Picture supply: Getty Photos

I received’t hold anybody in suspense – I don’t have a optimistic outlook for the Nvidia (NASDAQ:NVDA) share value in 2025. After an excellent couple of years, I feel issues are lastly beginning to change.

Over the past six months, the inventory’s traded sideways as income progress’s began to say no. I feel that is set to proceed subsequent 12 months, which makes me pessimistic about Nvidia shares.

Income progress

Nvidia shares are up over 2,000%, however the majority of the rise has come within the final two years. And the explanation for that is truly pretty easy.

Because the begin of 2023, the corporate’s gross sales have been rising quickly. After modest progress between 2020 and 2022, progress’s picked up considerably and the share value has adopted.

Nvidia Whole Income 2020-24

Created at TradingView

This nonetheless, doesn’t fairly inform the total story. Particularly, it doesn’t clarify why the share value has stopped exploding greater over the past six months.

The reason being that whereas complete gross sales have been going up, they haven’t been rising on the similar fee. Over the past couple of quarters, Nvidia’s fee of gross sales progress has truly been declining.

Nvidia year-over-year gross sales progress fee 2020-24

Created at TradingView

It appears unusual to assume that buyers is likely to be unimpressed by 93% income progress. However within the context of an organization that managed 206% a 12 months in the past, it’s a transfer within the fallacious course.

In assume the above chart finest explains the Nvidia share value over the past two years. So the factor buyers want to determine is what it’s going to appear to be in 2025.

What’s going to 2025 carry?

On the danger of stating the bleedin’ apparent, Nvidia rising its fee of gross sales progress’s going to be a giant problem. And I feel that is going to be the case increasingly as 2025 unfolds.

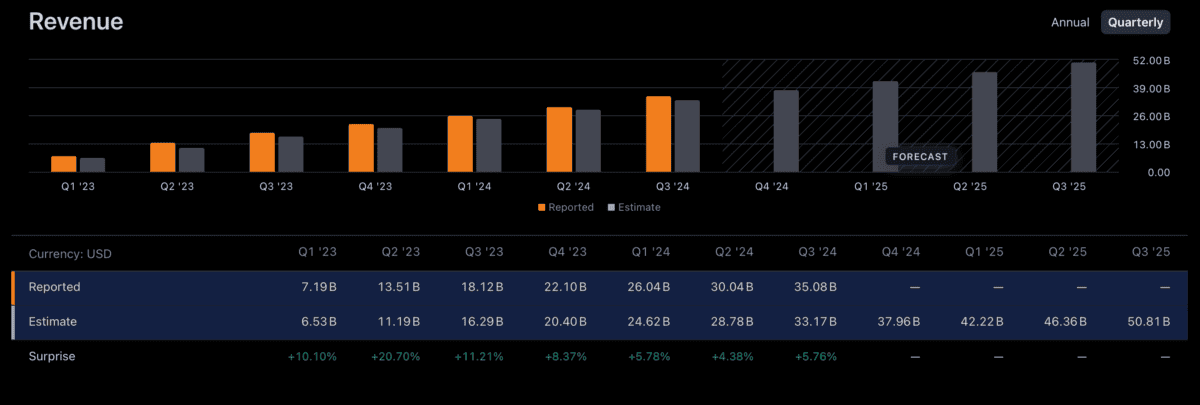

Analyst forecasts appear to bear out this view. The expectation is that gross sales will attain $50.81bn by Q3 2025. That’s 53% greater than in the identical interval of this 12 months.

I’m not saying that is something apart from spectacular from the underlying enterprise. And I can’t consider many corporations the place that type of income progress could be a disappointment.

What I’m saying although, is that this may be decrease than the expansion fee the corporate’s at the moment attaining. And this makes me pessimistic in regards to the share value in 2025 – particularly because the 12 months wears on.

Nothing’s sure and Nvidia may shock individuals – together with me. Its new Blackwell chip appears to be like very spectacular and the corporate has a particularly sturdy aggressive place in a rising trade.

Regardless of this, with the agency already promoting to the world’s largest companies (and in some circumstances, total nations) I’m uncertain a couple of 94% progress fee in 2025. And that makes me cautious in regards to the share value.

So… brief Nvidia, then?

I’m not about to wager in opposition to the Nvidia share value going into 2025. However I feel buyers who need to perceive what the share value has been doing over the past 5 years don’t have to look too far.

It’s not simply gross sales progress that has despatched the inventory greater – it’s the speed at which they’re rising. However this has been dropping and with analysts anticipating additional declines in 2025, buyers must be cautious.