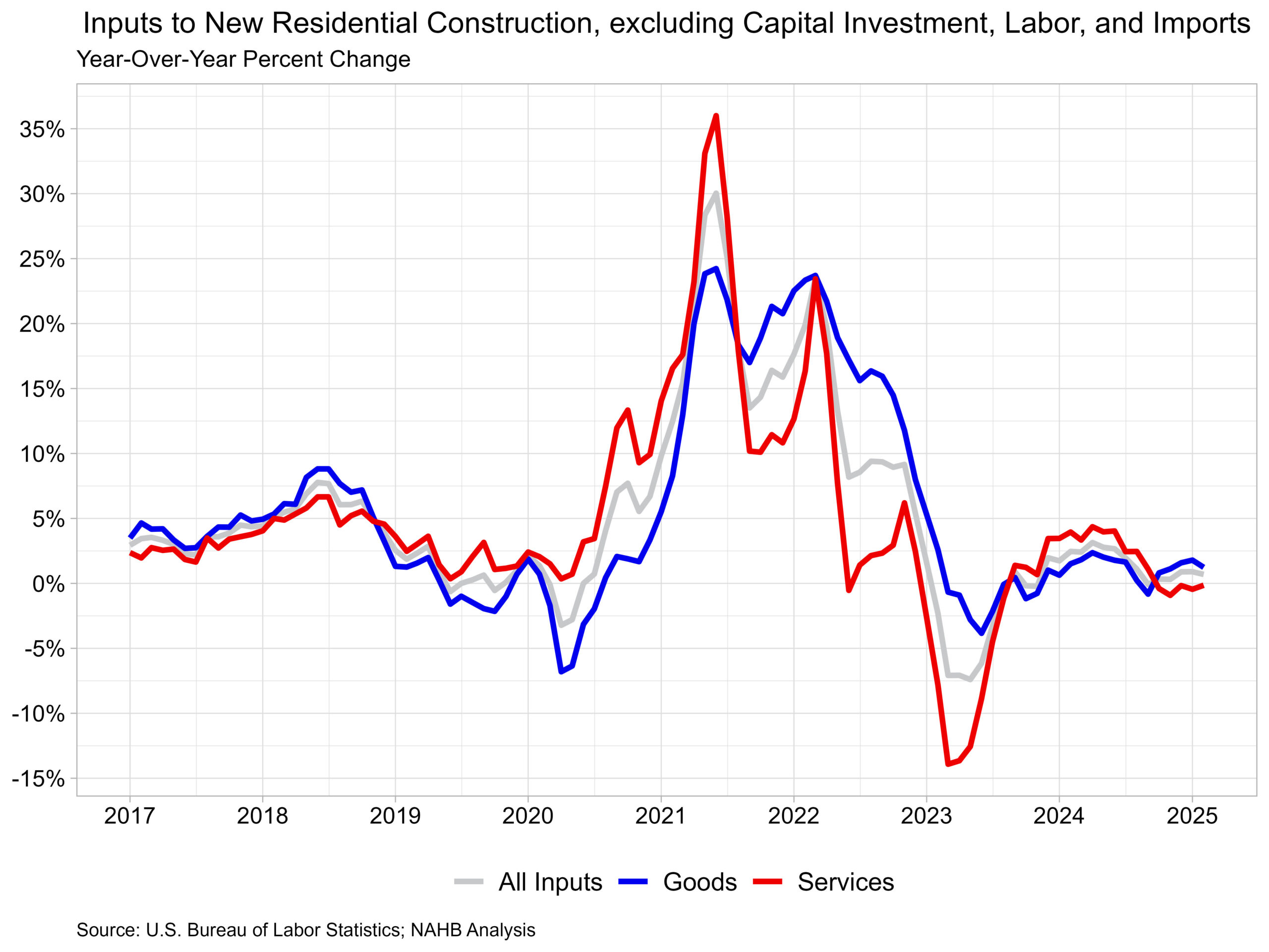

Costs for inputs to new residential development—excluding capital funding, labor, and imports—had been up 0.5% in February in line with the newest Producer Worth Index (PPI) report printed by the U.S. Bureau of Labor Statistics. The rise in January was revised downward to 1.1%. The Producer Worth Index measures costs that home producers obtain for his or her items and companies, this differs from the Client Worth Index which measures what shoppers pay and contains each home merchandise in addition to imports.

The inputs to the New Residential Development Worth Index grew 0.7% from February of final 12 months. The index might be damaged into two parts—the products element elevated 1.2% over the 12 months, whereas companies decreased 0.1%. For comparability, the whole ultimate demand index, which measures all items and companies throughout the financial system, elevated 3.2% over the 12 months, with ultimate demand with respect to items up 1.7% and ultimate demand for companies up 3.9% over the 12 months.

