This market has been making an attempt to digest a collection of sudden coverage disappointments. Most company executives thought we’d be getting tax cuts, deregulation, and a business-friendly setting. As an alternative, now we have gotten April 2nd Liberation Day tariff bulletins.

With tariffs, now we have seen two huge points:

First, it’s GOALS. What’s the objective of those tariffs? Why are we implementing them? In direction of what ends? Are we altering our world relationships, alliances, and buying and selling companions? What are we hoping to perform?

Second, the METHODS. How are we implementing these tariffs? What’s the methodology for deploying them? How clear are we speaking our intentions to our buying and selling companions and residents?

The objectives and the implementation strategies have been, at finest, opaque and complicated. Positively clumsy, considerably amateurish. April 2nd revealed that the president and his financial staff don’t really perceive how world economies and commerce work. Their calculations of tariffs have been lifted straight from ChatGPT, and the reasons underlying every particular nation’s tariffs make little sense. It appears misguided, reckless, and poorly thought out.

We. Tariffed. Penguins.

“Liberation Day” is now threatening to liberate People from sturdy actual wage development, low unemployment, and an excellent chunk of their retirement financial savings.

Markets are a future cash-flow discounting mechanism. Consensus previous to April 2 had estimated future company revenues and earnings. Put up April 2nd, that consensus was revelead to be wildly over-estimated. The present pricing of equities is getting adjusted downwards to mirror future decreases in shopper spending and company investments, all pushed decrease by across-the-board tariffs. These are a tax on shoppers and companies that may make every part they buy from abroad way more costly. That adjustment has thus far lowered the Nasdaq by 17% YTD, the Russell 2000 by 18%, with the S&P500 and Dow not far behind.

~~~

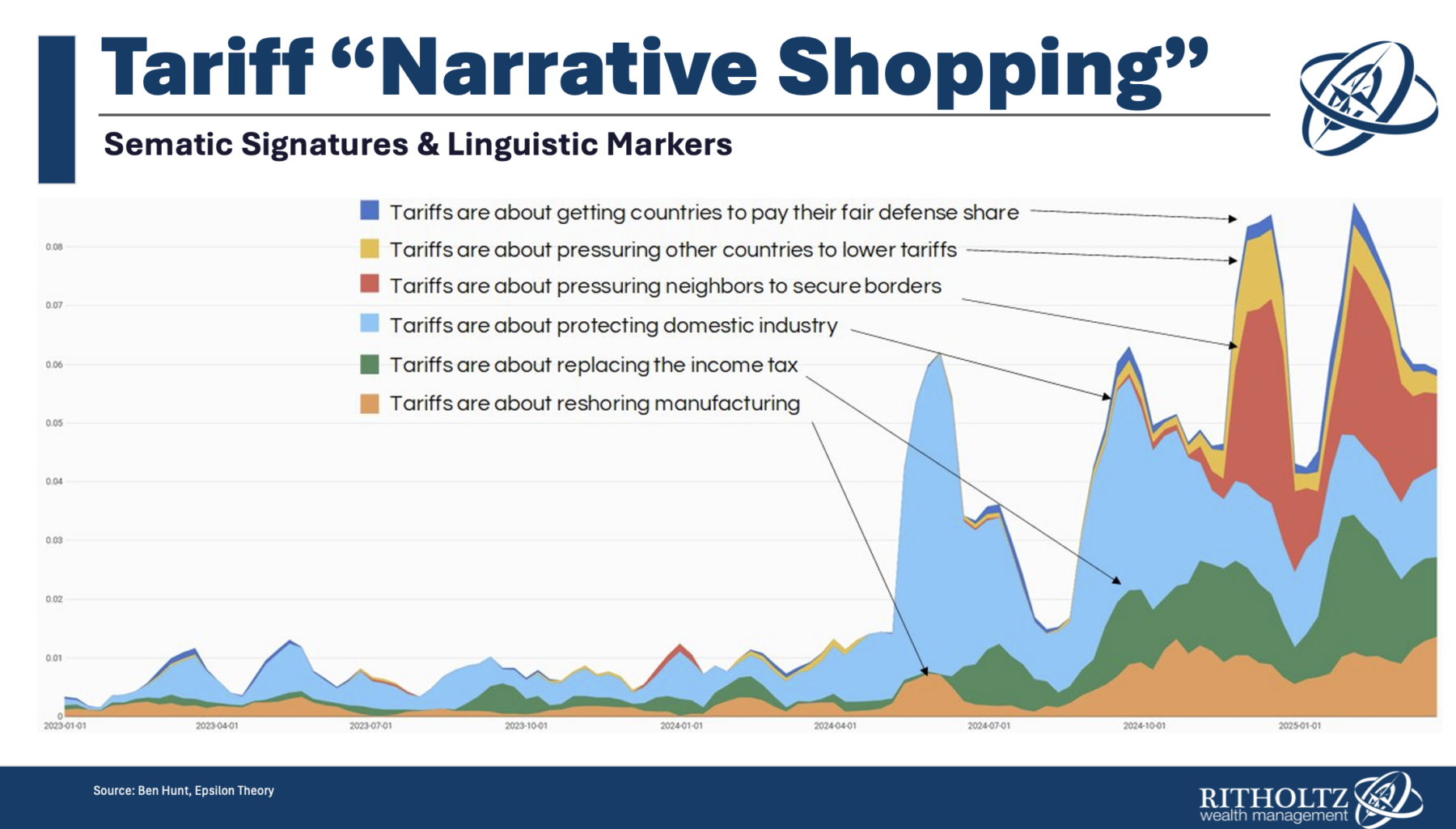

The implementation of tariffs is past the scope of this easy publish, however what in regards to the objectives? Ben Hunt of Epsilon Principle does a captivating analytical apporach, working off of Substack and blogs and information shops and social media information. They information analytics on the language, searching for linguistic markers and semantic signatures about totally different topics. This creates a baseline to determine how steadily they’re used.

That information is then used to indicate how this modifications over time:

We see then-presidential candidate Trump focus on tariffs, primarily targeted on “defending home trade” (mild blue). That’s the kind of factor you say while you’re a candidate operating for workplace and hoping to win votes in Michigan and Wisconsin and Ohio.

The opposite issues candidate Trump was about pressuring our neighbors to safe borders.

What’s so fascinating about this narrative procuring evaluation is that after the election the explanations for the tariffs started to shift. Pressuring our neighbors to safe borders, getting different nations to pay their share for protection.

“Narrative procuring” refers to the concept this can be a coverage we would like applied, even when we’re not precisely certain why. We would like these tariffs, so let’s seek for a rationalization. Listed below are a bunch of various causes, let’s trial balloon them, we’ll float ’em on the market and see what sticks…

There aren’t any winners in a Commerce battle and the April 2nd Supersized Tariff regime have gone past most individuals’s worst fears.

~~~

What are the “Finest-case” and “Worst-case” eventualities of the 2025 Tariff Wars? I’ll focus on these later this week…

Beforehand:

Tune Out the Noise (February 20, 2025)

7 Rising Chances of Error (February 24, 2025)

How A lot is the Rule of Regulation Value to Markets? (August 2, 2021)

Supply:

Narrative Buying

by Rusty Guinn

Epsilon Principle, April 3, 2025

The publish The Penalties of Chaos appeared first on The Massive Image.