I wrote Enterprise Cycle: Boring Bond Funds at Looking for Alpha in June 2019, describing the yield curve and that circumstances had been favorable to extend allocations to bonds. In hindsight, I consider {that a} “gentle touchdown” would have been achieved had it not been for the COVID-induced recession. The conservative accounts that I handle are actually absolutely invested in bonds. On this article, we are going to take a look at “Spicy Bond Funds” for many who are fascinated by excessive yield and security. Spicy, however not too sizzling, and straightforward to handle!

There are a number of vital issues for investing in bonds. First, the S&P 500 earnings yield is lower than the 10-year Treasury which has not occurred because the Dotcom Bubble. The inventory market is overvalued by most metrics, and the return on the S&P 500 has slowed to 1.4% over the previous three months. Second, the danger premium for period and investment-grade bonds is low. This favors shorter-duration bonds with alternatives in investment-grade bonds. Third, inflation is sticky and expectations for increased inflation are rising. Fourth, coverage uncertainty about tax cuts, tariffs, deporting immigrants, and spending cuts are including to volatility and the lengthy finish of the yield curve is flattening.

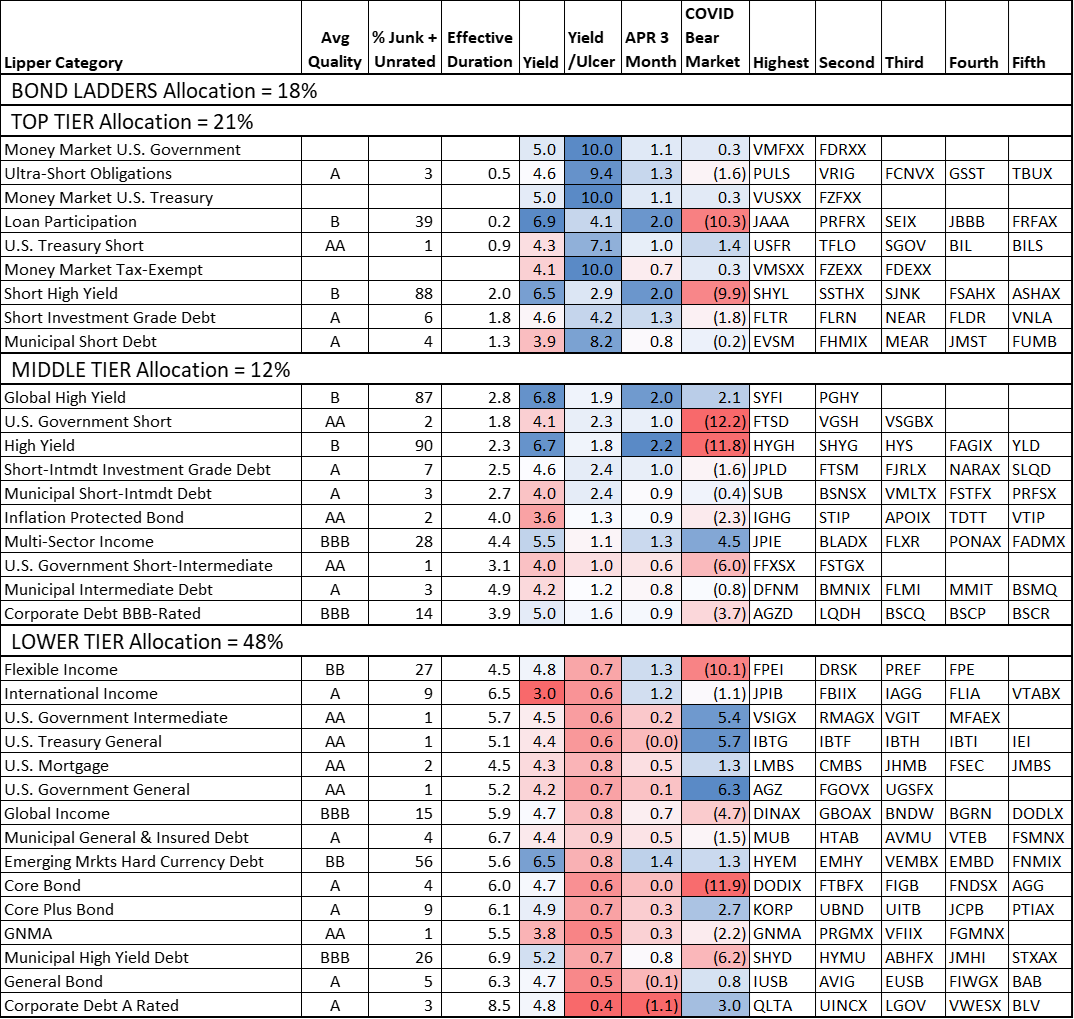

I exploit about twenty metrics from Mutual Fund Observer to rank over 300 bond funds by Danger, Yield, High quality (together with period), Tendencies, and Returns weighted for a conservative investor reminiscent of myself to establish favorable Lipper Classes and high-performing funds. I preselected the funds primarily based on risk-adjusted return and Fund Household Ranking, amongst different components. Efficiency through the COVID bear markets is likely one of the twenty metrics utilized in my rating system. I exploit the MFO Nice Owl score to extend the “Rank” of funds and the “Three Alarm” score to punish these with deteriorating efficiency. I exploit “Bullish” and “Bearish” ETF bond screens at Constancy and Relative Energy Index (RSI) from Looking for Alpha to “bend” my score for shorter-term momentum.

