As curiosity in understanding the financial impacts of local weather change grows, the local weather economics and finance literature has developed quite a lot of indices to quantify local weather dangers. Varied approaches have been employed, using firm-level emissions knowledge, monetary market knowledge (from fairness and derivatives markets), or textual knowledge. Specializing in the latter method, we conduct descriptive analyses of six text-based local weather threat indices from revealed or well-cited papers. On this weblog publish, we spotlight the variations and commonalities throughout these indices.

Textual content-Based mostly Approaches to Measuring Local weather Danger

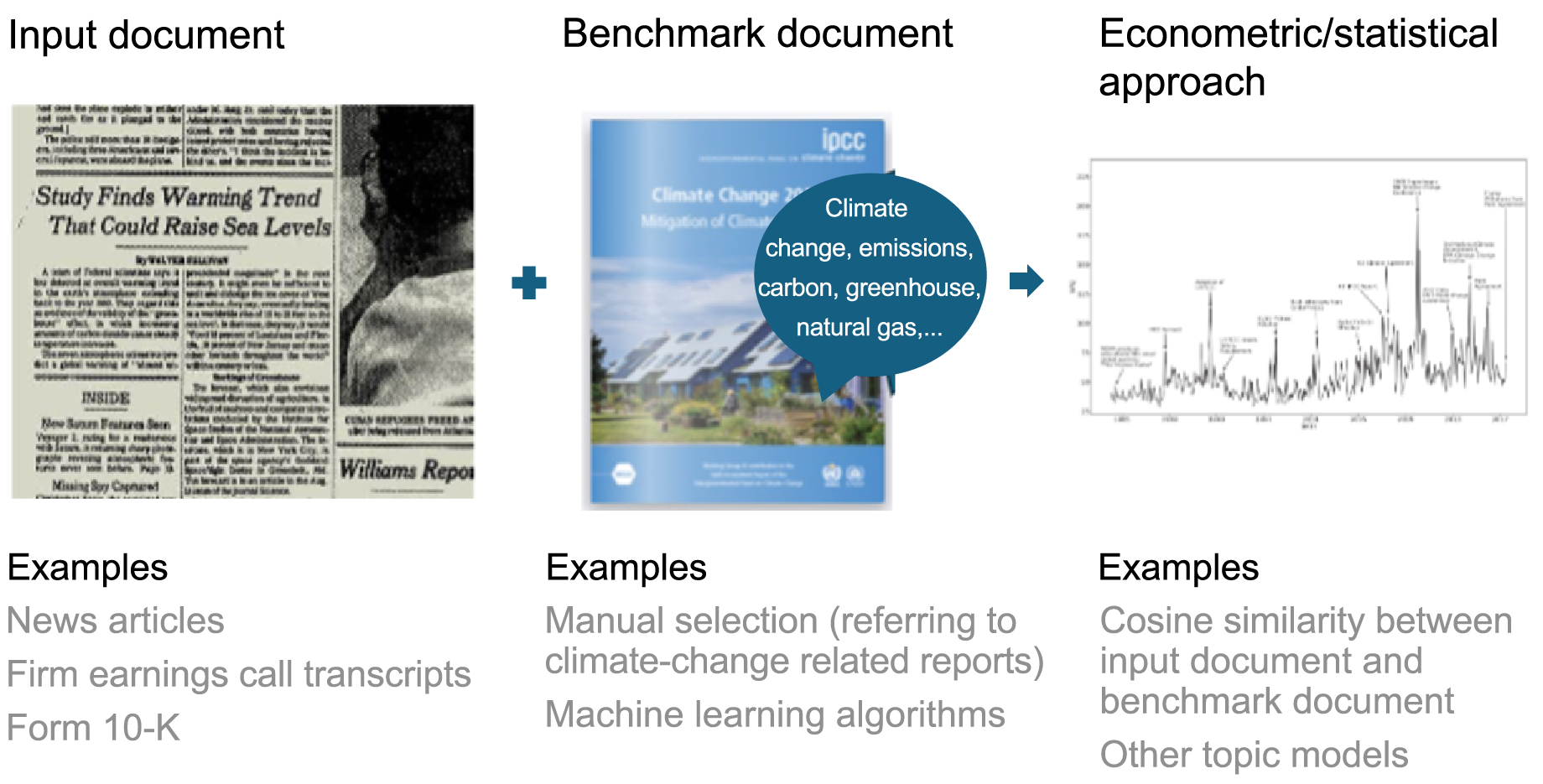

Textual content-based approaches to gauging local weather threat share a typical implementation framework. They start through the use of newspaper articles or agency disclosures, like annual stories and earnings name transcripts, which might replicate financial brokers’ perceptions of local weather threat. These texts are then in comparison with a benchmark doc as a set of key phrases, phrases, or textual content sections representing local weather change. Various econometric and statistical strategies are subsequently utilized to quantify the similarity between the enter textual content and the benchmark doc, with the outcomes aggregated to supply a local weather threat index. The determine beneath visualizes this framework.

