Whereas insurance policies to fight local weather change are designed to handle a world downside, they’re usually applied on the nationwide stage. However, the influence of home local weather insurance policies might spill over internationally given nations’ financial and monetary interdependence. For instance, a carbon tax charged to home corporations for his or her use of fossil fuels might lead the corporations to cost larger costs to their home and overseas clients; given the significance of worldwide worth chains in trendy economies, the influence of that carbon tax might propagate throughout a number of layers of cross-border manufacturing linkages. On this put up, we quantify the spillover results of local weather insurance policies on forward-looking asset costs globally by estimating the influence of carbon value shocks within the European Union’s Emissions Buying and selling System (EU ETS) on inventory costs throughout a broad set of country-industry pairs. In different phrases, we measure how asset markets consider the influence of adjustments to the carbon value on progress and profitability prospects of the corporations.

The EU ETS and Local weather Coverage Shocks

The EU ETS is predicated on a “cap and commerce” precept, the place corporations are confronted with a set restrict (the cap) on the quantity of greenhouse gases they’ll emit in a given 12 months. The cap is expressed in tons of CO2-equivalent, and corporations can bid on allowances to have bigger limits by way of a centralized public sale system. These allowances are then traded on the EU ETS market, thereby setting a market value for carbon emissions.

Empirical Technique

To estimate the influence of a carbon shock emanating from the EU ETS on worldwide inventory markets over 2005-2019, we mix annualized month-to-month country-sector (U.S. {dollars}) inventory returns information for twenty-six nations with the carbon shock time collection. We hypothesize {that a} coverage announcement that results in an surprising enhance in carbon costs can have a unfavorable influence on inventory returns, as a rise in carbon costs will elevate the price of manufacturing for corporations inside the EU and these prices can be handed on by way of enter costs throughout world input-output linkages. After demonstrating a unfavorable influence of carbon shock on world inventory costs, we take a look at for this speculation by making use of the worldwide manufacturing community information from the World Enter-Output Database (WIOD), as in a few of our earlier work.

Kanzig (2023) exploits coverage bulletins in regards to the EU ETS since its inception in 2005 to determine coverage “surprises” that have an effect on carbon costs by way of supply-side forces (for instance, the tightening of allowances). He follows the frequent method used to determine financial coverage shocks that depends on value adjustments in futures markets round bulletins. These value change surprises are used to assemble the shock collection that enter our regressions mentioned under.

We think about two local weather shock collection in our regressions. The primary is the uncooked collection, which, following Kanzig (2023), is normalized such {that a} one normal deviation change within the shock corresponds to a one share level change within the power part of the EU’s CPI on influence. This shock solely takes values of 1 for focused industries within the EU, which we check with as “soiled” EU sectors (labeled as such if they’re within the prime 10 % of emissions-to-output ratio throughout all EU country-sector pairs as of 2014, corresponding to utilities and transportation sectors and a few heavy manufacturing).

The second shock collection weights the uncooked carbon shock collection by every country-sector’s intermediate enter utilization originating from “soiled” EU sectors as a ratio of the country-sector’s whole manufacturing. This weighted shock then varies throughout country-sectors, in addition to over time, and is supposed to seize the relative significance of direct provide chain linkages of a given country-sector with the sectors which are immediately affected by local weather coverage shocks within the EU ETS.

Along with the local weather shock variable, we embody in our empirical evaluation adjustments within the VIX, the broad U.S. greenback index, and the U.S. two-year Treasury fee, as these variables are additionally anticipated to affect inventory returns.

