Earlier Episodes of the Non-public Fairness (Mini) Collection:

Non-public Fairness Mini Collection (1): My IRR just isn’t your Efficiency

Non-public Fairness Mini sequence (2) – What sort of “Alpha” are you able to anticipate from Non-public Fairness as a Retail Investor in comparison with public shares ?

Non-public Fairness Mini Collection (3): Listed Non-public Asset Managers (KKR, Apollo & Co)

Non-public Fairness Mini sequence (4) : “Investing like a “billionaire” for retail buyers within the UK inventory market by way of PE Trusts

Non-public Fairness Mini Collection (5): Commerce Republic affords Non-public Fairness for the plenty (ELTIFs) -“Good attempt, however hell no”

Non-public Fairness (Mini) Collection 6: Non-public Fairness for the plenty – Y2K version

Background:

Possibly a fast phrase why I’m doing this sequence on Non-public Fairness:

I’ve to confess that I’m fascinated by the PE business as such and no matter occurs there has a particular affect on the inventory market, both by means of take-privates or IPOs or different extra oblique developments (Non-public Credit score growth and many others.).

As well as, as Non-public Fairness is now focusing on an increasing number of retail buyers, I wish to present some background data as at present these merchandise are offered on a really “uneven” foundation. There’s little or no goal data accessible about these merchandise apart from the shiny gross sales pitches.

I’m very a lot afraid that many retail buyers will remorse placing cash into Retail buildings in a couple of years from now.

What are PE “Secondaries” anyway ?

There are two issues that I actually do actually admire from the Non-public Fairness business: First, that they managed to maintain their 2/20 price schedule since their beginnings within the Eighties and by no means shared any “scale economics” with buyers. And second, that they’re very artistic find new methods to promote their product.

I’ve been discussing the comparatively new retail merchandise already however an identical large pattern in Non-public Fairness are socalled “Secondary Funds”.

Secondary funds are available in many flavors however the primary one is to purchase Non-public Fairness belongings from sad buyers and promote them to new buyers. There are two totally different “flavours” of this:

- Secondary LP Fund stakes

Right here, present buyers wish to promote their Fund stakes (“Restricted Associate”, LP) for one purpose or the opposite. As these are illiquid and infrequently intransparent automobiles, patrons will solely purchase them for a sure low cost.

- GP Led secondaries / Continuation automobiles

In these circumstances, the PE supervisor (“Common Associate”, GP) can’t exit an funding inside a fund by way of the traditional route of an IPO or M&A transaction and is searching for new LPs to which he can promote these firm stakes to, additionally usually at a reduction to the final valuation within the fund..

The FT had a latest article that each forms of secondary transactions are booming.

The article speculates that in 2026, the overall quantity of secondary offers may very well be as much as 50% larger:

That is much more outstanding as fundraising for “major” i.e. new funds has declined considerably in 2025. So secondaries are the one shiny spot for PE corporations in the meanwhile.

The massive query is after all: Who’s promoting all these stakes and who’s shopping for it ? The primary query is slightly tough to reply, as these transactions are largely personal.

The second query is way simpler to reply: The Non-public Fairness business is shopping for all these stakes and “repackaging them” as Secondary funds and promoting them once more to institutional buyers, very often to those that had been promoting these major stakes within the first place.

However why would institutional buyers do that ? The reply is surprisingly easy:

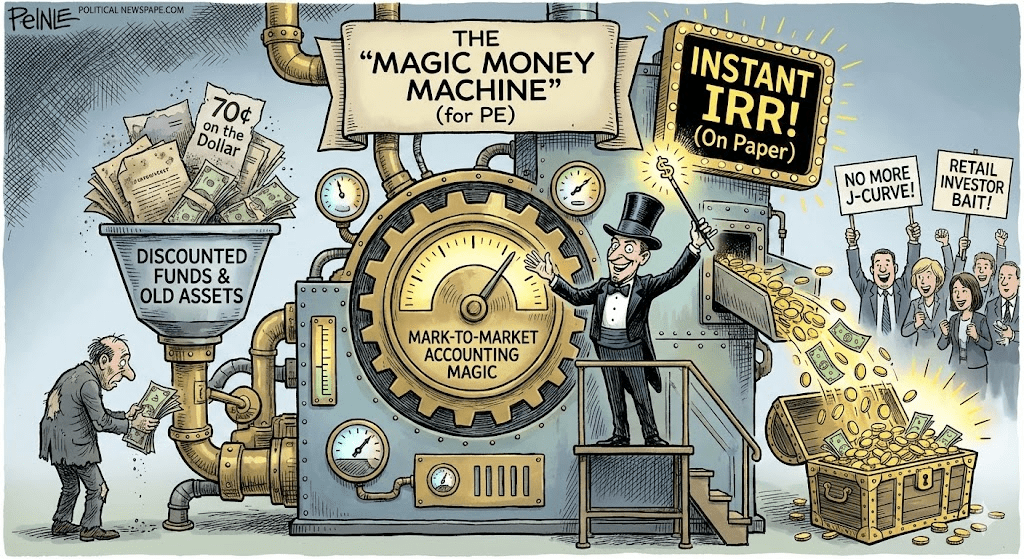

It’s an accounting trick.

I had linked to a Morningstar put up already final yr the place this was properly explaine:

So simply to match this with a listed inventory fund. Italian Holding firm Exor SPA (well-known for its stake in Ferrari) has at present an NAV of round 180 EUR per share however solely a share worth of 70 EUR.

If a portfolio supervisor buys a share of Exor, he would possibly assume that the share is price greater than 70 EUR, however the share will likely be valued at 70 EUR in his portfolio. The precise share worth might want to rise so as to have the ability to present a constructive efficiency.

