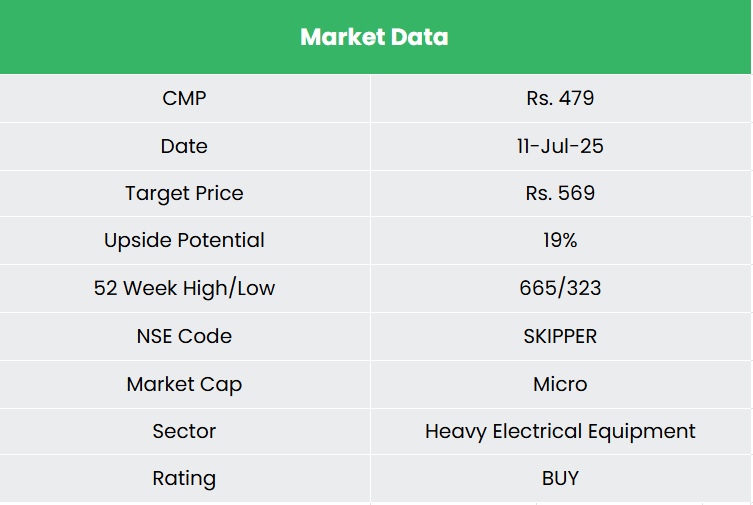

Skipper Ltd – Energizing the Future

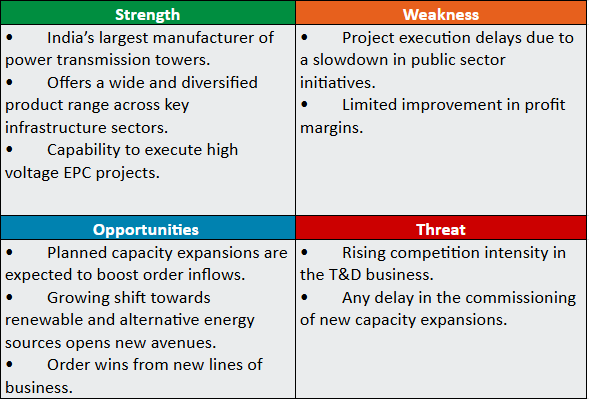

Established in 1981 and headquartered in Kolkata, Skipper Ltd. is a well-established producer of Transmission and Distribution (T&D) buildings (Towers and Poles). The corporate can be a distinguished participant within the polymer trade and a dependable accomplice for executing important infrastructure EPC initiatives. The corporate is the biggest producer of transmission towers in India and ranks among the many high 10 globally. With 4 manufacturing amenities throughout India, the corporate boasts a mixed annual capability of 300,000 MTPA for engineering merchandise and 62,000 MTPA for polymer pipes and fittings. It at the moment serves prospects in over 50 nations worldwide.