Baseline Outcomes

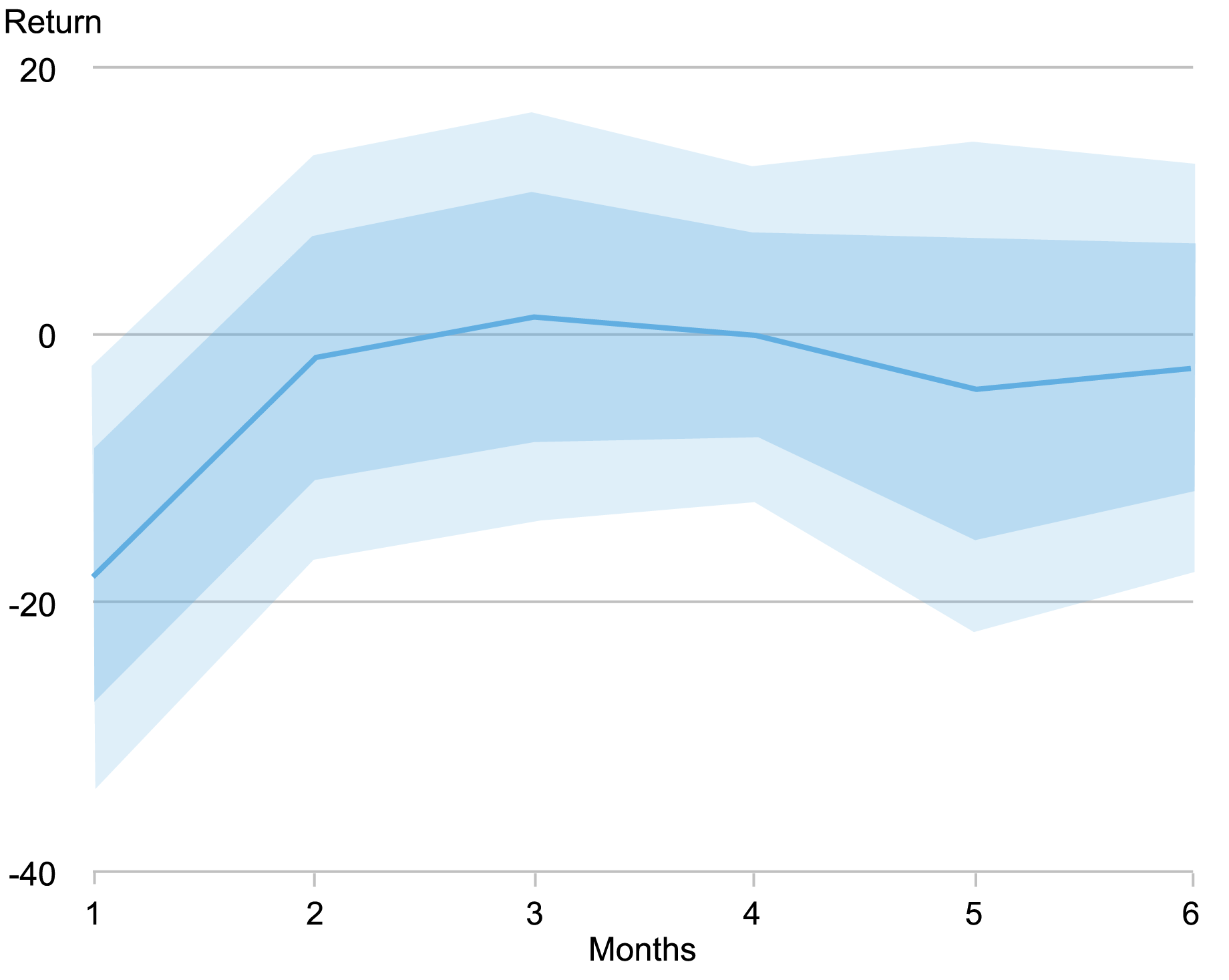

The chart under presents the month-to-month influence of the uncooked local weather shock on inventory returns within the common country-sector, the place we embody one (darkish blue) and two (mild blue) normal deviation bands. A optimistic innovation in carbon costs has a right away unfavorable influence on inventory returns within the first month. This influence will not be long-lived, solely being statistically important within the first month, however it’s also not reversed subsequently. The magnitude of the influence implies that the biggest carbon value shock noticed within the collection (which corresponds to a 0.02 share level change within the power part of the EU’s CPI on influence) results in a 37 % decline in annualized month-to-month inventory returns worldwide on common (which is about one-half of a mean month-to-month return and about 17 % of month-to-month inventory returns deviations).

The Impact of the Carbon Coverage Shock Is Important on Influence

Sources: Authors’ calculations primarily based on carbon value shocks from Kanzig (2023) and inventory market returns information from Refinitiv World Fairness Indices database.

