I not often share any market commentary, as I largely imagine that ready round and doing nothing is the perfect plan of action. Nonetheless, I even have about 89 browser tabs open, and writing helps me set up my pondering, so listed here are some ideas.

Current AI information appears to have kicked off each much more AI optimism and AI skepticism. Right here’s a Bloomberg article (paywall) outlining among the round offers:

Matt Levine has the funniest parody of this example with tech CEOs whispering “omniscient robots” to one another after which saying “yesssssss”. From right here on out, that is what I’ll visualize when a brand new deal is introduced.

The financing software is, you go to Broadcom and you place your arm round their shoulder and also you gesture sweepingly within the distance and whisper “omniscient robots” and so they whisper “yesssss” and also you say “we’ll want a couple of hundred billions {dollars} of chips and tools from you” and so they say “after all” and also you say “good” and so they say “do you will have lots of of billions of {dollars}” and also you whisper “omniscient robots” once more and they’re enlightened. And then you definitely announce the deal and Broadcom’s inventory provides $150 billion of market capitalization and also you’re like “see” and so they’re like “sure” and also you’re like “omniscient robots” and so they’re like “I do know proper.” That’s the financing software!

I imply, if OpenAI desires to purchase $500 billion of NVDA chips, however doesn’t even have $500 billion, however as an alternative indicators a promise that it will purchase $500 billion of chips, after which NVDA goes up by $500 billion in market cap in response, and now agrees to both make investments or lend $500B to OpenAI… is that pioneering genius? Or is it a bubble?

In fact, I do not know. Heck, all of the issues that occurred yesterday are an enormous shock to me. How may I presumably predict the long run?

I do know that if I bought each time I noticed a chart warning me about excessive P/E ratios, I’d have been in money for greater than a decade and my portfolio could be a lot, a lot smaller. As an alternative, let’s have a look at some up to date relative valuations to higher measure the “loopy”. One factor is the earnings yield, which is the inverse of the worth/incomes ratio. So if the incomes yield is 5%, then if the worth is $100 then it studies $5 a 12 months in earnings. When you personal the S&P 500, it may be cheap to imagine that over the long-term, your earnings will develop a minimum of with inflation.

Listed here are the historic earnings of the S&P 500 on a log scale, displaying how they the truth is have a tendency to extend sooner than inflation over the long term. (Supply: Yardeni)

Then we even have TIPS, which provide a assured actual yield above inflation. As an alternative of conventional Treasury bonds, you could possibly use this TIPS actual yield as a base “risk-free fee”.

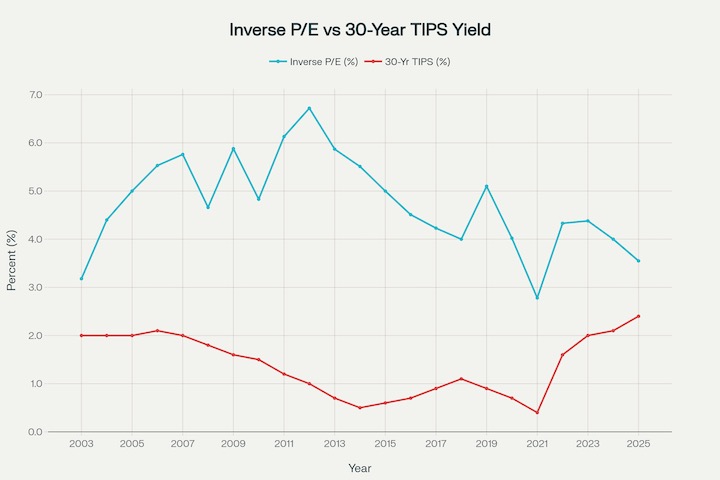

Here’s a chart that compares the historic S&P 500 earnings yield and the TIPS actual yield. Sources: FRED and Multpl. As you may see, the hole between the 2 continues to be constructive, but it surely’s undoubtedly shrinking and near the narrowest it’s been over the last 15 years (proper now about 1%).

The issue is that making an attempt to time these things is just not a good suggestion. It’s one of many these enduring classes about investing. I can’t predict the highest. I can’t predict the underside.

One key characteristic of bubbles is seeing another person get wealthy doing one thing silly/dangerous, not having the ability to deal with it, after which deciding you need to play alongside too. There may be undoubtedly loads of the “getting wealthy doing one thing dangerous” happening. However then once more, there are additionally lots of people who went to zero however are quiet about it. All the cash that went into the GraniteShares 3x Quick AMD ETP… already went to zero.

On the similar time, one other one of the necessary classes of constructing wealth is that you could at all times keep away from “blowing up”. When you multiply by zero, it doesn’t matter what your historic returns are. By no means cease the compounding. Take into account the situation of (1) the shares in your portfolio happening by 50%, (2) dropping your job for six months, and (3) different individuals panicking. These three issues are likely to occur on the similar time.

As Howard Marks stated in 2001 in one of many memos that made him well-known: “You Can’t Predict. You Can Put together.” Supply: Humble Greenback. Now is an efficient time to test if you’re ready by checking the chance ranges of your portfolio, your money reserves, your job stability, and all the different psychological intangibles.

I prefer to assume that I’m ready. Portfolio-wise, I proceed to purchase, maintain, and rebalance. Shopping for with ongoing IRA/401k contributions. Holding and never promoting something. Rebalancing by investing all incoming funds and dividends into Treasury bonds as a result of I’m obese in US and worldwide shares. I’m maintaining a tally of the money cushion and planning for big bills – we did some house repairs not too long ago and possibly have extra on the horizon. I don’t require a lot liquidity within the close to future, and I don’t personal any non-public belongings with potential liquidity considerations.