Merchandise and Providers

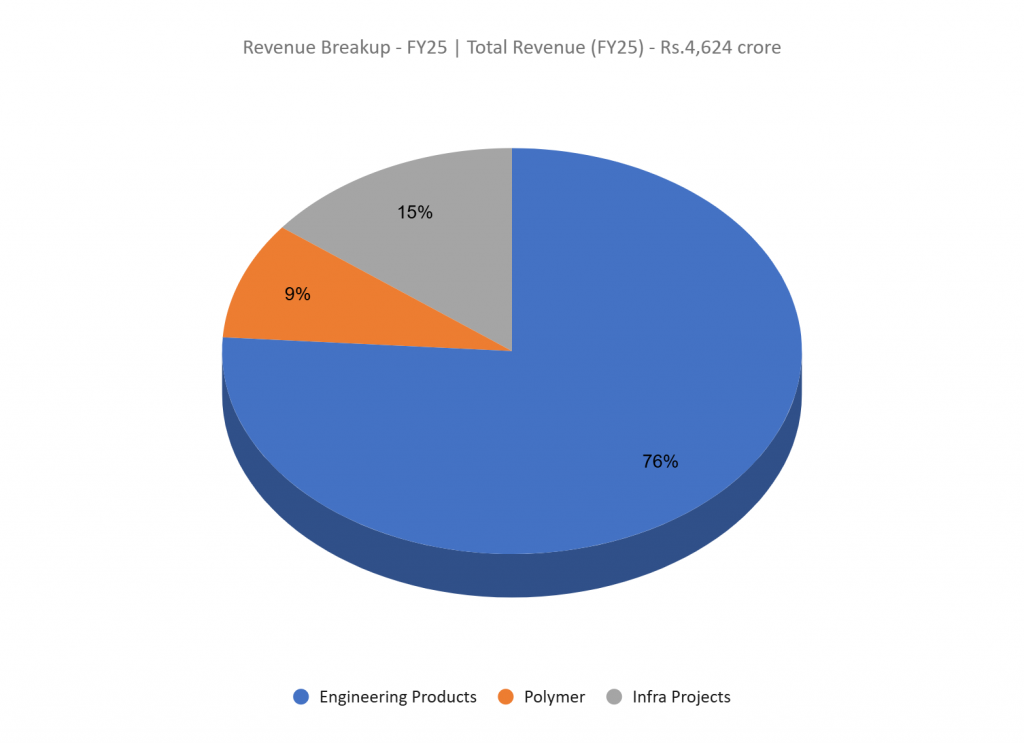

The corporate’s choices could be labeled throughout 3 segments:

- Engineering – Manufacturing of T&D buildings equivalent to energy distribution poles, energy transmission and telecom towers, railway buildings, monopoles, MS and excessive tensile angles.

- Infrastructure – EPC initiatives specialising in dwell line operations, retrofitting and energy evacuation options, coating options.

- Polymer – PVC pipes and fittings, HDPE pipes, bathtub equipment, tanks, borewell pipes and fittings, CPVC solvent cement, and so forth.

Subsidiaries: As of FY24, the corporate has 1 three way partnership and no different subsidiary/affiliate firm.

Funding Rationale

- Increasing order ebook – In FY25, the corporate reported its highest-ever annual order influx, exceeding Rs.5,335 crore. The year-end order ebook stood at Rs.7,458 crore, additionally a file excessive, with a well-diversified mix- 88% from home and 12% from worldwide markets. In the course of the yr, the corporate secured its first order within the U.S. market by a multi-million-dollar contract with a number one regional EPC participant. It additionally entered the EPC substation section with a serious transmission line order. The corporate was chosen as a most well-liked provider and contractor by Energy Grid for increased voltage transmission initiatives and secured key orders, together with the 800 kV Khavda HVDC venture and several other 765 kV / 400 kV initiatives.

- Progress methods – Skipper is pursuing aggressive development methods, together with a capability enlargement of 75,000 tons already underway and plans for an extra 75,000 tons within the coming yr, supported by a Rs.200 crore capex. Within the newest quarter, the corporate’s engineering and polymer segments achieved their highest-ever revenues, every posting 34% year-on-year development. Inside the polymer enterprise, the corporate is sharpening its concentrate on the plumbing section and expects 25% – 30% development, together with improved margins. Moreover, the corporate has secured all mandatory approvals to enter the fuel pipeline section utilizing MDPE (Medium-Density Polyethylene) pipes, leveraging its present HDPE (Excessive-Density Polyethylene) infrastructure as a part of its broader polymer technique.

- Q4FY25 – In the course of the quarter, the corporate generated its highest ever quarterly income of Rs.1,288 crore, a rise of 12% in comparison with the Rs.1,154 crore of Q4FY24. Working revenue elevated from Rs.109 crore of Q4FY24 to Rs.124 crore of Q4FY25, a development of 14%. The corporate reported web revenue of Rs.48 crore, a rise by 90% YoY in comparison with Rs.25 crore of the corresponding interval of the earlier yr.

