THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

In search of a better approach to develop your cash with out playing it away?

Whether or not you’re saving for a down fee, constructing an emergency fund, or simply need your money to do greater than sit in a financial savings account, you’re not alone.

Many individuals are asking the identical query: The place can I park my money brief time period with out taking large dangers?

The excellent news?

There are alternatives – low danger investments that provide strong returns with out locking up your cash for many years.

In the event you’re seeking to develop your cash safely over the following 1 to five years, these choices could give you the results you want.

On this information, we’ll discover a number of the greatest brief time period funding choices out there proper now.

Whether or not you’re simply getting began or wish to fine-tune your monetary plan, this text offers you actual, actionable concepts that will help you make your cash work more durable – with out the stress.

The ten Finest Brief Time period Investments For Your Cash

| Funding Sort | Benefits | Drawbacks |

|---|---|---|

| Excessive Yield Financial savings Account | -Easy accessibility to funds (extremely liquid). -FDIC insured (as much as $250,000). |

-Rates of interest can fluctuate. -Decrease returns in comparison with different investments. |

| Financial institution CD | -Assured fastened return. -FDIC insured. |

-Early withdrawal penalties. -Decrease liquidity (locked-in for a time period). |

| Dealer CD | -Entry to increased CD charges by means of varied banks. -Will be offered on the secondary market (extra versatile). |

-Might promote under unique worth if cashed out early. -Not all brokerage CDs are FDIC insured, will depend on the issuing financial institution. |

| Cash Market Accounts | -Greater curiosity than commonplace financial savings accounts. -Examine-writing and debit card entry (in some instances). |

-Might require a excessive minimal steadiness. -Rates of interest not as aggressive as some on-line choices. |

| Financial savings Bonds | -Backed by the U.S. authorities. -Tax-deferred curiosity till redeemed. |

-Should be held for no less than 1 12 months (not liquid). -Penalty if cashed earlier than 5 years (lose 3 months’ curiosity). |

| Treasury Payments | -Very low danger (government-backed debt securities). -Extremely liquid and straightforward to promote. |

-Decrease yields in comparison with riskier investments. -Curiosity is topic to federal revenue tax. |

| Put money into Small Companies | -Greater fee of return than different choices. -Skill to take a position spare change. |

-Potential to lose cash. -Rate of interest might drop sooner or later. |

| Put money into Actual Property | -Greater fee of return than different choices. -Can make investments with as little as $10. |

-Can’t promote for six months. -Redemption payment if offered inside 5 years. |

| Brief Time period Bond Funds | -Diversification throughout a number of bonds -Potential for increased returns than .financial savings accounts or CDs. |

-Not insured, worth can fluctuate. -Rate of interest danger (worth could drop if charges rise). |

| Peer 2 Peer Lending | -Potential for increased returns. -Helps particular person debtors or small companies. |

-Greater default danger (not insured). -Funds could also be tied up for the mortgage time period (decrease liquidity). |

#1. Excessive Yield Financial savings Accounts

The most secure place to place your cash is a standard financial savings account at your financial institution or credit score union.

The issue with these accounts is that they pay little to no curiosity.

So whilst you don’t lose cash as a result of the cash you place in is secure, you do lose in terms of buying energy.

For instance, in case you are incomes 1% in your financial savings and inflation is 4%, your cash is rising slower than costs are rising.

If in case you have $100 saved, in a single 12 months you’ll have $101. However one thing that prices $100 at present will value $104 in a single 12 months.

As you possibly can see, you didn’t lose your cash in your checking account, however you’re falling behind in terms of maintaining with inflation.

The excellent news is that many banks and credit score unions provide excessive yield saving accounts.

These are the very same as a traditional financial savings account besides that they pay increased rates of interest.

Since most banks provide these accounts, you’ll want to discover a financial institution that’s not solely reliable, but additionally pays a excessive rate of interest.

You don’t wish to merely select the financial institution with the very best charges as oftentimes these could be teaser charges that may drop shortly.

