Over the previous 10 years, environmental, social, and governance (ESG) investing has developed from a distinct segment type to a mainstream funding choice. Demand from buyers is widespread, significantly amongst girls and millennials. These cohorts are inclined to view ESG investing as a manner of expressing their values and making a optimistic influence on the world. Because of the curiosity, the funding house has seen a proliferation of sustainable funding merchandise, significantly from traditionally conventional managers. In 2020, sustainable fund flows reached an all-time excessive of $51.1 billion, in line with Morningstar.*

Regardless of garnering record-breaking flows, solely 21 p.c of economic advisors are proactive in initiating ESG discussions with shoppers, and solely 32 p.c of advisors use ESG to draw new shoppers, in line with InvestmentNews. Don’t miss this helpful alternative to distinguish your providers from these of different advisors and proceed exceeding your shoppers’ expectations by introducing ESG. In case you’re not speaking to shoppers about ESG investing, you might be lacking out on an efficient option to meet their wants and retain their enterprise. Under, my colleague Sarah Hargreaves and I take a look at the efficiency of sustainable investing merchandise and lay out a plan for broaching this matter together with your shoppers.

The Case for Aggressive Efficiency

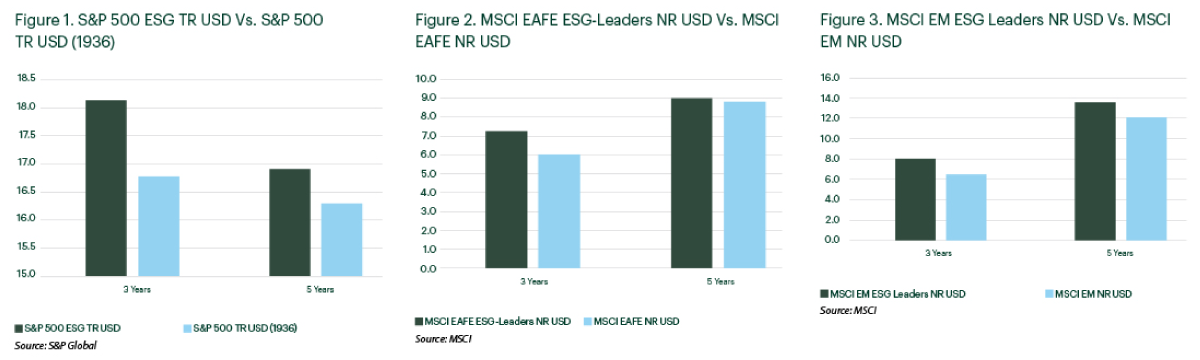

Some skeptics would possibly dismiss ESG investing, believing that incorporating its requirements and rules would result in underperformance in contrast with conventional funding methods. However, current information suggests in any other case. As proven in Figures 1, 2, and three, ESG indices outperformed their conventional counterparts throughout numerous areas and time frames—whatever the nation of domicile. Primarily based on these wide-ranging efficiency comparisons, it’s clear that ESG investing gives a aggressive efficiency alternative.

Information as of three/31/2021.

A Plan for Speaking to Purchasers About ESG Investing

How will you get snug steering a shopper dialogue towards sustainable investing? One of the best practices outlined beneath present a great way to get began.

Get educated. Improve your understanding of sustainable investing and the obtainable approaches earlier than introducing this idea to your shoppers. Try the academic assets provided by the Middle for Sustainable Funding Schooling or Ideas for Accountable Funding to get began. When you verify the basics of the house, you’ll be higher ready to debate ESG investing together with your shoppers.

Provoke a dialog. Be proactive and ask your shoppers if they’ve heard of ESG investing or if they’ve an curiosity in studying extra about this investing method. Not solely is that this a good way to gauge your shopper’s curiosity, however it additionally lets you interact together with your shoppers on their monetary targets and priorities.

Stick with the fundamentals. When framing some great benefits of sustainable investing, it’s finest to maintain it easy. By utilizing an ESG framework, buyers can acquire a extra holistic understanding of how an organization operates. You may as well point out how leveraging ESG elements may help mitigate dangers by figuring out high-quality firms with sustainable enterprise fashions—key drivers of long-term outperformance.

Hold it private. Go the additional mile and tailor the dialog to the problems your shoppers care about most. You may even present related examples or information to additional set the stage. Both manner, personalizing the message will assist you to successfully attain your shoppers.

Be ready for questions. Some shoppers might have little publicity to this house, and others might know bits and items, so be able to reply their questions. Some might marvel tips on how to incorporate ESG into an current monetary plan, and others could also be involved with efficiency.

A Dedication to Your Purchasers’ Evolving Wants

As evidenced by the current proliferation in shopper curiosity and asset flows, there’s no time like the current to decide to speaking to shoppers about ESG investing. Whereas there isn’t a uniform method to incorporating ESG methods into shopper portfolios, proactively initiating a dialog will assist you to tackle your shoppers’ funding wants, whereas gauging their curiosity within the sustainable investing house. As investor preferences proceed to evolve, being ready to current all obtainable funding choices will assist you to display your ongoing experience and devoted monetary stewardship.

*Supply: Morningstar, “Sustainable Fairness Funds Outperform Conventional Friends in 2020,”

January 2021.