As a enterprise proprietor, operating errands is inevitable. However generally, you might be too busy to make the run your self. You may ship an worker to choose up one thing or deal with a activity for you. If you end up relying on staff to make use of their private vehicles for enterprise, take into account providing mileage reimbursement. So, what’s mileage reimbursement?

What’s mileage reimbursement?

Mileage reimbursement contains compensating staff for utilizing their private automobiles (e.g., vehicles or vehicles) to run enterprise errands. You may use mileage reimbursement to pay staff for doing issues like:

- Driving to the financial institution for a enterprise transaction

- Driving to satisfy prospects

- Driving to choose up workplace provides

- Different business-related errands

Usually, the federal mileage reimbursement fee modifications annually. The usual mileage fee for 2025 is 70 cents per mile, up 3 cents from 2024’s fee of 67 cents per mile. However, there isn’t a legislation stating employers should use this fee.

Most companies use the usual mileage reimbursement fee. Nevertheless, companies or organizations may want to make use of completely different charges, relying on the trade.

For instance, customary mileage reimbursement charges for medical or transferring functions for certified active-duty members of the Armed Forces is 21 cents per mile pushed for 2025. And, charity-related exercise mileage reimbursement is 14 cents per mile pushed.

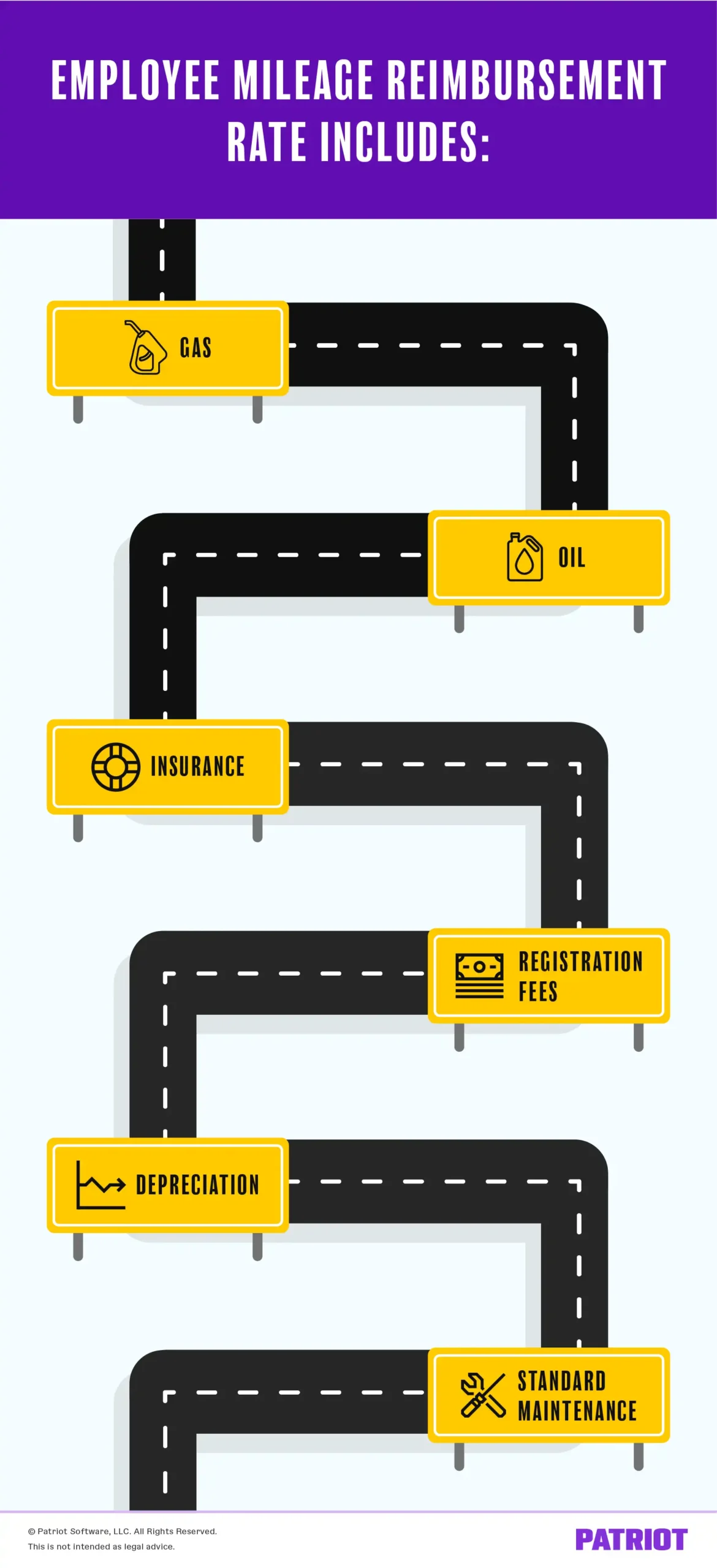

What does mileage reimbursement cowl? Mileage charges are based mostly on the fastened and variable prices of working a car.