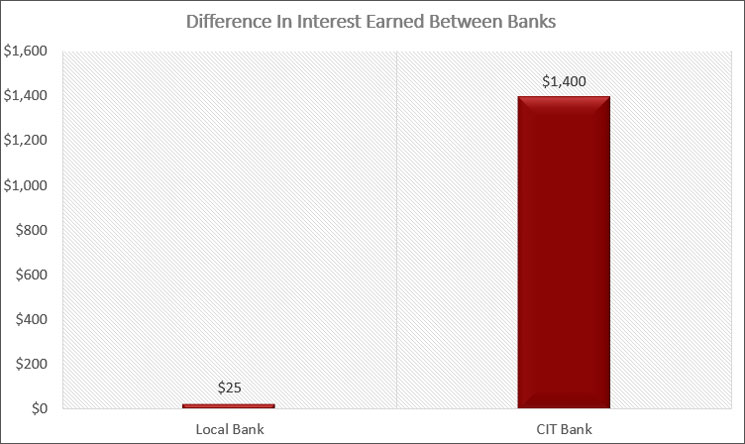

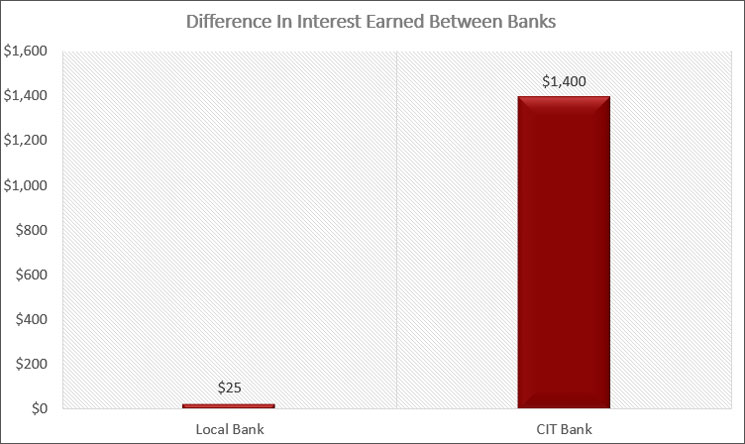

Considered one of my favourite banks is CIT Financial institution.

Finest Financial institution Account

CIT Financial institution

With one of many highest paying rates of interest within the U.S. CIT Financial institution stands out as one of the best excessive yield financial savings account. Add in ease of use and nice customer support, and you’ve got a transparent winner.

We earn a fee for those who make a purchase order, at no extra value to you.

This financial institution gives an internet financial savings account with an rate of interest that’s traditionally one of many highest within the nation, permitting you to earn much more curiosity.

They usually constantly rank on the prime of the record of highest curiosity paying accounts on a regular basis.

Present Price You Can Anticipate to Earn: Between 4.25% and 5% relying on the financial institution

#2. Financial institution Certificates of Deposit

Investing in a certificates of deposit (CD) is a good way to earn the next rate of interest in your cash.

The distinction with a financial institution CD is the potential for increased curiosity, often known as yield.

In return for this increased yield you must lock your cash up for a time frame.

With a financial savings account, you’re free to take your cash out of the account everytime you need.

However with a CD, you could have a time frame that you must depart the cash within the account.

You realize the size of this time period since you select the time period.

Most typical CD phrases are 6 months, 1 12 months, 18 months, 2 years and 5 years.

The longer you lock your cash up, the upper the rate of interest you’ll earn.

After all, if you really want the cash, you possibly can nonetheless shut the CD early and get your a reimbursement.

However by doing this, you’ll usually forfeit 3 months price of curiosity funds.

Word that there are some CDs that provide no penalty for those who shut the CD early, however they pay a barely decrease rate of interest due to this.

Lastly, there are some CDs that provide the choice to extend your rate of interest one time through the time period.

Since your rate of interest is locked while you open the CD, you can lose out if rates of interest rise with a typical CD.

By letting you improve your fee one time, you possibly can decrease the possibilities of this danger.

Present Price You Can Anticipate to Earn: Between 4% and 4.50% relying on the time period

#3. Brokerage Certificates of Deposit

You may as well purchase a CD by means of your dealer, like Schwab or Constancy.

Doing this gives two major advantages: increased curiosity and extra liquidity.

Most CDs you should buy by means of a dealer provide the next rate of interest than from a financial institution.

After I was investing in these CDs just a few months in the past, a 6-month financial institution CD was paying 4.5% whereas a dealer CD was paying 5.25%.

The opposite profit is that you could promote your CD at any time on the secondary market.

It is a fancy approach of claiming there are traders all the time on the lookout for CDs and consequently, you possibly can promote your CD earlier than maturity.