Framework for Constructing Local weather Danger Indices

Supply: Authors; Engle et al. (2020).

What Do Textual content-Based mostly Local weather Indices Have in Frequent?

Our evaluation of six text-based local weather indices—from Engle et al. (2020); De Nard et al. (2024); Gavriilidis (2021); Faccini et al. (2023); Bua et al. (2023)—reveals a number of stylized info. First, the typical pairwise correlation between indices is notably low, at 0.24, suggesting that they seize several types of info. These low correlations seemingly stem from variations throughout indices with respect to knowledge sources, benchmark doc creation, and econometric strategies.

Second, only some occasions are constantly recognized as vital drivers throughout indices, highlighting an absence of consensus in pinpointing main local weather threat occasions. We compiled an inventory of occasions recognized by the authors of the papers in our examine as vital drivers of their respective indices, leading to thirty-eight distinctive occasions. Of those, solely 4 are generally recognized throughout two or extra indices: the ratification of the Kyoto Protocol, the United Nations Local weather Change Conferences in Copenhagen and Doha, and america’ withdrawal from the Paris accords. This low degree of settlement means that figuring out main local weather transition occasions stays difficult.

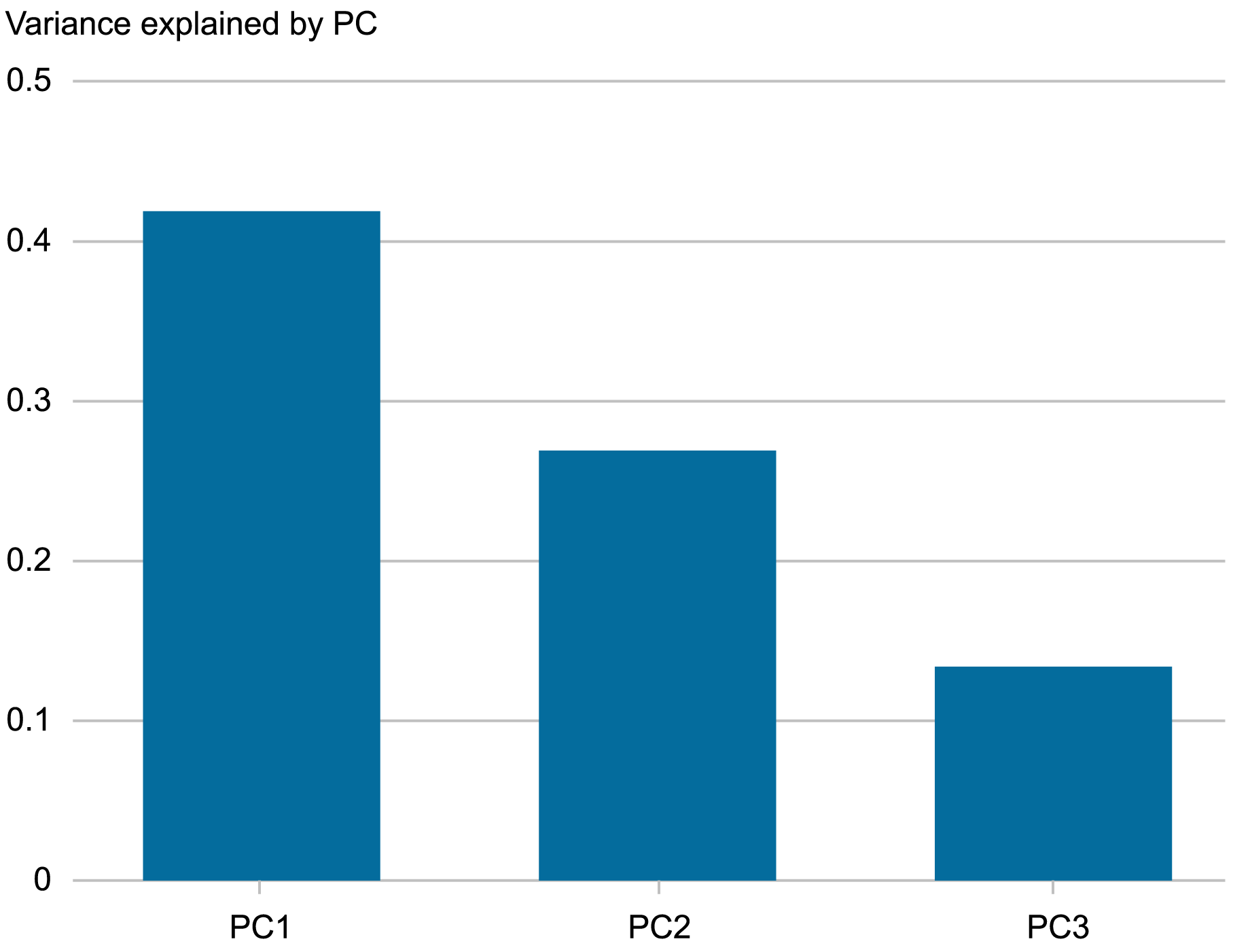

Our third discovering comes from principal element evaluation (PCA), which helps us to determine frequent patterns of variability throughout the indices. The outcomes of our PCA, offered within the chart beneath, present that the primary three principal elements (PCs) collectively clarify 82 % of the variation, with the primary PC (PC1) alone accounting for 42 %.

First Three Principal Parts (PCs) Clarify 82 % of Variation Throughout Local weather Indices

Supply: Authors’ calculations.

