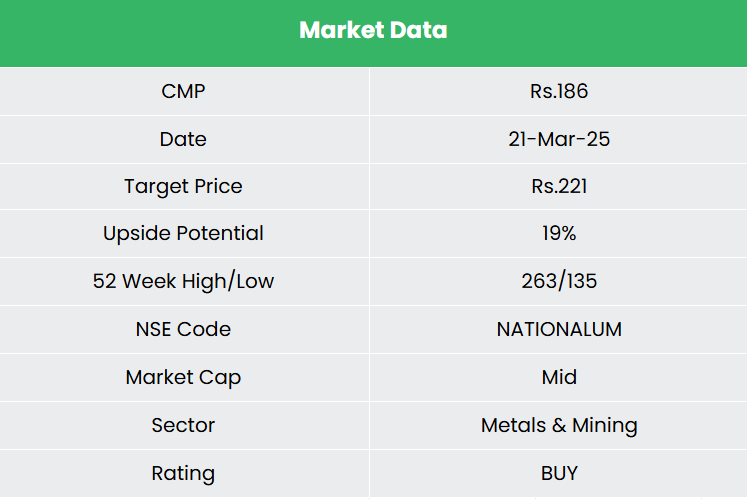

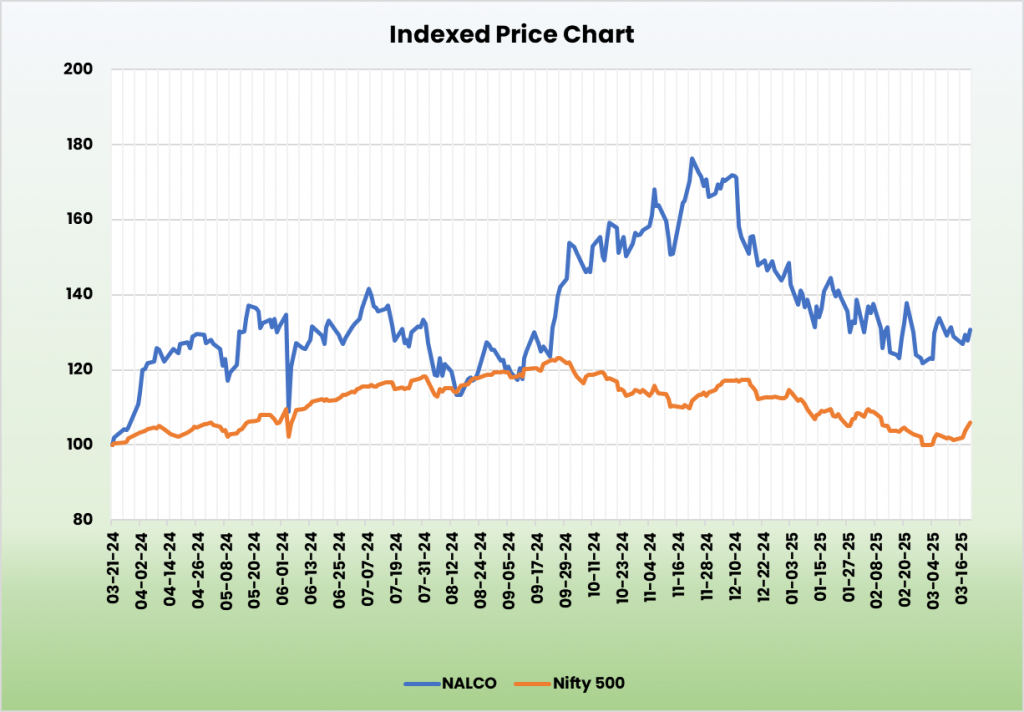

The corporate’s all-round growth plans are anticipated to payoff and speed up its development momentum. We advocate a BUY ranking within the inventory with the goal worth (TP) of Rs.221, 12x FY26E EPS.

Threat

- Execution delays – Any surprising delays within the completion of growth tasks would possibly impression the corporate operations.

- Foreign exchange Threat -The corporate has vital operations in overseas markets and therefore is uncovered to foreign exchange danger. Any unexpected motion within the foreign exchange market can adversely have an effect on the corporate.

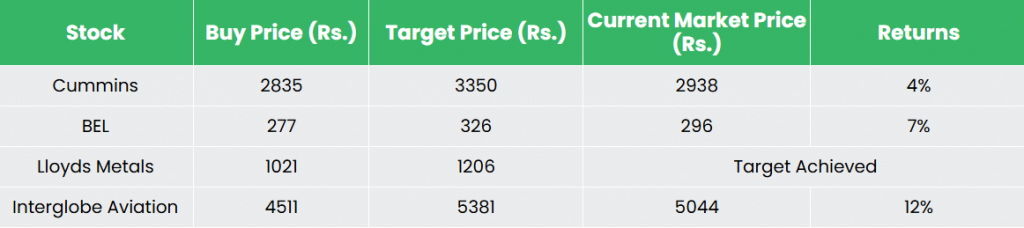

Recap of our earlier suggestions (As on 21 March 2025)

Disclaimer: Investments within the securities market are topic to market dangers, learn all associated paperwork fastidiously earlier than investing. Securities quoted listed here are exemplary, not recommendatory. Please seek the advice of your monetary advisor earlier than investing. Please notice that we don’t assure any assured returns for the securities quoted right here.

Analysis disclaimer: Funding within the securities market is topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing. Registration granted by SEBI, and certification from NISM on no account assure the efficiency of the middleman or present any assurance of returns to buyers.

For extra particulars, please learn the disclaimer.

Different articles chances are you’ll like

Publish Views:

69