There isn’t any penalty for doing so, however rates of interest will decide how a lot or how little you possibly can promote it for.

Present Price You Can Anticipate to Earn: Between 4% and 4.75% relying on the time period

#4. Cash Market Accounts

Cash market accounts, or cash market funds, are a approach so that you can earn increased curiosity with out locking your cash up like with a certificates of deposit.

There are 2 forms of cash market accounts.

The primary is nearly the identical as a financial savings account.

The one actual variations are that you simply have a tendency to want the next steadiness within the account, for instance $25,000 or extra and you’ll write checks on the account.

Banks pays the next rate of interest on a cash market account since you’re depositing extra money.

The second kind of cash market account is a cash market mutual fund.

These accounts put money into short-term financial institution devices and a few brokers name them a money administration account as a result of you possibly can deposit cash, write checks, and in some instances, have a debit card.

The underlying worth of the cash market fund stays at $1 (though again in 2008 after the housing collapse, some funds did “break the buck”).

Primarily, with a cash market fund, your cash is secure and you’ll earn a little bit extra curiosity than a primary account on the financial institution.

Present Price You Can Anticipate to Earn: Between 3.60% to 4.50% relying on the financial institution

#5. Financial savings Bonds

Financial savings bonds are one other brief time period funding possibility.

Whereas usually thought of long run investments, you need to use these authorities securities within the brief time period.

Financial savings bonds are backed by the total religion and credit score of the federal Authorities and are subsequently thought of freed from default danger.

At the moment there are two forms of financial savings bonds out there for buy, the EE Collection and Collection I.

The distinction is how they pay curiosity.

- EE Collection financial savings bonds pay a hard and fast fee of curiosity. The speed you earn is ready while you buy the bond, and stays fixed for the lifetime of the bond.

- I Bonds pay fastened fee of curiosity, plus an adjustable fee. The rate of interest on an I Bond is made up of two parts, a hard and fast fee part and a floating fee part. The fastened fee part on an I Bond is ready when the bond is bought and stays fixed for the lifetime of the bond. The floating fee part is reset each 6 months and is predicated on the present degree of inflation.

The rate of interest on an EE Collection financial savings bonds is decrease than what you will see with most of the different choices listed right here.

However there are some attention-grabbing issues to contemplate.

First, for those who hold your EE Bond for 20 years the federal government ensures that it’s going to no less than double in worth.

Whenever you do the maths, this comes out to a return of three.5% over the lifetime of the bond.

This works as a result of for those who money in your bond after 20 years and it isn’t price double the acquisition worth, the federal government will make an adjustment to the ultimate worth of the bond so will probably be price double what you paid.

The second attention-grabbing factor to contemplate is that whereas you’ll owe federal revenue tax on the curiosity you earn on the bond, you’ll not owe any state revenue tax.

Lastly, you possibly can keep away from taxes altogether by utilizing the bonds and the curiosity to pay for increased schooling.

The identical tax advantages of the EE bonds are true for I bonds as nicely.

Lastly, you possibly can money in a financial savings bond at any time after holding the bond for 1 12 months.

Nevertheless, for those who money the financial savings bond in earlier than holding it for five years, then you must quit 3 months price of curiosity.

After 5 years you possibly can money the bond in at any time with out penalty.

Additionally take into account that a person can buy as much as $10,000 price of EE bonds and $10,000 price of I bonds in any given 12 months.

Present Price You Can Anticipate to Earn: Round 3%

#6. Treasury Payments

Treasury Payments, generally generally known as T-Payments, are brief time period debt securities issued by the U.S. authorities.

They’re thought of one of many most secure investments out there as a result of they’re backed by the total religion and credit score of the U.S. Treasury.

T-Payments are usually offered in phrases starting from just a few days to 1 12 months, making them splendid for traders on the lookout for short-term, low-risk alternatives.

T-Payments are bought at a reduction to their face worth, and traders earn a return when the invoice matures and the total face worth is paid.

For instance, you would possibly purchase a $1,000 T-Invoice for $980 and obtain the total $1,000 at maturity, with the $20 distinction being your earnings, or the “curiosity” you earn.

As a result of there are a lot of patrons for these authorities bonds, they’re extremely liquid, permitting you promote at any time.

