U.S. family debt balances grew by $147 billion (0.8 %) over the third quarter, in accordance with the newest Quarterly Report on Family Debt and Credit score from the New York Fed’s Middle for Microeconomic Information. Balances on all mortgage merchandise recorded reasonable will increase, led by mortgages (up $75 billion), bank cards (up $24 billion), and auto loans (up $18 billion). In the meantime, delinquency charges have additionally risen over the previous two years, returning to roughly pre-pandemic ranges (and exceeding them within the case of bank cards and auto loans), although there are some indicators of stabilization this quarter. Are rising combination debt burdens sustainable? Or is that this enlargement to be anticipated given will increase in combination earnings and inhabitants dimension? On this publish, we check out debt balances scaled by earnings, monitoring the evolution of this ratio over the previous twenty-five years.

Be aware: The Quarterly Report and this evaluation are based mostly on the New York Fed Client Credit score Panel (CCP), drawn from Equifax credit score experiences.

How Excessive Are Debt Balances?

Since we have an interest within the sustainability and affordability of family debt within the total economic system, we select right here to look at the ratio of debt balances to disposable private earnings (DPI), outlined as combination nominal annual earnings obtainable for spending after taxes; we categorical our ratio as proportion phrases. (Our measure makes use of the extent of debt fairly than the price of servicing debt. The Federal Reserve Board produces knowledge on debt service prices as a share of private earnings.)