If he could be a PE man and Exor could be a secondary stake in an unlisted portfolio firm,, he might mark up that share instantly from 70 to 180 EUR and present greater than 150% revenue with out the market worth transferring a cent. This sounds loopy, proper ?

However that is precisely what Non-public Fairness is doing with secondaries:

You purchase the asset as a reduction and (virtually all the time) on day one, you may truly write-up the asset to the NAV acknowledged by the Fund Supervisor and present a so-called “day one revenue”.

The upper the low cost, the higher and the higher the “efficiency” of the Secondary fund.

Apparently, within the present atmosphere, each Non-public Fairness Managers and buyers like it.

The PE managers clearly as a result of they will “recycle” their outdated stuff and in lots of circumstances can earn an extra price layer on prime of the prevailing charges within the underlying funds.

Buyers like it as a result of the efficiency seems so good proper from (and particularly from) the beginning. In conventional PE, you usually have to attend a couple of years till you see important constructive efficiency as a number of the preliminary prices drag down Fund efficiency (J Curve).

So shopping for into these secondary funds seems like an excellent funding choice regardless of the double layer of Non-public Fairness charges that these buyers are sometimes paying.

That is wath Gemini Nano Banana got here up with after I requested it as an example the mechanics and I feel it’s completely good:

However can it final ?

The principle argument and the “story” of the PE business is that these reductions are purely “liquidity reductions”, i.e. the sacrifice that “pressured sellers” of those stakes must endure and subsequently presents kind of a “free lunch” for patrons.

Alternatively, it’s no secret that many market individuals assume that acknowledged NAVs and valuations of most PE funds are usually not sensible.

I’ve personally witnessed a scenario the place the valuation of a PE fund dropped from 130% of invested capital to 60% (i.e. -50%) in 9 months as a consequence of “structural adjustments” on the PE agency.

Personally, I do assume that “true” liquidity reductions solely symbolize a small minority of the offers and {that a} a lot bigger share of these reductions are extra sensible assumptions on the precise values of PE funds and their constituents.

Most of the sellers are slightly refined addresses that won’t promote a extremely good fund at a big low cost.

Possibly a giant rebound for “Worth” and “Outdated Economic system” shares will slender the over-valuations. Alternatively, the present carnage in Saas shares creates new issues for funds uncovered to that sector (Thomas Bravo for example) which was one of many few shiny spots.

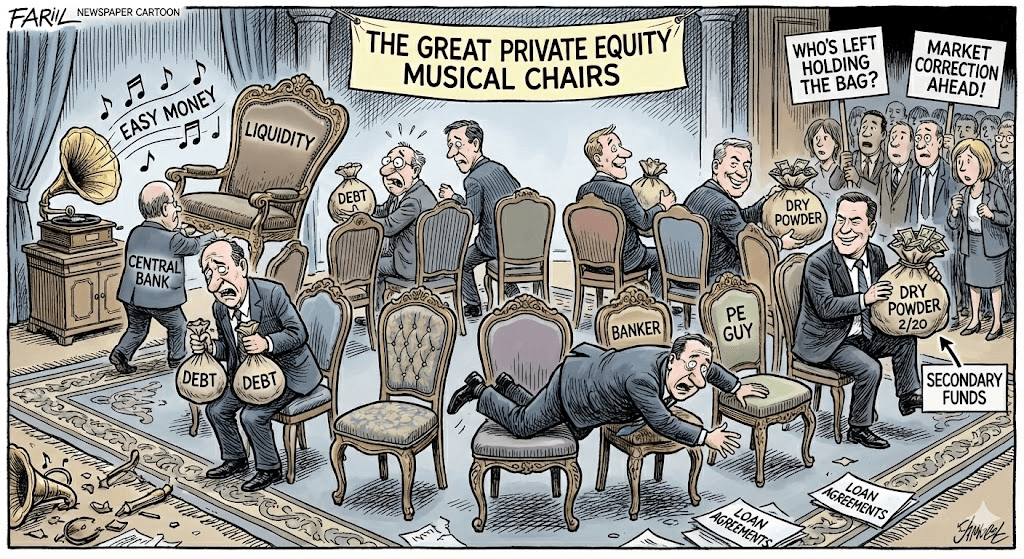

In any case, the “Day one sport” solely works so long as “recent cash” is coming right into a product. As soon as the recent cash stops, there are not any new “day one beneficial properties”.

What’s the take away for personal buyers ?

As these secondary transactions are additionally fairly standard to juice up returns within the quick run for retail PE buildings (ELTIFS and many others.), that is another reason to steer clear of these price laden, intransparent buildings.

That is for example from the July report of the EQT ELTIF (offered by Commerce republic):

Boosting the “efficiency” simply by shopping for a brand new asset is a good factor to have in case you are a Non-public Fairness retail fund.

And naturally, some “good” persons are attempting to play this sport in public markets, too. Swiss liste firm Matador for example does precisely the identical. Shopping for secondary stakes at a reduction after which marking them up immediately.

In case you are an institutional investor, you need to verify if the fund prospectus incorporates data on what proportion of the efficiency is generated by means of “someday beneficial properties” and what’s generated by means of precise efficiency.

Particularly these secondary funds that comprise essentially the most overvalued PE funds would possibly see a really “impolite awakening” within the coming months/quarters when these NAVs is perhaps revised downwards and people “day one beneficial properties” disappear.

Till then, the music remains to be taking part in…..once more illustrated properly by Nano Banana:

Bonus Track: Let the music play – Barry White

Barry White – Let The Music Play (Official Music Video)