Present Price You Can Anticipate to Earn: Between 4% and 4.20% relying on the time period

#7. Make investments In Small Companies

Earlier than I advised you how one can earn 192% extra curiosity by opening an account with CIT Financial institution.

Right here I’ll do you one higher.

You’ll be able to earn near 200% extra curiosity by buying Worthy Bonds.

What are Worthy Bonds?

It’s an funding that has your funding loaned out to small companies to fund their stock wants.

In addition they assist fund actual property tasks as nicely.

Worthy fees a low rate of interest to the small enterprise after which Worthy turns round and provides you 7% in your funding.

By investing with Worthy Bonds, you earn 7% in your cash.

Finest Method To Earn Passive Revenue

Worthy Monetary

Seeking to safely earn the next return in your cash? Worthy Bonds gives 5% 7% curiosity in your cash. Put money into small companies and earn a return for doing so. New customers get a $10 bonus when buy your first bond.

We earn a fee for those who make a purchase order, at no extra value to you.

The catch is there’s some danger to your funding.

In actual fact, that is the primary brief time period funding that does put your principal in danger.

Perceive although that this danger is small.

Worthy is required to have a contingency fund of cash in case a small enterprise doesn’t pay again their mortgage.

On this case, Worthy would use the cash within the contingency fund to pay you the 5% in your financial savings.

In different phrases, Worthy Bonds has an emergency fund to guard traders.

The chances of this occurring nonetheless are slim because the firm goes to nice lengths to mortgage cash out to top quality companies.

Moreover, the loans are backed by the stock of the small enterprise.

You will get began with Worthy Bonds with as little as $10. You’ll be able to even arrange your account to take a position your spare change.

This works by having Worthy spherical up your purchases to the closest greenback and make investments your spare change to purchase extra bonds.

In the event you common $500 in spherical ups a 12 months, in 10 years you’ll have an extra $6,600!

Present Price You Can Anticipate to Earn: At the moment 7% till January 2026, then 5%

#8. Put money into Actual Property

I’m an enormous fan of investing cash in actual property.

The issue is you want sufficient cash for a down fee to purchase a property.

And for those who plan to lease it out, there’s plenty of work there, until you rent a administration firm, after which there’s an added value.

To sidestep this, I’ve been investing with Arrived.

It’s a crowdfunding platform that swimming pools traders cash and buys properties.

Then quarterly, I earn a dividend based mostly on my share of possession.

I additionally earn a return when the appreciated property is offered.

The rationale Arrived is a brief time period funding possibility is due to their Non-public Credit score Fund.

Best Method To Make investments In Actual Property

Arrived Properties

In search of a straightforward approach to get began investing in actual property with out some huge cash? Look into Arrived Properties. Choose the only household homes within the components of the nation you wish to put money into and earn passive revenue.

Begin Investing In Actual Property

We earn a fee for those who make a purchase order, at no extra value to you.

This fund invests in short-term loans to fund actual property tasks.

At the moment you earn round 8% and make investments with as little at $10.

The drawboack of this concept?

It’s not essentially the most liquid funding as a result of you must hold your cash locked up for no less than six months earlier than you possibly can promote, and there’s a payment for those who promote in lower than 5 years.

Present Price You Can Anticipate to Earn: At the moment 8%

#9. Brief Time period Bond Funds

The following brief time period funding to contemplate is brief time period bonds.

The primary distinction with brief time period bonds over the opposite concepts talked about is that that is the primary one that you’ve the next danger shedding principal.

In different phrases, for those who make investments $1,000 in brief time period bonds, you can find yourself with $900 or much less.

So far as the rate of interest brief time period bonds pay, all of it will depend on general charges and what the Federal Reserve is doing.

However earlier than you run off to purchase brief time period bonds, you must perceive how they work.

With out complicated you utterly, know that when bond costs rise, rates of interest fall.

And when bond costs fall, rates of interest rise.

For instance, take a bond that’s promoting for $100 and yielding 3%.

If charges rise to three.25%, the value of the bond will drop under $100. When you lose principal, you do earn extra curiosity.

Perceive that I like to recommend investing in bond funds over particular person bonds as it’s simpler and less expensive.

The easiest way to put money into brief time period bonds is thru ETFs and mutual funds.

By investing in brief time period bond funds, you purchase a basket of bonds at varied costs and rates of interest, diversifying your danger.

You additionally purchase bonds with varied maturity dates.