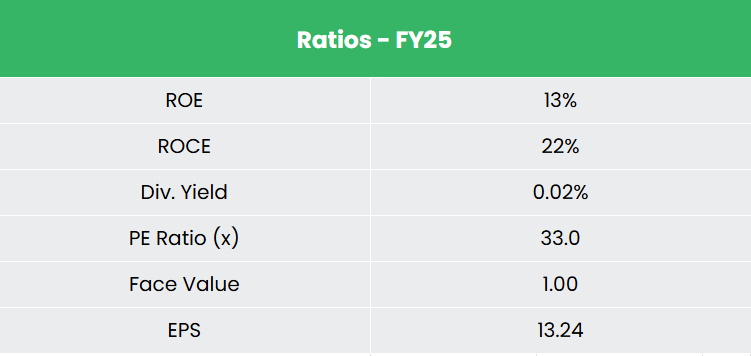

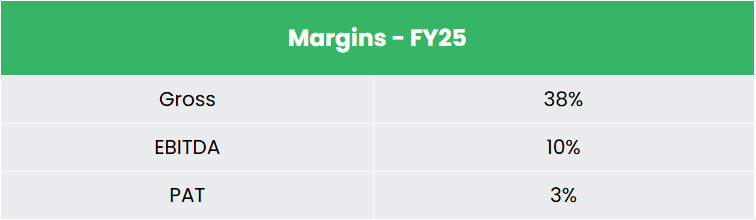

- FY25 – In the course of the FY, the corporate generated income of Rs.4,624 crore, a rise of 41% in comparison with the FY24 income. Export income grew by 21% throughout the interval. Working revenue is at Rs.452 crore, up by 41% YoY. The corporate reported web revenue of Rs.149 crore, a rise of 82% YoY.

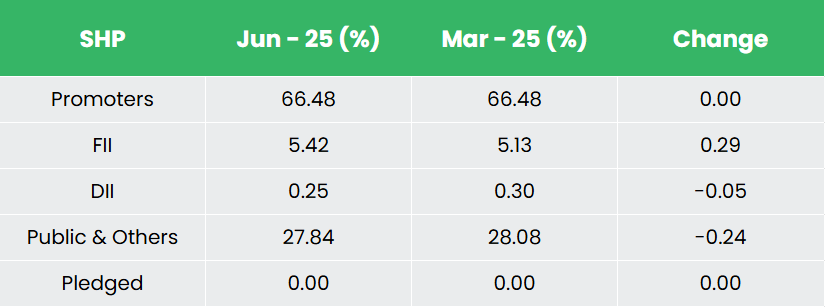

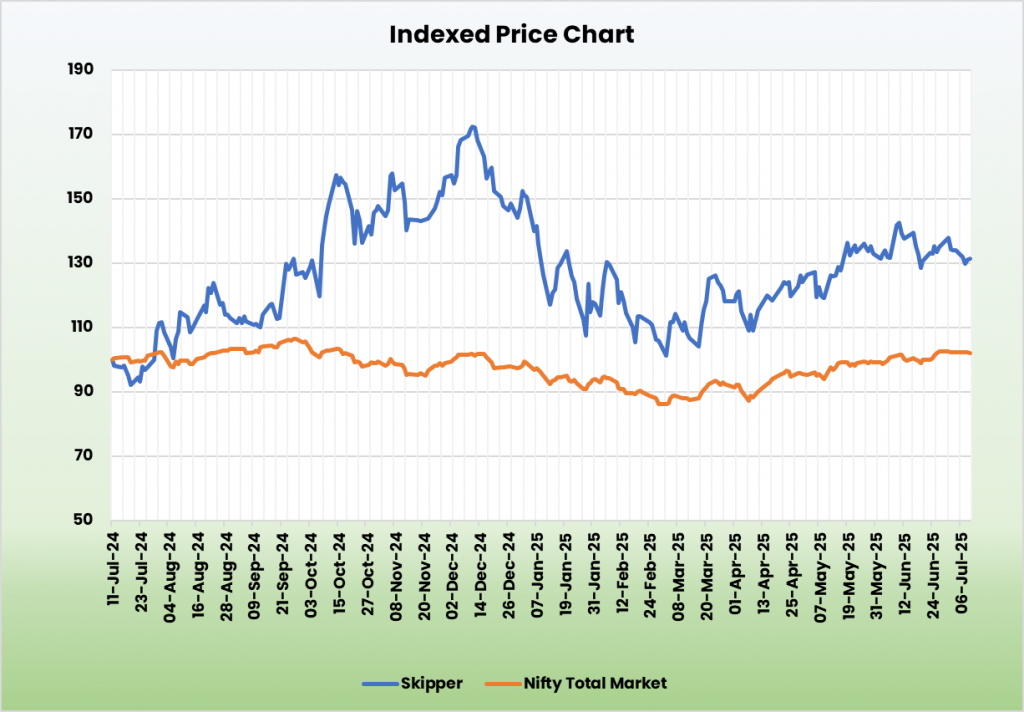

- Monetary Efficiency – The three-year income and web revenue CAGR stands at 39% and 81% respectively between FY23-25. The corporate has a strong capital construction with a debt-to-equity ratio of 0.62. Common 3-year ROE and ROCE is round 10% and 19% for FY23-25 interval.

