Why do banks fail? In a new working paper, we research greater than 5,000 financial institution failures within the U.S. from 1865 to the current to know whether or not failures are primarily attributable to financial institution runs or by deteriorating solvency. On this first of three posts, we doc that failing banks are characterised by rising asset losses, deteriorating solvency, and an growing reliance on costly noncore funding. Additional, we discover that issues in failing banks are sometimes the consequence of speedy asset development within the previous decade.

U.S. Financial institution Failures in Historical past

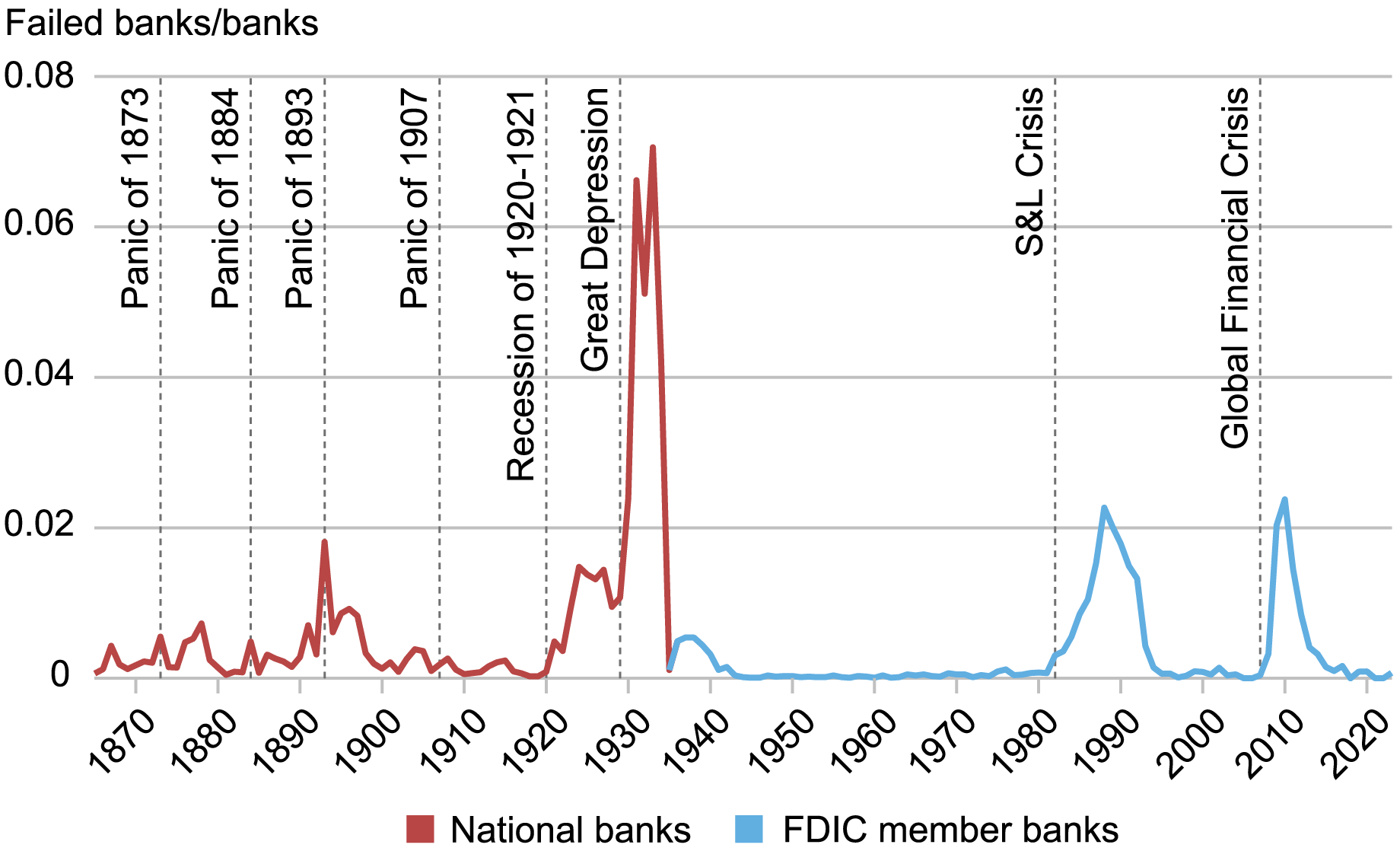

Financial institution failures have been a recurrent function of the U.S. banking system over the previous 160 years. The chart beneath plots the speed of financial institution failures since 1865. Spikes in financial institution failures have characterised the most important monetary crises in U.S. historical past, from the Panic of 1893 to the Nice Despair to the 2008 International Monetary Disaster.

Price of Financial institution Failures within the U.S. from 1865 to 2023

Sources: Workplace of the Comptroller of the Forex (OCC), Annual Report back to Congress; Federal Deposit Insurance coverage Company (FDIC). See Correia, Luck, and Verner (2024) for particulars.

Notes: The chart plots the ratio of financial institution failures to the full variety of banks. The pink line plots the speed of failing nationwide banks, outlined as nationwide banks positioned into receivership, as reported within the OCC’s Annual Report back to Congress (varied years). The blue line plots the speed of banks categorised as failed by the FDIC as reported within the FDIC checklist of failing banks. We prohibit our pattern of FDIC member banks to nationwide member banks, state member banks, and state nonmember banks and exclude financial savings associations, financial savings banks, and financial savings and loans. Vertical traces point out chosen main banking crises and financial downturns.

