Launched in 2011, Wealthfront is a robo-advisor with $75+ billion in property underneath administration as of January 2025. A robo-advisor is an funding advisory service that makes use of an algorithm as a substitute of individuals that will help you make investments.

Wealthfront is a tax-efficient and low-cost option to make investments. Its providing is compelling. For simply 0.25%, they do all of the heavy lifting utilizing a pc algorithm.

I believe robo-advisors are nice as a result of they provide skilled advisory providers, no less than a vanilla model (or cosmopolitan, to maintain the ice cream analogy as correct as potential), to the plenty by counting on algorithms fairly than an advisor-heavy strategy.

Many funding advisers received’t meet somebody with out no less than six figures to speculate since they receives a commission as a share of property underneath administration. Robo-advisors can do that as a result of robots don’t want something however hugs.

Their funding crew is spectacular, that includes names like their Chief Funding Officer, Dr. Burton Malkiel (A Random Stroll Down Wall Road), and Charles Ellis (Profitable the Loser’s Recreation), founding father of Greenwich Associates.

At a Look

- $500 minimal beginning stability

- 0.25% annual payment

- Customizable premade portfolios

- Tax loss harvesting

- AI-powered monetary recommendation

Who Ought to Use Wealthfront

Wealthfront is nice for individuals who desire a robo-advisor with tax loss harvesting and don’t care about receiving personalised monetary recommendation. It has three premade portfolios that may be personalized with a wide range of different investments.

If you’d like to have the ability to converse to a human advisor, Wealthfront might not be for you.

Wealthfront Options

Desk of Contents

- At a Look

- Who Ought to Use Wealthfront

- Wealthfront Options

- What Wealthfront Gives

- Concerning the “Robots”

- How Wealthfront Invests

- Threat Tolerance & Asset Allocation Instrument

- Wealthfront Money Account

- Wealthfront Free Monetary Planning

- Portfolio Line of Credit score

- How a lot does Wealthfront value?

- Wealthfront Options

- Wealthfront Evaluate: Last Ideas

What Wealthfront Gives

Simplicity and optimization.

All robo-advisors promise funding returns with out as a lot upkeep. With an account minimal of simply $500, Wealthfront affords an funding advisory service to the plenty.

It took me a few years to amass $5,000 in investable property, and it sat in an index fund at Vanguard whereas it grew. I didn’t pay a lot in charges, however I additionally didn’t get tax loss harvest both (heck, I didn’t even study it till a few years later!).

I noticed my job as an investor as being two major duties:

- Decide and set up an asset allocation and,

- Rebalance their portfolio periodically.

Wealthfront does the primary activity by having you reply a questionnaire about your threat tolerance to ascertain your asset allocation. Then, its robots do their magic to build up the best property to get the allocation that most closely fits your threat tolerance.

As an ongoing service, they deal with rebalancing, tax loss harvesting, dividend reinvestment, and all the opposite smaller duties that may add to your returns however that we regularly neglect to do. That’s the place the optimization is available in.

Concerning the “Robots”

Computer systems are solely pretty much as good because the individuals who design and program them, so whereas I say “robots” so much on this submit (it’s a “robo-advisor”), the oldsters who constructed the robots and provides them the perception to do their automated magic – they’re not robots.

They’re PhDs led by Dr. Burton Malkiel. They rent solely PhDs to work on the funding crew.

How Wealthfront Invests

Wealthfront has three premade portfolios to select from, however every will be simply personalized. In complete, it affords 239 investments, 17 asset courses, and two cryptocurrency trusts.

The three premade portfolios are:

Basic: It is a portfolio of index funds that’s globally diversified. Its foremost holdings as of January 2025 are 45% in US inventory by way of Vanguard’s Whole Inventory Market Fund, 18% overseas shares by way of Vanguard’s FTSE Developed Markets ETF, and 16% rising market shares by way of Vanguard’s FTSE Rising Markets ETF.