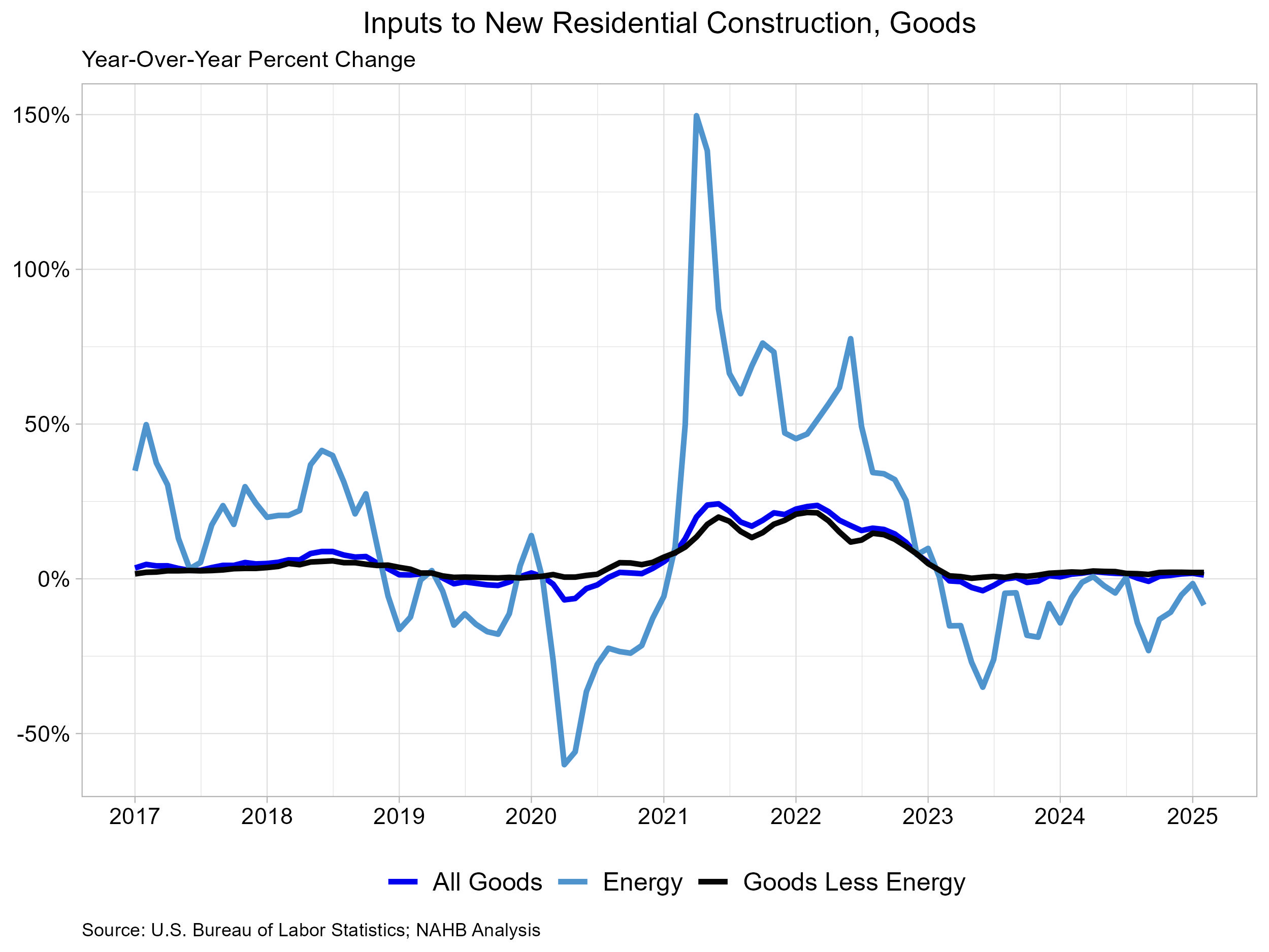

Enter Items

The products element has a bigger significance to the whole residential development inputs value index, representing round 60%. For the month, the value of enter items to new residential development was up 0.6% in February.

The enter items to residential development index might be additional damaged down into two separate parts, one measuring power inputs with the opposite measuring items much less power inputs. The latter of those two parts merely represents constructing supplies utilized in residential development, which makes up round 93% of the products index.

Power enter costs grew 2.6% between January and February however remained 8.5% decrease in comparison with one 12 months in the past. Constructing materials costs had been up 0.5% between January and February whereas they had been up 2.0% in comparison with one 12 months in the past.

Amongst supplies utilized in residential development, lumber and wooden merchandise ranks third when it comes to significance for the Inputs to New Residential Development Index. Nonmetallic mineral merchandise and metallic merchandise rank 1st and a couple ofnd, respectively. The highest lumber and wooden merchandise embody basic millwork, prefabricated structural members, not-edge labored softwood lumber, softwood veneer/plywood and hardwood veneer/plywood. Costs for these wooden commodities skilled little progress for many of 2024. At present, softwood lumber costs had been 11.7% larger in comparison with one 12 months in the past whereas on a month-to-month foundation, costs rose 3.0%. This marks the fourth straight month the place yearly value progress was above 10% for softwood lumber.