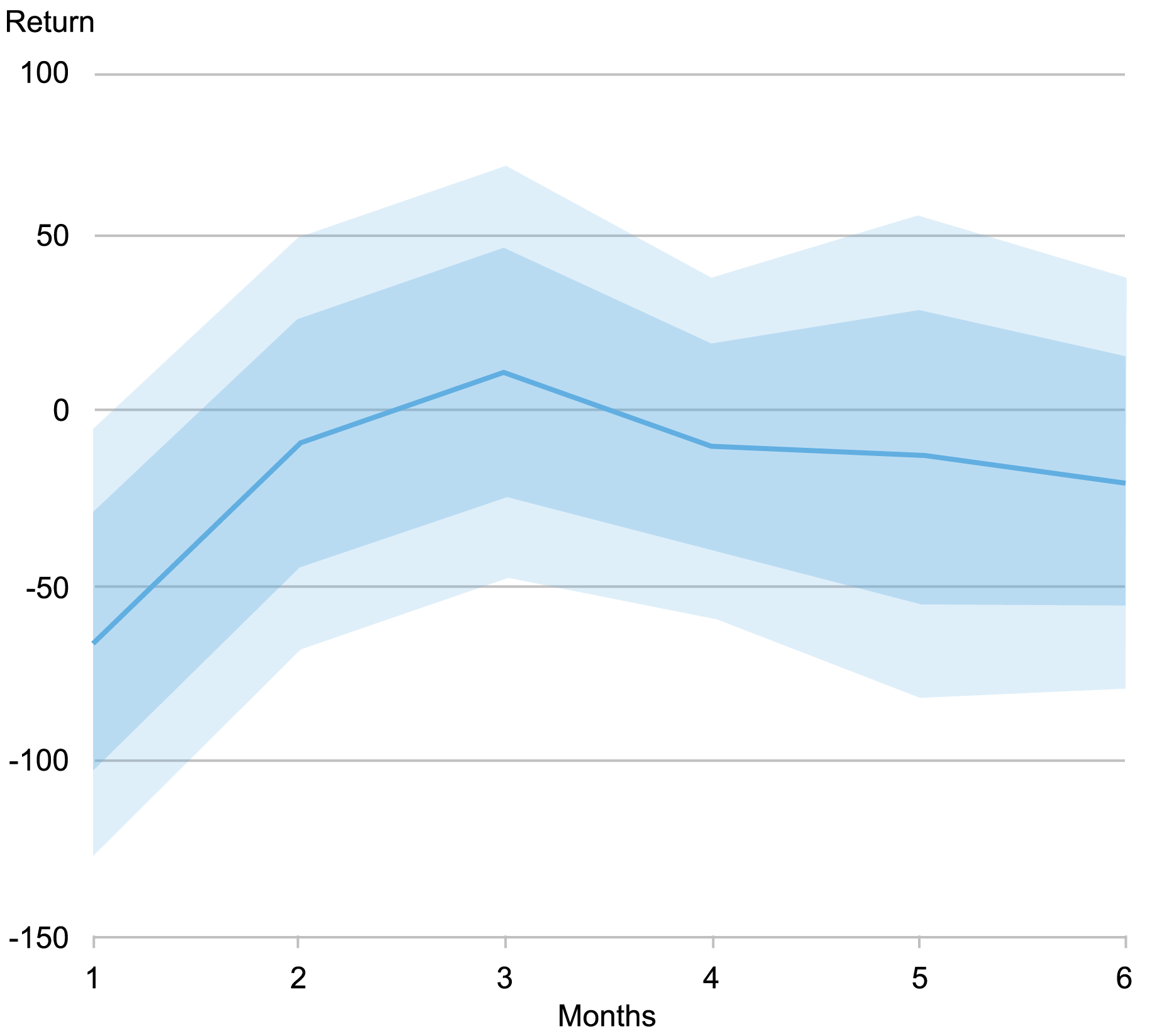

The chart under explores how a lot of the impact is because of input-output linkages that transmit carbon shocks to overseas inventory markets. The chart presents the impulse response of inventory returns to the carbon shocks as outlined above however weighted by the amount of inputs from the “soiled” EU sectors. The dynamics are much like these for the uncooked shock collection, in that almost all of the influence of an surprising enhance in inventory costs accrues instantly and isn’t offset over time. Quantitatively, the biggest noticed weighted carbon shock results in a few 33 % decline in inventory returns. That’s, practically all the impact we beforehand noticed is as a result of linkages by way of commerce in intermediate items.

Enter-Output Linkages Play a Position in Propagating the Carbon Value Shock

Sources: Authors’ calculations primarily based on carbon value shocks from Kanzig (2023), inventory market returns information from Refinitiv World Fairness Indices database, and information from the World Enter-Output Database.

Conclusion

This put up presents some early proof on the spillover of home local weather coverage on overseas inventory markets, primarily based on the case of EU ETS. Our work enhances current research by Bolton and Kacperczyk (2023) and Bolton, Lam, and Muûls (2023) that look at the influence of local weather insurance policies on home markets. By exploiting surprising adjustments in carbon costs, we present that whereas there are sizable spillovers, they don’t seem to be significantly massive within the context of inventory return volatility. Furthermore, whereas the results are usually not offset within the following months, they don’t persist past the month of the influence. In ongoing work, we’re additional investigating the significance of particular commerce linkages within the transmission of carbon shocks throughout inventory markets and different determinants of cross-sectional variations within the influence that we observe within the information. Keep tuned.

Julian di Giovanni is the top of Local weather Threat Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Galina Hale is a professor of economics on the College of California, Santa Cruz.

Neel Lahiri is a former analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group, and at present a graduate pupil on the College of Chicago.

Anirban Sanyal is an assistant advisor within the Reserve Financial institution of India’s analysis group.

The right way to cite this put up:

Julian di Giovanni, Galina Hale, Neel Lahiri, and Anirban Sanyal, “Worldwide Inventory Markets’ Reactions to EU Local weather Coverage Shocks,” Federal Reserve Financial institution of New York Liberty Road Economics, October 10, 2024, https://libertystreeteconomics.newyorkfed.org/2024/10/international-stock-markets-reactions-to-eu-climate-policy-shocks/.

Disclaimer

The views expressed on this put up are these of the creator(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the creator(s).