The Publish WW2 interval was marked by the mass consumption growth and the rise of the ‘center class’, which is a sociological designation that’s supposed to say that the working class had segments that had skilled higher circumstances and outcomes than the labouring cohorts. The truth that Capital (as a category) deigned to concede to the rise of this cohort was because of the menace that the Soviet Union and the rising curiosity in Marxism in Western nations in the course of the mid-C20th posed to the on-going hegemony of capital. The answer was to share a little bit of the booty out with staff, enhance pay and dealing circumstances, and supply the idea for a ‘divide and conquer’ technique, which might successfully section the working class into ‘particular person’ components that could possibly be performed off in opposition to one another. And to keep up the earnings, gross sales needed to increase and what higher means than to encourage the ‘center class’ households to devour like loopy and fill their ever rising measurement houses with stuff. That technique labored for some a long time till the center class and the commerce unions began to get too vocal and demand extra at which level one thing needed to give. And within the early Nineteen Seventies, give it did, and with Monetarism operating rife within the academy and industrialists plotting to seize the legislatures (suppose Powell Manifesto), the circumstances for neoliberalism had been laid. And the following a number of a long time have seen that ideology turn into dominant and set up a dynamic that’s now prone to implode.

In the present day, I report on dimensions of that implosion.

I learn a report a number of weeks in the past that motivated a little bit of analysis to see what it was all about.

The information report (February 25, 2005) – The Wealthiest 10% of US Households Now Signify Practically 50% of Shopper Spending – was reporting on a analysis report launched by Moody’s Analytics and the title says all of it.

Within the US, the:

… the richest 10% of U.S. households — outlined as making about $250,000 or higher — represented 49.7% of all shopper spending. That’s the very best determine on file since knowledge assortment surrounding this metric was first measured by Moody’s … additionally identified that shopper spending is answerable for driving roughly 70% of United States GDP

Within the 12 months to September 2024, these highest revenue recipients elevated consumption spending by a staggering 12 per cent.

On the different finish of the revenue distribution:

In distinction, spending by each lower-income and middle-income American households declined throughout that very same interval.

Commentators have puzzled why the US financial system didn’t gradual appreciably because the Federal Reserve Financial institution hiked rates of interest.

The reply is, as I’ve mentioned in lots of earlier weblog posts, that the affect of rate of interest hikes is just not as easy as mainstream economics would really like us to imagine.

On the coronary heart of the affect is a distributional mechanism.

Debtors are negatively impacted as their revenue should service larger curiosity funds.

However collectors are positively impacted as their curiosity revenue will increase.

Additional, those that maintain wealth within the type of monetary property profit.

Low-income households spend extra of every greenback they earn whereas high-income households save extra of every greenback (as a result of they’ve so lots of them).

However the distinction in spending propensity between these completely different revenue cohorts simply tells us on the margin – what quantity of the additional greenback will likely be spent by every cohort.

Nonetheless, in absolute phrases, the excessive revenue earners might find yourself spending extra total after they take pleasure in revenue shifts as a result of these shifts are usually bigger than any incremental revenue positive factors or losses for low revenue earners.

It’s merely a scale problem.

That’s the reason the brand new article quotes the creator of the Moody’s examine who wrote

Wealthier households are financially safer and thus extra ready and prepared to spend their revenue … That’s, they save lower than they’d in any other case. That is in line with our estimates of shopper spending by revenue group, which reveals the well-to-do within the prime quintile of the revenue distribution powering the current progress in spending.

There are two further info.

1. Mortgages are usually largely fixed-rate within the US, which implies that the rising rates of interest didn’t actually have an effect on the prevailing mortgage holders, solely new mortgages.

2. The rise in public debt in the course of the pandemic help implies that there was a rise in monetary property within the US financial system and so revenue flows to the bond holders elevated considerably in the course of the interval that rates of interest rose.

So the Federal Reserve was really performing to stimulate a fiscal enlargement by way of the rise in authorities curiosity funds.

Which is why the high-income recipients, who overwhelmingly maintain such property, skilled a giant fiscal increase and had been in a position to enhance their consumption spending a lot.

The Report notes that round 3 a long time in the past;

… the wealthiest 10% of American households had been answerable for about 36% of U.S. shopper spending.