Danger Premium

The Core, Normal, and Company BBB-rated funds that I observe had a median annualized return of 4.7% over the complete cycle from November 2007 till December 2019 with a median APR of 0.6% through the Nice Monetary Disaster bear market. This compares to eight.4% for the S&P 500 over the identical full cycle and -41.4% through the bear market. The bonds have a 30-day yield of 4.8% in comparison with 1.2% for the S&P 500. Bonds are topic to inflation, period, and high quality danger. Uncertainty may also impression bond efficiency.

Inflation Danger

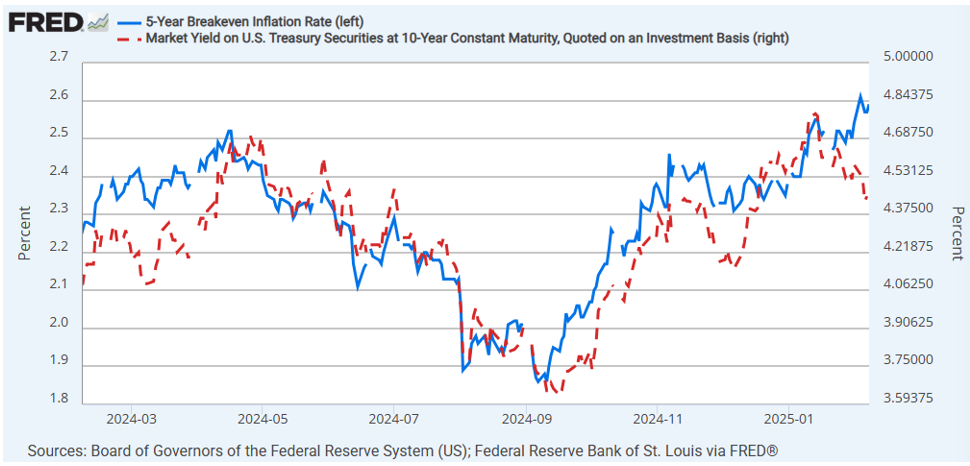

Determine #1 reveals the anticipated inflation to be round 2.6% within the subsequent 5 years, on common as estimated by the breakeven inflation charge. It has risen from a current low of 1.9% in September as inflation has confirmed to be sticky and issues over tariffs. The patron value index got here in increased than anticipated for January rising 3.0% over the previous twelve months, and 0.5% for the previous month. In response, the yield on the 10-year Treasury jumped to 4.64%.

Determine #1: 5-Yr Breakeven Inflation and Yield on 10-Yr Treasuries

Supply: Federal Reserve Financial institution of St. Louis FRED Database: 5-Yr Breakeven Inflation Fee [T5YIE]; Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Yr Fixed Maturity [DGS10]

The Republican administration has instructed opening extra federal land for oil leases. It takes money and time to discover these fields, consider the outcomes, construct the infrastructure, and drill the manufacturing wells. I don’t count on the advantages to decrease inflation within the close to time period particularly when the $72 value per barrel offers little incentive to speculate.

