I’ve been working in Manila this week as a part of a ‘information sharing discussion board’ on the Home of Representatives which was termed ‘Pathways to Progress Reworking the Philippine Economic system’ that was run by the Congressional Coverage and Funds Analysis Division, hooked up to the Congress (Authorities). I’m additionally giving a presentation at De La Salle College on rogue financial coverage. It has been a really fascinating week and I got here in touch with a number of senior authorities officers and discovered rather a lot about the way in which they suppose and do their each day jobs. I Hope the interactions (information sharing) shifted their pondering somewhat and reorient to some extent the way in which they assemble fiscal coverage. This weblog publish studies (so far as I can given confidentiality) what went on on the Congress.

Sarcastically, I’ve been staying at a lodge that was inbuilt 1976 to host the IMF/World Financial institution Annual Assembly in Manila.

It was the product of a large authorities help to personal property builders and building firms.

Since then, the lodge has been the popular selection when the highest echelons of Chinese language management together with Xi Jinping, Hu Jintao and Jiang Zemin go to Manila.

Provided that historical past I assumed it was applicable that I used to be housed there (-:

It is usually adjoining to the central financial institution constructing (an enormous advanced) and the Division of Finance.

That additionally appeared applicable (-:

And it’s near the waterfront promenade which is about the one place within the locality that one can go for lengthy runs within the early morning with out being killed by the manic site visitors congestion within the Better Manila space or die from exhaust poisoning.

However what could be a very lovely locality is considerably uncared for and rundown, which works for a lot of the town and offers the federal government, in my opinion, with large potential to create jobs to alleviate the persistent underemployment and poverty.

The Philippines is what world authorities name a middle-income nation.

In Manila, there are pockets of utmost wealth instantly adjoining to areas of crippling poverty the place kids lie in gutters absent from participation in schooling.

One runs previous the extremely protected Manila Yacht Membership on the seafront the place the marina appears to be housing a few of the largest luxurious boats one might ever see, after which instantly comes throughout numerous folks dwelling in appalling situations, who attempl to eke out survival promoting all types of junk.

As an apart, in Melbourne, for instance, I discover youthful folks provide their seat of the trams to me in deference to my age, which nonetheless is a practice in my dwelling city.

The repsone to age in Manila seems to be hawkers coming as much as me providing black market viagra for a couple of pesos (-:

After all, I politely declined however questioned what guests stand up to on this metropolis.

These hawkers are far and wide and one additionally usually encounters very younger kids who come up and tug in your pockets in search of a couple of pesos.

It’s nearly Dickensian.

But it surely tells me there may be great scope for progress given the extent to which the nation is losing its most useful sources, some extent I’ll return to.

The opposite factor that I’ve been musing about in relation to my present work on degrowth, delinking and breaking colonial dependencies is how far faraway from such a story are nations such because the Philippines.

Everybody I’ve spoken to needs sooner development and materials accumulation, which might be an outrageous aspiration in superior nations however is completely comprehensible within the context of a nation just like the Philippines.

Making an attempt to carry these two ‘worlds’ collectively to avoid wasting the planet is an nearly insurmountable process and I’ll have additional discussions as we speak with officers to additional perceive this concern.

However strolling by the streets of Manila – dodging site visitors and motor cycles (and viagra sellers!) – the overwhelming feeling I’ve had is how distant from reaching some extent the place degrowth might change into a subject of dialog in international locations like this.

When I’m dwelling in Japan, it’s simple to see such a story rising.

However in Manila, it looks like a highway to far.

That may be a difficult thought.

On Wednesday (January 22, 2025), I travelled out to the Home of Representatives advanced close to Quezon Metropolis, which is a 25 kms journey that may take two hours or so given the site visitors congestion.

I used to be invited to come back to the Philippines to talk on the workshop organised by the CPBRD of the Home of Representatives.

My pal, Professor Jesus Felipe additionally spoke. He labored on the Asian Improvement Financial institution for a few years and is now at De La Salle College in Manila.

Prior to now, we’ve labored collectively on ADB sponsored tasks learning financial improvement in Central Asia and Pakistan and so we’ve an extended working affiliation.

