Properly, one other 12 months is within the books on the VA, and like prior years, Veterans United topped the record because the #1 VA mortgage lender in America.

This marked their third 12 months as the highest VA mortgage lender, beating out United Wholesale Mortgage (UWM) for the highest spot this time round.

They’ve now taken the highest spot in 2024, 2023, and 2022, and as in previous years by a big margin.

The Columbia, Missouri-based mortgage firm funded almost 62,000 loans totaling over $19 billion in the course of the 12 months.

That was greater than sufficient to beat out UWM, which solely mustered about $15.6B. Learn on to see the others within the high ten.

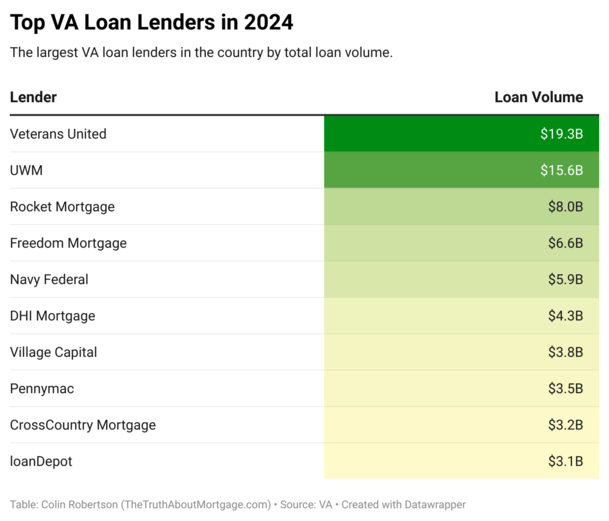

High VA Mortgage Lenders in 2024

| Rating | Firm Identify | 2024 VA Mortgage Quantity |

| 1. | Veterans United | $19.3 billion |

| 2. | UWM | $15.6 billion |

| 3. | Rocket Mortgage | $8.0 billion |

| 4. | Freedom Mortgage | $6.6 billion |

| 5. | Navy Federal | $5.9 billion |

| 6. | DHI Mortgage | $4.3 billion |

| 7. | Village Capital | $3.8 billion |

| 8. | Pennymac | $3.5 billion |

| 9. | CrossCountry Mortgage | $3.2 billion |

| 10. | loanDepot | $3.1 billion |

As famous, Veterans United House Loans was the most important VA mortgage lender final 12 months, per new Lender Statistics from the Division of Veteran Affairs.

The corporate funded $19.3 billion in VA loans, together with over $17 billion in residence buy loans.

Spectacular given 2024 was one other powerful 12 months for residence consumers given the mixture of elevated mortgage charges and nonetheless rising residence costs.

That didn’t appear to decelerate the corporate, which noticed its total manufacturing rise from $17.7 billion a 12 months earlier.

The remainder of their manufacturing was pushed largely by streamline refinances, specifically the Curiosity Fee Discount Refinancing Mortgage (IRRRL).

Additionally they did about $540 million in money out refinance loans for veterans and energetic obligation navy householders.

In different phrases, almost 90% of their manufacturing comes from residence buy lending, and just about all their loans are backed by the VA. Although they do are inclined to do a tiny quantity of standard lending and FHA loans.

Taking the second spot in 2024 was Pontiac, Michigan-based UWM, which occurs to be the #1 mortgage lender total throughout all mortgage varieties.

However there was nonetheless a big hole between them, with UWM solely funding $15.6 billion in VA loans final 12 months.

Nevertheless, UWM beat out Veterans United within the refinancing classes, so it’s actually the house purchaser section that they should work on.

Taking third place was Rocket Mortgage with a a lot smaller $8 billion, pushed largely by refinance loans, together with over $4 billion in VA money out loans.

Rocket has historically captured extra refinance enterprise than buy lending enterprise in all classes.

Rounding out the highest 5 have been Freedom Mortgage with $6.6 billion and Navy Federal Credit score Union with $5.9 billion.

Others within the high 10 included DHI Mortgage, the mortgage division of high residence builder D.R. Horton, together with Village Capital, Pennymac, CrossCountry Mortgage, and loanDepot.