Period Danger

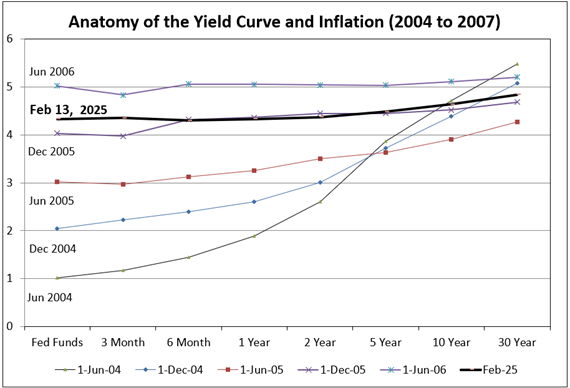

I exploit the yield curves from the 2004 to 2007 interval to show period danger. Bond values are inversely associated to yields, and longer durations are extra delicate to adjustments within the yield. Throughout this era, yields on the 10-year Treasury fluctuated round 4.5% inside a variety of +/- 0.6%. The darkish line is the yield curve on the time of this writing. I count on it to be vary sure between roughly 4.0% and 5.5% till inflation is beneath management and there’s extra readability on the funds deficit.

Determine #2: Anatomy of the Yield Curve and Inflation (2004 to 2007)

Pola Rocha at Investopedia explains why yields on longer period bond charges are more likely to keep increased for longer in The Treasury Secretary Says Trump Needs Lengthy-Time period Charges to Fall—It Could Take a Whereas. The Federal Reserve controls short-term charges, however long-term charges are pushed extra by inflation and authorities borrowing amongst different components. Because the center of September, the yield on the 10-year Treasury rose from 3.6% to 4.8% earlier than declining to 4.4% not too long ago. In the present day, it has risen again above 4.6% over hotter-than-expected inflation readings for January.

Preston Caldwell, Hong Cheng, and Dominic Pappalardo at Morningstar clarify in Why Lengthy-Time period Curiosity Charges Aren’t Falling—And What That Means For Your Portfolio that the largest driver of upper inflation expectations might be increased expectations for financial development and the power of the labor market resulting in extra upward pricing stress. They counsel traders ought to take into account reasonably extending the period of their portfolios to seize potential positive aspects regardless of the chance of additional steepening. They favor intermediate-term Treasuries.

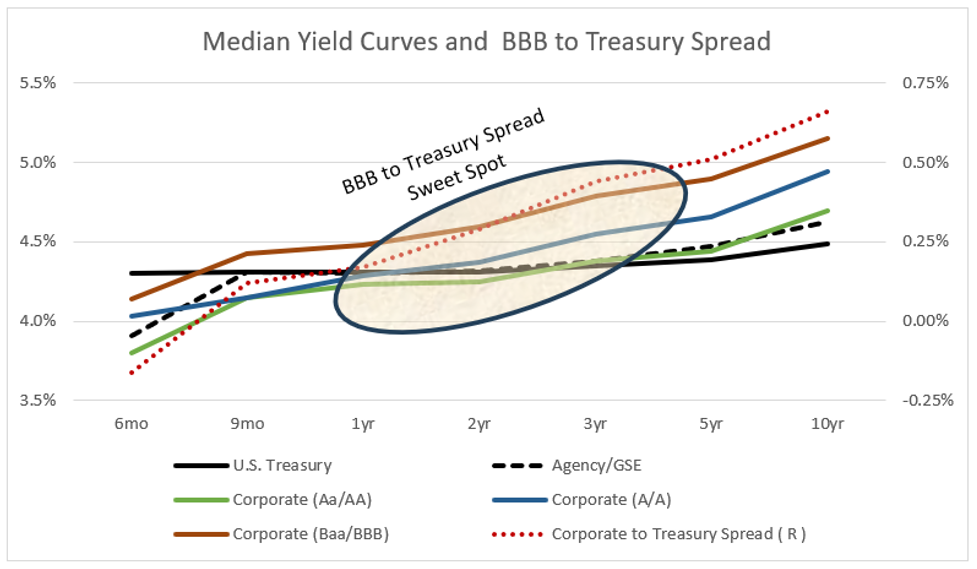

Credit score High quality Danger Premium

Determine #3 is predicated on median yields for bonds from Constancy. For investing in funding grade bonds with a 3-year period, an investor is receiving a traditionally low premium of solely 0.5%, and to spend money on Treasuries with a 10-year period as an alternative of a 2-year period, that investor receives the identical yield with no period premium. I discover the one-to-four-year period in investment-grade debt to be engaging for taxable bonds.