Different knowledge reveals that the luxurious items market has boomed within the final 12 months or so:

From designer luggage to first-class airline tickets to cruise journeys, the highest 5% of households spent 10% extra on luxurious splurges in comparison with final 12 months … They’re going to Paris and loading up their suitcases with luxurious luggage and sneakers and garments.

I assume Trump should impose some tariff or one other to cease these imports 🙂 🙂

The newest US Bureau of Labor Statistics knowledge – Shopper Expenditure – 2023 (printed September 25, 2024) – reveals that:

Annual progress in consumption expenditure by quintile – 2022-23

| Revenue quintile | Annual progress (%) |

| Lowest quintile | 3.6 |

| Second quintile | 2.7 |

| Third quintile | 5.7 |

| Fourth quintile | 7.3 |

| Highest quintile | 6.7 |

The upper-income quintiles thus elevated their nominal spending in actual phrases (sooner than the inflation charge) whereas the lower-income cohorts skilled actual cuts of their total spending.

These developments modified additional within the following 12 months (no actual knowledge but) and the expansion was a lot larger for the higher-income cohorts and flat to detrimental on the backside.

The information reveals that:

The underside 80% of earners spent 25% greater than that they had 4 years prior, barely edging out worth hikes of 21% over the identical time frame. Then again, the highest 10% of earners spent 58% extra.

What does that indicate?

The Publish WW2 reliance on the ‘center class’ to drive consumption progress and revenue realisation is being eroded by the very system that created that reliance.

Progress and revenue reliance in recent times has more and more required profligate consumption excesses by the rich high-income group. The kind of consumption items and providers they buy are biased in the direction of a slim vary of luxurious merchandise.

Any monetary market disturbance will even affect on total spending considerably.

Neoliberalism has steadily been hollowing out the ‘center class’.

The evaluation by the Pew Analysis Heart within the US gives proof of this for the US – The State of the American Center Class (printed Could 31, 2024).

It confirmed that:

The share of People who’re within the center class is smaller than it was once. In 1971, 61% of People lived in middle-class households. By 2023, the share had fallen to 51% …

Consequently, People are extra aside than earlier than financially. From 1971 to 2023, the share of People who dwell in lower-income households elevated from 27% to 30%, and the share in upper-income households elevated from 11% to 19%.

Thus, 6 out of 10 People had been categorised as middle-class within the early Nineteen Seventies simply earlier than the neoliberal assault.

Now solely 5 out of 10.

Two main elements of this shift are notable:

1. “the expansion in revenue for the center class since 1970 has not stored tempo with the expansion in revenue for the upper-income tier.”

2. “the share of whole U.S. family revenue held by the center class has plunged.”

The rising inequality can be extremely concentrated throughout ethnic teams and geographic places.

So the rise of ethnically-biased city ghettos is rising.

The conclusion is that the top-end-of-town have turn into so obsessive about grabbing the booty for themselves – via their affect on authorities coverage and their roles as employers and so forth – that they’ve forgotten why the ‘mass consumption’ growth was motivated within the first place.

If an rising proportion of the inhabitants turn into impoverished and the center class continues to be hollowed out then the ‘stability safeguards’ that defend capitalism was falling to mass uprisings of the kind seen within the C19th and past, will likely be undermined and social instability will enhance.

The US and different superior nations will likely be heading in the direction of a state of affairs like we see in nations like South Africa, the place the quickest rising employment sector is the safety trade defending the property of the wealthy from the hungry hordes.

The hollowing out of the ‘center class’ has been an unfolding story during the last a number of (neoliberal) a long time and the tempo of the retrenchment has diversified in several nations.

The seize of presidency by the elites which has marked the shift from the ‘welfare state’ Capitalism of the quick Publish WW2 interval as much as the Nineteen Seventies (about) to the austerity-biases in financial coverage and the reduce backs in public infrastructure provision (together with transport, telecommunications, well being and schooling) and social welfare security nets have been instrumental in that retrenchment.

The assaults on the Welfare State have had diversified impacts throughout nations and the place the social help is extra pervasive and beneficiant (say within the Scandinavian nations) the retrenchment has been much less devastating than it has been in nations just like the US, which began with a reasonably threadbare social welfare system.

There have additionally been sequential tax cuts for top revenue earners and corporations which have contributed to the revenue shifts to the highest.

Decrease-income ladies are actually much less prone to marry their high-income boss and this has contributed to the discount in social mobility throughout the revenue lessons which decreased revenue inequality in the course of the Welfare State period.