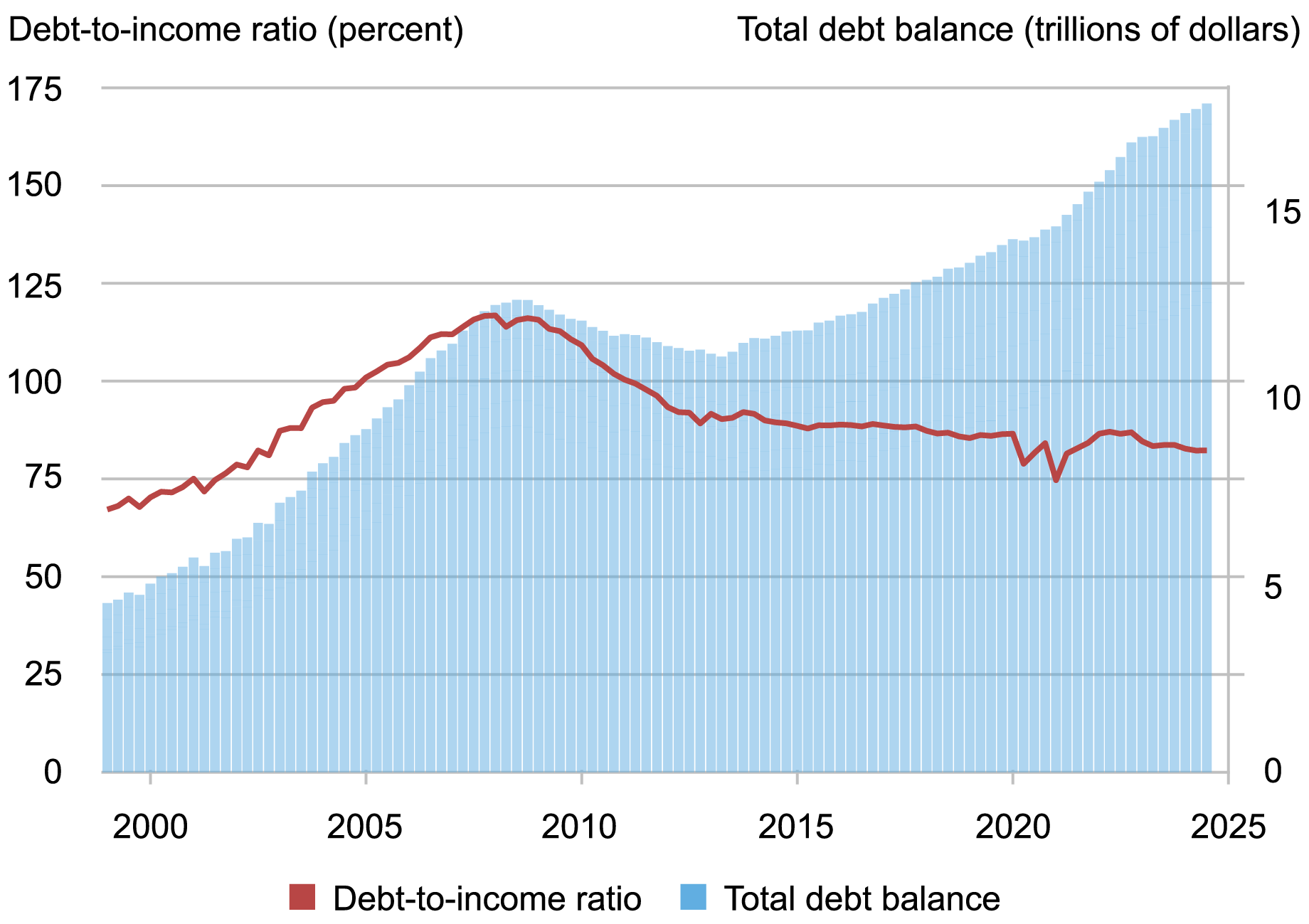

The combination debt steadiness has continued to climb for the reason that pandemic, reaching $17.94 trillion within the third quarter of 2024. Nevertheless, throughout this identical time, Individuals’ disposable private earnings has grown as effectively, reaching a price of $21.80 trillion. Now, the ratio of complete debt steadiness to earnings is 82 %, slightly below the pre-pandemic stage of 86 % in 2019. Relative to earnings, balances are literally decrease than they have been earlier than the pandemic.

The Combination Debt-to-Revenue Ratio Is Beneath Pre-Pandemic Ranges Regardless of All-Time Highs in Nominal Client Debt

Sources: New York Fed Client Credit score Panel / Equifax; Bureau of Financial Evaluation.

Now we have a look at the evolution of the debt-to-income ratio over the enterprise cycle. In the course of the interval main as much as the World Monetary Disaster (GFC), Individuals borrowed closely, and debt balances swelled by a mean of almost 13 % yearly between 2002 and the top of 2007 (the beginning of the GFC). In the meantime, throughout this time, earnings expanded by solely about 5 % yearly—a stable annual progress charge, however not almost sufficient to maintain up with family borrowing. As the expansion in debt balances sharply outpaced the expansion in earnings, the debt-to-income ratio rose quickly, hitting an unprecedented stage of almost 120 % in 2008.

In the course of the recession and the years that adopted, American debtors deleveraged, lowering their debt balances considerably sooner than their incomes, due each to paydowns of present money owed, decreased borrowing, and charge-offs stemming from foreclosures and bankruptcies. By 2014, the interval of deleveraging had concluded. Each earnings and debt balances grew at an identical, reasonable tempo, leaving the ratio secure till the risky pandemic period.

Extra not too long ago, earnings progress has averaged a strong 6.2 % yearly, whereas combination debt balances have expanded at simply over 4 % per 12 months. This distinction has induced some downward motion within the debt-to-income ratio over the past two years. (Be aware that the debt-to-income measure all of a sudden decreases in two intervals throughout the pandemic, 2020:Q2 and 2021:Q1. These falls have been attributable to the sudden will increase in earnings as a result of stimulus checks [increase in the denominator] and weren’t attributable to sudden drops within the debt [decrease in the numerator]. The identical applies to all of the charts beneath as effectively.)