Determine #3: Median Yield Curves and BBB to Treasury Unfold

Coverage Uncertainty

The coverage adjustments from the brand new administration add uncertainty concerning tariffs, inflation, tax reduce stimulus, spending cuts, funds deficits, and nationwide debt ranges. The Federal Reserve’s persevering with Quantitative Tightening provides provide of long-term debt.

Portfolio Evaluation

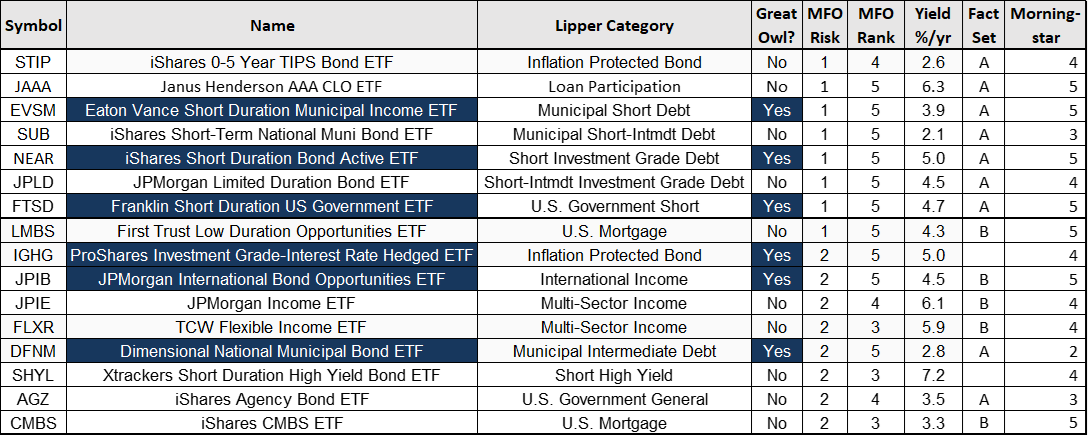

I created Desk #1 to indicate a complete snapshot of how bond funds are performing and to raised perceive how I’m invested. They’re sorted from my highest ranked Lipper Class to lowest. The very best-ranked 5 funds are proven for every Lipper Class. The Tier One Classes are these with a better risk-adjusted yield with higher current efficiency. They have a tendency to have shorter durations. Tier Two Classes step additional into the danger spectrum with barely longer durations and decrease high quality, however nonetheless have a excessive risk-adjusted yield. Tier Three Classes are these with longer durations and decrease risk-adjusted yields. I adjusted the yields and returns of tax-exempt funds increased to be the tax equal for an investor within the 22% tax bracket.

Of the bond funds that Constancy, Vanguard, or I handle, 21% are in Tier One, 12% are in Tier Two, and 48% are in Tier Three with one other 18% in bond ladders. Constancy and Vanguard handle the extra aggressive facet of investments and use extra core bond funds, whereas I handle the conservative facet of Bucket #2 for the intermediate time period. The yield on the taxable bond funds that I handle is 5% excluding the bond ladders. I constructed the bond ladder principally in Treasuries and Company bonds with yield to maturity of 4% or increased however with low dividends. I will probably be investing for a sustainable increased yield because the bonds mature.

Desk #1: Metrics for Lipper Classes with Excessive Yields

Methods For 2025

Barbell Technique

The barbell technique is a tactical technique that entails shopping for short-term and long-term bonds relying upon the form of the yield curve however nothing in between. Steve Johnson describes the barbell technique in ‘Barbell’ Impact Helps Fastened Revenue Newcomers Usurp Conventional Bond Funds revealed within the Monetary Occasions. Traders are shifting away from actively managed mutual funds that sit within the center to decrease price, actively managed funds on one finish, and different autos, reminiscent of personal credit score and infrastructure debt funds, on the different. Of the highest 5 bond funds per Lipper Class that I observe, 75% are actively managed and 65% are exchange-traded funds.