And the shifting industrial composition and the associated employment adjustments – from high-paid manufacturing to precarious, low-paid service sector employment has contributed.

As have the assaults in varied nations by governments on the capability of commerce unions to defend the wage pursuits of their memberships.

In America, the curious means that it runs its healthcare system, which is biased in opposition to low-income households is a specific contributor in that nation.

The Al Jazeera article (March 27, 2025) – The American Dream is formally over: All as a result of the wealthy should at all times steal from the poor – notes that:

The Warfare on Poverty/Nice Society programmes President Lyndon B Johnson pushed via in 1965 had been the ultimate straw for the burgeoning neoconservative motion …

Neoconservatives noticed Johnson’s imaginative and prescient of ending poverty and shifting extra public tax {dollars} to really raise all People into prosperity as communist and harmful. By the point of President Ronald Reagan’s conservative revolution within the Eighties, each the remnants of the Nice Society and Warfare on Poverty programmes and even the social welfare system Franklin D Roosevelt constructed via the New Deal within the Nineteen Thirties confronted assaults and austerity.

We will overlook the slip that “public tax {dollars}” had been shifted into spending, and settle for that the hollowing out of the US center class was not a random occasion.

It was a part of a coordinated and well-funded effort.

I wrote about that, partially, on this weblog publish – The best-wing counter assault – 1971 (March 24, 2016).

The article from Inequality.org (December 2, 2022) – Tax the Wealthy? We Did That As soon as – notes that:

Again on the tail-end of that period, within the early Sixties, America’s richest confronted a 91 % tax charge on revenue within the prime tax bracket. That prime charge had been hovering round 90 % for the earlier 20 years …

Within the Eighties, Ronald Reagan and his mates on Capitol Hill would shove that charge down even additional, first to 50 after which to twenty-eight % …

The present top-bracket charge: 37 %.

In 1987, the corporate tax charge was 42.5 per cent for revenue between $US1 million and $US1.405 million.

And, since 2018, the corporate tax for all revenue is now down at 21 per cent.

One mustn’t infer that this decreased the US authorities’s capability to help what social welfare system it had in place.

However the tax cuts have transferred large quantities of disposable revenue to the top-end of the distribution, which has not solely on condition that cohort elevated spending energy total, however extra capability to fund lobbying that advance their very own pursuits.

The US Division of Labor (whereas it nonetheless exists) publishes intensive minimal wage knowledge going again to 1968 for the federal and state jurisdictions – Modifications in Fundamental Minimal Wages in Non-Farm Employment Beneath State Legislation: Chosen Years 1968 to 2024.

The minimal wage within the US, which circumstances wage actions on the decrease finish of the distribution has, on the federal stage, been unchanged in nominal phrases since 2010 on the hourly charge of $US7.25.

What does that imply in actual (buying energy) phrases?

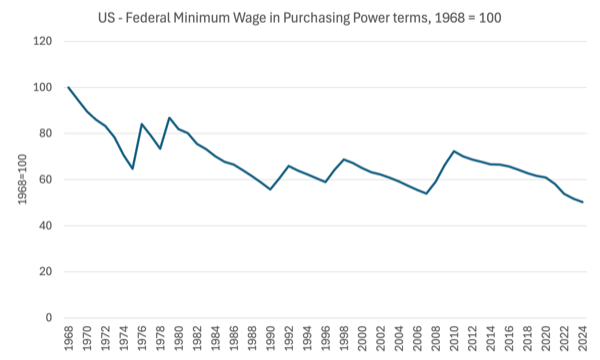

The next graph tells the story.

It’s listed at 100 in 1968 and tracks the actual equal of the federal minimal wage.

By 2024, the index worth was 50.27 factors, which implies that the actual worth of the wage has halved since 1968.

Because the final nominal adjustment in 2010, it has fallen by 30.4 per cent in actual phrases.

Conclusion

So the highest finish revenue has boomed in actual phrases whereas the underside finish has collapsed.

That’s the story of the US after a number of neoliberal a long time.

And it’s the story of most superior nations to various levels.

I’ll write extra in regards to the implications of that hollowing out in weeks to return as I do extra work on the subject.

That’s sufficient for immediately!

(c) Copyright 2025 William Mitchell. All Rights Reserved.