It is a fancy approach of claiming when the bond ends and the investor will get their principal funding again.

A great portfolio to put money into would include the next bonds funds:

- iShares Brief Treasury Bond ETF (SHV)

- iShares Extremely Brief-Time period Bond ETF (ICSH)

- iShares 0-5 Yr Funding Grade Bond ETF (SLQD)

By creating this portfolio of curiosity paying bonds, you’ll earn an OK yield and has the potential to supply progress of your principal as nicely.

Present Price You Can Anticipate to Earn: Between 5% and 6%

#10. Peer To Peer Lending

One other decrease danger possibility is to wanting into peer lending, or p2p lending.

That is the place individuals who want cash crowdfund their mortgage by skipping the financial institution.

Right here is the way it works.

Let’s say I would like $10,000 for a automotive.

I’m going in Lending Membership or Prosper and after doing a background verify on me, these websites enable my mortgage to be posted for funding.

You see my mortgage and the rate of interest you can be paid and resolve to take a position $200.

Assuming others make investments sufficient to hit my $10,000 objective, the mortgage is made.

Now each month for the following 5 years you’re going to get a portion of your $200 funding again, plus curiosity.

The rate of interest varies by mortgage and borrower and you’ll construct a portfolio of investments by investing in a handful of loans.

Present Price You Can Anticipate to Earn: Between 5% and 9%

Benefits And Drawbacks

After all with any funding, there are benefits and downsides.

That is true with the forms of brief time period investments I record above.

Benefits

- Protected principal. Most often, you received’t be risking your principal while you make investments for the brief time period.

- Straightforward to foretell. Since your principal is secure and you realize the rate of interest you’ll earn, it’s straightforward to do the maths to see how a lot cash you’ll find yourself with.

- Flexibility. It’s straightforward to get your cash while you want it, and never have it tied up long run.

- Small funding. You’ll be able to usually begin placing cash in these monetary merchandise with as little as $1.

Drawbacks

- Decrease returns. As a result of the investments are typically secure, they pay decrease returns.

- Taxes. In relation to bonds, you’re paying peculiar revenue tax charges for those who put money into a taxable account.

- Many choices. It is a profit besides if too many selections makes it more durable so that you can resolve on one funding.

- Curiosity Price Threat. The most important danger you face when seeking to generate income over the brief time period is fluctuating charges. Relying on how charges transfer, you would possibly earn much less cash, or with some funding concepts, lose a few of you preliminary funding.

Investments to Keep away from

When investing for the brief time period, there are some investments you wish to keep away from, principally as a result of the chance of shedding cash is simply too nice.

The primary is with particular person shares.

When you can earn a excessive fee of return, there’s an excessive amount of danger of shedding cash, particularly for those who want the cash in a single 12 months or much less.

One other funding to keep away from is company bonds.

Company bonds are debt issued by firms and the cash they make by promoting them is to develop or increase into new enterprise traces or territories.

They have a tendency to pay increased charges of curiosity in comparison with authorities bonds, primarily due to the elevated danger of default.

Whereas bonds general are a low danger funding, company bonds are a greater possibility for long run traders.

Brief Time period Funding Methods

With the entire forms of brief time period investments listed, you could be confused and a little bit overwhelmed as to what one of the best choices are for you.

Fortunately, I’ve you lined.

Here’s a breakout of brief time period funding methods you need to use proper now to earn extra curiosity with out a lot danger.

By following these methods, you’ll know precisely the way to make investments your cash.

#1. Begin Off With Excessive Yield Financial savings Accounts

It’s worthwhile to have a cushion for emergencies and one of the best place for this cash is an account at your financial institution.

Whereas your wants could differ, I recommend protecting $10,000 on this account.

This permits for fast entry to your cash do you have to want it.

I understand saving $10,000 sounds intimidating, however you are able to do it.

Simply break it out into smaller objectives, like saving $1,000 at a time and you’re going to get there quicker than you suppose.

Once more, I like to recommend going with CIT Financial institution since you can be incomes a wholesome quantity of curiosity in your financial savings.

After all, most any on-line financial institution will do, as most have a tendency to pay increased fee of curiosity than a standard brick and mortar financial institution or credit score union.

Lastly, I like to recommend you could have a separate account for every of your financial savings objectives.

This helps to maintain you motivated as you possibly can see the place you stand with every objective.