Business

India’s electrical tools market is anticipated to develop from US$ 52.98 billion in 2022 to US$ 125 billion by 2027, registering a robust CAGR of 11.68%, pushed by growing electrification, infrastructure growth, and coverage help. The sector advantages from its shut linkages with capital items, engineering, and development industries. To fulfill rising energy demand – projected at 458 GW by 2032 – the federal government has dedicated Rs.9.15 lakh crore (US$ 109.5 billion) to improve energy infrastructure. With an put in capability of 466.24 GW as of January 2025, India is the world’s third-largest electrical energy producer and client. The concentrate on common entry to energy, coupled with a shift in direction of renewables and grid modernization, creates important long-term alternatives within the T&D house.

Progress Drivers

- Authorities initiatives, such because the PM Gati Shakti Nationwide Grasp Plan, are taking part in a vital position in strengthening the capabilities of the T&D sector.

- The federal government has de-licensed the engineering sector with 100% FDI permitted.

- Rising electrical energy demand, accelerated urbanization, the combination of renewable power, ongoing grid digitalization efforts, and the alternative of getting older infrastructure throughout numerous areas are anticipated to function main development catalysts for the T&D trade.

Peer Evaluation

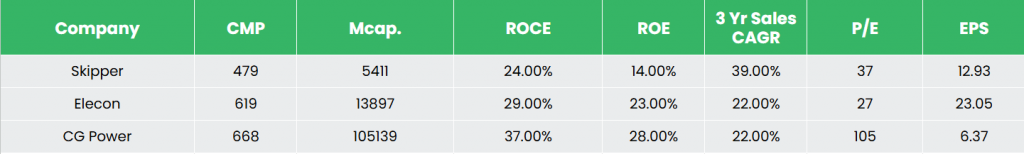

Rivals: Elecon Engineering Firm Ltd, CG Energy & Industrial Options Ltd, and so forth.

Among the many above opponents, the corporate stands out with regular income development, steady return ratios, and wholesome earnings potential, reflecting the corporate’s monetary stability and its capability to effectively generate revenue and returns on invested capital.

Outlook

The corporate is witnessing a strong bidding pipeline with a wholesome conversion fee, and administration stays assured about sturdy order inflows, which had beforehand been restricted by capability constraints. With its ongoing and deliberate capability expansions, the corporate now has clear income visibility. It’s concentrating on a development fee of 20–25% over the following 2–3 years and has dedicated Rs.800 crore in capital expenditure over the following 4 years. Moreover, Skipper is eyeing important alternatives within the U.S. market, with a bid pipeline of round $150 million.

Valuation

We consider the corporate is well-positioned to maintain its development momentum, supported by a robust order pipeline and anticipated capability expansions. We advocate a BUY score within the inventory with the goal worth (TP) of Rs.569, 41x FY27E EPS.

SWOT Evaluation

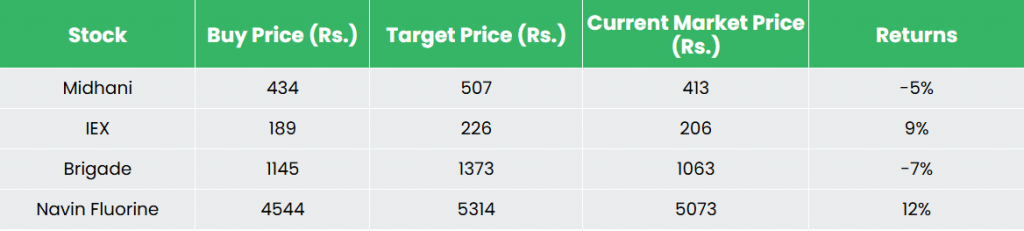

Recap of our earlier suggestions (As on 11 July 2025)

Disclaimer: Investments within the securities market are topic to market dangers, learn all associated paperwork fastidiously earlier than investing. Securities quoted listed below are exemplary, not recommendatory. Please seek the advice of your monetary advisor earlier than investing. Please notice that we don’t assure any assured returns for the securities quoted right here.

Analysis disclaimer: Funding within the securities market is topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing. Registration granted by SEBI, and certification from NISM on no account assure the efficiency of the middleman or present any assurance of returns to traders.

For extra particulars, please learn the disclaimer.

Different articles you might like

Submit Views:

55