High VA Buy Mortgage Lenders

| Rating | Firm Identify | 2024 VA Mortgage Quantity |

| 1. | Veterans United | $17.0 billion |

| 2. | UWM | $8.9 billion |

| 3. | Navy Federal | $5.5 billion |

| 4. | DHI Mortgage | $4.3 billion |

| 5. | Rocket Mortgage | $3.0 billion |

| 6. | CrossCountry Mortgage | $2.7 billion |

| 7. | USAA | $2.5 billion |

| 8. | Freedom Mortgage | $2.3 billion |

| 9. | Fairway Unbiased | $2.3 billion |

| 10. | Lennar Mortgage | $2.1 billion |

If we break it down by residence buy loans, Veterans United was nonetheless #1, and by a good wider margin as a result of that’s just about all they deal with.

The corporate funded a staggering $17 billion, with second place UWM not even shut at $8.9 billion.

Navy Federal got here in third with $5.5 billion, and unsurprisingly, DHI Mortgage grabbed the fourth spot with $4.3 billion.

A lot of the high residence builders have their very own captive lenders, and these days they’ve been providing huge mortgage price buydowns to assist extra residence consumers qualify.

This has helped firms like DHI Mortgage develop their mortgage manufacturing and beat out impartial mortgage lenders, who usually can’t compete.

Rocket nonetheless managed to snag the fifth spot, albeit with slightly below $3 billion in VA buy loans.

The remainder of the highest 10 included CrossCountry Mortgage, USAA, Fairway Unbiased Mortgage, Freedom Mortgage, and Lennar Mortgage.

USAA is a financial institution that primarily serves navy members and their households, whereas Lennar Mortgage is the financing arm of residence builder Lennar. So no actual surprises right here.

High VA Refinance Lenders (Streamline)

| Rating | Firm Identify | 2024 VA Mortgage Quantity |

| 1. | UWM | $3.9 billion |

| 2. | Freedom Mortgage | $2.4 billion |

| 3. | Village Capital | $2.3 billion |

| 4. | Pennymac | $1.8 billion |

| 5. | Veterans United | $1.7 billion |

| 6. | Rocket Mortgage | $1.0 billion |

| 7. | Planet House | $617 million |

| 8. | Lakeview | $596 million |

| 9. | Newrez | $500 million |

| 10. | Mortgage Options Monetary | $246 million |

After we flip our consideration to refinance loans, high lender total UWM was in a position to seize the lead within the class with almost $4 billion funded.

The VA presents a streamline refinance that requires little or no by way of documentation to acquire a decrease rate of interest and/or new mortgage time period

And UWM, which is powered by impartial mortgage brokers, led the way in which.

In second was Freedom Mortgage with $2.4 billion, one of many high correspondent lenders in each the VA and FHA area.

They have been adopted by Village Capital with $2.3 billion, which is completely targeted on streamline refis, together with FHA streamlines as nicely.

Fourth went to Veterans United and fifth went to Pennymac, which was fashioned by ex-Countrywide staff about 15 years in the past.

Different huge names included Rocket, Planet House Lending, Lakeview Mortgage Servicing, Newrez, and Mortgage Options Monetary.

High VA Refinance Lenders (Money Out)

| Rating | Firm Identify | 2024 VA Mortgage Quantity |

| 1. | Rocket Mortgage | $4.0 billion |

| 2. | UWM | $2.7 billion |

| 3. | Freedom Mortgage | $1.9 billion |

| 4. | New Day Monetary | $1.4 billion |

| 5. | Village Capital | $1.3 billion |

| 6. | loanDepot | $1.2 billion |

| 7. | Federal Financial savings Financial institution | $1.1 billion |

| 8. | Veterans United | $543 million |

| 9. | Pennymac | $434 million |

| 10. | Carrington Mortgage | $349 million |

The ultimate class is VA money out loans, and that is Rocket Mortgage’s bread and butter, with over $4 billion funded. That represented half of their whole VA manufacturing.

In second was UWM with $2.7 billion, adopted by Freedom Mortgage with $1.9 billion.

New Day Monetary took fourth with $1.4 billion and Village Capital took fifth with $1.3 billion.

Others making the highest 10 included loanDepot, The Federal Financial savings Financial institution, Veterans United, Pennymac, and Carrington Mortgage.

Once more, no actual surprises, and solely actually huge names. And keep in mind, you don’t want to make use of one of many largest VA lenders to get a mortgage.

There are actually over 1,000 VA mortgage lenders within the nation, each huge and small, and every part in between.

You should definitely take the time to buy round amongst them, as an alternative of merely going with the most important title, which could cost you for the privilege.