Only a week after Rocket Mortgage exited Canada, father or mother firm Rocket Firms has introduced its intent to amass Redfin.

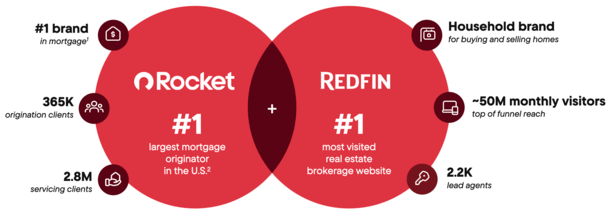

The Seattle, WA-based actual property brokerage is likely one of the largest in america, in addition to essentially the most visited actual property platform on the net.

The acquisition will give one of many nation’s largest mortgage lenders an enormous leg up within the dwelling buy lending world, doubtlessly permitting it to reclaim the highest spot total.

Rocket Mortgage had been the highest mortgage lender for a number of years earlier than being unseated by crosstown rival United Wholesale Mortgage in 2023.

With refinance quantity falling in recent times as mortgage charges surged increased, it’s been clear that to rise to the highest, you should be originating lots of buy loans as properly.

Given Redfin has greater than 2,200 actual property brokers below its umbrella, Rocket may as soon as once more discover its approach again to #1.

Rocket to Purchase Redfin in All-Inventory Transaction

When it comes to the financials, Rocket Firms (NYSE:RKT) has agreed to pay $12.50 per share for Redfin (NASDAQ:RDFN) in an all-stock transaction, which values the corporate round $1.75 billion.

That’s fairly a premium from its prior closing worth final Friday of $5.88. Eventually look, Redfin shares had been buying and selling round $10 this morning, signaling extra upside to return if the deal closes.

The trade ratio is 0.7926 of Rocket Class A standard inventory for every share of Redfin widespread inventory.

Shares of Rocket had been down about 14% this morning on the information to round $13.65, about $2 decrease on the day.

Concerning the timeline, the deal is anticipated to shut within the second or third quarter of 2025, pending shareholder and regulatory approval.

For reference, Redfin shares traded at almost $100 per share again in February 2021, across the time of the pandemic housing and refinance growth, when mortgage charges had been within the sub-3% vary.

However Redfin struggled mightily of late, with shares slipping under $5 per share as mortgage charges surged and residential gross sales collapsed.

Nonetheless, the actual property brokerage was capable of facilitate 61,000 dwelling transactions in 2024 alone by way of its huge community of actual property brokers.

Concerning management, Glenn Kelman will stay as Chief Government Officer of Redfin post-merger.

In a convention name this morning, Rocket Firms CEO Varun Krishna stated, “Our settlement to amass Redfin is an ideal match with our mission to assist everybody dwelling.”

It is going to carry extra shoppers within the Rocket ecosystem, particularly on the prime of the funnel, when potential dwelling consumers first start to view for-sale listings.

A Extra Streamlined Course of That Combines House Shopping for and Mortgage

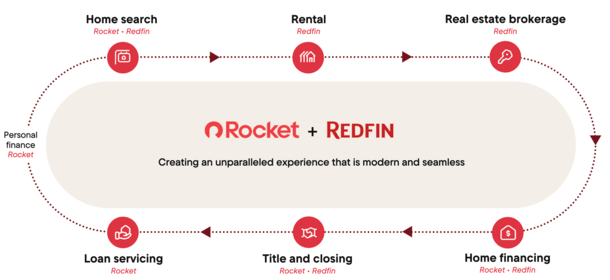

As a substitute of getting to undergo a patchwork system to discover a actual property agent, a mortgage, a title insurance coverage coverage, and so on., shoppers can take pleasure in a extra streamlined course of by way of this tie-up.

“By uniting search, shopping for, promoting, mortgage, title, and servicing all below Rocket, we’re creating a contemporary, intuitive expertise that places the patron first,” Krishna stated within the name.

“With your complete journey below Rocket, we achieve highly effective economies of scale that profit each Rocket and the patron.”

Whereas Redfin has its personal in-house mortgage lender, often called Redfin Mortgage, with greater than 200 mortgage officers, its connect charge has been fairly poor.

In 2024, Redfin buy-side clients solely used the in-house lender in 27% of dwelling buy transactions.

In different phrases, whereas they could have used a Redfin agent, they had been usually going elsewhere for the mortgage

The corporate additionally has its personal title and escrow unit, which had a barely higher 61% connect charge, however there’s nonetheless lots of room for enchancment.

Likelihood is Rocket will drastically improve that connect charge because it integrates the brokerage and pushes clients into its way more established mortgage community.

“We are able to introduce distinctive product choices and move worth again to consumers and sellers as a result of we earn income throughout a number of components of the transaction,” stated Krishna.

To that finish, the corporate expects $200 million in run-rate synergies, and for the consumer, prices presumably dropping in half from $40,000 on a hypothetical dwelling buy to simply $20,000.

“The chance to remodel dwelling shopping for at scale is right here, and we’re able to prepared the ground.”

The Merger Will Drive Buy Mortgage Progress at Rocket

It’s very clear that Rocket desires extra dwelling buy enterprise. They’ve lengthy been the king of mortgage refinancing, however as soon as the market shifted to buy loans, they misplaced out to UWM.

UWM took the mortgage crown in each 2023 and 2024 as a result of it was capable of fund much more dwelling buy loans by way of its giant community of mortgage brokers.

The corporate recorded dwelling buy origination quantity of almost $100 billion in 2024 ($96.1B), whereas Rocket solely mustered $101.2 billion in whole origination quantity.

Total, UWM funded $139.4 billion final yr, with simply $43.4B coming by way of refinances.

In the meantime, Rocket’s buy mortgage market share solely elevated from 3.7% in 2023 to 4% in 2024, regardless of efforts to spice up share with modern packages like Rocket Purchase+.

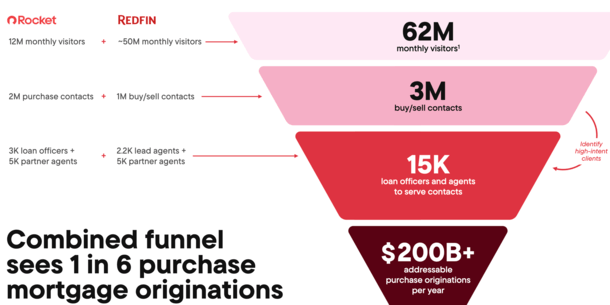

By taking up Redfin, Rocket will achieve entry to 2,200 lead brokers and 5,000 associate brokers, together with 50 million month-to-month guests to Redfin.

In addition they stand to achieve a million extra purchase/promote contacts within the course of, with $200 billion in “addressable buy originations” yearly.

Mixed, their lead funnel may see them seize considered one of each six buy mortgages, or a market share nearer to 17%.

That might simply propel the corporate again to the standing of #1 mortgage lender in america, regardless of UWM’s sturdy efforts of late.

And that seems to be precisely the plan.