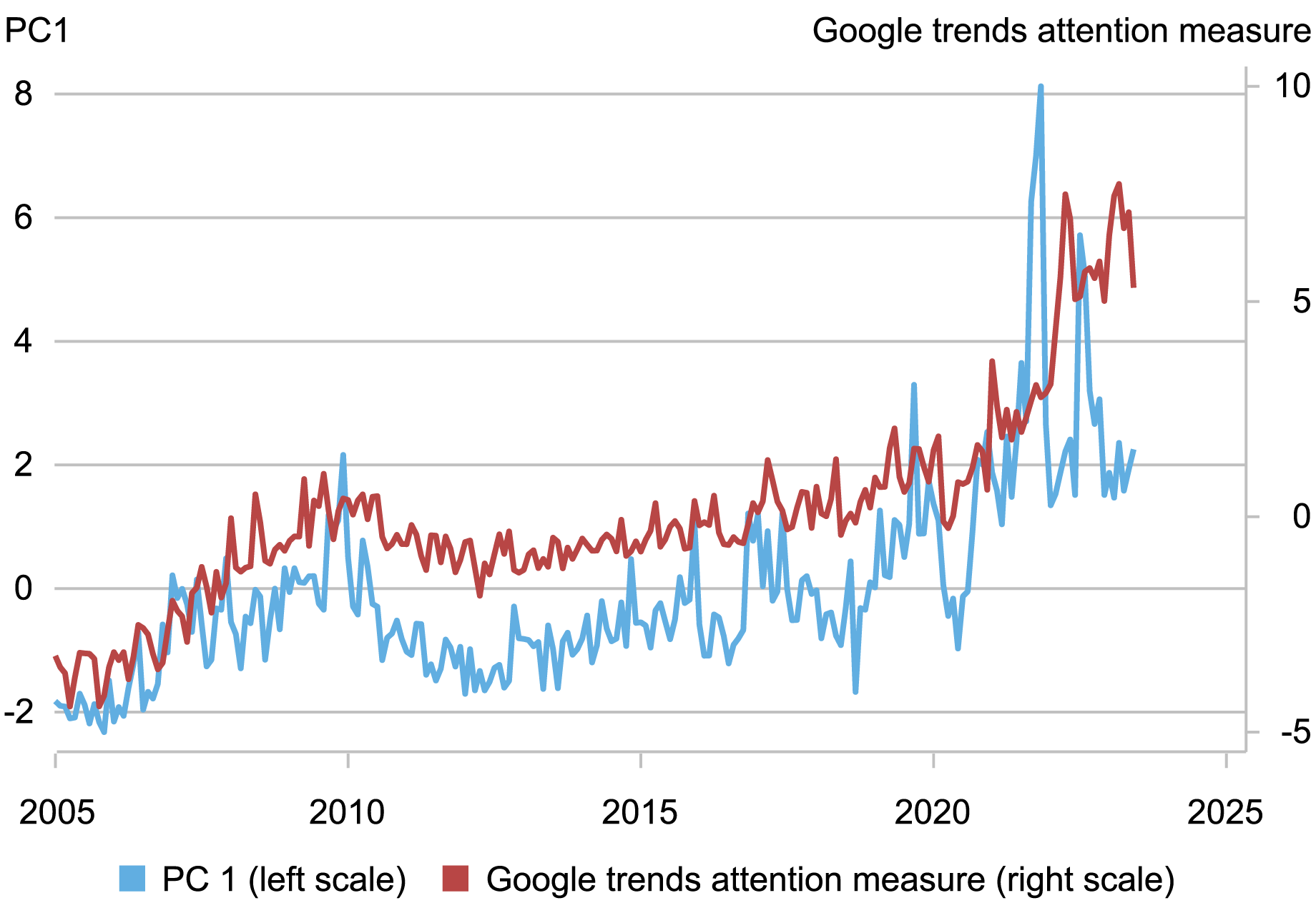

What macroeconomic components are related to the three principal elements? To reply this, we correlate the primary three PCs with numerous macroeconomic variables. As proven within the desk beneath, we discover that PC1 is strongly related to elevated public consideration to local weather change, measured by Google Developments search quantity for local weather key phrases as recognized by the New York Instances.

Correlations between First Three Principal Parts (PCs) and Macroeconomic Elements

| Measure | PC1 | PC2 | PC3 |

| PC1 | 1 | 0.11 | 0.17 |

| PC2 | 0.11 | 1 | -0.90 |

| PC3 | 0.17 | -0.09 | 1 |

| Google Developments | 0.75 | -0.80 | 0.28 |

| Stranded asset | -0.36 | 0.63 | -0.01 |

| U.S. Financial Coverage Uncertainty | 0.09 | -0.04 | 0.57 |

| Oil Volatility Index | 0.10 | -0.09 | 0.31 |

| Local weather legal guidelines | 0.45 | -0.11 | 0.03 |

| Geopolitical Danger | 0.05 | -0.12 | -0.13 |

The next chart exhibits that PC1 certainly carefully follows the Google Developments consideration measure, each of which elevated sharply through the 2021-22 interval. As well as, we discover a excessive correlation between PC1 and the variety of local weather legal guidelines carried out, which must also be anticipated to correlate with consideration to local weather change.

Time Sequence of First Principal Part (PC1) and

Google Developments Consideration Measure

Supply: Authors’ calculations.

We discover that PC2 is correlated with the efficiency of the fossil gas sector (measured by returns on vitality and coal ETFs, normalized by market returns—a technique utilized in Jung et al. [2021]), whereas PC3 is correlated with U.S. financial coverage uncertainty (utilizing an index constructed by Baker et al. [2016]). We discover that oil volatility is considerably correlated with PC3, and that, curiously, geopolitical threat (index constructed by Caldara and Iacoviello [2022]) isn’t strongly correlated with any of the three PCs.

Total, these findings recommend that, although it’s difficult to determine a typical set of “local weather shock occasions” that drive vital adjustments throughout all indices, most indices are likely to rise collectively over time, particularly after 2020, and this development appears to be strongly correlated with the eye to local weather change issue.