The assembly was attended by greater than 100 senior officers from the main financial coverage areas of presidency – Central Financial institution (BSP), Division of Finance, Division of Treasury, Division of Funds Administration, and different associated coverage making departments and financial analysis institutes.

These are the individuals who design and implement financial coverage within the Philippines and so it was a very good likelihood to speak to those that affect issues right here in a single room reasonably than having separate conferences which might have been unattainable.

In his introduction, Jesus laid out the basics of Trendy Financial Principle (MMT) on condition that the Philippines has its personal foreign money and floats it on worldwide markets.

That introduction laid the foundations for my presentation, which started by noting that on the finish of December 2024, the Secretary of Finance, Mr Recto (they name the accountable portfolio Minister Secretaries right here in the way in which the US authorities categorises these positions) launched the 2025 fiscal assertion – Recto: PHP 6.326 trillion nationwide funds for 2025 strongest device to ship the largest financial advantages to Filipinos, reaffirms DOF’s dedication to work laborious in funding it.

The assertion launched a 6.3 trillion peso nationwide spending initiative which represented a 9.3 per cent development in appropriations.

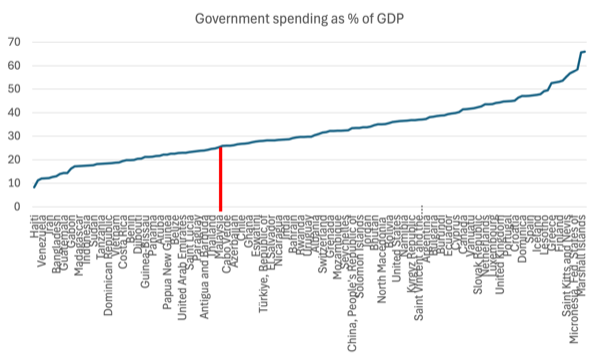

Authorities spending will represent round 22 per cent of GDP in 2025, which the officers imagine represents ‘large authorities’.

I identified that this was really a reasonably modest authorities footprint relative to different nations.

Seek the advice of the information – Authorities expenditure, % of GDP – to see the purpose.

Out of 152 nations for which the IMF provides this measure, the Philippines is standing at rank 53 (from smallest to largest) – so there are about 100 nations which have bigger authorities sectors.

The next graph reveals the distribution of the 152 nations and the vertical line demarcates the Philippines.

Surrounding the Philippines (in proportion of GDP) are

Qatar 24.3 per cent

Thailand 24.6 per cent

Cambodia 24.8 per cent

Malaysia 25.3 per cent

Philippines 25.9 per cent

Cabo Verde 26.0 per cent

Togo 26.0 per cent

Azerbaijan 26.2 per cent

Senegal 26.6 per cent

Chile 26.8 per cent

The Bahamas 26.9 per cent

The purpose is that perceptions are very vital influences on how coverage makers suppose and on this case, the ‘perception’ that the federal government sector has a ‘giant footprint’ when actually it’s comparatively small, is a crucial ‘noise’ within the discussions.

The Secretary’s assertion famous that of the 6.4 trillion nationwide funds for 2025, 4.64 trillion was being supported by revenues, which is framing that conditioned my following dialogue.

The assertion additionally famous:

Secretary Recto reassured the general public that the DOF will be certain that the nation has sufficient funds to satisfy its wants and that each centavo can be spent effectively on applications and tasks that may significantly profit the folks.

And:

He emphasised that the DOF will attempt to not simply meet however exceed its income targets to generate extra sources—simply because the nation’s sturdy fiscal efficiency this yr has demonstrated.

In my slide I highlighted:

– “the nation has sufficient funds”

= “to generate extra sources”

– “sturdy fiscal efficiency”

After which posed the next questions:

1. What does “supported by revenues” imply?

2. What does “make sure the nation has sufficient funds” imply?

3. What does “to generate extra sources” imply?

4. What’s a “sturdy fiscal efficiency” imply?

5. Most essential query: Is that this a full employment fiscal coverage or not?

These questions supplied the speaking factors to additional illustrate the important variations to the way in which an MMT economists thinks and the mainstream framing.

