While you personal a small enterprise, it’s necessary to have additional money available to make use of for investing or paying your liabilities. However with cash continually coming in and going out, it may be troublesome to watch how a lot is leftover. Use a retained earnings formulation to trace how a lot your online business has amassed.

Realizing the quantity of retained earnings your online business has may help with making choices and acquiring financing. On this article, we are going to outline retained earnings, clarify the way to calculate them, present retained earnings examples, and clarify the way to report it.

What are retained earnings?

Retained earnings are enterprise earnings that can be utilized for investing or paying down enterprise money owed. They’re cumulative earnings that symbolize what’s leftover after you may have paid bills and dividends to your online business’s shareholders or house owners. Retained earnings are also called retained capital or amassed earnings.

You have to report retained earnings on the finish of every accounting interval. Frequent accounting durations embrace month-to-month, quarterly, and yearly. You may examine your organization’s retained earnings from one accounting interval to a different.

Methods to calculate retained earnings

So, what goes into retained earnings? To calculate retained earnings, you should know your online business’s earlier retained earnings, web earnings, and dividends paid.

You’ll find your online business’s earlier retained earnings in your enterprise steadiness sheet or assertion of retained earnings. Your organization’s web earnings may be discovered in your earnings assertion or revenue and loss assertion. When you’ve got shareholders, dividends paid is the quantity that you just pay them.

Retained earnings formulation

Use the next retained revenue formulation to find out your organization’s retained earnings for an accounting interval:

Retained Earnings = Starting Retained Earnings + Web Earnings – Dividends Paid

If you’re a brand new enterprise and should not have earlier retained earnings, you’ll enter $0. And in case your earlier retained earnings are detrimental, ensure to accurately label it.

Can retained earnings be detrimental? When you’ve got a web loss and low or detrimental starting retained earnings, you’ll be able to have detrimental retained earnings.

Alternatively, if in case you have web earnings and an excellent quantity of amassed retained earnings, you’ll in all probability have constructive retained earnings.

Retained earnings examples

Let’s say that you’ve starting retained earnings of $25,000. For this accounting interval, you had a web earnings of $30,000. And, you paid dividends of $20,000.

Retained Earnings = $25,000 + $30,000 – $20,000

Retained Earnings = $35,000

You could have a constructive retained earnings account of $35,000.

Now, let’s have a look at a detrimental retained earnings instance. You could have starting retained earnings of $4,000 and a web lack of $12,000. You didn’t pay dividends.

Retained Earnings = $4,000 – $12,000 – $0

Retained Earnings = -8,000

You could have a deficit of $8,000 at your online business. As a result of retained earnings are cumulative, you will have to make use of -$8,000 as your starting retained earnings for the subsequent accounting interval. You’ll need a excessive web earnings to get out of the outlet.

Retained earnings accounting

You have to regulate your retained earnings account everytime you create a journal entry that raises or lowers a income or expense account.