#2. Create A CD Ladder

After you have $10,000 in financial savings on the financial institution, you possibly can start to create a ladder of CDs.

This works by having you put money into certificates of deposit which have completely different maturity dates and varied rates of interest.

By doing this you restrict the chance of rising charges whereas your cash is locked up.

I recommend you make investments your cash in 4 CDs with the next maturities:

- 12 Month (1 12 months) CD: $1,500

- 18 Month (1 ½ 12 months) CD: $1,500

- 24 Month (2 12 months) CD: $1,500

- 60 Month (5 12 months) CD: $1,500

In complete you’re investing $5,500 in financial institution CDs. When every CD matures, you merely reinvest the cash for a similar time period in a brand new CD.

#2a. Make investments In Worthy Bonds

As an alternative choice to constructing a ladder with certificates of deposit, you possibly can put money into Worthy Bonds.

I encourage you to reap the benefits of their spherical up characteristic that will help you velocity up the method of saving cash shortly.

#2b. Make investments with Arrived

One other different to a CD ladder is Arrived.

You’ll get the next fee of return with a comparatively secure funding.

However you can’t redeem your cash for six months and are charged a small payment is you redeem earlier than 5 years.

The excellent news is that they have a minimal funding of simply $10.

#3. Put money into Brief Time period Bond Funds

You now have $15,500 invested between financial savings and financial institution CDs or Worthy Bonds/Arrived.

The next step is investing in brief time period bond funds.

To do that, purchase the next bonds:

- iShares Brief Treasury Bond ETF: (SHV)

- iShares Extremely Brief-Time period Bond ETF: (ICSH)

- iShares 0-5 Yr Funding Grade Bond ETF: (SLQD)

You wish to ensure you have the next proportion of every in your funding portfolio:

- 45% – iShares Brief Treasury Bond ETF (SHV)

- 35% – iShares Extremely Brief-Time period Bond ETF (ICSH)

- 20% – iShares 0-5 Yr Funding Grade Bond ETF (SLQD)

This can diversify your cash and offer you a pleasant month-to-month revenue stream.

The draw back to that is each month your month-to-month revenue is getting taxed at peculiar revenue charges, which is increased than funding taxes.

So earlier than you do that, evaluation your monetary scenario to verify it is smart for you.

Incessantly Requested Questions

There may be plenty of confusion and a few thriller surrounding the numerous forms of brief time period investments.

I created this FAQ part that will help you perceive precisely what you’re stepping into when investing in these funding varieties.

When ought to I put money into brief time period investments?

In relation to investing, your time horizon performs an enormous function into what you truly put money into.

With out making an allowance for your timeframe, you can find yourself investing in an asset that’s too dangerous or one which carries too little danger and subsequently received’t present the return you want.

Subsequently, you’ll want to ensure you choose the appropriate funding based mostly on while you want the cash, your monetary objectives, and danger tolerance.

Under is a chart in your reference.

| When Cash is Wanted | Finest Funding |

|---|---|

| Much less Than 1 Yr | Money (Financial savings Account, CD) |

| Between 1-5 Years | Money & Brief Time period Bonds |

| Extra Than 5 Years | Shares & Bonds |

From the chart you possibly can see that you probably have a short while horizon, similar to needing your cash in lower than 5 years, then you ought to be investing in money and/or bonds.

Investing in conventional long run investments like shares or equities at this level is just not suggested since you’ll danger shedding your principal in return for the next fee of return.

This danger is just too nice and you need to follow money and/or bonds.

Are brief time period investments secure?

The following query I get requested concerning the several types of brief time period investments is are they secure.

For essentially the most half, they’re secure.

After all, for those who hear to speak radio, there can be advertisements touting all types of secure investments, lots of that are nowhere close to secure and others even I haven’t heard of.

Except for these outliers, brief time period investments are secure to put money into.

Is my principal is secure?

The overwhelming majority of instances when investing in checking, financial savings, and certificates of deposits, the principal you make investments is secure 99.99% of the time.

The one approach you’ll lose your principal is that if the financial institution the place the funding is held at goes below and it wasn’t lined by FDIC insurance coverage.

Moreover, for those who had extra invested than the Federal Deposit Insurance coverage Company protection quantity permits, your further financial savings could possibly be in danger.

When do I danger shedding cash?

