Navigating the finances approval course of in nonprofit organizations can typically really feel like a maze stuffed with irritating useless ends. You realize your finances is the map to achieve your group’s objectives, however the labyrinth-like challenges—like countless evaluate cycles and unclear decision-making authority—can derail monetary plans and decelerate mission-driven actions.

To streamline this important course of, it’s important to establish frequent blockages, enhance communication throughout departments, and simplify workflows. By addressing these ache factors within the nonprofit finances approval course of, you possibly can be sure that monetary choices are made rapidly, transparently, and in alignment with organizational objectives.

The Ache of a Convoluted Nonprofit Finances Approval Course of

Have you ever ever felt the frustration of navigating an unnecessarily advanced or poorly understood finances approval system? Who approves what? Why did somebody change the finances when everybody thought it was finalized?

These frequent points can create important bottlenecks and inefficiencies to your group.

- A number of Approvers: Having too many individuals concerned within the approval course of can result in confusion and delays. It’s usually unclear who has the ultimate say, and choices can get caught in a loop of countless critiques.

- Lack of Transparency: Adjustments to the finances can occur with out correct communication, leaving staff members at the hours of darkness. This lack of transparency can result in frustration and distrust amongst employees.

- Inconsistent Updates: When updates to the finances usually are not persistently communicated and documented, your staff could inadvertently use outdated info for decision-making. Ensuing errors can create a misalignment in your long-term and short-term monetary planning.

- Guide Processes: Counting on guide processes for finances approval will be time-consuming and susceptible to errors. It could actually additionally result in burnout amongst finance professionals who’re consistently chasing approvals and updates as an alternative of engaged on strategic initiatives.

By simplifying and streamlining the finances approval course of, you possibly can be sure that your last finances is aligned along with your objectives, scale back the chance of overspending, and enhance total monetary administration.

Widespread Points to Keep away from in Your Finances Approval Course of

Listed here are six frequent errors nonprofits make when designing and implementing their finances approval course of.

- No Documented Finances Approval Course of: When there isn’t documentation, folks depend on outdated info or make up their very own course of. Conduct an intensive evaluate of your present finances approval course of to establish and tackle frequent delays. What number of instances are folks reviewing updates? Speak with folks at numerous phases of the finances course of to grasp the place the frustrations are. Your approval course of must be documented as a part of your bigger finances course of documentation.

- Inconsistent (or Non-Existent) Communication: Begin with a kick-off assembly so everybody concerned understands the objectives, timelines, and documented course of to your finances creation. Being clear about approval expectations on the entrance can velocity up the method. Arrange common check-ins and, if doable, use collaborative challenge administration instruments so everybody can see progress.

- Not Utilizing Expertise: So many nonprofit monetary groups depend on spreadsheets for his or her budgeting course of. It’s an excellent place to start out, nevertheless it’s obscure what’s last and what’s modified. Put money into a fund accounting system with finances administration capabilities, akin to automated workflows, real-time monitoring, and centralized documentation administration. The aim is to work smarter, not more durable!

- Lack of Coaching for New Workers: Present coaching for brand spanking new employees and stakeholders on the finances approval course of and instruments. Get everybody began on the precise foot and supply coaching for others who would possibly want a refresher.

- Unclear Deadlines: Set up clear deadlines for every stage of the finances approval course of. Use your challenge administration instruments to set reminders. Your challenge administration instrument also can make it clear what’s hinging on a late approval—if the group backyard program hasn’t finalized their a part of the finances, the bigger program staff doesn’t know what they want, and the advertising staff wants this system finances to grasp what number of appeals to plan on sending.

- Merely Checking the Field: Your course of might want to regulate based mostly in your staff, your organizational priorities, and what’s taking place within the bigger world. Constantly monitor the finances approval course of and collect suggestions from employees and stakeholders on easy methods to make it higher going ahead. Be sure employees aren’t simply checking the field however are actively engaged and conscious all through the method.

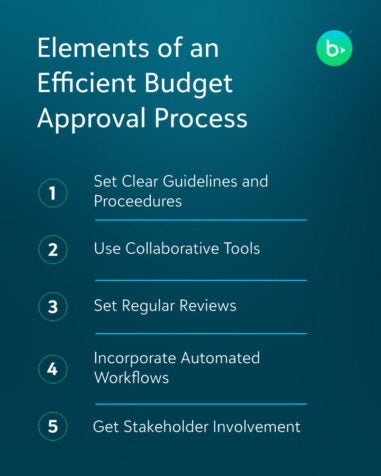

Key Parts of an Environment friendly Finances Approval Course of

The finances approval course of is the spine of your nonprofit’s monetary administration, making certain that each greenback is accounted for and aligned along with your group’s objectives. The individuals who want a say within the finances have reviewed and signed off on the ultimate doc. When performed proper, your finances approval course of units clear monetary boundaries, promotes transparency, and fosters accountability amongst staff members.

Listed here are 5 methods to create an environment friendly finances approval course of.

1. Set Clear Pointers and Procedures

Establishing clear tips and procedures for finances approval helps streamline the method. This implies documented expectations that staff members can entry and seek advice from all through the finances course of. These tips be sure that employees perceive their roles and obligations. Present coaching annually to evaluate finest practices, spotlight frequent points, and tackle performance updates in your fund accounting system.

2. Use Collaborative Instruments

Use collaborative instruments and software program to facilitate communication and doc sharing amongst staff members. This may help scale back delays and guarantee everyone seems to be on the identical web page. Spreadsheets are an inevitable a part of a budgeting course of, however use templates each time doable and ensure you add your finalized finances into your fund accounting system so everybody can see the end result—and any modifications after the finances has been finalized are clearly tracked.

3. Set Common Opinions and Updates

Schedule common critiques and updates to the finances to deal with any modifications in monetary circumstances or organizational priorities. This proactive method helps your staff make well timed changes and keep away from last-minute surprises.

4. Incorporate Automated Workflows

Implement automated workflows to deal with routine duties akin to information entry, approvals, and notifications. Automation can considerably scale back the effort and time required for finances approval, so your staff can deal with strategic actions. Perceive what choices you could have inside your fund accounting system to automate your finances and monetary reporting processes.

5. Get Stakeholder Involvement

Be sure to contain key stakeholders at applicable factors within the finances approval course of to make sure their enter and buy-in. You don’t need to get to the ultimate approval and have the board query the necessity to your new fund accounting system. This collaborative method results in extra knowledgeable choices and better assist for the ultimate finances.

Construct Confidence with a Streamlined Finances Approval Course of

A streamlined finances approval course of ensures better transparency and accelerates decision-making. When monetary choices are made rapidly and clearly, you allotted your sources effectively, which helps your mission’s success. Everybody can see precisely the place funds are directed and perceive the reasoning behind monetary decisions. This open method not solely builds confidence but in addition encourages additional assist and engagement.

Prepared for a system that simplifies your budgeting course of? Try the webinar, 10 Methods Blackbaud Makes Budgeting Straightforward.