Investing isn’t nearly choosing the right inventory; it’s about time available in the market. Berkshire Hathaway, underneath the stewardship of Warren Buffett, has lengthy been a beacon for long-term buyers. However what does a decade of endurance yield in tangible phrases? Let’s delve into the numbers and see how a modest funding has matured through the years.

The Preliminary Funding: $1,000 in 2015

In Might 2015, Berkshire Hathaway’s Class B shares (BRK.B) have been buying and selling at roughly $143.00 per share. With $1,000, you can have bought about 6.99 shares. Whereas fractional shares weren’t as frequent then, for this evaluation, we’ll think about the complete quantity invested. This funding marked the start of a journey with one of the vital famend conglomerates within the monetary world. The corporate’s numerous holdings offered a stable basis for development.

The Progress Over a Decade

Quick ahead to Might 2025, and BRK.B shares are buying and selling at roughly $513.74. These 6.99 shares would now be price about $3,590.97. This represents a achieve of $2,590.97 over the preliminary funding. Such development underscores the potential advantages of long-term investing. It’s a testomony to Berkshire Hathaway’s constant efficiency and strategic acquisitions.

Annualized Return: Breaking Down the Numbers

To know the funding’s efficiency, we calculate the Compound Annual Progress Fee (CAGR). Utilizing the system:

CAGR = (Ending Worth / Starting Worth)^(1 / Variety of Years) – 1

Plugging within the numbers:

CAGR = ($3,590.97 / $1,000)^(1/10) – 1 ≈ 13.6%

This annualized return outpaces many conventional funding automobiles, highlighting the power of Berkshire Hathaway’s enterprise mannequin.

Evaluating to the S&P 500

Over the identical interval, the S&P 500 index has averaged an annual return of about 10%. Whereas the index gives diversification, Berkshire Hathaway’s efficiency showcases the potential of particular person inventory investments. Nevertheless, it’s important to notice that particular person shares include increased volatility. Berkshire’s diversified holdings considerably mitigate this threat, however buyers ought to at all times assess their threat tolerance. Diversification stays a key precept in funding technique.

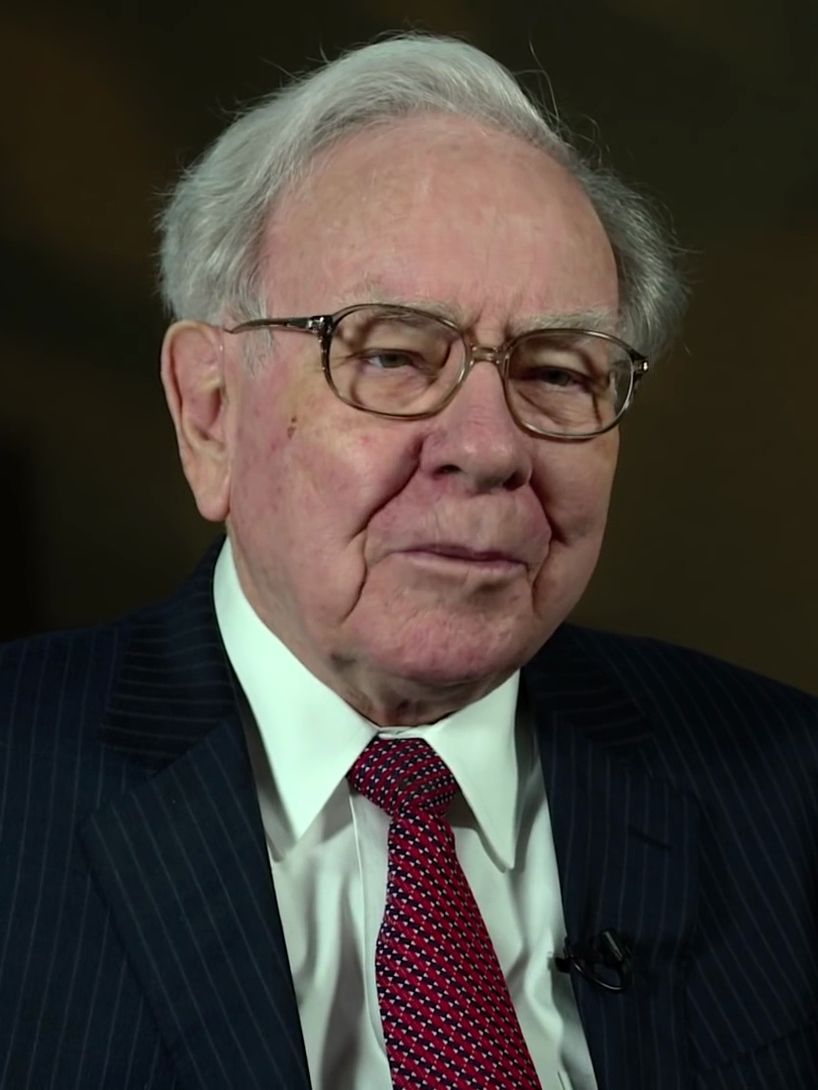

The Buffett Impact: Management and Imaginative and prescient

Warren Buffett’s management has been instrumental in Berkshire Hathaway’s success. His worth investing philosophy and long-term imaginative and prescient have guided the corporate’s acquisitions and development methods. Traders have benefited from his disciplined method and eager eye for undervalued belongings. As succession plans unfold, the corporate’s future management will intention to uphold these ideas. Buffett’s legacy units a excessive commonplace for continued efficiency.

Reinvesting Dividends: A Non-Issue

In contrast to many firms, Berkshire Hathaway doesn’t pay dividends. As an alternative, it reinvests earnings into the enterprise, in search of alternatives for development. This technique aligns with Buffett’s perception in compounding returns. For buyers, this implies relying solely on capital appreciation for returns. The corporate’s monitor report suggests this method has been efficient.

Classes for Traders

The expansion of a $1,000 funding in Berkshire Hathaway over ten years illustrates a number of key funding ideas:

-

Endurance Pays Off: Lengthy-term holding can yield vital returns.

-

High quality Issues: Investing in firms with robust fundamentals is essential.

-

Reinvestment Methods: Corporations that successfully reinvest earnings can provide substantial development.

-

Diversification Inside a Firm: Berkshire’s various holdings present built-in diversification.

These classes can information buyers in constructing resilient portfolios.

Reflecting on the Journey

A decade in the past, a $1,000 funding in Berkshire Hathaway might need appeared modest. In the present day, it’s a testomony to the ability of long-term investing and the influence of strategic management. Whereas previous efficiency doesn’t assure future outcomes, the corporate’s historical past gives helpful insights for buyers. As markets evolve, the ideas demonstrated by Berkshire Hathaway stay related.

Have you ever thought-about long-term investments like Berkshire Hathaway? Share your experiences and ideas within the feedback beneath!

Learn Extra

How To Put together For A Recession: Investing, Spending And Saving Ideas To Defend Your Wealth

6 Investments That Would Have Made You A Millionaire Had You Invested 5 Years In the past