Despite the fact that these are secure investments within the sense you’ll by no means lose principal, relying on the rate of interest you’re incomes, you continue to danger shedding cash to inflation.

I’ve talked earlier than about inflation, however too many traders ignore it.

Over time, inflation eats away on the buying energy of your cash.

We see this on a regular basis.

I keep in mind as a child a pack of gum costing me $0.50. Now it prices $1.99.

That is the impact inflation has on costs. It causes costs to rise over time.

Traditionally, inflation runs between 2-3% yearly.

In case your financial savings account earns you 1% per 12 months, you’re shedding out to inflation.

Let’s take a look at the numbers to see this in motion.

Let’s say you could have $1,000 and wish to use it purchase a house theater system that additionally prices $1,000.

However you don’t wish to purchase it now, you wish to purchase it in 1 12 months after you could have your new home.

You resolve to take a position your cash in a financial savings account incomes 1% yearly.

Throughout this time, inflation is operating at 3% yearly.

After one 12 months, you earned $10 in curiosity, making your financial savings price $1,010.

Due to inflation, the house theater system that value $1,000 originally of the 12 months now prices $1,030 on the finish of the 12 months.

Your financial savings account a secure kind of funding since you didn’t lose your unique $1,000. However it isn’t a secure funding as a result of inflation is outpacing your return.

When you earned $10 in curiosity, the price of the house theater system rose by $30, thus you “misplaced” $20.

That is the hazard of secure forms of investments.

You sleep at evening as a result of you aren’t shedding the cash you saved or invested.

However you’re shedding buying energy and consequently, want to save lots of extra money yearly.

Because of this they name inflation the silent killer. It slowly destroys your funds behind the scenes.

The excellent news is that by incomes an rate of interest within the 2-3% vary, you retain tempo with inflation and it doesn’t have a unfavourable affect in your wealth.

Are there another dangers with investing for the brief time period?

The one different danger elements is rate of interest danger.

As a result of charges can change, you danger not incomes sufficient cash to satisfy your objective.

Because of this it’s important to take a position your cash in several types of brief time period securities to restrict this danger.

What are excessive yielding secure brief time period investments?

Sadly, there isn’t a such factor as a excessive yielding brief time period funding, no matter what the person on the radio or late evening tv is attempting to promote you.

At all times do not forget that danger and return are associated.

The upper the chance, the upper the potential return you possibly can anticipate. The decrease the chance, the decrease the potential return you possibly can anticipate.

As of now, the very best yield you possibly can anticipate to earn and nonetheless have your cash secure by way of not shedding cash is with Worthy Bonds or CIT Financial institution.

For my part, they’re one of the best brief time period investments you may make and that is the place I put my cash.

The place is one of the best place to take a position my cash for 1 12 months?

In the event you want your financial savings inside 1 12 months, one of the best brief time period investing choices are an internet financial savings account or a financial institution or dealer CD.

The final word reply would be the rate of interest.

I choose these choices as a result of the chance of shedding cash is extraordinarily low and also you cash is FDIC insured.

I might first contemplate an internet financial institution since they’re straightforward to open and also you withdraw your cash at any time with out penalty.

Choose just a few and see which one gives one of the best charges.

From there, I might take a look at just a few completely different banks for his or her fee on a 1 12 months CD.

If the speed is increased than with a financial savings account, put money into the CD.

If the speed is decrease, then put your cash into an account with CIT Financial institution.

Is a Roth IRA a very good brief time period funding?

A Roth IRA is an efficient place for a brief time period funding since you possibly can withdraw your contributions with none tax penalties or penalties.

You simply must make sure you solely are taking out as a lot as you invested.

It is because whereas earnings are tax free in case you are over 59 ½ they’re topic to taxes and penalties for those who withdraw them earlier than you flip 59 ½.

Additionally, you’ll want to solely put money into much less dangerous investments.

This implies no shares for those who anticipate to want the cash in lower than 5 years.

Last Ideas

Total, in terms of the forms of brief time period investments, you could have a handful of selections.

Simply choose the appropriate funding automobiles for you objectives and you ought to be all set.

Keep in mind to not fall sufferer of taking up extra danger only for the next return for those who want the cash in lower than 5 years.

Belief me, the chance is just not price it.

Settle for that you’re incomes much less curiosity and be accomplished with it.

As you noticed from the numerous choices I listed, you possibly can nonetheless earn an honest return with out taking up the added danger.