The overall quantity of excellent acquisition, improvement, and development (AD&C) loans made by FDIC-insured establishments fell for the third consecutive quarter through the third quarter of 2024 to a quantity of $490.7 billion, down from $495.8 billion within the second quarter. Rates of interest remained increased over the third quarter, because the Fed issued its first fee reduce on the finish of the quarter in September. Future AD&C lending circumstances are poised to enhance because the Fed continues its easing cycle over the subsequent 12 months regardless of potential headwinds of upper Authorities deficits and financial uncertainty.

The amount of 1-4 household residential development and land improvement loans totaled $90.8 billion within the third quarter, down 8.4% from one 12 months in the past. This year-over-year decline marked the fifth straight quarter the place the full quantity of excellent loans declined in comparison with a 12 months prior. All different actual property improvement loans totaled $399.9 billion within the third quarter, down $4.3 billion from the earlier quarter.

It’s value noting, the FDIC information symbolize solely the inventory of loans, not adjustments within the underlying flows, so it’s an imperfect information supply. Lending stays a lot decreased from years previous. The present quantity of current 1-4 household residential AD&C loans now stands 55% decrease than the height stage of residential development lending of $204 billion reached through the first quarter of 2008. Different sources of financing, together with fairness companions, have supplemented this capital market in recent times.

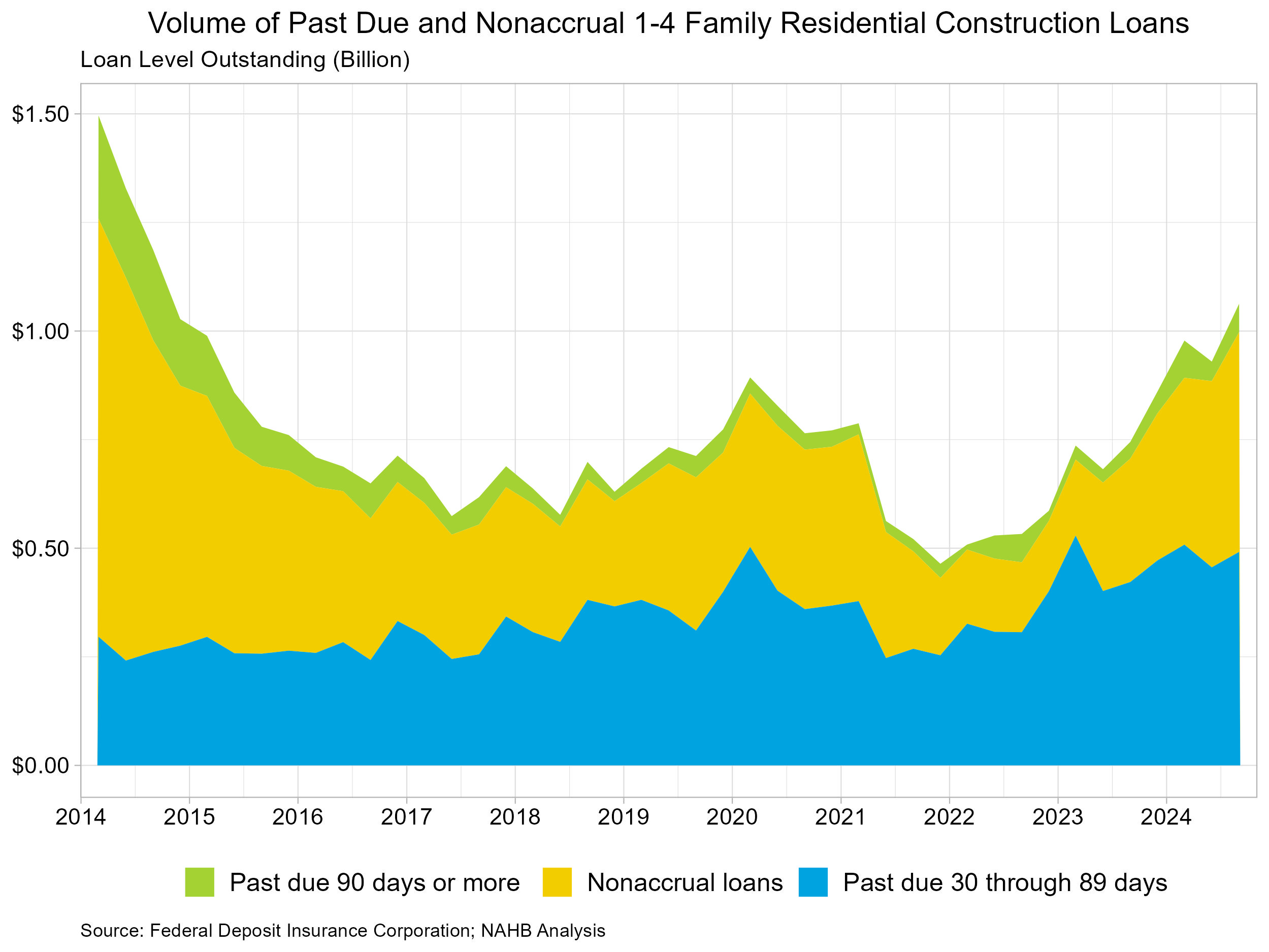

Whereas the quantity of 1-4 household residential AD&C loans fell through the third quarter, the quantity of overdue and nonaccrual residential AD&C loans rose above $1 billion for the primary time since 2014. A majority of this excellent complete was made up of loans in nonaccrual standing (sometimes a mortgage the place the lender doesn’t count on to obtain cost) which totaled $505.9 million. The excellent mortgage steadiness for these 30-89 days overdue was $491.5 million and loans 90 days or extra overdue totaled $65.4 million. As a share of the full excellent inventory of 1-4 household residential AD&C loans ($90.8 billion), overdue and nonaccrual loans ($1.0 billion) made up 1.2% of the excellent inventory of loans.

Uncover extra from Eye On Housing

Subscribe to get the most recent posts despatched to your electronic mail.