Bond Ladder Technique

The bond ladder technique is an all-weather technique that invests in bonds that mature in given years in an effort to produce a gradual stream of revenue. The principle benefit is that charges might be locked in when excessive. The disadvantages of bond ladders are the excessive barrier to entry, much less liquidity, default danger, and the danger of charges rising. I’ve about 18% of my bond investments in particular person bonds (rungs) that mature annually (spacing).

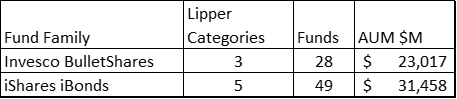

Trade-traded funds which are designed to be rungs on an ETF bond ladder have been round for over a decade. Invesco manages Bulletshares bond funds and BlackRock has iShares iBonds that pay a dividend and mature in a selected 12 months. They arrive within the flavors of Company Debt BBB-Rated, Excessive Yield, Inflation Protected, U.S. Treasury Normal, and Municipal Bonds. Desk #2 reveals the variety of funds and belongings beneath administration of those funds.

Desk #2: Bond Ladder ETFs.

They’ve the benefits of simplicity, diversification, liquidity, and adaptability. The disadvantages are that an energetic investor has the benefit of with the ability to selectively choose higher-yielding bonds, the dividends aren’t as predictable, and within the last 12 months bonds which have matured are reinvested in Treasury payments.

Creator’s Technique

As a retiree, I’m fascinated by stability and a gradual stream of revenue. As I’ve written beforehand, conventional portfolios with a stock-to-bond ratio of 60/40 are anticipated to have below-average returns of round 6% within the coming decade in comparison with 8.3% through the 2010 decade. I see alternatives briefly to intermediate-term investment-grade credit score. I’ve been shifting from core bond funds in Tier Three to quick and short-intermediate funding grade bond funds in Tier One and Two. I’ve been spicing up my portfolio with decrease danger, increased yielding funds within the Mortgage Participation, Excessive Yield with 1-to-3-year durations, and multi-sector bond funds.

I keep away from high-yielding funds that require a major period of time monitoring the industries and administration adjustments in addition to sizzling new funds with out at the least three years of efficiency historical past.

Janus Henderson Aaa Clo ETF (JAAA)

One of many funds that I’ve been shopping for is the Janus Henderson Aaa Clo ETF (JAAA) within the Mortgage Participation class. It isn’t the spiciest fund within the spice rack. The explanations that I prefer it are that it invests 95% in “AAA” bonds, solely has 15% within the high ten holdings, has $20B in AUM, 92% is securitized, and expense ratio of 0.21%. Throughout its four-year life, it has returned 4.6% yearly with a most drawdown of two.3%. It has a TTM yield of 6.32%. It has an MFO Danger of “1” for “Very Conservative” and is within the high quintile for risk-adjusted efficiency within the mortgage participation class. It has a FactSet score of A, and a 5-star Morningstar score. It isn’t with out its dangers although, with 58% invested in South America, and with 68% of its investments categorised as long-term. It isn’t a tax-efficient fund, so I personal it principally in Conventional IRAs.