Avenues for Future Analysis

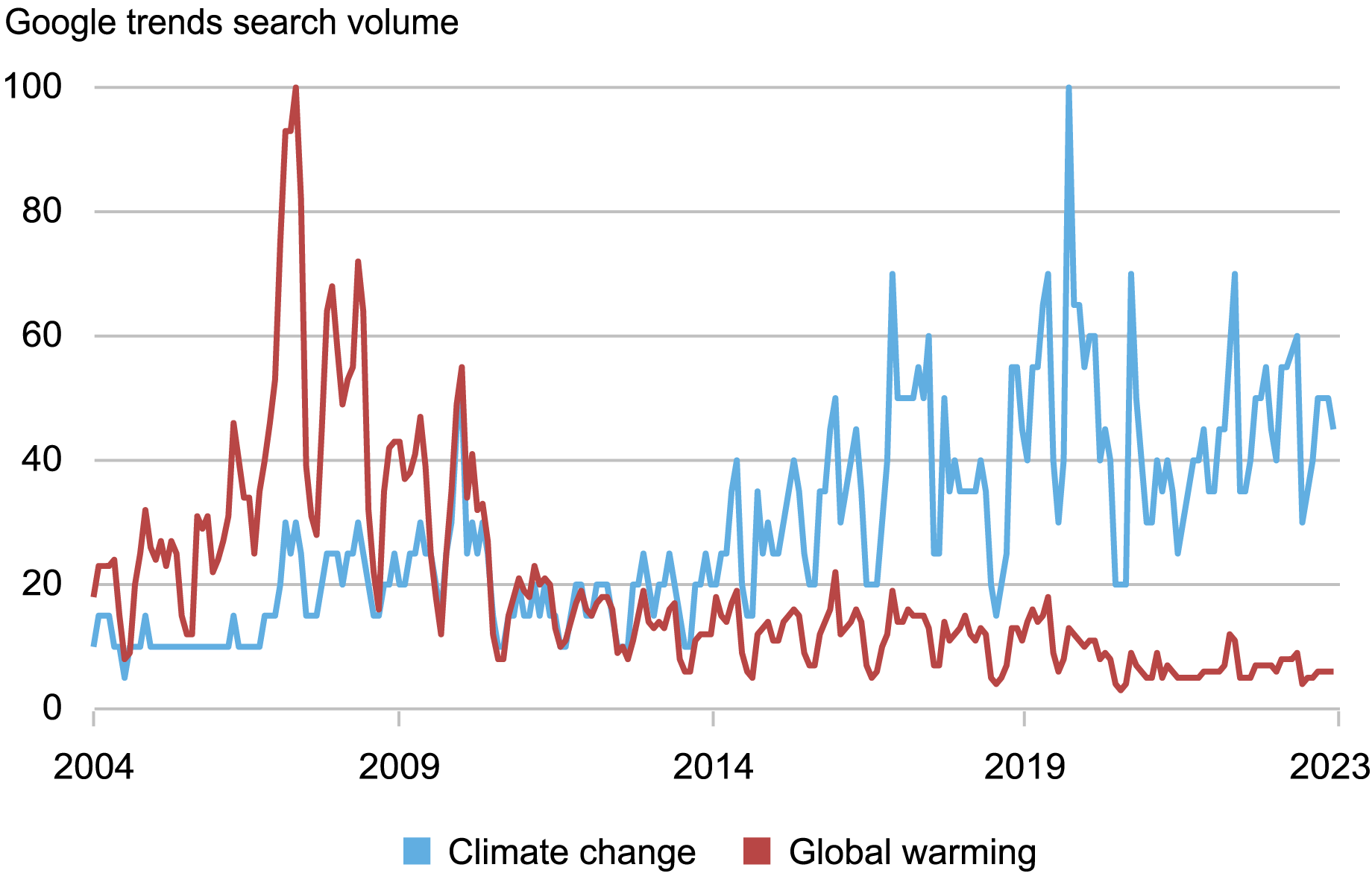

How can local weather indices enhance? Making the benchmark doc time-varying is necessary, particularly if we need to lengthen the evaluation over an extended horizon. The chart beneath illustrates the dynamic nature of local weather change phrasing by evaluating Google search volumes for “local weather change” and “world warming,” indicating that utilizing “world warming” with out “local weather change” because the key phrase can result in a deceptive index.

Creating native indices can be helpful for understanding worldwide spillovers or regulatory arbitrage, notably as local weather insurance policies diverge throughout areas. As an illustration, two indices—one by Engle et al. (2020) based mostly on U.S. information sources and one by Bua et al. (2024) based mostly on European sources—make use of very related empirical approaches of their building, however present a correlation of simply 0.01. This low correlation is probably going pushed, no less than partially, by variations in local weather polices between the U.S. and Europe.

Google Developments Search Quantity for “Local weather Change” and

“International Warming”

Supply: Authors’ calculations.

Our findings recommend a promising course for future analysis. Since PC1 appears to extend with rising consideration to local weather change, it might be beneficial for analyzing how the speedy repricing of local weather threat impacts monetary stability.

Hyeyoon Jung is a monetary analysis economist in Local weather Danger Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Oliver Hannaoui is a graduate scholar on the Polytechnic Institute of Paris.

Methods to cite this publish:

Hyeyoon Jung and Oliver Hannaoui , “What Do Local weather Danger Indices Measure?,” Federal Reserve Financial institution of New York Liberty Road Economics, October 7, 2024, https://libertystreeteconomics.newyorkfed.org/2024/10/what-do-climate-risk-indices-measure/.

Disclaimer

The views expressed on this publish are these of the creator(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the creator(s).