Socially Accountable: This portfolio focuses on sustainability, range, and fairness. Its foremost holdings as of January 2025 are 60% US shares by way of iShares ESG Conscious MSCI USA ETF, 12% overseas developed shares by way of iShares ESG Conscious MSCI EAFE ETF, and 11% company bonds by way of iShares ESG Conscious USD Company Bond ETF

Direct indexing: This portfolio invests in particular person shares and is designed for portfolios over $100K. Your portfolio allocation might be decided by your threat tolerance.

Along with the premade portfolios, there are a number of funding classes you may put money into. They’re:

- US inventory ETFs

- Bond ETFs

- Overseas/ rising markets ETFs

- International inventory ETFs

- Socially accountable ETFs

- Tech/ innovation ETFs

- Cryptocurrency trusts

- Wealthfront unique choices

- Investing technique ETFs

- Sector ETFs Commodity ETFs

Tax Loss Harvesting

To economize on taxes, Wealthfront makes use of tax loss harvesting. If an asset drops in worth, Wealthfront will promote it and purchase a distinct, but related, inventory. You may then use that loss to offset any funding good points you may have.

Your threat tolerance performs a big half in your asset allocation. Wealthfront helps you identify your threat tolerance by way of a quiz on the web site.

It’s fairly easy. It takes a couple of seconds to by way of the questionnaire and get your beneficial funding plan: (you are able to do this your self with out placing any private data, they don’t ask for or require an e mail to play with this software)

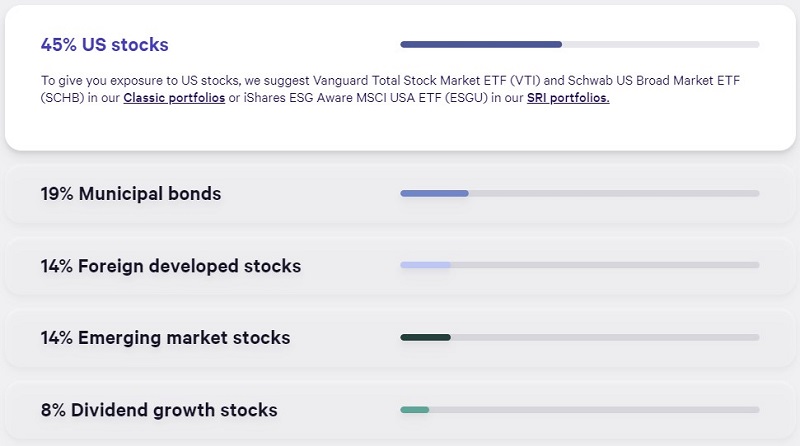

Scroll right down to see the breakdown:

Underneath every class, they checklist the three main ETFs. In idea, you may go and purchase these allocations immediately. For those who click on on every of the bars, you’ll see a breakdown.

You may mess around with the Threat Tolerance slider to see how the allocations change (the portfolio is 7.5, the max is 10), plus see the distinction between a Taxable Funding Combine and a Retirement Funding Combine. I like that the Projected Efficiency is a variety versus a single line because it’s usually depicted as a result of it extra precisely displays the information.

As you may see, the funding choices for the taxable account encompass the Vanguard Whole Inventory Market Fund and Schwab US Broad Market ETF. If you wish to put money into a socially accountable fund, it suggestsiShares ESG Conscious MSCI USA ETF.

Wealthfront Money Account

Lastly, typically you’ll have money not invested within the markets, and Wealthfront has a money account that presently pays 4.00% with FDIC insurance coverage as much as $8,000,000.

There are not any month-to-month charges and no minimal stability necessities.

Wealthfront Free Monetary Planning

Wealthfront affords a free automated monetary planning expertise that’s obtainable to everybody.

It’s an automatic monetary recommendation engine that takes your particular person information, like earnings, spending, and investing, to guard your monetary property and talent to satisfy future targets.

It considers life occasions, like shopping for a home and having kids, and adjusts your plan accordingly. And it does this commonly, fairly than annually or as soon as 1 / 4, as you’ll with a human advisor.