How the Composition of Family Debt Drives the Ratio

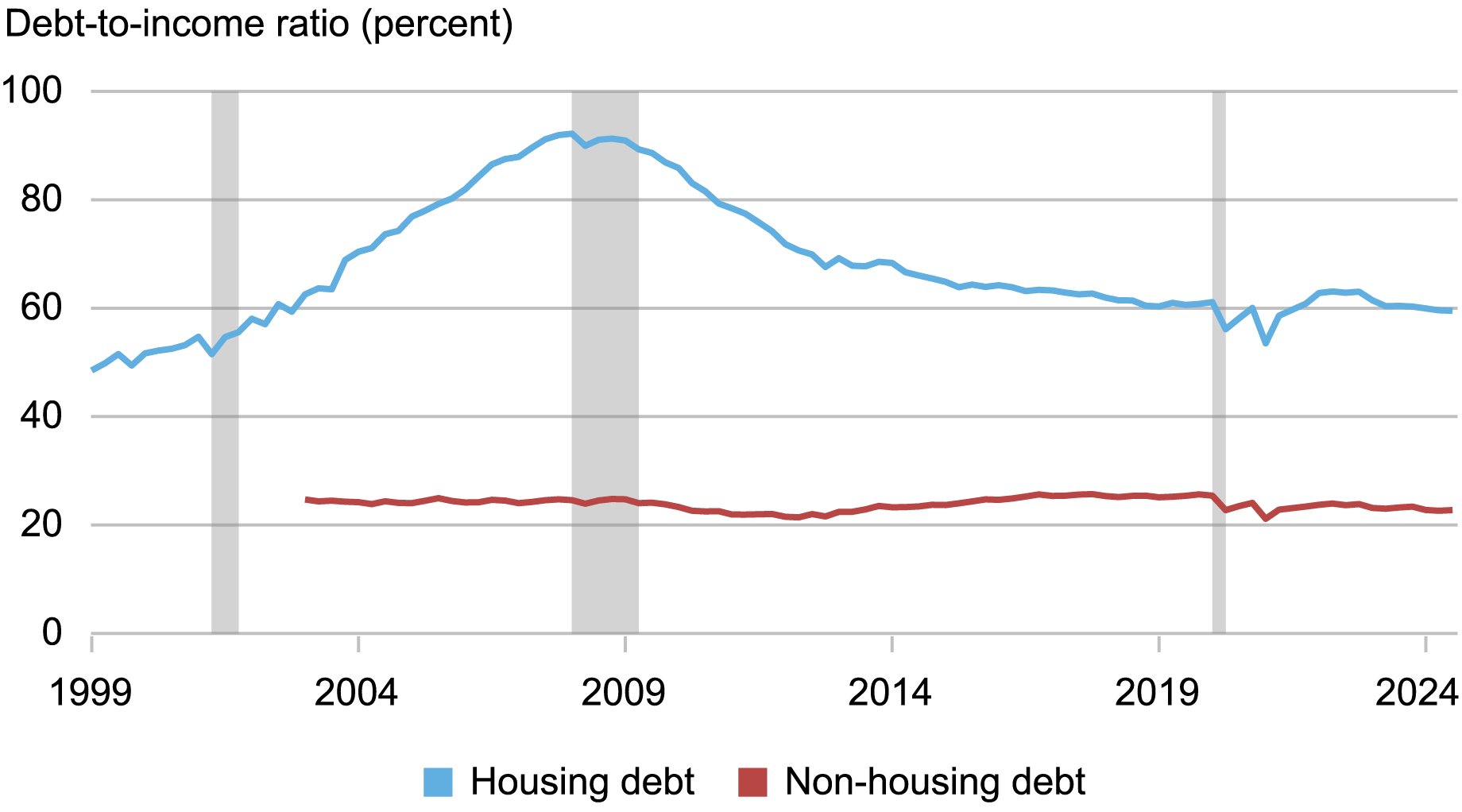

As mortgage balances make up 70 % of complete family balances, this bigger pattern is generally pushed by mortgages. Within the chart beneath, we disaggregate these debt-to-income ratios into housing-related balances (mortgages and residential fairness strains of credit score) and non-housing balances (bank cards, auto loans, pupil loans).

Disaggregating this into totally different debt merchandise reveals totally different dynamics. Mortgages, which dominate family debt balances, noticed a quick rise throughout the run-up to the GFC—and a subsequent decline throughout the recession and ensuing fallout. Non-housing balances make up a smaller share of debt, at round 30 %, and the ratio of non-housing balances to earnings exhibits a lot smaller actions over the enterprise cycle.

These elements even have considerably totally different impacts on family budgets; mortgages are bigger, however are paid over longer phrases—often fifteen or thirty years. Non-housing money owed are inclined to have shorter compensation intervals, so whereas these balances are smaller, they might account for a disproportionately bigger piece of month-to-month family budgets. For instance, assuming a 6 % rate of interest, a $50,000 auto mortgage with a four-year time period would have almost the identical cost as a $200,000 mortgage with a thirty-year time period—each being just below $1,200 monthly. These variations in cost burdens are seen within the Federal Reserve Board’s Debt Service Ratios: debt service funds on client money owed and mortgage balances every account for almost the identical share of earnings—just below 6 %.