There are two major explanation why banks fail. First, financial institution failures may end up from financial institution runs, by which depositors withdraw from banks that will have survived if the run had not occurred. Whereas financial institution runs can in precept carry down in any other case wholesome banks or banking methods, they are often particularly problematic for troubled banks that, though struggling, could possibly be viable within the absence of a run. Second, financial institution failures might be attributable to poor fundamentals, akin to realized credit score threat, rate of interest threat, or fraud, that set off insolvency regardless of whether or not depositors run.

Understanding what generally causes financial institution failures, in flip, has necessary coverage implications. If financial institution failures are primarily on account of financial institution runs, coverage priorities ought to naturally gravitate towards stopping runs with instruments akin to emergency liquidity amenities. If, in distinction, financial institution failures are extra generally associated to realized losses, deteriorating solvency, and unviable enterprise fashions, extra consideration needs to be paid to making sure ample capitalization of banks, each earlier than and through crises.

A Novel Knowledge Supply

To know the causes of financial institution failures, we assemble an thrilling new database with steadiness sheet info for many banks within the U.S. because the Civil Warfare. Our knowledge include a historic pattern that covers all nationwide banks from 1865 to 1941 and a contemporary pattern that covers all business banks from 1959 to 2023. Thus, our knowledge go far past the time horizon usually thought-about in educational work, which has—on account of knowledge availability—usually targeted on the interval from 1976 onward.

Our long-run historic perspective for understanding financial institution failures is efficacious for 2 causes. First, it permits us to review hundreds of financial institution failures. Altogether, our knowledge include steadiness sheets for round 37,000 distinct banks, of which greater than 5,000 fail. Second, it permits us to review financial institution failures earlier than the arrival of presidency interventions aimed toward stopping financial institution runs, akin to deposit insurance coverage and the lender of final resort authority of the Federal Reserve System.

Three Info About Failing Banks

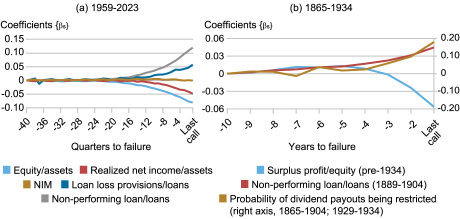

Reality 1: Failing banks see rising losses and deteriorating solvency earlier than failure.

