Picture supply: Getty Photos

Scottish Mortgage Funding Belief (LSE: SMT) prides itself on discovering the following big-winner development inventory. However this method comes with a good quantity of volatility.

For proof, take a look at the Scottish Mortgage share worth, which has risen 41% over the previous 18 months however nonetheless stays 37% decrease than its 2021 peak.

When the S&P 500 and Nasdaq are each surging to new heights on an virtually day by day foundation, that’s been a bit irritating for a lot of shareholders (myself included).

Granular knowledge

Maybe that’s why there’s been a noticeable effort from the managers to extend engagement with shareholders. Extra interviews, webinars, updates, insights, that kind of factor.

There was even an October lunch interview with lead supervisor Tom Slater in The Instances, the place we discovered that he likes aubergine involtini and makes use of a sensible mattress to trace his sleep.

Lately, Scottish Mortgage additionally launched a quarterly knowledge pack, which gave shareholders an under-the-bonnet peak on the portfolio returns. There was some fascinating information in there, I feel, that proves the facility of long-term investing.

A FTSE flop

Simply 3% of the belief’s property are at present in UK shares. Considered one of them is Ocado (LSE: OCDO), the web grocery/robotics firm.

In keeping with the Q3 knowledge pack, the belief’s funding in it had fallen by 83.6% within the 5 years to 30 September. Ouch.

With the advantage of hindsight, we are able to see that investing in Ocado in 2020 in the course of the peak of the pandemic-driven on-line grocery growth was folly. It’s been downhill ever since, with post-Covid circumstances normalising, together with Ocado’s development charges.

The agency has even been demoted from the blue-chip FTSE 100 after its spectacular fall. The issue comes all the way down to earnings, or lack of them. In H1 2024, it reported a pre-tax lack of £154m.

I had a short encounter with the inventory a 12 months in the past, opening a small place then working for the hills when the CFO mentioned it could be as much as one other “six years” (!) earlier than the agency anticipated to make a pre-tax revenue.

One danger right here is that Ocado must faucet shareholders for extra money in some unspecified time in the future. In spite of everything, the high-tech robotic warehouses it builds in partnership with main international grocers aren’t low cost.

That mentioned, Ocado’s been the UK’s fastest-growing grocer in current months, whereas its robotics enterprise nonetheless has thrilling potential. Nonetheless, I gained’t make investments, preferring as a substitute to realize publicity by means of Scottish Mortgage’s stake (what’s left of it).

Asymmetry in motion

For each handful of Ocados that drop 80%+, the belief has hit the jackpot with an enormous winner.

We noticed this within the knowledge pack, which confirmed that its stakes in Nvidia and Tesla had returned 2,475% and 1,415%, respectively, over 5 years. Good.

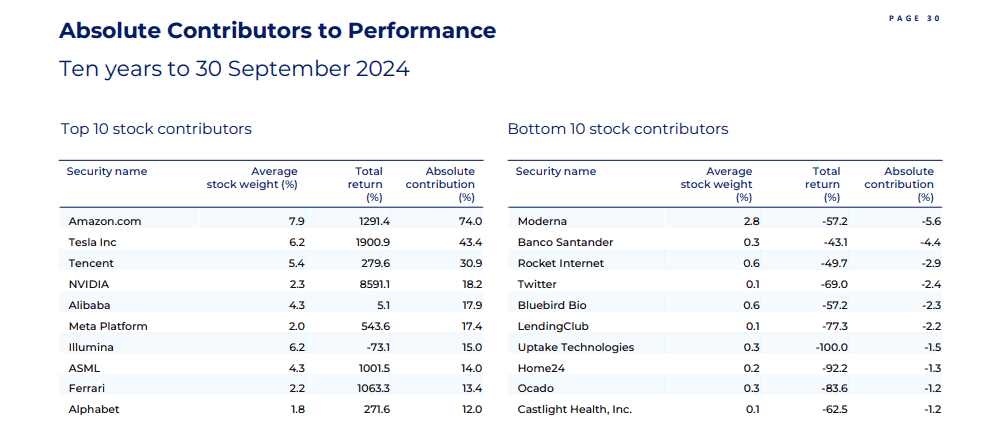

Throughout 10 years, the uneven returns have been much more pronounced. The belief was sitting on 5 ’10-baggers’ (10x returns). These have been Nvidia (really an 85-bagger!), Tesla, Amazon, ASML, and Ferrari.

It’s these outliers which have helped Scottish Mortgage ship a 347% return over the previous decade, thrashing the 211% produced by the FTSE All-World index.

The chance is that the managers fail to determine the following technology of huge inventory market winners. However trying the portfolio at this time, I’m optimistic that they’re in there someplace, able to drive extra features.