Picture supply: Getty Photos

Primarily based on payouts over the previous 12 months, Harbour Vitality (LSE:HBR) is without doubt one of the finest dividend shares on the FTSE 250. Resulting from its beneficiant yield, it sits comfortably inside the high 10% of shares in the UK’s second tier of listed firms.

And following the acquisition of property beforehand owned by Wintershall Dea, it’s now the most important oil and fuel producer within the North Sea. This transformational deal, which was accomplished in September 2024, means the group now has the monetary firepower to additional improve its dividend.

Certainly, the corporate intends to pay $380m to legacy shareholders over the subsequent 12 months. At present (9 January) change charges, this equates to 21.5p (26.4 cents) a share. On the time of writing, Harbour Vitality’s shares are altering palms for round 265p. This means a yield of 8.1%, greater than twice the FTSE 250 common.

However returns to shareholders are by no means assured, notably within the oil and fuel sector. Earnings will be risky, which implies dividends can fluctuate considerably from one interval to a different.

Nevertheless, in it’s brief existence as a listed firm, Harbour has a powerful file of steadily growing its payout (see desk beneath).

| Monetary 12 months | Dividend kind | Dividend per share ($) |

|---|---|---|

| 2021 | Last | 0.11 |

| 2022 | Interim | 0.11 |

| 2022 | Last | 0.12 |

| 2023 | Interim | 0.12 |

| 2023 | Last | 0.13 |

| 2024 | Interim | 0.13 |

Extra income

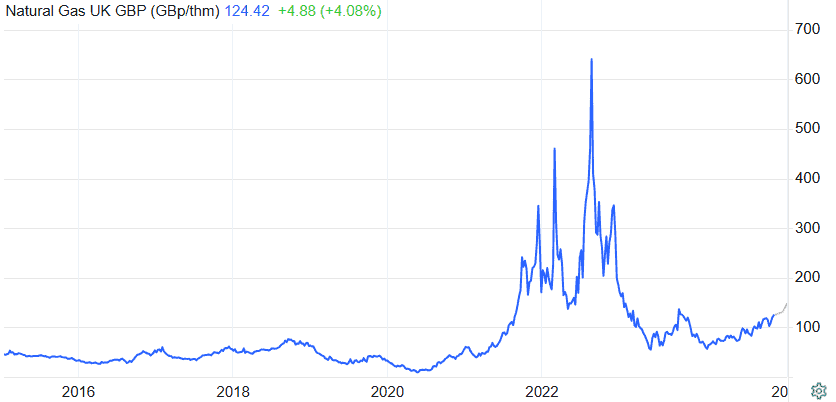

Undoubtedly, this has been made potential by spikes in wholesale oil and fuel costs, notably in 2021 and 2022.

However this can be a double-edged sword.

In response to public stress, the earlier authorities launched a ‘windfall tax’, formally often known as the Vitality Income Levy (EPL). Not surprisingly, the corporate’s share value has been steadily declining because the Might 2022 announcement.

Subsequent will increase imply the group now faces an efficient company tax charge of 78% on its income derived from the UK Continental Shelf.

Partially, this explains the acquisition of Wintershall Dea’s oil and fuel fields. None of those are in UK waters, due to this fact the EPL doesn’t apply. And on account of the deal, the group is now producing 90% greater than beforehand. This provides me some confidence that it may well proceed to develop its dividend.

Commodity costs

Present laws means the EPL will stay till 31 March 2030. However there are provisions for it to be scrapped.

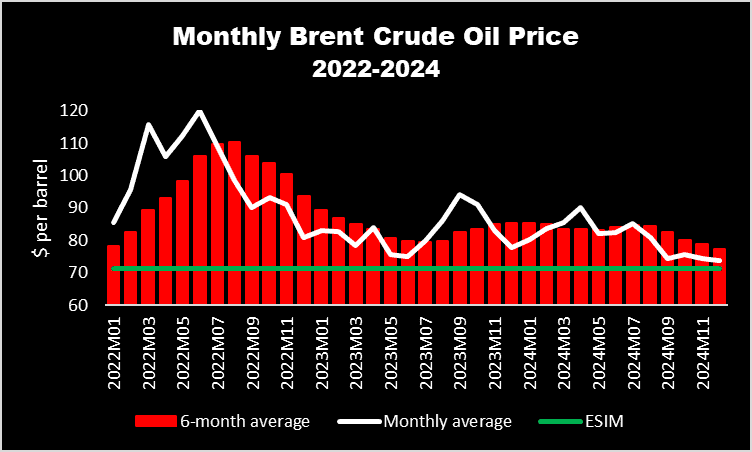

On the one hand, a falling oil and fuel value would harm income. Nevertheless, if (for six consecutive months) the typical month-to-month oil value falls beneath $71.40 — and the fuel value goes underneath 54p a therm — the ‘windfall tax’ might be abolished.

However this seems unlikely to occur any time quickly.

Though Brent crude is falling, it nonetheless stays above the value flooring.

And I ponder if fuel costs will ever drop beneath 54p once more.

In my view, it appears to be like as if the EPL is right here to remain.

My opinion

Regardless of this, I plan to maintain my Harbour Vitality shares.

That’s as a result of I feel diversifying away from the UK is an effective transfer.

And though it’s not possible to precisely predict future vitality costs, the extra income earned outdoors of Britain’s waters ought to assist be certain that the group is ready to — no less than — preserve (in money phrases) its beneficiant dividend.