Revenue Progress Outpacing Progress in Mortgage Debt

Sources: New York Fed Client Credit score Panel / Equifax; Bureau of Financial Evaluation.

Be aware: Non-housing knowledge sequence begins in 2003 as a result of unavailability of pupil mortgage knowledge previous to 2003.

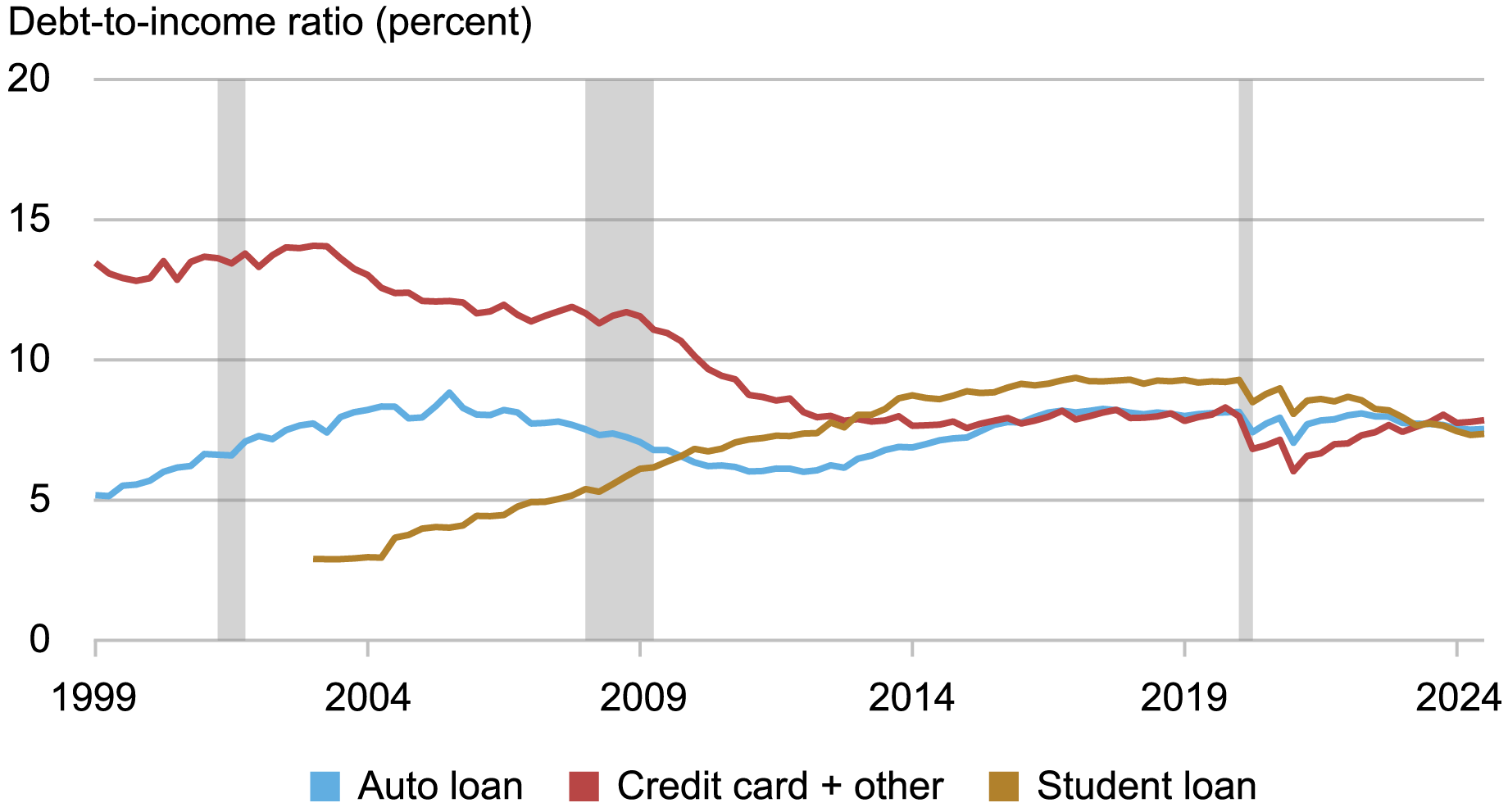

Whereas secure total, there have been broader actions inside the elements of non-housing debt. The next chart splits non-housing debt into pupil loans, auto loans, and bank cards. We embody “different” balances with bank card right here, because the elements—which embody retail playing cards and miscellaneous client loans—are usually consumption-related. Every of those classes has excellent balances which can be fairly comparable, inflicting these ratios to converge close to 8 % in latest quarters. Scholar loans have been a comparatively small share within the early a part of the sequence however grew steadily; bank card balances declined in share for a lot of the previous twenty-five years, whereas auto mortgage balances have been in tighter ranges and have co-moved with the enterprise cycle. Current actions within the debt-to-income ratio for bank card balances have been according to pandemic-era macro circumstances, with stimulus-fueled extra financial savings driving a lower in bank card balances in 2020-21 and the depletion of these financial savings sparking a rebound in bank card balances in 2022-24; the latter contributed to sturdy combination consumption in 2023 regardless of restrictively excessive rates of interest.

Non-Housing Debt-to-Revenue Ratios Converge, from Divergent Histories

Sources: New York Fed Client Credit score Panel / Equifax; Bureau of Financial Evaluation.

Be aware: Scholar mortgage knowledge aren’t obtainable till 2003.

Conclusion

Combination debt-to-income ratios are a helpful rule of thumb to scale family debt at a really macro stage—and as we’ve proven right here, the general ratio has declined for the reason that GFC, reflecting the truth that incomes are increasing sooner than money owed. Nonetheless, these combination measures don’t essentially symbolize what is occurring on the family stage when it comes to borrower earnings, race, and age. Money owed—and incomes—aren’t distributed evenly over the inhabitants. Mortgages are the dominant product in total debt balances, and shifts in underwriting and lending requirements for the reason that GFC have resulted in newly originated mortgages overwhelmingly going to higher-income debtors with greater credit score scores, a gaggle that’s comparatively older. The truth is, measuring the ratio of debt funds to a borrower’s month-to-month earnings is a key a part of underwriting.