The left panel of the chart beneath plots the dynamics of capitalization, internet earnings, and nonperforming loans (NPLs) in failing banks within the decade earlier than failure for banks that failed between 1959 and 2023. Particularly, the plots present regression coefficients indicating how these variables advanced within the ten years earlier than a financial institution failed relative to their values precisely ten years earlier than failure. We discover that within the years earlier than failure, there’s a 10 proportion level rise in NPLs. This improve interprets into rising mortgage loss provisions, which end in a decline in realized internet earnings. The autumn in internet earnings depresses the return on property by 5 proportion factors within the yr earlier than failure. Consequently, the equity-to-assets ratio declines significantly within the run-up to failure, falling by 10 proportion factors. Web curiosity margins, in distinction, are steady.

Rising Asset Losses and Deteriorating Solvency in Failing Banks

Sources: Federal Monetary Establishments Examination Council (FFIEC), Consolidated Stories of Situation and Earnings (“Name Stories”); Workplace of the Comptroller of the Forex (OCC), Annual Report back to Congress; Federal Deposit Insurance coverage Company (FDIC). See Correia, Luck, and Verner (2024) for particulars.

Notes: The chart plots the evolution of the ratio indicated within the chart legend within the ten years earlier than failure. Extra particulars on the underlying regression mannequin used to acquire the sequence of coefficients might be present in Correia, Luck, and Verner (2024). Within the left panel, the online curiosity margin (NIM) is outlined because the distinction of whole curiosity earnings internet of curiosity bills normalized by whole property. In the correct panel, surplus revenue to fairness is the sum of the excess fund and undivided earnings relative to whole fairness capital (paid-in capital, undivided earnings, and surplus fund). Nonperforming loans is proxied by the road merchandise “different actual property owned (OREO)” and is offered for the 1889-1904 subsample. The likelihood of dividend payouts being restricted relies on the share of banks with undivided earnings of whole fairness falling wanting 1 p.c. This measure captures restrictions on dividend payouts on account of low capitalization and is offered for 1865-1904 and once more after 1929.

The fitting panel of the chart plots related measures for the financial institution failures that occurred from 1865 to 1934. Regardless of variations in accounting requirements, banks that failed within the historic pattern show indicators of hassle related to people who failed within the fashionable pattern. Specifically, these banks additionally see a gradual rise within the share of NPLs and a gradual deterioration in surplus earnings (akin to retained earnings) relative to whole fairness, indicating declining profitability and capitalization. Within the paper, we additional present that, as soon as these banks enter failure, the loss charges on their property quantity to 49 p.c on common, indicating that failing banks usually suffered giant losses on their loans and different property within the historic pattern.