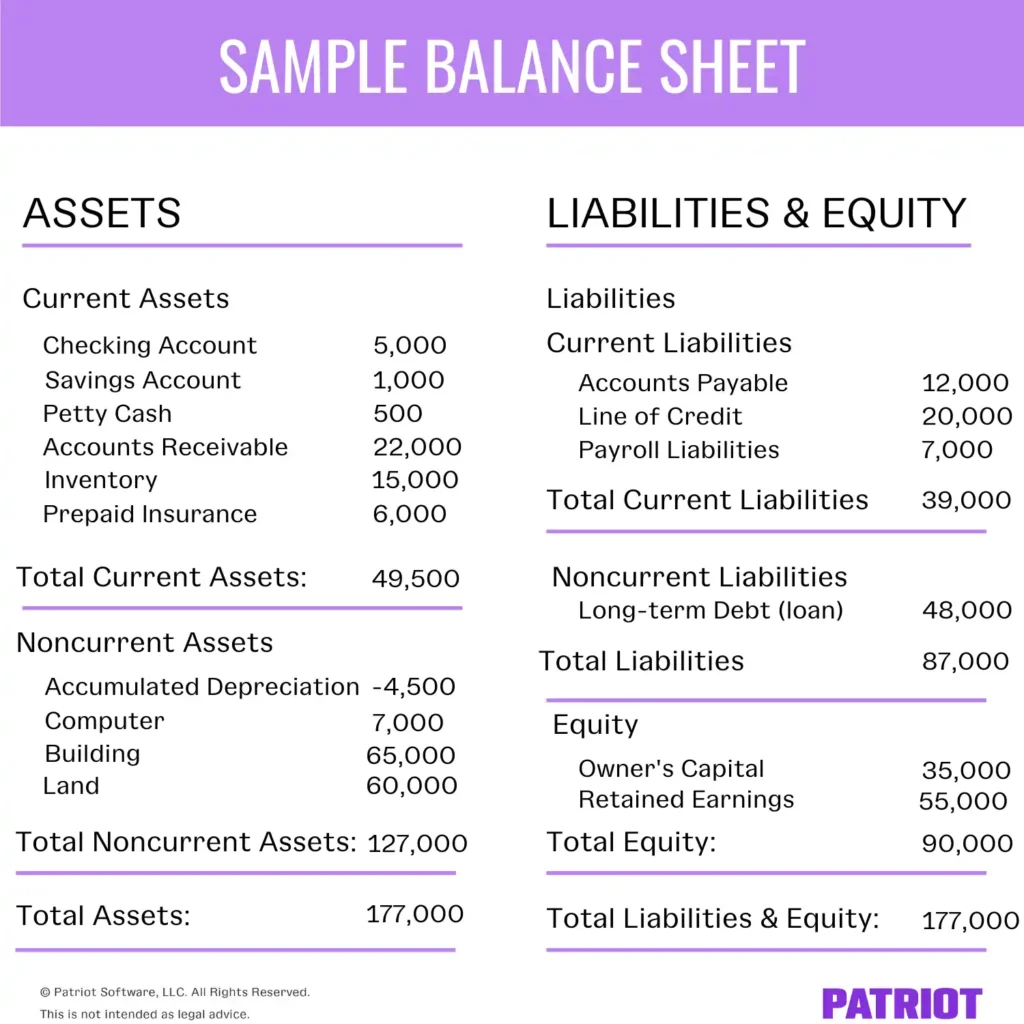

Are retained earnings an asset? Retained earnings are literally reported within the fairness part of the steadiness sheet. Though you’ll be able to make investments retained earnings into belongings, they themselves aren’t belongings.

Retained earnings must be recorded. Usually, you’ll report them in your steadiness sheet beneath the fairness part. However, you too can report retained earnings on a separate monetary assertion generally known as the assertion of retained earnings.

The steadiness sheet is break up into three components: belongings, liabilities, and proprietor’s fairness. The belongings part reveals you the objects of worth that your online business owns. The liabilities part reveals you what you owe. And, the fairness part reveals you the cash you may have left over after paying money owed.

On the steadiness sheet, retained earnings seem beneath the “Fairness” part. “Retained Earnings” seems as a line merchandise that can assist you decide your whole enterprise fairness.

The assertion of retained earnings is a monetary assertion fully dedicated to calculating your retained earnings. Just like the retained earnings formulation, the assertion of retained earnings lists starting retained earnings, web earnings or loss, dividends paid, and the ultimate retained earnings.

Understanding the retained earnings formulation is essential for monitoring your online business’s monetary well being and making knowledgeable choices. By calculating and monitoring retained earnings, you’ll be able to decide how a lot revenue is reinvested into your organization or used to pay down liabilities. Whether or not you’re analyzing retained earnings examples to grasp the idea higher or studying the way to outline retained earnings within the context of your steadiness sheet, this information empowers you to handle your online business funds extra successfully.

How do you calculate retained earnings on a steadiness sheet?

The retained earnings line is listed beneath the “Fairness” part on a steadiness sheet. You may calculate retained earnings by utilizing the retained earnings formulation:

Retained Earnings = Starting Retained Earnings + Web Earnings – Dividends Paid

What’s included in retained earnings?

Retained earnings contains your organization’s whole web earnings, much less any dividends paid to shareholders.

Is retained earnings the identical as web revenue?

Retained earnings aren’t the identical as web revenue. Retained earnings account for dividend funds to shareholders. Additionally, retained earnings are cumulative, whereas web revenue is your organization’s revenue throughout a time interval.

Able to simplify your accounting? Patriot’s small enterprise accounting software program may help you precisely monitor earnings, bills, and retained earnings.

This text has been up to date from its unique publication date of July 28, 2015.

This isn’t supposed as authorized recommendation; for extra data, please click on right here.