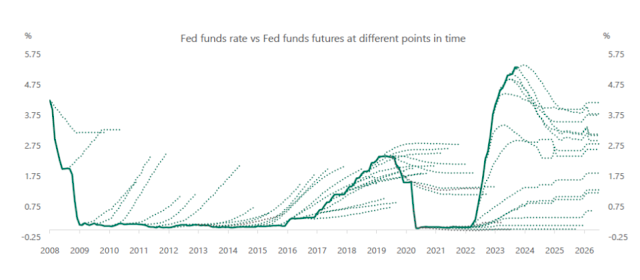

A stunning plot from the at all times fascinating Torsten Slok. The graph reveals the precise federal funds charge, along with the trail of “anticipated” funds charge implicit in fed funds futures market costs. (Roughly talking the futures contract is a guess on the place the Fed funds charge can be at numerous dates sooner or later. If you wish to bloviate about what the Fed will do, it is simple to place your cash the place your mouth is!)

A variety of graphs appear to be this, together with the Fed’s “dot plot” projections of the place rates of interest will go, inflation forecasts, and long term rate of interest forecasts primarily based on the yield curve (yields on 10 12 months bonds suggest a forecast of 1 12 months bonds over the ten 12 months interval.) Simply change the labels.

In phrases, all through the 2010 zero certain period, markets “anticipated” rates of interest to raise off quickly, 12 months after 12 months. It was type of like spring in Chicago — this week, 35 levels and raining. Subsequent week can be sunny and 70! Rinse and repeat. As soon as charges began rising in 2016, markets truly thought the rise can be slower than it was, however then didn’t see the top of the rise. After all they didn’t see the sudden drop in 2020, as a result of they did not see covid.

I discover it fascinating that for the primary full 12 months of inflation, 2021-20222, markets didn’t value in any rate of interest rise in any respect. The Taylor rule (elevate rates of interest promptly when inflation rises) wasn’t that forgotten on the Fed! The one time when it made plentiful sense to forecast the Fed would elevate charges, markets didn’t mirror that forecast.

When the Fed lastly did begin to elevate charges, amid raging inflation, the market much more curiously thought the speed rises would cease rapidly. This being a pasted graph, I can not simply add inflation to it, however with the federal funds charge considerably under inflation till June 2022, it is fascinating the markets thought the Fed would cease. The story of “transitory” inflation that may go away by itself and not using a repeat of the early Nineteen Eighties — with out rates of interest considerably under inflation — was sturdy.

The market forecast appears to me nonetheless remarkably dovish. GDP simply grew like gangbusters final quarter, and the Fed believes within the Phillips curve (sturdy progress causes inflation). We’re operating a historic price range deficit for an financial system at full steam. The Taylor rule (rates of interest react to inflation and output) remains to be a reasonably good description of what the Fed does, in the end. So, in the event you have been to commerce on the historic sample, you’d guess on charges falling rather more rapidly than forecast. Hmm.

That is an outdated phenomenon. The “expectations” in market forecasts do not appear proper. Do not leap to quick to “irrational,” finance at all times has a method out. We name it the “danger premium.” There’s cash to be made right here, however not with out danger. In the event you at all times guess that the funds charge can be under the futures charge, you will generate income more often than not, however you’ll lose cash every so often. First, in lots of such bets the occasional losses are bigger than the small common good points. That’s vital, as a result of the sample of fixed misses in the identical route suggests irrational forecasts, however that is not true. In the event you play roulette and guess on something however 00, you win more often than not, however lose huge every so often and are available out even total, Extra plausibly, if you lose you lose at instances when it’s notably inconvenient to lose cash.

Economists usually use the federal funds future to determine the “anticipated” federal funds charge, after which any motion together with no motion in any respect counts as an “sudden” shock. By that measure the early 2010s have been one sequence of “sudden” unfavourable financial coverage shocks, month after month. The graph makes it clear that is a studying of historical past that wants some nuance in its interpretation.