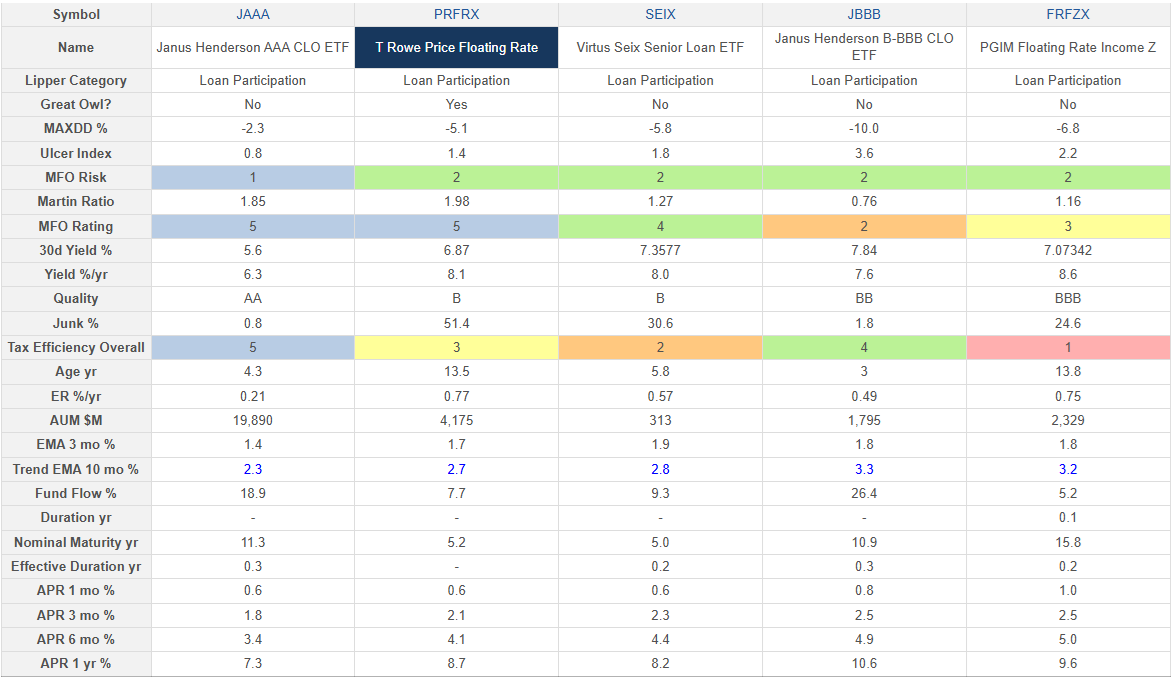

Desk #3 compares the highest-performing mortgage participation funds by my rating system.

Desk #3: Bond Ladder ETFs – Three-Yr Metrics

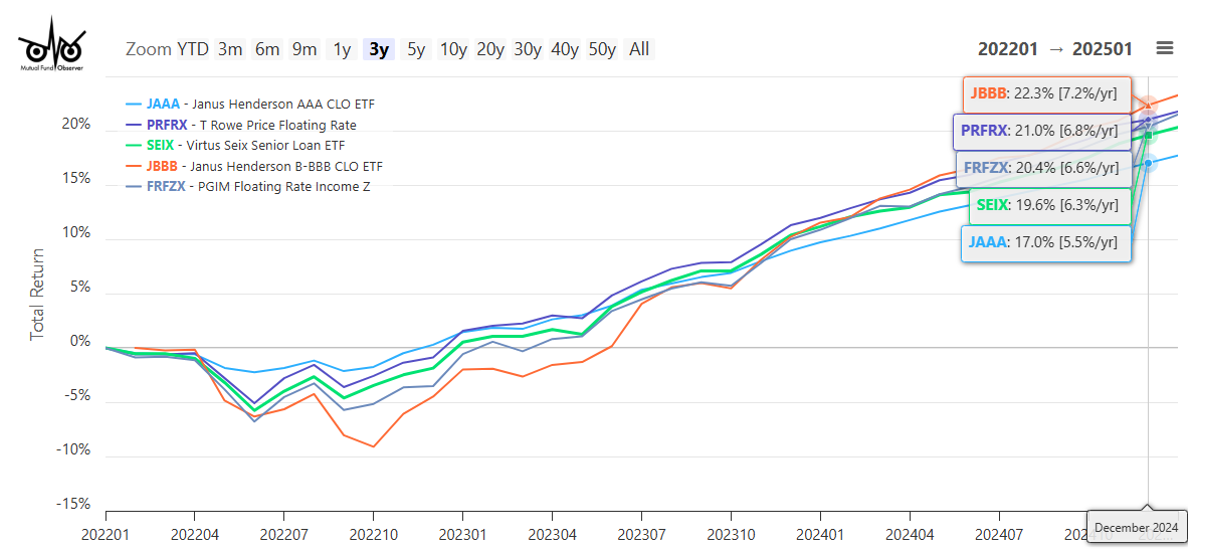

Determine #4 reveals that whereas JAAA doesn’t have the very best return, it has the bottom drawdown. That’s my sort of spice!

Determine #4: Excessive-Performing Mortgage Participation Funds

Closing

Are you in search of an excellent place to start out? Under is an inventory of among the exchange-traded funds that my system is telling me to take a look at. I personal shares in Janus Henderson AAA CLO ETF (JAAA), iShares Brief Period Bond Energetic ETF (NEAR), and iShares 0-5 Yr Excessive Yield Company Bond ETF (SHYG). Invesco World ex-US Excessive Yield Company Bond ETF (PGHY) pursuits me however shouldn’t be but on my radar display.

Desk #4: Bond Ladder ETFs