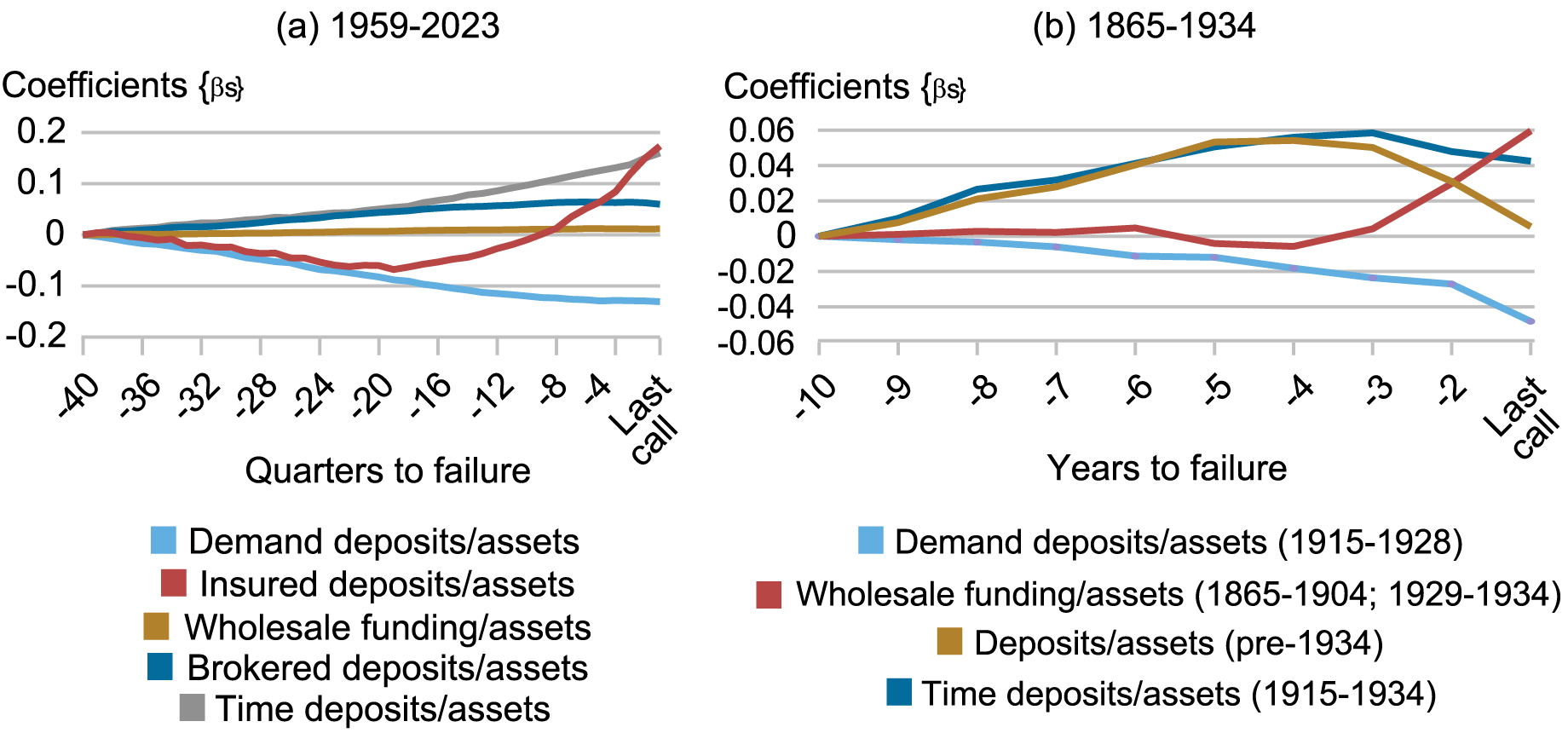

Reality 2: Failing banks rely more and more on noncore funding.

How does financial institution funding evolve as a financial institution approaches failure? The left panel of the chart beneath presents the evolution of varied funding ratios for banks that failed between 1959 and 2023. Failing banks more and more depend on what we consult with as noncore funding: costly kinds of deposit funding or non-deposit wholesale funding. Specifically, the most important improve is accounted for by time deposits, adopted by brokered deposits. Failing banks additionally more and more depend on non-deposit wholesale funding. Some of these funding are usually dearer than demand deposits, because the corresponding rates of interest are extra delicate to actions within the risk-free fee within the financial system. Some of these funding additionally are usually “flighty” and extra delicate to a financial institution’s threat of default. On the identical time, failing banks begin to see an influx of insured deposits mirrored by an outflow of uninsured deposits, in step with depositors looking for to deposit quantities underneath the deposit insurance coverage restrict in failing banks.

Rising Reliance on Costly Noncore Funding in Failing Banks

Sources: Federal Monetary Establishments Examination Council (FFIEC), Consolidated Stories of Situation and Earnings (“Name Stories”); Workplace of the Comptroller of the Forex (OCC), Annual Report back to Congress; Federal Deposit Insurance coverage Company (FDIC). See Correia, Luck, and Verner (2024) for particulars.