The worker mileage reimbursement fee contains:

- Gasoline

- Oil

- Insurance coverage

- Registration charges

- Depreciation

- Normal upkeep

Solely present mileage reimbursement in case your worker makes use of their private automotive for enterprise functions. In case your worker makes use of an organization automotive, don’t reimburse them with federal mileage reimbursement.

Calculating customary mileage reimbursement instance

Let’s take a look at an instance of calculating customary mileage reimbursement.

Say your worker, Caitlin, is operating some errands for your online business. Caitlin drives 14 miles roundtrip to choose up provides. Later, she drives 11 miles to satisfy a consumer and 11 miles to drive again to the workplace.

Caitlin drove 36 enterprise miles. So, you reimburse her $25.20, as a result of the usual mileage fee is 70 cents. (0.70 customary mileage fee x 36 enterprise miles pushed).

How does mileage reimbursement work?

To obtain mileage reimbursement, staff should hold observe of their enterprise mileage. Staff can observe enterprise miles utilizing paper or digital varieties.

Staff can file enterprise miles pushed all through the day utilizing pen and paper. Many companies present staff with mileage reimbursement varieties. That approach, staff can fill out the shape every time they full a business-related errand.

Mileage reimbursement varieties ask for particulars concerning the drive. Info on the shape normally contains the date, enterprise function, vacation spot, origin, miles traveled, and whole miles.

Types sometimes have a number of strains or areas so staff can add details about a number of journeys. Some companies could have staff flip in mileage varieties as soon as every month, whereas different firms require it as soon as per yr.

Corporations may additionally enable staff to trace enterprise miles utilizing an software or on-line spreadsheet. The knowledge on digital varieties could be the identical as paper varieties. And, using digital mileage varieties cuts out the potential of staff dropping the mileage info (e.g., misplacing or dropping a paper type).

Decide how continuously you need staff turning of their mileage info. Maintain the timeframe constant.

Add particulars similar to deadlines, necessities, {qualifications}, and exemptions in a mileage expense reimbursement coverage. Embody your coverage in your worker handbook.

Learn how to reimburse for mileage

Paying staff mileage reimbursement might be executed a number of other ways.

Earlier than you compensate staff for mileage, decide a number of issues:

- Are you paying mileage reimbursement with paper checks or direct deposit?

- Do you intend on including mileage reimbursements together with common wages or individually from payroll?

Some companies pay mileage reimbursement together with an worker’s common wages. That approach, mileage and different wages are listed on one pay stub. Different firms could choose to reimburse staff with a separate verify or direct deposit transaction.

Typically, you need to refund staff two weeks after they submit their mileage report.

Are mileage reimbursements taxable?

Staff don’t should pay taxes on mileage reimbursements with an accountable plan.

Mileage reimbursement advantages

Mileage reimbursements profit each employers and staff. Try the benefits for every beneath.

Employer benefits:

- Elevated worker satisfaction

- Can obtain enterprise mileage deduction for reimbursing staff

- Staff extra prone to run business-related errands

Mileage reimbursements assist forestall disgruntled staff, enhance worker satisfaction, and may positively have an effect on worker engagement.

Employers may also obtain a tax break for providing staff reimbursement for mileage. In the case of calculating mileage for taxes, there are two strategies, together with the usual mileage fee and the precise expense methodology.

The way in which you calculate enterprise mileage and your sort of enterprise decide which varieties you file. You may must file Type 1040, Schedule C (e.g., sole proprietors), and/or Type 4562 with the IRS to obtain a enterprise mileage deduction.

Examine with the IRS for extra details about the enterprise mileage deduction.

Worker benefits:

- Compensation for mileage and utilizing private automotive for enterprise functions

- Much less fear about mileage prices

Because of the Tax Cuts and Jobs Act of 2017, staff can now not declare the enterprise mileage deduction. Nevertheless, self-employed staff can nonetheless deduct mileage bills.

Mileage reimbursement legal guidelines

Should you plan to supply staff mileage reimbursement, you need to know which legal guidelines to comply with.

Federal legislation doesn’t require you to supply mileage reimbursement to staff. And, the IRS doesn’t have any particular federal mileage reimbursement guidelines. Nevertheless, you continue to must comply with minimal wage necessities when you don’t provide mileage reimbursement. Ensure you pay staff not less than the minimal wage after deducting mileage bills.

Some states, like California and Massachusetts, have mileage reimbursement necessities. Examine together with your state for extra details about mileage reimbursement legal guidelines.

Want a option to reimburse staff for mileage? Patriot’s on-line payroll software program is simple to make use of and allows you to run payroll utilizing a fast three-step course of. And, we provide free, USA-based assist. What are you ready for? Get began together with your free trial immediately!

This text has been up to date from its authentic publication date of March 21, 2012.

This isn’t supposed as authorized recommendation; for extra info, please click on right here.