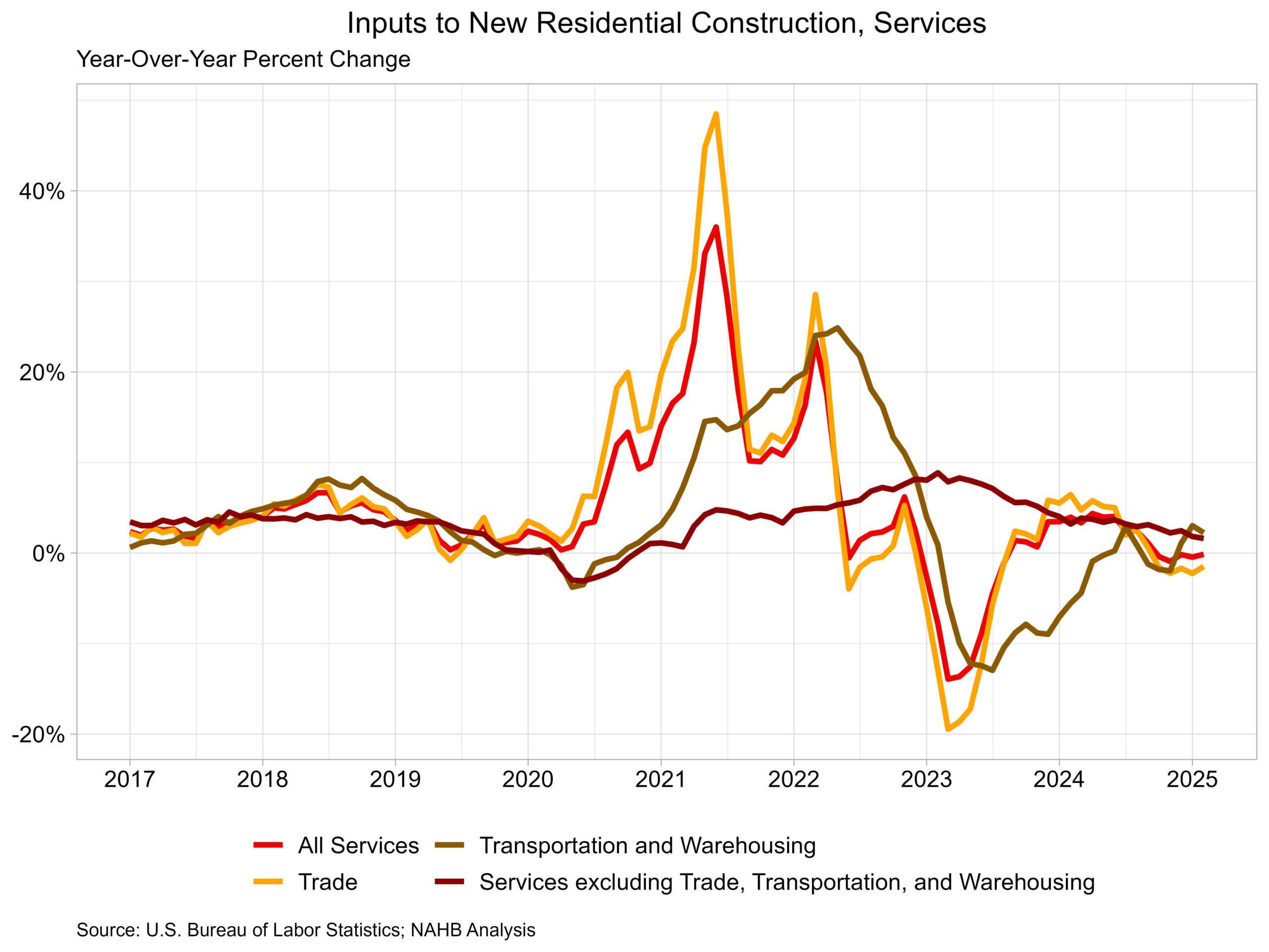

Enter Providers

Whereas costs of inputs to residential development for companies had been down 0.1% over the 12 months, they had been up 0.4% in February from January. The worth index for service inputs to residential development might be damaged out into three separate parts: a commerce companies element, a transportation and warehousing companies element, and a companies excluding commerce, transportation and warehousing element. Probably the most major factor is commerce companies (round 60%), adopted by companies much less commerce, transportation and warehousing (round 29%), and at last transportation and warehousing companies (round 11%). The most important element, commerce companies, was down 1.5% from a 12 months in the past. The companies much less commerce, transportation and warehousing element was up 1.6% over the 12 months. Lastly, costs for transportation and warehousing companies superior 2.2% in comparison with February final 12 months.

Uncover extra from Eye On Housing

Subscribe to get the newest posts despatched to your e mail.