Notes: The chart plots the dynamics of the funding ratios indicated within the chart legend within the ten years earlier than financial institution failure. Extra particulars on the underlying regression mannequin used to acquire the sequence of coefficients might be present in Correia, Luck, and Verner (2024). Within the left panel, wholesale funding is the quantity reported within the name report line merchandise “different borrowed cash,” which swimming pools varied sources of financial institution wholesale funding, akin to advances from Federal Dwelling Mortgage Banks (FHLBs), different kinds of wholesale borrowings within the non-public market, and credit score prolonged by the Federal Reserve. In the correct panel, wholesale funding is outlined because the sum of “payments payable” and “rediscounts.” Time and demand deposits are reported individually for the 1915-1928 subsample.

The fitting panel of the chart exhibits the evolution of funding ratios in failing banks for banks that failed throughout 1865-1934. As within the fashionable pattern, these banks more and more depend on time deposits. Earlier than deposit insurance coverage, deposit funding as a share of whole property begins to say no within the two years earlier than failure, just like the decline in uninsured deposits for failures within the fashionable pattern. The outflowing deposits are changed almost one-for-one by dearer non-deposit wholesale funding, probably decreasing financial institution profitability. Thus, in each the historic and fashionable intervals, failing banks more and more depend on costly and extra risk-sensitive types of funding.