You’ll hyperlink your entire accounts so the software program can see your present standings. It’s going to calculate your networth and provide you with a plan to satisfy your targets. You may get a snapshot of your funds, discover numerous eventualities, after which take a look at completely different tradeoffs. For those who’ve by no means constructed a plan, they’ve an interactive Monetary Well being Information that helps you get began.

Portfolio Line of Credit score

You probably have a person or joint account with a stability of no less than $25,000, a Portfolio Line of Credit score enables you to request money as much as 30% of the present worth of your account, and so they’ll ship it over as rapidly as one enterprise day.

Your portfolio turns into a line of credit score. (therefore the identify!)

The rate of interest is variable and will depend on the efficient funds price, plus 1.08% (price schedule & definitions):

Their rate of interest might beat a house fairness line of credit score (because it’s technically a margin lending product and never a standard mortgage), and since there are not any charges, it’s even cheaper. And in contrast to a daily mortgage product, there is no such thing as a credit score test, no minimal month-to-month funds, and the mortgage is secured by the property in your portfolio.

How a lot does Wealthfront value?

Wealthfront doesn’t cost a fee or account upkeep charges; as a substitute, it depends on an account administration payment. The account administration payment is 0.25% of property. That is on high of the charges charged by the underlying ETFs, which common 0.12%.

Wealthfront Options

There’s so much to love about Wealthfront, but it surely’s at all times a good suggestion to comparability store earlier than signing on to any funding account. It’s your hard-earned cash, in spite of everything. Listed here are a couple of Wealthfront alternate options to think about.

Betterment

Betterment is one other robo-advisor that provides tax loss harvesting. You may get began for $10, and it costs both $4 a month or 0.25%. You’ll be charged the 0.25% when you arrange recurring month-to-month deposits of no less than $250 or you may have a stability of no less than $20,000.

It additionally has a money reserve account that earns 4.00% APY and has a $0 minimal stability requirement. FDIC insurance coverage goes as much as $2 million.

You probably have a stability of no less than $100,000, you will get personalised one-on-one recommendation from a CFP®. There’s an annual administration payment of 0.65% for this service.

Right here’s our full Betterment overview for extra data.

SoFi® Investing

Mortgage large SoFi additionally affords robo-advisor providers. You can begin with $50 and it costs 0.25%, the identical as Wealthfront. It doesn’t have a money reserve account precisely, but it surely does provide financial institution accounts, together with a high-yield financial savings account that earns as much as 3.80% APY (unlocked with direct deposit or by depositing $5,000+ each 30 days, in any other case 1.00% APY).

One massive good thing about SoFi Investing is that it affords human monetary advisors to all shoppers at no further prices. However it doesn’t present tax loss harvesting.

Right here’s our full overview of SoFi Investing for extra data.

M1 Finance

With M1 Finance, your portfolio is known as a “pie,” and inside this pie, you may add as many “slices” as you want. These slices will be particular person shares, ETFs, or skilled pies. It doesn’t present tax loss harvesting.

You may get began for $100 and the primary 90 days are free. After that, the payment is $3 a month, until you may have a stability of no less than $10,000 or an lively private mortgage.

It has a high-yield financial savings account to function your money reserve account that earns 4.00% APY.

Right here’s our full overview of M1 Finance for extra data.

Wealthfront Evaluate: Last Ideas

Wealthfront has top-notch software program and automation, a shocking Ph.D. funding crew led by one of many greats, and is low-cost. You’ll pay 0.25% it doesn’t matter what your stability is, which is a deal when your stability is small however might get dear as your stability grows.

Additionally they provide tax loss harvesting, which not each robo-advisor does. So, if that’s one thing you’re searching for, Wealthfront is value contemplating.

Concerning recommendation, they solely provide automated recommendation, and there’s no possibility to talk to a human advisor.

For those who’re utilizing Wealthfront, I’d love to listen to about your expertise!