The Philippines points its personal foreign money and has ‘infinity minus a peso’ spending capability in monetary phrases.

So it is senseless to spend a second contemplating that the federal government may not have sufficient funds (of its personal foreign money) or by framing the fiscal problem by way of proportions of the full spending dedication that’s ‘supported by income’.

Additional, the deal with monetary sources diverts consideration from the true problem – utilising the productive sources which can be out there successfully.

The day earlier than the workshop I had taken an extended stroll (a number of kms) by the town and I noticed a whole lot of ‘wasted sources’ – principally the residents within the casual economic system dwelling in poverty with little work and shelter.

Generations of Filipinos within the streets and the youngsters not in class and begging for pesos.

Within the dialogue yesterday, an official claimed that there was no fiscal house for the federal government as a result of ‘everyone accepted’ that the nation was at full employment.

It was a shocking commentary after what I noticed the day earlier than within the streets.

The official unemployment charge is low – true.

However even the official knowledge reveals that there are 15 per cent of the survey underemployed.

And 30 per cent of these categorized as workers within the official knowledge are categorized as working in ‘Elementary Occupations’ – that are precarious, low-paid, and low-productivity actions.

However extra stark is the truth that round 80 per cent of complete ’employment’ is within the casual economic system, not captured within the official knowledge that’s collected utilizing the ILO’s Labour Pressure framework.

So to suppose that the nation is remotely near working at full employment is loopy and the issue is that that misperception or accepted model situations the coverage selections.

Which, in my opinion is why there may be a lot useful resource waste right here and a lot poverty.

For a couple of pesos, the federal government might make a large distinction to the lives of the poorest residents.

On this context, I requested the next questions:

1. Why hasn’t the fiscal coverage plan outlined a significant public sector job creation program.

2. Why not present jobs no less than at a socially inclusive minimal wage?

3. Why not present full-time positions to remove underemployment?

4. Why not present coaching ladders inside the jobs to extend abilities?

The officers mentioned there have been some job creation schemes, however when one examines them it’s clear they’re small and do little to resolve the nationwide drawback, even when they assist the members individually.

What they point out is that scaling up these interventions would ship large advantages to the inhabitants and would supply an actual likelihood to scale back the poverty and useful resource wastage.

The federal government’s aspirations are to create high-level manufacturing industries (change into a number one producer of EVs, for instance), however in my opinion they’re a distance away from having the capability to realize that intention and would get a lot bigger rapid returns by beginning with job creation prograns within the areas the place abject poverty is the defining attribute.

There city areas want vital work to enhance the standard of life – beginning with cleansing the streets and the drains and the waterways.

Once I exit operating I see tens of hundreds of jobs that could possibly be comparatively simply supplied which might radicalise the native surroundings and enhance the dwelling requirements right here.

That might be a very good place to begin however the nationwide fiscal assertion didn’t permit for any such intervention.

I additionally mentioned the proposition that the restricted social safety system right here would quickly ‘run out of funds’.

It is a repeating declare and is nonsensical.

The system, which is characterised by a number of totally different funds, has a number of issues, together with low protection and have to broaden protection and enhance advantages.

However the schemes can by no means ‘run out of cash’ until the nationwide authorities chooses that possibility for political functions.

Spending valuable time debating countless actuarial assessments that produce elaborate graphs displaying insolvency factors diverts the officers from the precise problem.

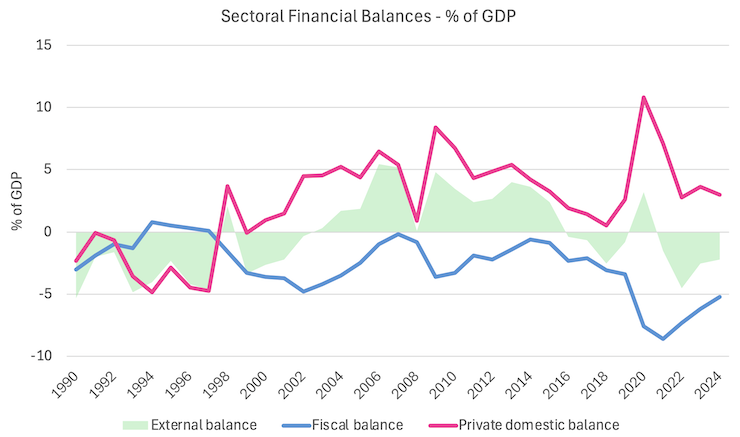

I used this graph which reveals the monetary balances of the federal government, exterior and personal home sectors from 1990 to 2024 as an example some important factors.