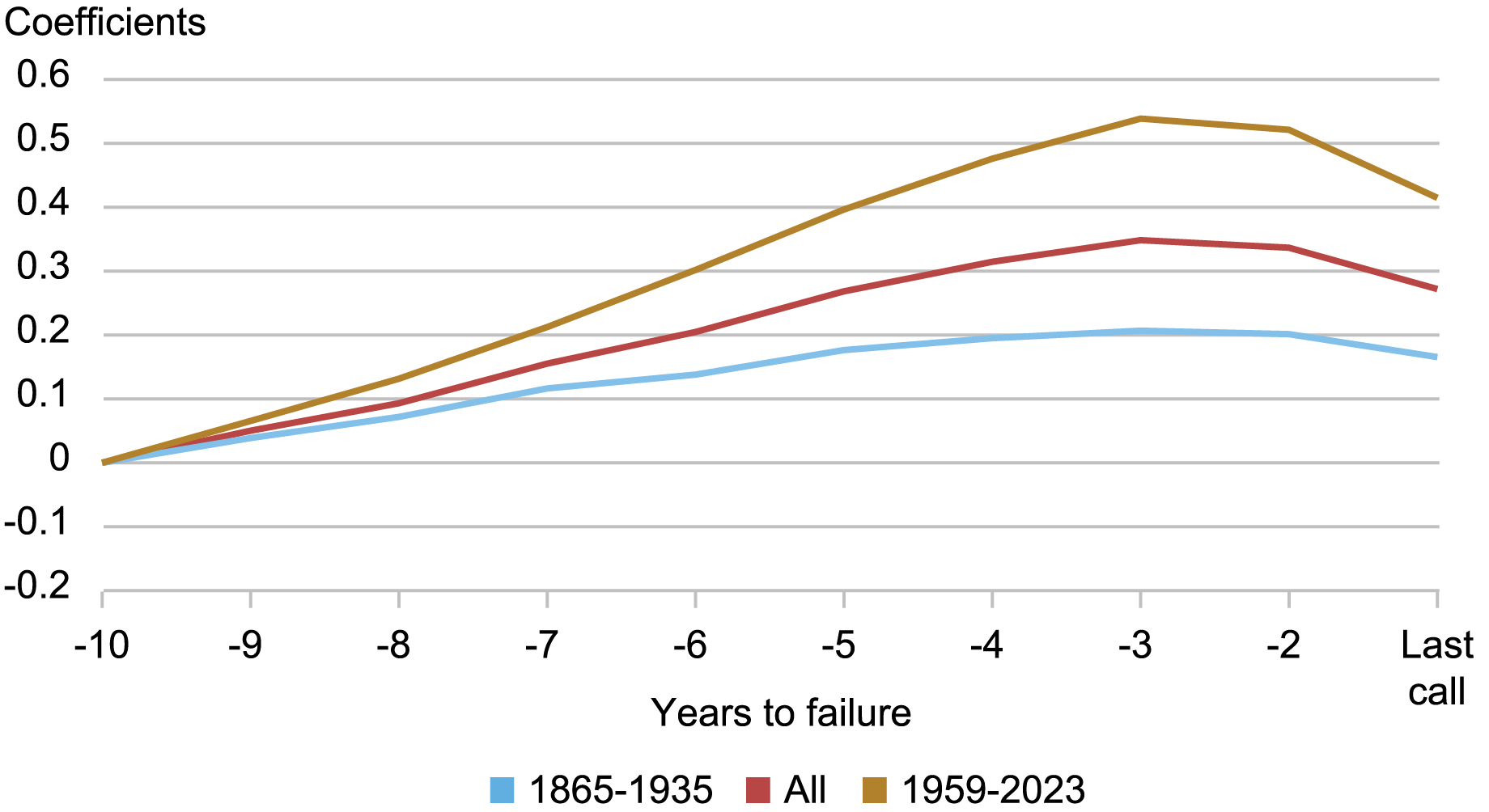

Reality 3: Failing banks comply with a boom-bust sample. They develop quickly, each in absolute phrases and relative to their friends, as much as three years earlier than they fail, after which they contract.

Why do banks expertise regularly rising losses that ultimately result in failure? The chart beneath reveals that whole property in failing banks comply with a boom-and-bust sample within the decade earlier than failure. Within the full pattern, property broaden by over 30 p.c in actual phrases from ten years to 3 years earlier than failure after which contract over the past two years earlier than failure. This asset development is often pushed by speedy development in actual property lending. The chart additionally exhibits the dynamics of property in failing banks individually for the pre-1935 pattern and the fashionable pattern. The boom-and-bust sample is current in each samples. Nevertheless, it’s considerably extra pronounced within the fashionable interval.

Asset Increase and Bust in Failing Banks

Sources: Federal Monetary Establishments Examination Council (FFIEC), Consolidated Stories of Situation and Earnings (“Name Stories”); Workplace of the Comptroller of the Forex (OCC), Annual Report back to Congress; Federal Deposit Insurance coverage Company (FDIC). See Correia, Luck, and Verner (2024) for particulars.

Notes: The chart plots the dynamics of whole property (deflated by the CPI). The sub-samples indicated within the chart legend are chosen primarily based on the years by which a financial institution failed. Extra particulars on the underlying regression mannequin used to acquire the sequence of coefficients might be discovered within the paper.

Wrapping Up

This submit presents three details about failing banks. The standard failing financial institution goes by a increase earlier than coming into a bust. As failing banks increase, they more and more finance themselves with costly types of noncore funding. As failure approaches, these banks expertise rising losses and deteriorating solvency. All three patterns level to the central function of deteriorating fundamentals and rising insolvency threat for financial institution failures. Within the subsequent submit, we ask whether or not these patterns enable us to foretell financial institution failures and we focus on implications for the causes of financial institution failures.

Sergio Correia is a principal economist within the Monetary Stability Division on the Board of Governors of the Federal Reserve System.

Stephan Luck is a monetary analysis advisor in Banking Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Emil Verner is an affiliate professor of finance on the MIT Sloan College of Administration.

cite this submit:

Sergio Correia, Stephan Luck, and Emil Verner, “Why Do Banks Fail? Three Info About Failing Banks,” Federal Reserve Financial institution of New York Liberty Road Economics, November 21, 2024, https://libertystreeteconomics.newyorkfed.org/2024/11/why-do-banks-fail-three-facts-about-failing-banks/.

Disclaimer

The views expressed on this submit are these of the creator(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the creator(s).