In contrast, non-housing balances could have totally different, and extra diverse, impacts on family steadiness sheets. Decrease-income debtors bearing bank card and auto debt look very totally different than higher-income households with bigger mortgages, whereas pupil mortgage debtors are usually youthful and within the early levels of their careers. This divergence of debt-to-income measures based mostly on the kind of family debt and the heterogeneous traits of debtors would possibly make clear the financial conditions confronted by totally different teams of individuals within the U.S., significantly when paired with differential actions in delinquency charges. The latest downward motion within the ratio of debt to earnings has been adopted by an obvious moderating of delinquency charges for auto loans and bank cards throughout the third quarter, and if that pattern continues, it will recommend that rising debt burdens stay manageable. However extra work is required to grasp the evolution of the burden of debt balances throughout the inhabitants. Such an evaluation also needs to consider adjustments on the asset aspect of family steadiness sheets, together with adjustments in labor market earnings and the values of investments, financial savings, and houses.

Andrew F. Haughwout is the director of Family and Public Coverage Analysis within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Donghoon Lee is an financial analysis advisor in Client Habits Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Daniel Mangrum is a analysis economist in Equitable Progress Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Joelle Scally is a regional financial principal within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Wilbert van der Klaauw is the financial analysis advisor for Family and Public Coverage Analysis within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

cite this publish:

Andrew Haughwout, Donghoon Lee, Daniel Mangrum, Joelle Scally, and Wilbert van der Klaauw, “Revenue Progress Outpaces Family Borrowing ,” Federal Reserve Financial institution of New York Liberty Road Economics, November 13, 2024, https://libertystreeteconomics.newyorkfed.org/2024/11/income-growth-outpaces-household-borrowing/.

Disclaimer

The views expressed on this publish are these of the writer(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the writer(s).