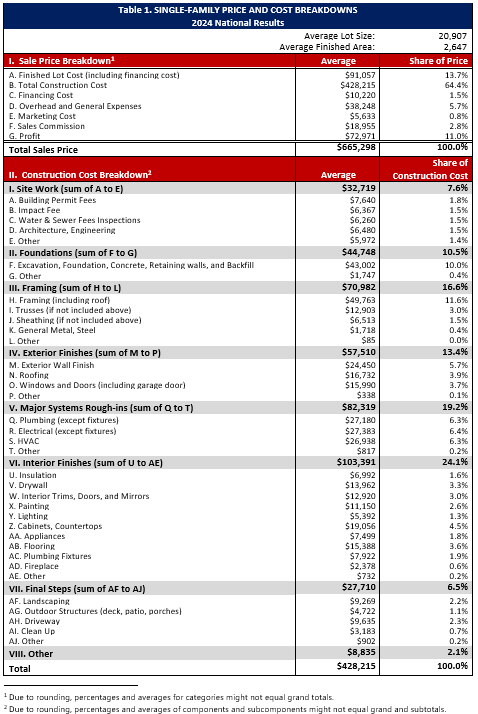

Building prices account for 64.4% of the common value of a house, in keeping with NAHB’s most up-to-date Value of Building Survey. In 2022, the share was 3.6 factors decrease, at 60.8%. The most recent discovering marks a document excessive for development prices for the reason that inception of the collection in 1998 and the fifth occasion the place development prices represented over 60% of the whole gross sales value.

The completed lot was the second largest value at 13.7% of the gross sales value, down greater than 4 share factors from 17.8% in 2022. The share of completed lot to the whole gross sales value has fallen consecutively within the final three surveys, reaching a collection low in 2024.

The typical builder revenue margin was 11.0% in 2024, up lower than a share level from 10.1% in 2022.

At 5.7% in 2024, overhead and common bills rose when in comparison with 2022 (5.1%). The rest of the common house sale value consisted of gross sales fee (2.8%), financing prices (1.5%), and advertising prices (0.8%). Advertising prices have been primarily unchanged whereas gross sales fee and financing prices decreased in comparison with their 2022 breakdowns.

Building prices have been damaged down into eight main levels of development. Inside finishes, at 24.1%, accounted for the most important share of development prices, adopted by main system rough-ins (19.2%), framing (16.6%), exterior finishes (13.4%), foundations (10.5%), website work (7.6%), remaining steps (6.5%), and different prices (2.1%).

Discover the interactive dashboard beneath to view the prices and share of development prices for the eight levels and their 36 elements.

Desk 1 exhibits the identical outcomes because the dashboard above in desk format. Please click on right here to be redirected to the total report (which incorporates historic outcomes again to 1998).

Uncover extra from Eye On Housing

Subscribe to get the newest posts despatched to your e mail.