It permits us to know that when fiscal coverage shifts, the non-public home sector’s monetary stability shifts roughly in the wrong way, if the exterior sector stability is comparatively steady.

It additionally helps begin a story about what occurs when governments search to scale back the fiscal deficit – which is the medium-term intention of the federal government.

Clearly, after the pandemic assist, the federal government is now attempting to scale back its fiscal place and that’s forcing the non-public home sector in direction of deficit.

Such a development technique is finally unsustainable and there may be proof that personal debt within the Philippines has grown considerably within the final a number of years.

Finally, the rising precariousness of the non-public stability sheets will result in a correction (spending discount) after which the nation heads to recession and the federal government is compelled to extend its fiscal deficit.

I famous this enables us to distinguish between ‘good’ and ‘dangerous’ fiscal deficits.

A ‘good’ deficit outcomes when the federal government fills the non-government spending hole to push the economic system to full employment.

A ‘dangerous’ deficit is when the federal government tries to maneuver in direction of surplus and the fiscal drag doesn’t match the spending and saving needs of the non-government sector, and the ensuing recession reduces tax income and forces the federal government to extend welfare outlays, which finally see the fiscal deficit rising.

That led to a whole lot of dialogue within the Q&A bit of the workshop and prompted the ‘full employment’ remark I famous above.

The truth is that there’s vital ‘fiscal house’ by way of idle actual sources on this nation and denying that actuality leads the coverage makers down unproductive deads ends that spend time speaking about monetary ratio whereas ‘Rome burns’.

I additionally mentioned the nationwide debt concern and famous that through the early years of the pandemic the BSP mainly credited financial institution accounts on behalf of the fiscal departments to fund the coverage interventions.

For eample, on March 23, 2020, the BSP bought PHP300 billion BTr bonds and on March 26, 2020 it remitted PHP20 billion to the Treasury as dividends on the big holdings of presidency bonds held by the central financial institution (BSP).

This was a case of the federal government lending to itself.

Proper pocket sells bonds to the left pocket and pays the left pocket curiosity returns, that are then remitted again to the best pocket of presidency as dividends.

It’s an elaborate accounting charade that makes an attempt to cover the fact that the federal government is simply spending its personal foreign money and doesn’t want tax income or debt issuance to ‘elevate funds’.

In that context, I requested the officers the next questions:

1. What does it imply for presidency debt to be ‘manageable’ (a time period utilized by an official report when the rising public debt stage was being scrutinised lately)?

2. What would occur if the federal government stopped issuing debt that’s denominated in foreign currency echange? (Round 35 per cent of complete public debt is such and exposes the nation to the vagaries of export markets – completely pointless).

3. What would occur if the Division of Finance merely stopped issuing long- and short-term home debt and instructed the BSP to see all authorities funds have been cleared (suppose March 2020)?

4. What have been the implications of the federal government simply lending to itself through the pandemic – good or dangerous?

5. What would occur if it merely wrote all of its authorities debt holdings off?

6. Who would discover?

These questions prompted a whole lot of dialogue.

Lastly, on the finish of the workshop, an official from the Congressional Coverage and Funds Analysis Division (Mr Aquino) introduced me with the next present:

Which characterised the great heat and hospitality that everybody has given me throughout my keep right here for which I’m very appreciative.

Conclusion

Right now I’m off to the native college to current a seminar on why New Keynesian financial coverage prioritisation is a failed coverage technique.

Not like yesterday, as we speak can be a unique sort of discuss, technical and educational.

That’s sufficient for as we speak!

(c) Copyright 2025 William Mitchell. All Rights Reserved.